Retirement income tax refers to the portion of an individual's income that is subject to taxation during their retirement years. While many people assume that retirement is a tax-free period, the reality is that various sources of income, such as pensions, retirement account withdrawals, and Social Security benefits, may be subject to taxation. Retirement income tax differs from the income tax individuals pay during their working years. The tax rules and regulations governing retirement income may vary depending on the country or jurisdiction. In some cases, the tax rates and thresholds may differ from those applied to active employment income. As individuals approach retirement, understanding how income tax works becomes crucial for effective financial planning. The transition from active employment to retirement brings about changes in income sources and tax obligations, making it essential to grasp the intricacies of calculating income tax in this phase of life. 1. Social Security Income: This is often the base of retirement income for many retirees. Depending on your overall income, a portion of your Social Security benefits may be taxable. 2. Pension Income: Depending on your state of residence and the type of pension you receive, pension income can be fully or partially taxable. 3. 401(k) and IRA Distributions: Withdrawals from traditional 401(k)s and IRAs are typically taxed as ordinary income. 4. Annuities and Life Insurance: The tax treatment for annuities depends on the type of annuity and how the money was invested. Life insurance proceeds are generally tax-free, but there can be exceptions. 5. Investment Income: This includes dividends, interest, and capital gains from investments outside of retirement accounts. These are typically taxed at different rates depending on your overall income and the type of investment. Not all retirement income is subject to tax. For example, certain types of pensions, life insurance payouts, and some Social Security income can be partially or entirely tax-free. Understanding which parts of your income are taxable is a crucial step in calculating your overall income tax liability. The initial step in determining your retirement tax liability involves aggregating all your retirement income streams. This process encompasses both taxable and non-taxable income sources. Notably, your income isn't limited to the traditionally recognized forms of retirement income, such as pensions or Social Security benefits. Be sure to include income from any part-time employment or freelance projects. By compiling a comprehensive income tally, you establish a firm foundation for your subsequent tax calculations. Once you have your total retirement income, subtract any non-taxable income. Then, adjust your income for any tax deductions and credits you are eligible for. This could include standard or itemized deductions, medical expenses, or certain tax credits for the elderly. Determine your tax bracket based on your taxable income. As per the tax year of 2023—the tax return you should have submitted by April 2024 or need to file by October 2024—seven federal income tax brackets are established: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Your filing status and taxable income dictate the tax bracket you fall into. Finally, apply the appropriate tax rate to your taxable income to determine your federal income tax liability. Remember, the U.S. uses a progressive tax system, so different portions of your income may be taxed at different rates. Your state of residence may also tax your retirement income. Each state has its own rules regarding which types of income are taxable and at what rates. Some states offer generous exemptions for certain types of retirement income, while others do not. If you have money in tax-deferred retirement accounts like a 401(k) or IRA, you will have to start taking Required Minimum Distributions at a certain age. These distributions are generally taxable and need to be included in your tax calculations. Extra income from part-time work or freelance gigs can push you into a higher tax bracket and make more of your Social Security benefits taxable. Always consider these effects when planning for additional income in retirement. Depending on your total income, up to 85% of your Social Security benefits may be taxable. If Social Security benefits are your only income, they are likely not taxable, but if you have other substantial income, it's probable that a portion of your benefits will be taxed. Adopting strategic withdrawal plans from retirement accounts can play a pivotal role in reducing tax liability. One effective method can be to draw down from taxable accounts initially, thereby allowing tax-free accounts to accrue growth uninterrupted. Numerous tax deductions and credits specifically target retirees. By understanding eligibility for these financial incentives, retirees can substantially diminish their taxable income. Therefore, comprehensive knowledge of these benefits proves beneficial. Converting funds from a traditional Individual Retirement Account (IRA) to a Roth IRA stands as a viable strategy to control future tax obligations. Although the conversion incurs an immediate tax event, all qualified withdrawals from a Roth IRA are tax-free during retirement, presenting a long-term advantage. A tax professional can provide personalized advice based on your specific situation. They can also help ensure that you're making the most of your deductions and credits and guide you in making tax-efficient decisions. Look for a professional with expertise in retirement tax planning. They should have a strong understanding of retirement income sources, tax laws, and strategies for tax minimization. Calculating income tax in retirement requires a systematic approach to determine your tax liability accurately. Key steps include calculating total retirement income, determining taxable income by subtracting non-taxable income and applying deductions/credits, identifying your tax bracket, and applying the appropriate tax rate. Understanding the types of retirement income, such as Social Security, pensions, 401(k) distributions, and investment income, is crucial as they may be taxed differently. Additionally, it's essential to consider state taxes on retirement income, required minimum distributions, and the potential taxation of Social Security benefits. Strategies to minimize income tax in retirement involve tax-efficient withdrawal plans, leveraging deductions and credits, considering Roth conversions and seeking guidance from a tax professional experienced in retirement planning. By following these steps and utilizing effective strategies, retirees can better manage their tax liabilities and optimize their retirement income.What Is Retirement Income Tax?

Understanding Retirement Income

Types of Retirement Income

Taxable vs Non-taxable Retirement Income

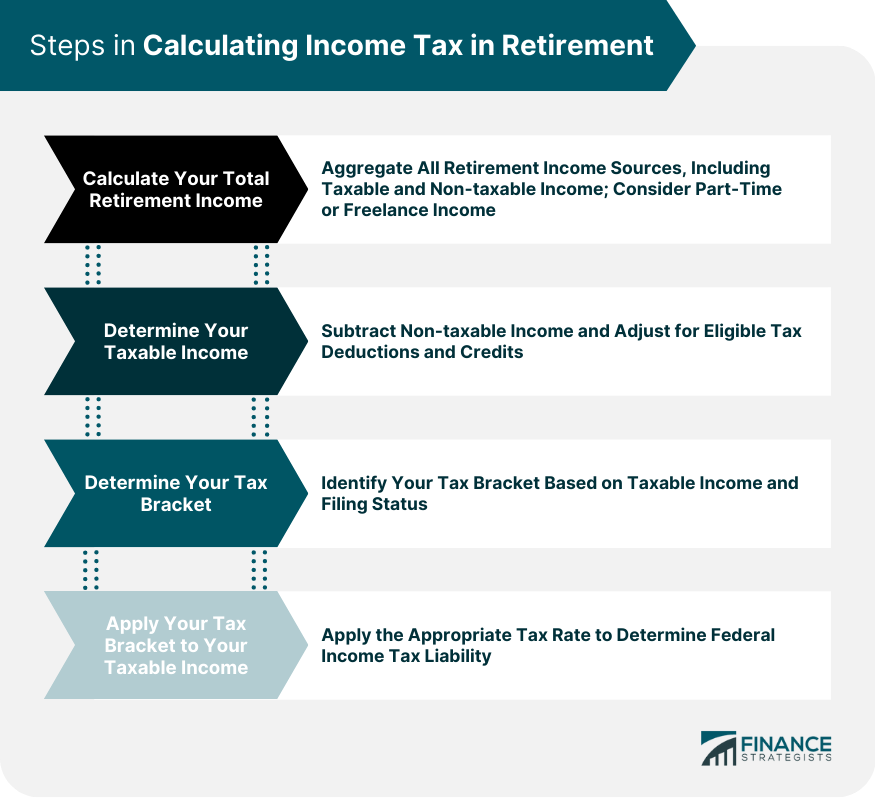

Process of Calculating Income Tax in Retirement

Calculate Your Total Retirement Income

Determine Your Taxable Income

Determine Your Tax Bracket

Apply Your Tax Bracket to Your Taxable Income

Special Considerations in Calculating Income Tax in Retirement

State Taxes on Retirement Income

Required Minimum Distributions (RMDs) and Their Tax Implications

Effect of Extra Income on Taxes

Taxation of Social Security Benefits

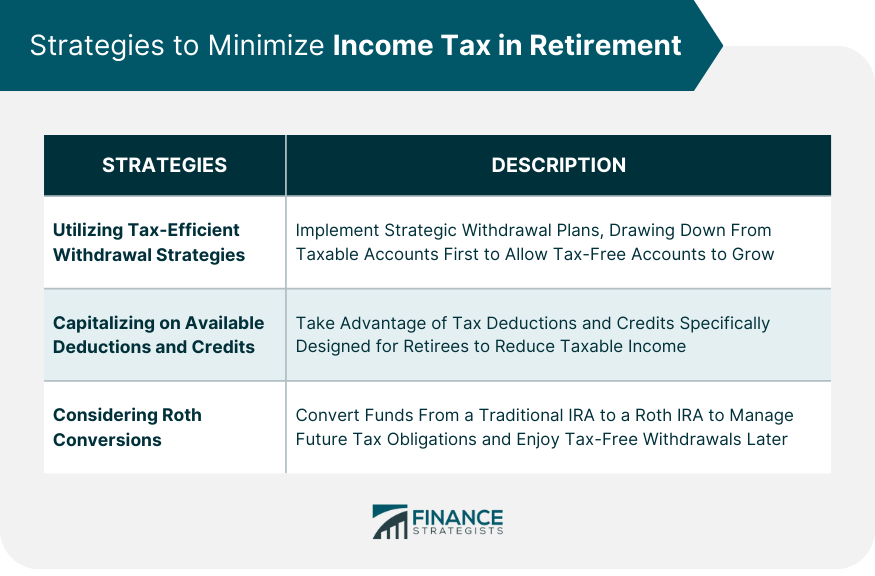

Strategies to Minimize Income Tax in Retirement

Utilizing Tax-Efficient Withdrawal Strategies

Capitalizing on Available Deductions and Credits

Considering Roth Conversions

Working With a Tax Professional

Benefits of Hiring a Tax Professional

How to Choose a Tax Professional for Retirement Planning

Conclusion

How to Calculate Income Tax in Retirement FAQs

The first step in calculating income tax in retirement is to understand your retirement income sources. These can include Social Security income, pension income, 401(k) and IRA distributions, annuities and life insurance, and investment income. Determine which income sources are taxable, calculate your total taxable income, and apply your tax bracket to determine your tax liability.

You should consider the types of income you're receiving, your total income amount, your tax deductions and credits, and your tax bracket. Also, consider your state's tax laws, as these can significantly impact your overall tax liability.

Online tax calculators, tax software, and tax professionals can be very helpful when calculating income tax in retirement. The IRS website also offers useful resources and information. Books on retirement planning and tax strategy can provide in-depth knowledge.

Tax-efficient withdrawal strategies, making use of available tax deductions and credits, and considering Roth IRA conversions are strategies that could potentially reduce your income tax in retirement. A tax professional can provide personalized advice based on your specific situation.

Extra income from part-time work or freelance jobs can increase your overall taxable income, potentially moving you into a higher tax bracket and making more of your Social Security benefits taxable. This additional income should be included when calculating your income tax in retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.