The Galliard Retirement Income Fund CL 35 is a closed-end fund that invests in a diversified portfolio of fixed-income securities. It is a conservative investment that is suitable for investors who are seeking a high level of current income and capital preservation. The fund is managed by Galliard Capital Management, LLC. It has a minimum initial investment of $5,000 and is listed on the New York Stock Exchange under the ticker symbol "WGRIX." The fund has returned an average of 5% per year over the past five years and has outperformed the Barclays Aggregate Bond Index over the same period. The fund's investment manager is looking for investments that will generate a steady stream of income, while also trying to protect the fund's value from declining. The fund invests in a diversified portfolio of fixed-income securities, including corporate bonds, municipal bonds, and government bonds. The fund's investment manager seeks to select securities that offer attractive yields and credit quality. This means that the fund's investments are spread out across a variety of different issuers and types of securities. This helps to reduce the fund's risk, as it is not too heavily reliant on any one issuer or type of security. As mentioned, the minimum initial investment for Galliard Retirement Income Fund CL 35 is $5,000. This means that investors must invest at least $5,000 to purchase shares in the fund. There is no initial sales charge or load for this fund. This requirement is designed to prevent small investors from making impulsive investment decisions. It also helps to ensure that investors have a sufficient amount of money to weather any short-term fluctuations in the value of the fund's shares. There are a few ways to invest in Galliard Retirement Income Fund CL 35 with less than $5,000. One way is to open a brokerage account and purchase shares through a fractional share purchase plan. Another way is to invest in a target-date fund or retirement savings plan. The expense ratio for Galliard Retirement Income Fund CL 35 is 0.65%. This means that for every $100 invested in the fund, 65 cents will be used to cover the fund's operating expenses. Expense ratios are one of the most important factors to consider when choosing an investment. Higher expense ratios can eat into an investment's returns over time. The Galliard Retirement Income Fund CL 35 expense ratio is higher than some other fixed-income funds. However, the fund has a long history of performance. The fund receives dividends from the companies whose bonds it owns. When a company pays a dividend, it is essentially giving back some of its profits to its shareholders. The fund's shareholders are entitled to a share of these dividends. The fund receives interest payments from the government and corporate entities that issue the bonds it owns. When a bondholder lends money to a company or government, they are entitled to interest payments on that loan. The fund may sell some of its investments, which generates capital gains for the fund. When the fund sells an investment at a profit, it is essentially making money on the difference between the price it paid for the investment and the price it sold it for. When interest rates rise, the value of existing bonds falls. This is because investors can buy new bonds with higher interest rates, so older bonds with lower interest rates become less attractive. Galliard Retirement Income Fund CL 35 invests in a variety of fixed-income securities, including bonds, municipal bonds, and government bonds. As interest rates rise, the value of these securities will fall, which could lead to losses for investors. It refers to the risk that the issuer of a bond will default on its payments. When a bond issuer defaults, it means that it is unable to make the interest payments or repay the principal on the bond. While Galliard Retirement Income Fund CL 35 invests in a variety of bond types, some of these bonds are issued by companies or governments that have a higher risk of defaulting than others. This is the risk that the value of the fund's investments will decline due to general market conditions. This can happen for a variety of reasons, such as a recession, a stock market crash, or a natural disaster. Like all else in the market, the Galliard Retirement Income Fund CL 35’s investments could decline based on the overall performance of the market. VMBMX is a passively managed mutual fund. It also tracks the performance of the Bloomberg Barclays Municipal Bond Index. VMBMX is a low-cost fund with an expense ratio of 0.15%. The fund has a long history of performance, with an average annual return of 5.5% over the past 10 years. VMBMX is a good option for investors who are looking for a high level of current income and are in a high tax bracket. The fund's tax-exempt status can help to reduce the overall cost of ownership. SHM is an exchange-traded fund that has a low expense ratio of 0.06%. As its name suggests, this fund primarily invests in municipal bonds with an intermediate term, typically meaning bonds with maturities between 5 and 15 years. SHM is a good option for investors who are looking for income and diversification in their municipal bond portfolio. Galliard Retirement Income Fund CL 35 is a conservative closed-end fund designed to provide investors with a high level of current income and capital preservation. Managed by Galliard Capital Management, LLC, the fund has a minimum initial investment of $5,000 and has consistently outperformed the Barclays Aggregate Bond Index, delivering an average annual return of 5% over the past five years. With a diversified portfolio of fixed-income securities, including corporate bonds, municipal bonds, and government bonds, the fund aims to generate steady income while reducing risk through broad exposure to various issuers and security types. However, investors should be aware of potential limitations, such as interest rate risk, credit risk, and market risk. Considering alternatives, investors may explore Vanguard Municipal Bond Index Fund or the Schwab Intermediate-Term Municipal Bond ETF. When deciding between Galliard Retirement Income Fund CL 35 and alternative options, investors should carefully evaluate their investment objectives, risk tolerance, and preferences. By conducting thorough research and considering individual investment goals, investors can make informed decisions that align with their financial strategies.What Is Galliard Retirement Income Fund CL 35?

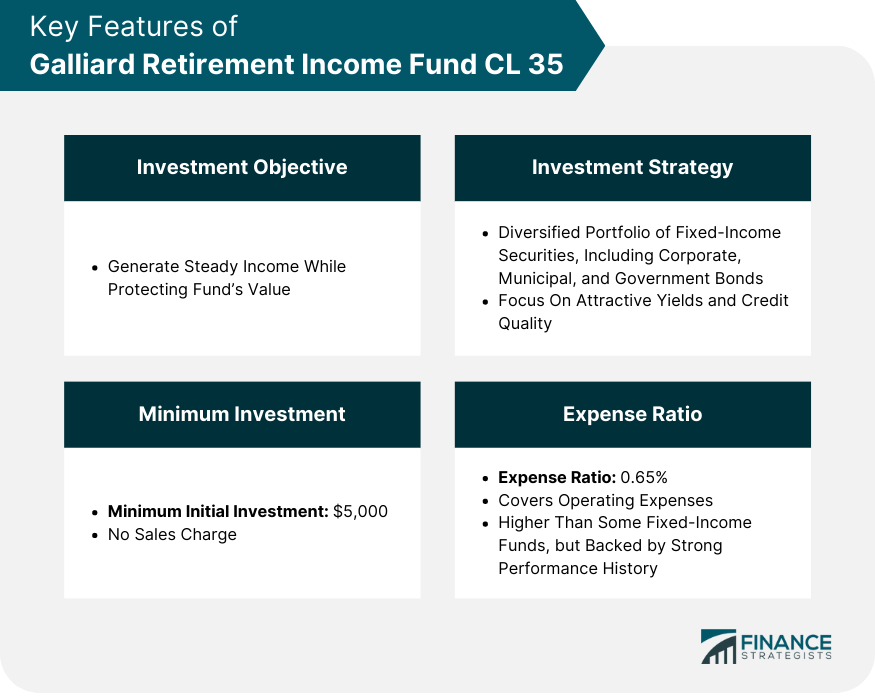

Key Features of Galliard Retirement Income Fund CL 35

Investment Objective

Investment Strategy

Minimum Investment

Expense Ratio

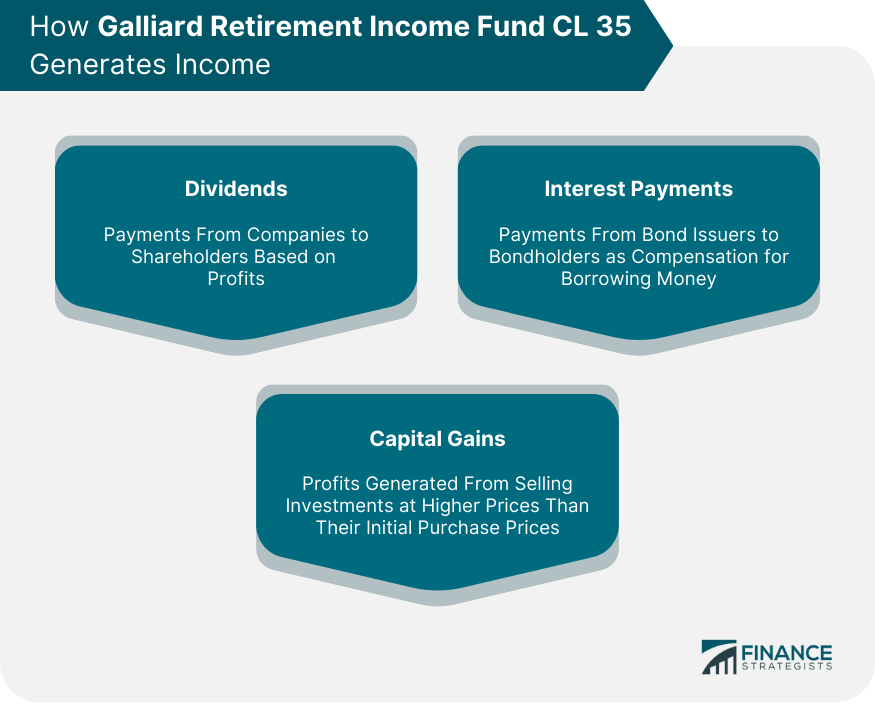

How Galliard Retirement Income Fund CL 35 Generates Income

Dividends

Interest Payments

Capital Gains

Limitations of Galliard Retirement Income Fund CL 35

Interest Rate Risk

Credit Risk

Market Risk

Alternatives to Galliard Retirement Income Fund CL 35

Vanguard Municipal Bond Index Fund (VMBMX)

Schwab Intermediate-Term Municipal Bond ETF (SHM)

Final Thoughts

Galliard Retirement Income Fund CL 35 FAQs

Galliard Retirement Income Fund CL 35 is a closed-end management investment company that invests primarily in fixed-income securities, such as bonds, preferred stocks, and other debt instruments.

The fund's investment objectives are to provide current income, preserve capital, and provide a stable source of income for retirement.

Like other funds and market players, the Galliard Retirement Income Fund CL 35 is open to market risk, credit risk, and interest rate risk.

The fund's fees include an expense ratio of 0.65%. This fee covers the costs of managing the fund, such as the salaries of the fund's managers, the cost of marketing the fund, and the cost of buying and selling the fund's investments.

You can invest in Galliard Retirement Income Fund CL 35 by opening an account with a brokerage firm that offers the fund. You can then purchase shares of the fund through your brokerage account.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.