Deemed distribution refers to a situation in which a taxpayer is considered to have received a distribution from a corporation, retirement plan, or other entity, even though no actual cash or property has been transferred. The distribution is treated as income for tax purposes and may be subject to various taxes, including income tax and capital gains tax. Understanding deemed distribution is essential for taxpayers and financial professionals as it impacts taxation and financial management. Deemed distributions can trigger tax liabilities, affect investment returns, and influence corporate decision-making. Properly managing deemed distributions can help taxpayers minimize tax liabilities and optimize their financial strategies. The legal and regulatory framework for deemed distributions is primarily based on two sources: The IRC governs federal taxation in the United States and contains provisions that address deemed distributions in various contexts, including corporate transactions, retirement plans, and international taxation. Treasury Regulations, issued by the U.S. Department of the Treasury, provide guidance and interpretation of the IRC provisions related to deemed distributions. These regulations help taxpayers and financial professionals understand the tax treatment of deemed distributions and comply with the relevant tax laws. The Internal Revenue Service (IRS) issues guidance, including revenue rulings, revenue procedures, and private letter rulings, to help taxpayers understand and comply with the tax laws related to deemed distributions. In the context of international taxation, deemed distributions may be addressed in tax treaties between countries. Tax treaties help prevent double taxation and clarify the tax treatment of deemed distributions involving taxpayers in different jurisdictions. Deemed distributions can occur in various contexts, including at the shareholder level, the corporate level, and within retirement plans. Phantom income refers to income recognized for tax purposes but not received by the taxpayer. This can occur, for example, when a shareholder is allocated income from a partnership or S corporation but does not receive a cash distribution. In certain cases, stock redemptions and buybacks can be treated as deemed distributions to shareholders, even if the shareholder does not receive cash or other property. Deemed distributions can occur at the corporate level when a corporation's earnings and profits are treated as distributed to shareholders for tax purposes, even if no actual distribution occurs. In some instances, stock dividends may be considered taxable and deemed distributions to shareholders. Deemed distributions can also occur within retirement plans in several situations: When a retirement plan participant fails to take a required minimum distribution (RMD), the amount not distributed may be treated as a deemed distribution and subject to tax. Excess contributions to retirement plans can be considered deemed distributions and subject to tax if they are not corrected in a timely manner. If a retirement plan participant defaults on a plan loan, the outstanding loan balance may be treated as a deemed distribution and subject to tax. Deemed distributions have various tax implications and reporting requirements for taxpayers. Deemed distributions are generally treated as income and subject to income tax at the taxpayer's ordinary income tax rate. In some cases, deemed distributions may also be subject to additional taxes or penalties, such as the 10% early withdrawal penalty for certain retirement plan distributions. In certain situations, deemed distributions can result in capital gains or losses for the taxpayer. These gains or losses are subject to capital gains tax rates, which may be more favorable than ordinary income tax rates. Taxpayers must report deemed distributions on their tax returns and may need to file additional forms or schedules, depending on the specific situation. Payers of deemed distributions, such as corporations or retirement plans, generally must issue Form 1099-DIV to the recipient, reporting the amount of the deemed distribution. Individual taxpayers must report deemed distributions as income on their Form 1040, U.S. Individual Income Tax Return. Corporations that make deemed distributions to shareholders must report the distributions on Form 1120, U.S. Corporation Income Tax Return. Taxpayers and financial professionals can use various tax planning strategies to minimize the tax impact of deemed distributions, such as: Timing of Distributions: Manage the timing of deemed distributions to defer or accelerate income recognition, depending on the taxpayer's tax situation. Tax-Efficient Investments: Invest in tax-efficient assets or structures that minimize deemed distributions or their tax impact. Tax-Loss Harvesting: Use investment losses to offset capital gains resulting from deemed distributions, reducing the overall tax liability. Deemed distributions are essential in taxation and financial management, with implications for individual and corporate taxpayers. Understanding the legal and regulatory framework, tax implications, and reporting requirements related to deemed distributions can help taxpayers and financial professionals navigate this complex area and develop effective tax planning strategies. By staying informed of future developments and trends in deemed distributions, such as potential changes to tax laws and regulations, technological advancements, and globalization, taxpayers and financial professionals can adapt their strategies and ensure compliance with the evolving tax landscape. Deemed distributions are significant in taxation and financial management. By understanding the intricacies of this concept and its implications, taxpayers and financial professionals can make informed decisions and optimize their tax strategies.What Is a Deemed Distribution?

Deemed Distribution: Legal and Regulatory Framework

Overview of Relevant Laws and Regulations

Internal Revenue Code (IRC)

Treasury Regulations

IRS Guidance and Rulings on Deemed Distribution

International Considerations and Tax Treaties Related to Deemed Distribution

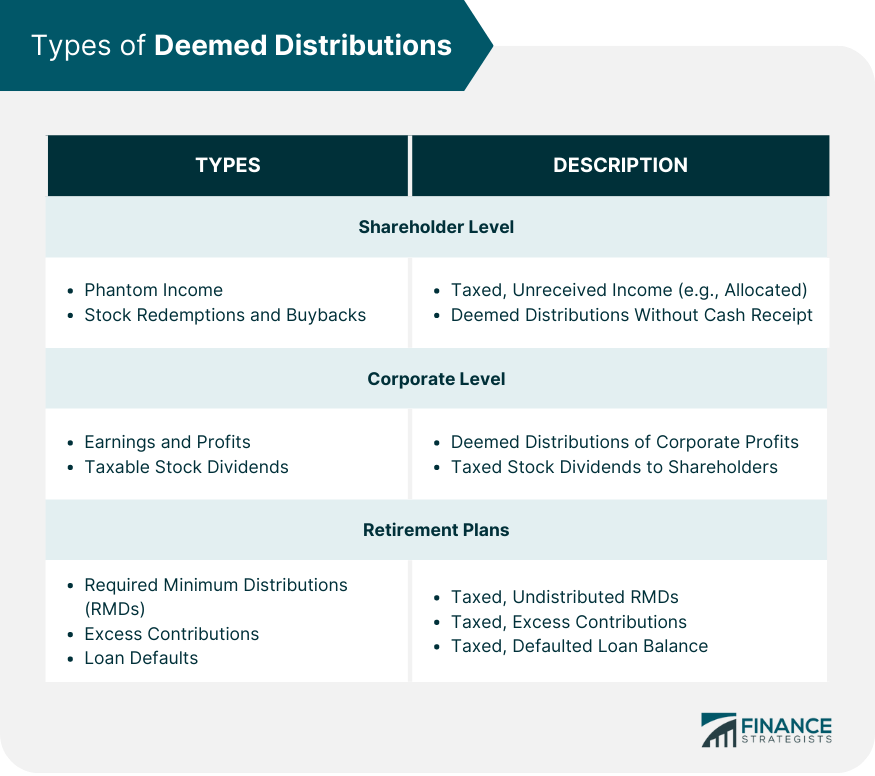

Types of Deemed Distributions

Deemed Distribution at Shareholder Level

Phantom Income

Stock Redemptions and Buybacks

Deemed Distribution at Corporate Level

Earnings and Profits

Taxable Stock Dividends

Deemed Distribution in Retirement Plans

Required Minimum Distributions

Excess Contributions

Loan Defaults

Tax Implications and Reporting Requirements for Deemed Distributions

Taxation of Deemed Distributions

Income Tax Consequences

Capital Gains Tax Consequences

Reporting Requirements for Deemed Distributions

Form 1099-DIV

Form 1040

Form 1120

Tax Planning Strategies and Considerations Related to Deemed Distributions

Conclusion

Deemed Distribution FAQs

A deemed distribution is a taxable event that occurs when a participant in a qualified retirement plan, such as a 401(k), fails to meet certain requirements, such as repaying a plan loan on time. The unpaid balance of the loan is treated as if it were distributed to the participant and is subject to income taxes and potentially early withdrawal penalties.

A deemed distribution in a 401(k) plan typically occurs when a participant fails to repay a plan loan according to the terms of the loan agreement. Common triggers for a deemed distribution include defaulting on loan payments, failing to repay the loan within the maximum term allowed, or terminating employment without fully repaying the loan.

The tax consequences of a deemed distribution include treating the amount of the deemed distribution as ordinary income for the participant in the year of the event. This amount is subject to federal and possibly state income taxes. Additionally, if the participant is under the age of 59½, the deemed distribution may be subject to a 10% early withdrawal penalty unless an exception applies.

No, a deemed distribution cannot be rolled over into another retirement account. Unlike an actual distribution, a deemed distribution does not involve the transfer of funds from the retirement plan to the participant. Instead, it is a notional distribution that is treated as taxable income for tax purposes.

To avoid a deemed distribution from a retirement plan loan, participants should ensure that they make all required loan payments on time and in full. Additionally, participants should be aware of the maximum term allowed for the loan (usually five years) and ensure that the loan is repaid within that time frame. If a participant's employment is terminated, they should work with the plan administrator to determine their options for repaying the loan and avoiding a deemed distribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.