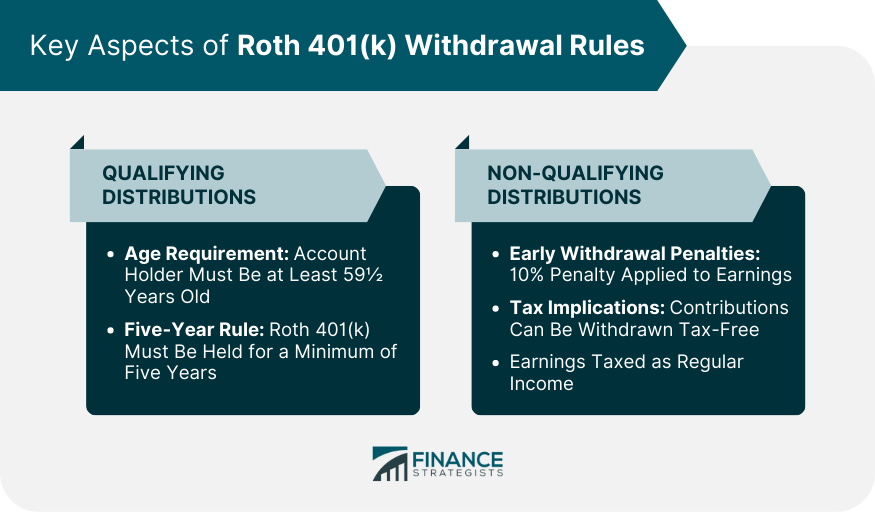

A Roth 401(k) is a type of retirement savings account that combines elements of a traditional 401(k) with features of a Roth IRA. Unlike the traditional 401(k), contributions to a Roth 401(k) are made using after-tax dollars, meaning withdrawals during retirement are generally tax-free. However, like a traditional 401(k), an employer can choose to match your contributions, providing an additional income source for retirement. Contribution limits for the Roth 401(k) are also higher than those of a Roth IRA. The account's growth potential, tax-free withdrawals, and ability to diversify tax risk make it a compelling option for retirement planning, particularly for younger employees or those expecting to be in a higher tax bracket when they retire. A distribution is deemed qualifying, and therefore tax-free and penalty-free, if it satisfies two primary conditions. The IRS stipulates that the account holder must be at least 59½ years old to avoid the 10% early withdrawal penalty. This rule ensures the funds are used for their intended purpose - retirement. In addition to the age requirement, the Roth 401(k) must have been held for a minimum of five years starting from the year of the first contribution. Both conditions must be met for a distribution to be qualified, thus promoting long-term savings. On the flip side, if your withdrawal doesn't meet the conditions mentioned, it's considered non-qualifying. If you withdraw from your Roth 401(k) before the age of 59 ½ or before your account has been open for five years, the distribution is subject to a 10% early withdrawal penalty, applied to the portion of the withdrawal that comes from earnings. The tax implications for non-qualifying distributions are relatively straightforward. Contributions to a Roth 401(k) are made post-tax; therefore, your original contributions can be withdrawn tax-free at any time. However, earnings on these contributions will be taxed as regular income if the withdrawal is non-qualifying. The IRS permits penalty-free withdrawals for certain hardship situations. These can include high unreimbursed medical expenses, higher education costs, or purchasing your first home. However, it's crucial to remember that even in these cases, taxes may still apply on earnings. If the account holder becomes permanently disabled or passes away, the penalties for early withdrawal are waived. The withdrawal rules will vary depending on whether the account is inherited or not. Also known as Substantially Equal Periodic Payments (SEPP), this approach allows for penalty-free withdrawals prior to reaching age 59½. The distribution amount is calculated based on the account holder's life expectancy and must continue for five years or until the account holder reaches age 59½, whichever comes later. RMDs are the minimum amount you must withdraw from your retirement account each year, starting at age 72. These rules ensure that savings in tax-advantaged retirement accounts are not accumulated indefinitely but are distributed during the account holder's lifetime. If you are still working at age 72 and don't own more than 5% of the company you work for, you can delay RMDs from your current employer's Roth 401(k) until you retire. Your RMD is determined by dividing the balance of your Roth 401(k) by a life expectancy factor provided by the IRS. Failure to take the RMD results in a hefty 50% penalty on the amount that should have been withdrawn. Roth IRAs have more flexible rules for withdrawals. They aren't subject to RMDs during the owner's lifetime, and they offer more exceptions to the early withdrawal penalty. One strategy to bypass the RMD rule associated with Roth 401(k)s is rolling over the funds into a Roth IRA. This move allows your investments to continue growing tax-free with no mandatory withdrawals during your lifetime. Planning tax-efficient withdrawals can significantly stretch the value of your retirement savings. Intelligently blending withdrawals from your Roth and traditional retirement accounts can help manage your taxable income, possibly keeping you in a lower tax bracket. Understanding how your withdrawals impact your taxable income can also affect how much of your Social Security benefits are taxed. Smart retirement planning starts early and involves consistent adjustment to align with your financial situation and goals. The sooner you start contributing to your Roth 401(k), the more time your money has to grow tax-free. Regular contributions, even if small, can significantly impact your retirement nest egg due to the power of compound interest. As life changes, so should your retirement strategy. Regular reviews will ensure your plan stays on track. Also, consider seeking advice from a financial advisor for a tailored approach to your retirement planning. The Roth 401(k) offers a unique combination of high contribution limits, tax-free growth, and tax-free withdrawals that make it a valuable retirement planning tool. Navigating its withdrawal rules can seem complex, but with an understanding of qualifying and non-qualifying distributions, exceptions, and the impact of Required Minimum Distributions, you can maximize your retirement savings and optimize your tax strategy. Additionally, the strategic blending of withdrawals from Roth and traditional accounts, along with careful consideration of how withdrawals affect taxable income and Social Security benefits, can further extend the value of your savings. Retirement planning is an ongoing process of adjusting to life changes and financial shifts. Starting early and consistently contributing, even in small amounts, can greatly impact the growth of your nest egg. Reach out to a financial advisor to begin crafting a personalized retirement strategy today.Overview of Roth 401(k)

Key Aspects of Roth 401(k) Withdrawal Rules

Qualifying Distributions

Age Requirement

Five-Year Rule

Non-Qualifying Distributions

Early Withdrawal Penalties

Tax Implications

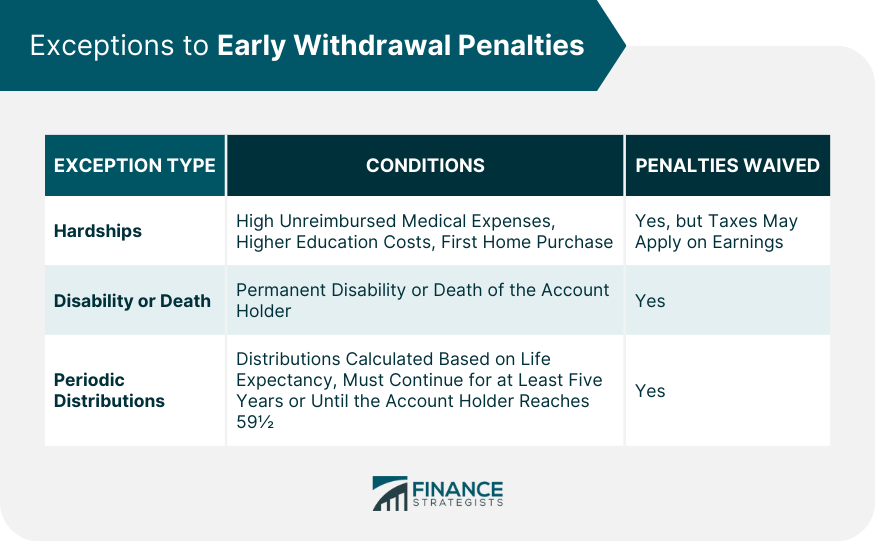

Exceptions to Early Withdrawal Penalties

Hardships

Disability or Death

Periodic Distributions

How Required Minimum Distributions (RMDs) Apply to Roth 401(k)s

Overview of RMDs

When and How They Apply to Roth 401(k)s

Calculating Your RMD

Roth 401(k) vs Roth IRA Withdrawal Rules

Highlighting the Differences

Advantage of Rolling a Roth 401(k) Into a Roth IRA to Bypass RMDs

Strategies for Tax-Efficient Withdrawals

Considerations for Blending Withdrawals From Roth and Traditional Accounts

Impact of Withdrawals on Taxable Income and Social Security Benefits

Tips for Planning Ahead

Benefits of Starting Early and Contributing Consistently

Importance of Periodic Reviews and Adjustments to Retirement Strategy

Bottom Line

Roth 401(k) Withdrawal Rules FAQs

You must be at least 59½ years old and have held the account for a minimum of five years.

Non-qualifying withdrawals can incur a 10% early withdrawal penalty and potential taxation on earnings.

Yes, exceptions include hardships like high medical costs, education expenses, first home purchase, disability, death, and Periodic Distributions (SEPP).

RMDs are the minimum amounts you must withdraw from your Roth 401(k) each year, starting at age 72.

Roth 401(k)s are subject to RMDs and have fewer exceptions for early withdrawal penalties compared to Roth IRAs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.