In addition to the popular 401(k) retirement plan, there are several other retirement plans available to individuals. One option is an Individual Retirement Account (IRA), which allows individuals to contribute money on a tax-deferred or tax-free basis, depending on the type of IRA chosen. Another option is a Simplified Employee Pension (SEP) IRA, which is designed for self-employed individuals or small business owners. SEP IRAs offer higher contribution limits and are relatively easy to set up. Additionally, there are 403(b) plans for employees of public schools and certain nonprofit organizations, as well as 457 plans for state and local government employees. Exploring these alternative retirement plans can help individuals diversify their retirement savings and find the best fit for their financial goals and circumstances. Have questions about Retirement Plans? Click here. Traditional Individual Retirement Accounts (IRAs) are personal savings plans offering tax-deferred growth. This means you pay taxes upon withdrawal rather than when contributing to the account. They're particularly beneficial if you expect your tax bracket to be lower in retirement. In contrast to Traditional IRAs, Roth IRA contributions are made with after-tax dollars. This means withdrawals in retirement are generally tax-free, making them a good option if you anticipate a higher tax bracket in retirement. Simplified Employee Pension (SEP) IRAs are designed for self-employed individuals and small business owners. They have higher contribution limits compared to Traditional and Roth IRAs, providing a way to save significantly more for retirement. Savings Incentive Match Plan for Employees (SIMPLE) IRAs are designed for small businesses with 100 or fewer employees. They're simpler and less costly for businesses to administer than other retirement plans. Defined benefit plans, often known as pensions, are a type of retirement plan where the employer guarantees a specified retirement benefit amount to the employee. The benefit is usually based on factors like salary history and duration of employment. 403(b) plans, also known as tax-sheltered annuity plans, are retirement plans for specific employees of public schools, tax-exempt organizations, and certain ministers. They're similar to 401(k) plans but are exclusively for these types of employees. 457 plans are non-qualified, tax-advantaged deferred compensation retirement plans offered by state, local government, and some nonprofit employers. They offer separate catch-up contributions over and above the standard contribution limit, providing an extra boost to retirement savings. The Thrift Savings Plan is a federal government-sponsored retirement savings and investment plan. It's similar to a 401(k) but is exclusively for federal employees and members of the uniformed services. Keogh plans, or HR-10 plans, are tax-favored retirement plans for self-employed individuals and small businesses. They allow higher contributions than many other plans, making them a good option for high-income business owners. Nonqualified Deferred Compensation (NQDC) plans are agreements between employers and employees to defer compensation until a future date. They're not a qualified plan, so they offer more flexibility but lack some of the tax advantages of other retirement plans. Health Savings Accounts are not strictly retirement plans, but they can play a critical role in retirement planning. HSAs allow for tax-deductible contributions, tax-deferred growth, and tax-free withdrawals for qualified medical expenses, making them a triple tax advantage. Unlike 401(k) plans that have a uniform contribution limit, other retirement plans, such as IRAs, SEP IRAs, SIMPLE IRAs, and others, have varying contribution limits and rules. It's crucial to understand these nuances to make the most of each plan's benefits. Just like 401(k) plans, other retirement plans come with their tax advantages. However, the nature of these advantages can vary, such as tax-deductible contributions, tax-deferred growth, or tax-free withdrawals. Each retirement plan has its unique rules about when you can access your funds and the penalties for early withdrawals. Understanding these rules can help you plan for liquidity needs in retirement and avoid unnecessary penalties. Some retirement plans, like the 401(k) and certain types of IRAs, often involve employer contributions. On the other hand, some plans like Traditional and Roth IRAs are established by individuals independent of their employers. Different retirement plans offer various options for portability and rollovers. Some, like 401(k)s and IRAs, can be rolled over into other plans, while others may have restrictions. When choosing a retirement plan, it's important to consider your unique financial goals. Different plans may be better suited to different goals, such as maximizing tax savings, accumulating wealth, or providing income in retirement. The tax implications of different retirement plans can have a significant impact on your overall financial situation. It's crucial to understand these implications and consult with a tax advisor if needed. If your employer offers a retirement plan, such as a 401(k), 403(b), or SIMPLE IRA, it's essential to understand the benefits of these plans, including any employer match. Different retirement plans offer different investment options and levels of flexibility. Some plans offer a wide range of investment choices, while others may be more limited. There are several retirement plans available besides the 401(k) that individuals can consider based on their specific needs and financial goals. Exploring options such as Individual Retirement Accounts (IRAs), Simplified Employee Pension (SEP) IRAs, 403(b) plans, 457 plans, and others allows individuals to diversify their retirement savings and take advantage of tax benefits and contribution limits. It's important to carefully consider factors like tax implications, employer offerings, investment options, and flexibility when choosing a retirement plan. Consulting with financial advisors or retirement planning professionals can provide valuable guidance in selecting the most suitable plan to meet individual retirement objectives. By understanding the various retirement plans and making informed decisions, individuals can work towards building a secure financial future.What Are Other Retirement Plans Besides 401(k)?

Individual Retirement Accounts (IRAs)

Traditional IRAs

Roth IRAs

SEP IRAs

SIMPLE IRAs

Defined Benefit Plans

403(b) Plans

457 Plans

Thrift Savings Plan (TSP)

Keogh Plans

Nonqualified Deferred Compensation Plans

Health Savings Accounts (HSAs)

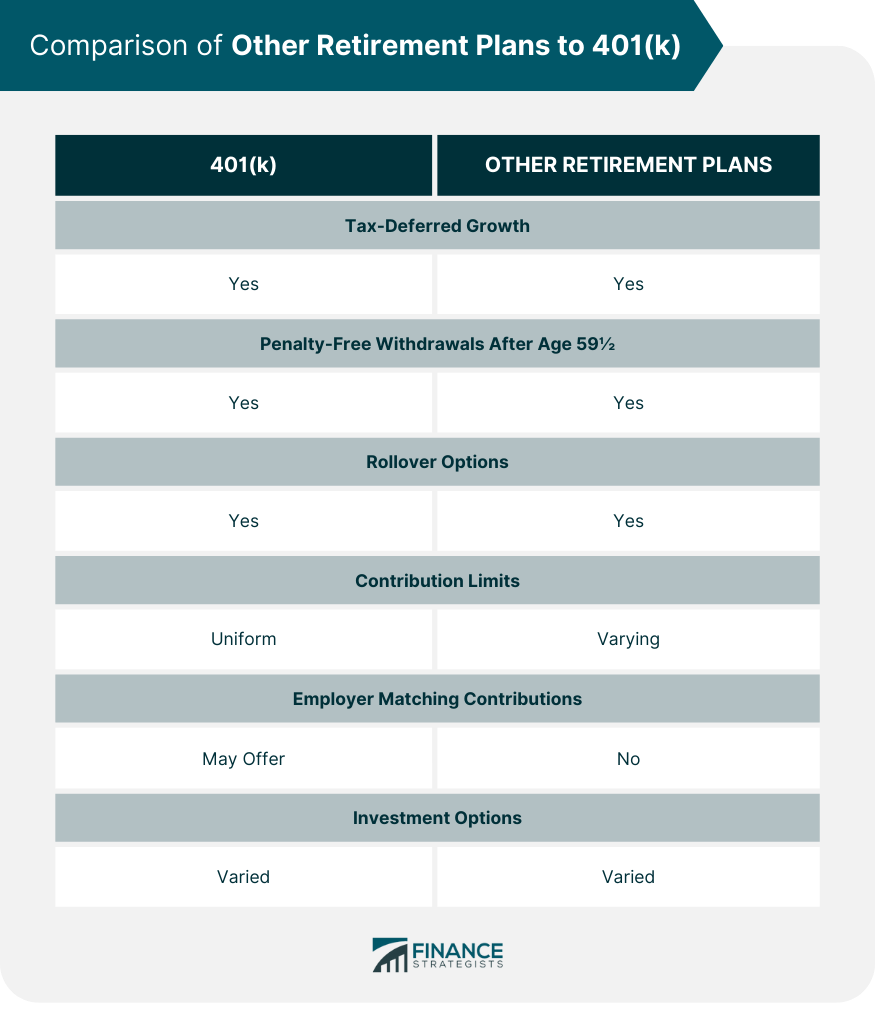

Comparison of Other Retirement Plans to 401(k)

Contribution Limits and Rules

Tax Advantages and Considerations

Accessibility and Withdrawal Restrictions

Employer Involvement and Contributions

Portability and Rollover Options

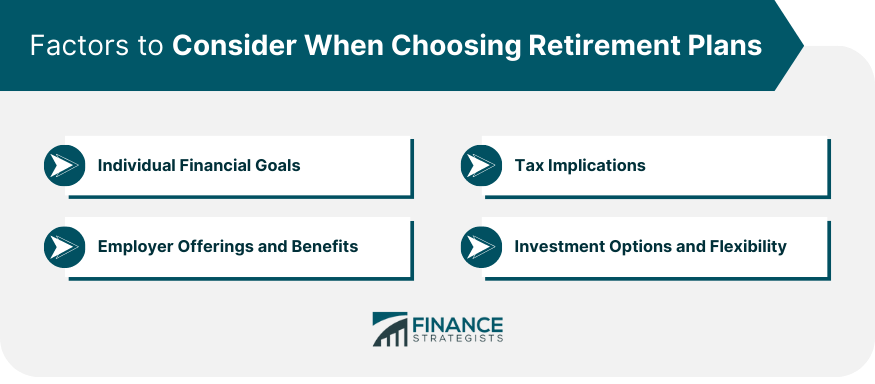

Factors to Consider When Choosing Retirement Plans

Individual Financial Goals

Tax Implications

Employer Offerings and Benefits

Investment Options and Flexibility

Conclusion

Other Retirement Plans Besides 401(k) FAQs

Other retirement plans include IRAs (Traditional, Roth, SEP, SIMPLE), Defined Benefit Plans, 403(b) Plans, 457 Plans, Thrift Savings Plan, Keogh Plans, Nonqualified Deferred Compensation Plans, and Health Savings Accounts.

These plans differ in aspects like contribution limits, tax advantages, accessibility, employer involvement, and portability.

Yes, you can contribute to both a 401(k) and an IRA at the same time, but there are income limits for IRA deductibility if you're covered by a workplace retirement plan.

The "best" retirement plan depends on your individual financial circumstances, tax situation, retirement goals, and the offerings from your employer.

Traditional IRAs offer tax-deductible contributions and tax-deferred growth, while Roth IRAs offer tax-free growth and tax-free withdrawals in retirement. Both provide potential tax advantages that can help grow your retirement savings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.