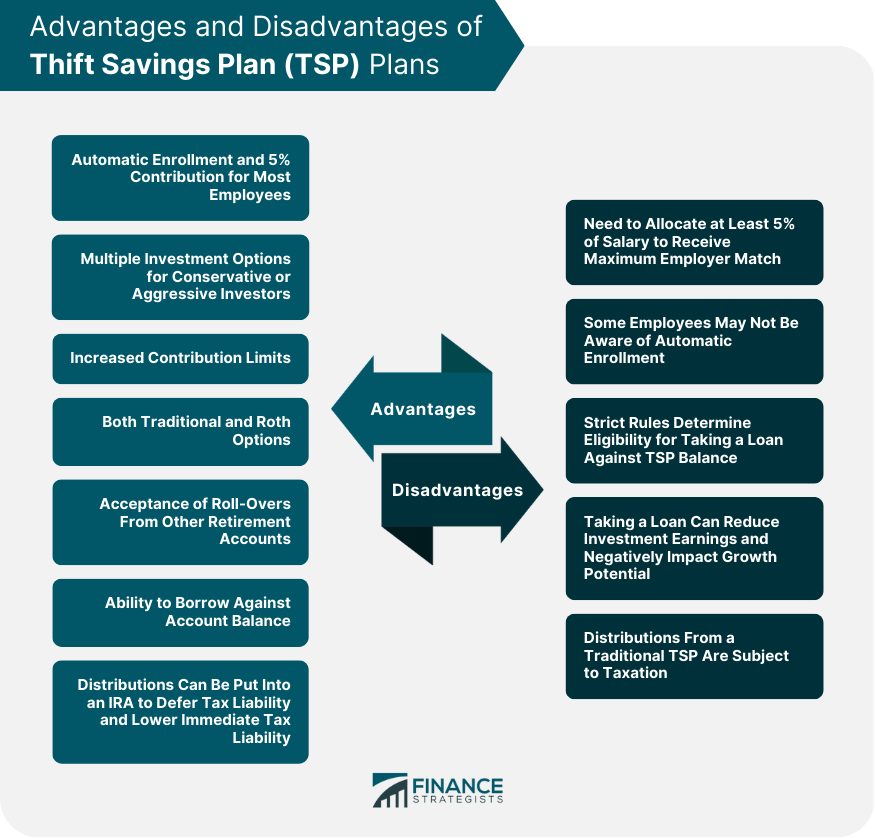

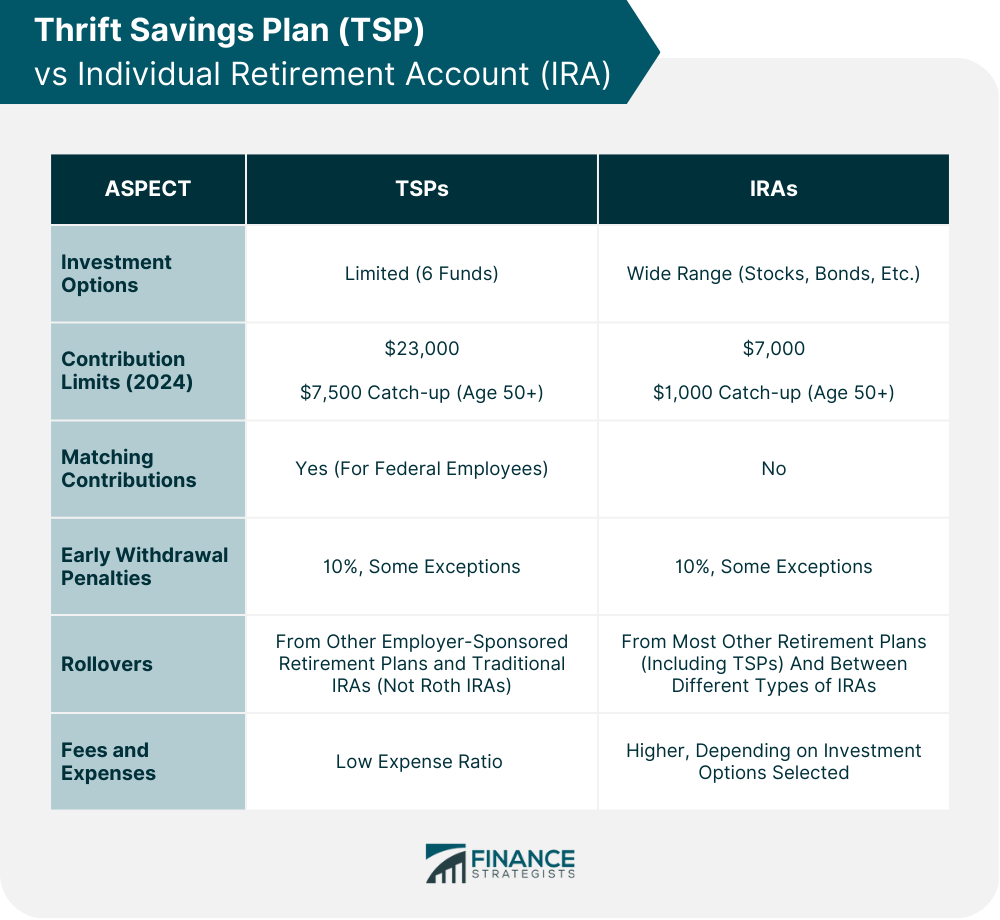

The Thrift Savings Plan is a retirement investment program exclusively available to federal employees and uniformed service members, including the Ready Reserve. It is a type of defined-contribution (DC) plan that offers many benefits similar to those offered by 401(k) plans in the private sector. The TSP works similarly to DC plans like 401(k) and 403(b), but it is exclusively available to government and military employees. The TSP is managed by the Federal Retirement Thrift Investment Board (FRTIB), which is an independent government agency. There are different ways to invest in a TSP, including: Automatic payroll deductions Agency matching contributions Contributions to either a traditional TSP (where withdrawals are taxed in retirement) or a Roth TSP (where withdrawals are tax-free in retirement). Regardless of the type of TSP or contribution structure, the contribution limit for 2024 is $23,000 and employees aged 50 and over can make catch-up contributions of $7,500 in 2024. Have questions about Thrift Savings Plans? Click here. Employees who qualify for TSPs are automatically enrolled by the federal government. If you're a FERS employee who started after July 31, 2010, your TSP will deduct 3% of your basic pay from each pay period. However, you can change or stop your contributions whenever you want. You can receive Agency/Service Automatic Contributions of 1% on every pay date without making your own contributions, and these contributions don't deduct from your paycheck. After completing three years of service, most FERS participants can vest the entire automatic contributions. Certain employees may have to wait two years. Employer matching programs are also available, where your employer matches your contributions up to a certain amount. To get the highest employer match amount, you need to contribute at least 5% to your TSP, and the first 3% of your contributions are matched dollar-for-dollar, while the next 2% are matched 50 cents on the dollar. TSPs offer six different funds, including G Fund (Government Securities Investment Fund), F Fund (Fixed Income Index Investment Fund), and C Fund (Common Stock Index Investment Fund). The three others are S Fund (Small Cap Stock Index Investment Fund), I Fund (International Stock Index Investment Fund), and Lifecycle (L) funds. L Funds are managed by professionals who invest your savings in diverse securities from the above funds based on target retirement dates. Several options are available, such as L2020, L2030, L2040, and L2050, and the year in the title indicates the year the plan is designed for an employee's retirement. For instance, an L2030 plan is designed for an employee retiring in 2030. The Thrift Savings Plan offers six different investment funds to choose from, each with its own advantages and potential drawbacks. The G Fund is a secure investment option offered by TSP that invests in U.S. Treasury securities specifically issued for TSP. It has very low credit and no market risks, making it the safest option. The earnings of G Fund are based on the yields of U.S. Treasury securities with different maturity periods, which are smoothed over four months for consistent returns. It is often recommended for people who are risk-averse or nearing retirement and want to protect their investment capital. The F Fund invests in a variety of safe, high-quality bonds such as those issued by the U.S. government, mortgage-backed securities, corporations, and foreign governments. It follows a passive investment strategy by mimicking the Bloomberg Barclays U.S. Aggregate Bond Index. Compared to other TSP investment choices, the F Fund has a moderate level of risk and potential return. The C Fund invests in a group of stocks that mirrors the performance of the S&P 500, a widely-used index representing the U.S. stock market. As a result, the C Fund's returns are influenced by the S&P 500's performance, making it a riskier investment compared to the G and F Funds, but with greater potential for higher returns. Typically, the C Fund is suggested for individuals who are willing to accept higher risk to achieve greater returns. The S Fund invests in small and medium-sized American companies that are not part of the S&P 500 Index. The fund's performance is influenced by the size of the companies it invests in, with larger companies having a greater impact. The S Fund's returns are usually more unstable than the C Fund's because small and medium-sized companies respond more to economic changes. The S Fund is suitable for individuals who are willing to take on more risk and want to benefit from the potential for higher returns from smaller companies. The I Fund is an investment option that invests in stocks of companies in developed and emerging foreign markets. The fund's performance is influenced more by larger companies in the index due to its weighted investment strategy. This fund carries a higher risk level than other TSP investment options because it invests in international markets, which can be more volatile and subject to political and economic instability. However, it also has a potential for higher returns, especially during periods of global economic growth. The I Fund is typically suggested for individuals who seek exposure to international markets and are willing to take on a higher level of risk. The L Funds are managed by professionals and offer a simple, hassle-free investment approach. These funds invest in a combination of the five TSP funds based on the target retirement date. There are five L Funds currently available, which include L2020, L2030, L2040, L2050, and L Income Fund. The TSP is an exclusive retirement investment program available only to certain individuals, including full-time or part-time federal employees or military members. The program is available to those who meet specific requirements, such as: Federal Employees Retirement System (FERS) employees hired on or after January 1, 1984 Civil Service Retirement System (CSRS) employees hired before January 1, 1984, who did not convert to FERS Active duty or Ready Reserve members of the uniformed services Civilians in certain categories of government service If you are unsure whether you qualify for a TSP, you should contact your human resources or benefits office. Once you reach the age of 70 and a half or leave federal employment, whichever comes later, you must start taking distributions from your TSP account. You have the option to make a partial or full withdrawal. With partial withdrawals, you can make a one-time withdrawal and leave the rest of your TSP funds for later. You can only make a partial withdrawal if you have not made a prior partial withdrawal or have one pending, and if you did not make an age-based in-service withdrawal while you were still employed by the Federal Government or uniformed services. The amount of the partial withdrawal must be less than $1,000. You can also make a full withdrawal either all at once, over time, or through an annuity that makes monthly payments. If you choose monthly payments, you can either designate a specific dollar amount or request payments based on IRS life expectancy tables. If you withdraw from your TSP account before you reach 55 years old, you may incur a penalty of up to 10%. If you leave federal or military employment, you can keep your TSP account as long as the balance is above $200, and it will continue to grow tax-advantaged with low administrative costs. However, you will not be able to contribute additional funds. Nonetheless, you can transfer money into TSP accounts from traditional IRAs and some employer-sponsored plans. You can also transfer your TSP funds into other qualified retirement plans if you prefer. Participating in a TSP offers numerous advantages, including building a robust retirement fund through diversified investments. Here is a look at the benefits of TSP plans: Automatic enrollment and 5% contribution for most employees Multiple investment options for those with conservative or aggressive investment strategies Increased contribution limits Both traditional and Roth options Acceptance of roll-overs from other retirement accounts Ability to borrow against the account balance Distributions can be put into an IRA to defer tax liability Lower immediate tax liability Despite the numerous advantages of participating in a TSP, there are also some downsides to consider before committing to the plan. Here are some of the cons of TSP plans: In order to receive the maximum employer match, employees need to allocate at least 5% of their salary to their TSP Some employees may not be aware they are contributing to a retirement account through automatic enrollment, which could lead to misunderstandings about their pay. There are only two reasons an employee can take a loan against their TSP balance, and strict rules determine eligibility. Taking a loan can reduce investment earnings and negatively impact the account's growth potential. Distributions from a traditional TSP are subject to taxation, which could decrease the value of the account over time Individual Retirement Accounts and Thrift Savings Plans are both retirement savings vehicles that allow investors to accumulate savings tax-free, but there are some key differences between them. One of the main differences between TSPs and IRAs is the investment options available. TSPs offer a limited number of investment options, typically six funds that invest in a mix of stocks, bonds, and government securities. In contrast, IRAs offer a wider range of investment options, including individual stocks, mutual funds, exchange-traded funds (ETFs), and more. Another significant difference between TSPs and IRAs is the contribution limits. For 2024, the contribution limit for TSPs is $23,000, up from $22,500 in 2023. Employees aged 50 and over can also make catch-up contributions of $7,500 in 2024, up from $6,500 in 2022. In contrast, the contribution limit for IRAs is $7,000, with a catch-up contribution limit of $1,000 for individuals aged 50 and over. Matching contributions are another key difference between TSPs and IRAs. TSPs offer matching contributions for federal employees, with the government matching the first 3% of an employee's contribution dollar-for-dollar and the next 2% at 50 cents on the dollar. In contrast, IRAs do not offer matching contributions. Both TSPs and IRAs charge penalties for early withdrawals, but the penalties differ. For TSPs, the penalty for early withdrawal is 10% for withdrawals made before age 59 1/2, with some exceptions. For IRAs, the penalty for early withdrawal is also 10%, but it applies to withdrawals made before age 59 1/2, with a few exceptions. In addition, the penalty for early withdrawal from a TSP can be waived for certain reasons, such as disability or death, whereas the penalty for early withdrawal from an IRA cannot be waived. Both TSPs and IRAs allow for rollovers, but there are some differences in how they work. TSPs allow for rollovers from other employer-sponsored retirement plans and traditional IRAs but not from Roth IRAs. In contrast, IRAs allow for rollovers from most other retirement plans, including TSPs, as well as between different types of IRAs. Finally, TSPs and IRAs differ in their fees and expenses. TSPs are known for their low fees, with an expense ratio of just 0.042% for the G Fund and 0.059% for the C Fund in 2022. In contrast, IRAs can have higher fees and expenses, depending on the investment options selected. However, IRAs offer more flexibility in choosing investments, which may justify the higher fees for some investors. The Thrift Savings Plan is a defined-contribution retirement investment program exclusively available to federal employees and uniformed service members. The TSP is managed by the Federal Retirement Thrift Investment Board and offers automatic enrollment, multiple investment options, increased contribution limits, and lower immediate tax liability. The TSP offers six different investment funds, including the G, F, C, S, and I Funds, as well as L Funds. While there are some disadvantages to consider, such as the need to allocate at least 5% of salary to receive the maximum employer match, the benefits of participating in a TSP are numerous. To make informed investment decisions regarding TSPs or other retirement plans, it is essential to seek the advice of a financial advisor. A financial advisor can help individuals understand their investment options, evaluate the potential risks and returns of different funds, and design a retirement strategy that aligns with their goals and priorities.What Is the Thrift Savings Plan (TSP)?

How the Thrift Savings Plan (TSP) Works

Thrift Savings Plan (TSP) Investment Options

Government Securities Investment Fund (G Fund)

Fixed Income Index Investment Fund (F Fund)

Common Stock Index Investment Fund (C Fund)

Small Cap Stock Index Investment Fund (S Fund)

International Stock Index Investment Fund (I Fund)

Lifecycle (L) Funds

Who Can Open a Thrift Savings Plan (TSP)

How to Withdraw From a Thrift Savings Plan (TSP)

Advantages of Thrift Savings Plans (TSPs)

Disadvantages of Thrift Savings Plans (TSPs)

Thrift Savings Plans (TSPs) vs Individual Retirement Accounts (IRAs)

Investment Options

Contribution Limits

Matching Contributions

Early Withdrawal Penalties

Rollovers

Fees and Expenses

Final Thoughts

Thrift Savings Plan (TSP) FAQs

The TSP is a retirement investment program exclusively available to federal employees and uniformed service members, including the Ready Reserve.

TSPs offer six different investment funds to choose from, including G Fund, F Fund, C Fund, S Fund, I Fund, and Lifecycle (L) Funds.

The contribution limit for 2024 is $23,000, and employees aged 50 and over can make catch-up contributions of $7,500.

TSPs offer a limited number of investment options, have higher contribution limits, and offer matching contributions for federal employees. In contrast, IRAs offer a wider range of investment options, have lower contribution limits, and do not offer matching contributions.

The penalty for early withdrawal is 10% for withdrawals made before age 59 1/2, with some exceptions, but it can be waived for certain reasons, such as disability or death.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.