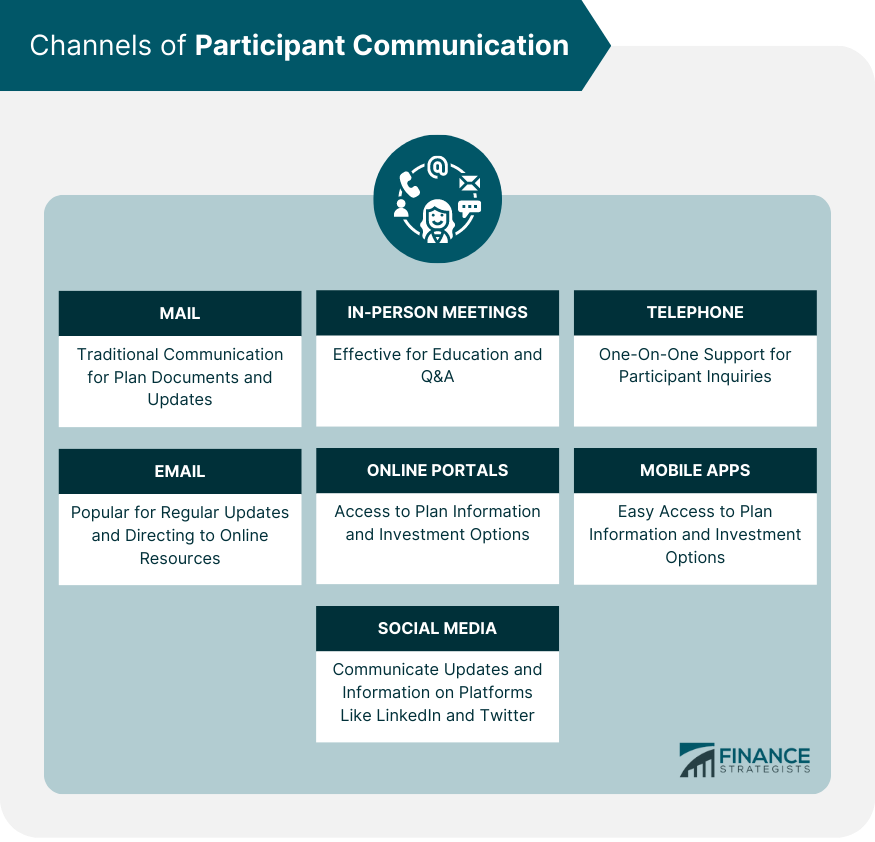

Participant communication in retirement involves the exchange of information between plan sponsors and participants regarding their retirement plan. This communication can help participants make informed decisions about their retirement savings and investments. It can take many forms, including written materials, online resources, in-person meetings, and educational workshops. Participant communication in retirement is crucial for ensuring that participants are educated about their retirement plan options, understand the benefits available to them, and are empowered to make informed decisions about their retirement savings. Pre-retirement education and planning involves providing participants with information about retirement planning, including the benefits and risks of different retirement plans and investment options. Ongoing communication and education involve providing participants with regular updates and information about their retirement plan, including investment performance and plan changes. Post-retirement communication involves providing participants with information about how to manage their retirement income, including options for distribution and tax implications. Participant communication can take place through a variety of channels: Mail is a traditional communication channel that can be effective for reaching participants who may not have access to digital communication. Employers can use mail to send out plan documents, updates, and other important information to participants. In-person meetings can be an effective way to communicate with participants about their retirement plan options. These meetings can be used to provide education and answer participant questions. Telephone communication can be useful for providing one-on-one support to participants who have questions or concerns about their retirement plan. Email is a popular communication channel that can be used to provide regular updates and important information to participants. Employers can also use email to direct participants to online resources and portals. Online portals can provide participants with access to their retirement plan information and investment options. These portals can be used to provide education, updates, and support to participants. Mobile applications can provide participants with easy access to their retirement plan information and investment options on their mobile devices. These applications can be used to provide updates, education, and support to participants. Social media can be used to communicate with participants and provide updates and information about retirement plan options. Employers can use social media platforms such as LinkedIn and Twitter to share articles and resources with participants. The Employee Retirement Income Security Act (ERISA) sets standards for retirement plans, including requirements for plan documentation, reporting, and fiduciary responsibility. Disclosure rules require retirement plans to provide participants with information about plan fees, investment options, and performance. Plan sponsors have a fiduciary responsibility to act in the best interests of their participants when making decisions about retirement plans. Participant engagement is a major challenge in retirement planning. Many workers, particularly younger workers, are not focused on retirement savings and may not fully understand the importance of saving for retirement. To overcome this challenge, employers can develop targeted communication strategies that emphasize the benefits of retirement savings and the importance of starting early. Employers can also provide educational resources and tools to help participants better understand retirement planning and investment options. Another challenge to effective participant communication is managing the amount of information participants receive. Participants can quickly become overwhelmed with too much information, leading to confusion and disengagement. To overcome this challenge, employers should prioritize the most important information and focus on delivering it in a clear and concise manner. Employers can also leverage technology to provide on-demand access to information, allowing participants to review materials at their own pace and on their own schedule. Limited resources can be a challenge for employers, particularly smaller employers who may not have the staff or budget to support robust communication strategies. To overcome this challenge, employers can leverage existing resources, such as retirement plan providers and industry associations, to access tools and resources that can support effective participant communication. Employers can also prioritize communication efforts to focus on the most critical information and leverage cost-effective communication channels, such as email and online portals. Clear and concise communication is essential for effective participant communication. It is important to provide information in a way that is easy to understand and digest. Complex information about retirement plans and investments can be overwhelming for participants, especially for those who are not financially savvy. To improve clarity, employers should consider using simple language, avoiding jargon, and using visual aids such as charts and graphs to supplement the text. Tailored communication can help employers better engage participants by providing information that is relevant to their individual circumstances. To tailor communication, employers should consider factors such as age, gender, income, and investment preferences. Employers can also use participant data to provide personalized recommendations and options that are specific to each participant's unique situation. This can help to increase engagement and encourage participants to take an active role in their retirement planning. Regular and consistent communication is crucial for keeping participants informed about their retirement plans and investment options. Employers should develop a communication plan that includes regular touchpoints throughout the year. This can include periodic statements, newsletters, and webinars. Employers should also ensure that communication is delivered in a timely manner and is consistent across all channels. This can help to build trust and confidence among participants, and promote long-term engagement with the retirement plan. Participant communication in retirement planning is a critical aspect of ensuring that employees are well-informed about their retirement options and can make the best decisions for their future. This communication can take many forms, including written materials, online resources, in-person meetings, and educational workshops. Pre-retirement education and planning, ongoing communication and education, and post-retirement communication are all crucial strategies in ensuring effective participant communication. Various channels can be used for participant communication, including mail, in-person meetings, telephone, email, online portals, mobile applications, and social media. Legal requirements for participant communication in retirement, such as those set forth by the Employee Retirement Income Security Act (ERISA), disclosure rules, and fiduciary responsibilities, must be adhered to by plan sponsors. Challenges to effective participant communication in retirement include participant engagement, communication overload, and limited resources. These challenges can be overcome by implementing best practices for participant communication in retirement, such as clear and concise communication, tailored communication, and regular and consistent communication. Overall, participant communication in retirement planning is a critical aspect of ensuring that employees are well-informed about their retirement options and can make the best decisions for their future.Definition of Participant Communication

Participant Communication Strategies

Pre-Retirement Education and Planning

Ongoing Communication and Education

Post-Retirement Communication

Channels of Participant Communication

Mail

In-person meetings

Telephone

Email

Online portals

Mobile applications

Social media

Legal Requirements for Participant Communication in Retirement

ERISA Requirements

Disclosure Rules

Fiduciary Responsibility

Challenges to Effective Participant Communication in Retirement

Participant Engagement

Communication Overload

Limited Resources

Best Practices for Participant Communication in Retirement

Clear and Concise Communication

Tailored Communication

Regular and Consistent Communication

Conclusion

Participant Communication FAQs

Participant communication is the process of educating and informing employees about their retirement plan options and benefits.

The best practices for participant communication in retirement planning include clear and concise communication, tailored communication, and regular and consistent communication.

Strategies include pre-retirement education, ongoing communication, and post-retirement communication.

Traditional channels like mail and in-person meetings, as well as digital channels like email, online portals, and mobile apps can be used.

Participant engagement, communication overload, and limited resources are some common challenges to effective participant communication.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.