The 401(k) average rate of return refers to the yearly gain or loss made on a 401(k) retirement plan, expressed as a percentage of the initial investment. It is calculated by evaluating the initial and final values of the investment, taking into account any contributions made during the period, and calculating the change over time. This rate is important as it provides a performance measure of retirement savings and informs strategic decisions like asset allocation and diversification. It's influenced by various factors including market performance, asset allocation within the account, timing and amount of contributions, and management fees. Historically, the U.S. stock market has seen an average annual return of about 10%, adjusted for inflation, although individual 401(k) returns can vary based on their specific investment mi Examining historical trends of the 401(k) average rate of return can help inform expectations for future performance. For instance, over the past few decades, the U.S. stock market has produced an average annual return of around 5% to 10%, after adjusting for inflation. It's important to remember that past performance is not indicative of future results. Economic factors, such as interest rates, inflation, GDP growth, and changes in employment levels, can all impact the 401(k) average rate of return. These macroeconomic variables influence stock market performance, which in turn affects the returns on 401(k) investments. Monitoring the 401(k) average rate of return can provide valuable input for retirement planning. By assessing the performance of your 401(k), you can estimate future account balances and plan accordingly. The average rate of return can signal when it might be beneficial to adjust your investment strategy. If your returns are consistently below expectations, it could be time to reassess your portfolio's asset allocation or risk level. Understanding your 401(k)'s average rate of return can help in managing investment risk. If your portfolio's returns are highly volatile, you may wish to consider a more conservative asset allocation to help smooth out returns. While the average rate of return provides useful information, it's important not to rely solely on this figure. Market volatility can lead to substantial variations in yearly returns, making it risky to extrapolate future performance based solely on past averages. The average rate of return can be misleading if not interpreted correctly. For instance, it doesn't account for the impact of compounding, and a few years of exceptionally high or low returns can skew the average. Every investor's situation is unique, and the 401(k) average rate of return does not consider individual financial circumstances, risk tolerance, or investment horizons. It's therefore important to use this metric in conjunction with other financial planning tools. Diversification, or spreading your investments across a variety of asset classes, can help to optimize the 401(k) average rate of return. This strategy can help to reduce risk and potentially enhance returns. Regularly reviewing your portfolio and rebalancing as needed can help ensure your investments align with your goals and risk tolerance. This can contribute to optimizing your 401(k) average rate of return over the long term. Sticking to a long-term investment strategy, rather than trying to time the market or chase short-term returns, can help optimize your 401(k) average rate of return. Over time, the power of compound interest can help to grow your retirement savings. The 401(k) average rate of return can provide a benchmark for setting and adjusting your retirement savings goals. By tracking this metric, you can assess whether you're on track to meet your goals or whether adjustments are needed. Understanding the average rate of return for your 401(k) can inform your asset allocation strategy. For example, if your current portfolio's return is less than your target, you may decide to invest in higher-risk assets to potentially achieve higher returns. By monitoring the variability in your 401(k)'s average rate of return, you can get a sense of your risk tolerance. If large swings in your portfolio's value make you uncomfortable, you might opt for a more conservative investment approach. Professional financial advice can be beneficial in optimizing the 401(k) average rate of return. Advisors can provide personalized advice, help avoid common investment mistakes, and guide decisions on asset allocation, diversification, and risk management. Choosing a financial advisor who understands your financial goals, risk tolerance, and investment horizon can have a positive impact on your 401(k) average rate of return. Look for advisors with relevant qualifications, a transparent fee structure, and a good track record. 401(k) average rate of return serves as a crucial metric for retirement planning. It is influenced by several factors including market performance, asset allocation, and the timing and amount of contributions. Monitoring this rate assists in setting retirement savings goals, adjusting investment strategies, and managing risk. However, it's not foolproof. The unpredictable nature of markets and individual circumstances necessitate caution in relying solely on this figure. Strategies like diversification, regular portfolio rebalancing, and long-term investment can optimize returns. Professional guidance can further enhance outcomes by providing personalized advice and helping with crucial investment decisions. Thus, the 401(k) average rate of return, while important, is just one of many tools that can help shape a successful retirement plan.401(k) Average Rate of Return Overview

Market Trends of the 401(k) Average Rate of Return

Historical Trends

Effect of Economic Changes on the Average Rate of Return

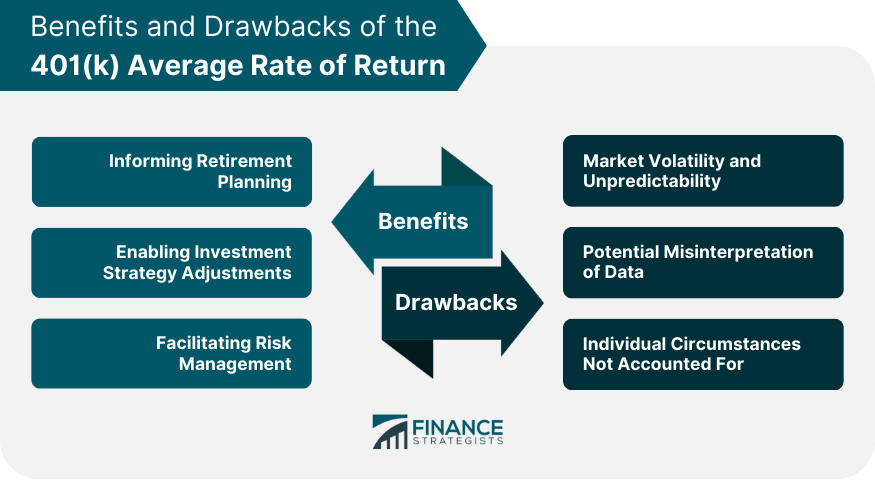

Benefits of the 401(k) Average Rate of Return

Informing Retirement Planning

Enabling Investment Strategy Adjustments

Facilitating Risk Management

Drawbacks of the 401(k) Average Rate of Return

Market Volatility and Unpredictability

Potential Misinterpretation of Data

Individual Circumstances Not Accounted For

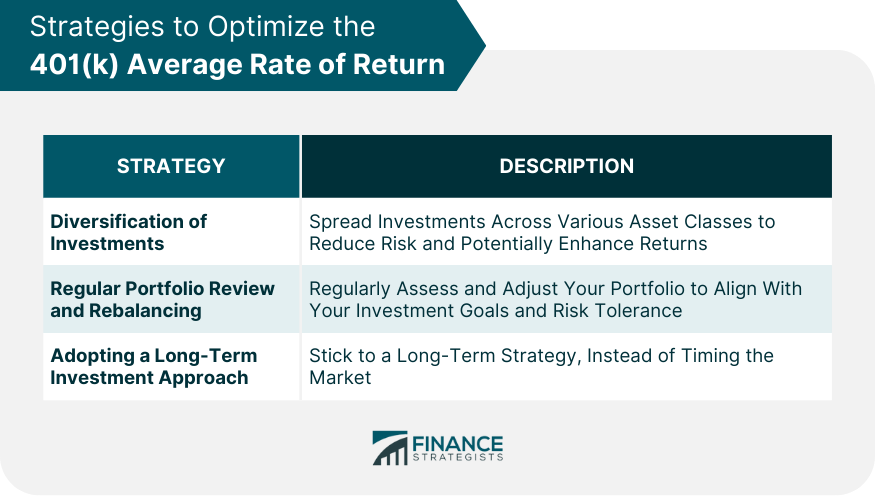

Strategies to Optimize the 401(k) Average Rate of Return

Diversification of Investments

Regular Portfolio Review and Rebalancing

Adopting a Long-Term Investment Approach

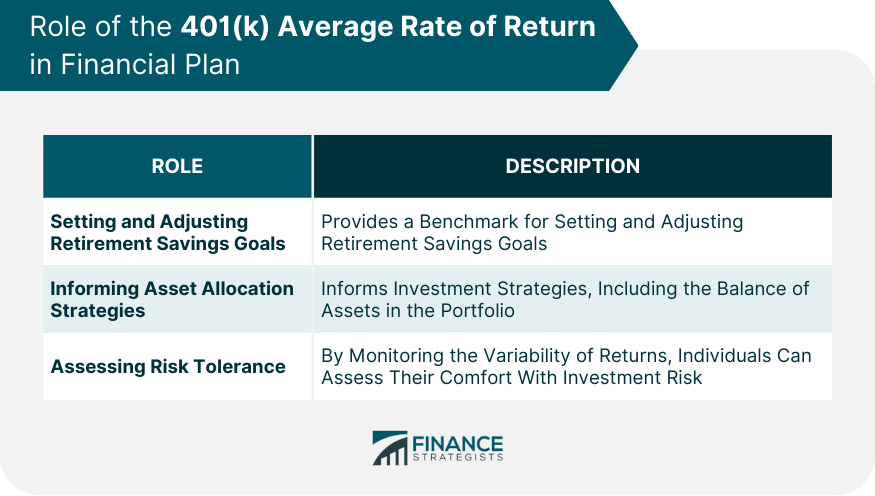

Role of the 401(k) Average Rate of Return in Financial Plans

Setting and Adjusting Retirement Savings Goals

Informing Asset Allocation Strategies

Assessing Risk Tolerance

Impact of Professional Guidance on the 401(k) Average Rate of Return

When to Seek Professional Advice

Choosing the Right Financial Advisor

Conclusion

401(k) Average Rate of Return FAQs

The 401(k) average rate of return refers to the annualized percentage gain or loss made on an investment in a 401(k) retirement plan over a specified period.

The average rate of return is calculated by determining the initial and final values of your investment, considering contributions made during the period, and calculating the percentage change over time.

The average rate of return can be influenced by factors such as the specific allocation of assets within the 401(k) account, market performance, the timing and amount of contributions, and the management fees charged by the 401(k) provider.

Monitoring the 401(k) average rate of return can provide insights into how well your retirement savings are growing, inform retirement planning, enable adjustments to your investment strategy, and facilitate effective risk management.

Strategies to optimize your 401(k) average rate of return can include diversification of investments, regular portfolio review, and rebalancing, adopting a long-term investment approach, and seeking professional financial advice.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.