When an individual files for bankruptcy, they are typically responsible for paying the costs of the bankruptcy process. The cost of filing for bankruptcy can vary depending on several factors, including the type of bankruptcy, the complexity of the case, and the location of the bankruptcy court. However, the filing fees can range from a few hundred to a few thousand dollars. Those with household incomes that are below 150% of the federal poverty level are entitled to having their fees waived for chapter 7 bankruptcy, which is a kind of bankruptcy where assets are liquidated to pay off debts. For those who want to qualify for the waiver, it is necessary to file Form 103B, the application to have the chapter 7 filing fee waived. It is best to include this form when filing for bankruptcy to simplify the process. Applicants must verify their income and attest to their inability to make installment payments when filling out the form. By submitting the form together with their chapter 7 bankruptcy filing, they can deal with everything at once. Bankruptcy is a legal process that businesses can use to reorganize or discharge their debts when they are no longer able to pay them. When a business files for bankruptcy, it is required to pay for the costs of the bankruptcy process, including legal fees, filing fees, trustee fees, credit counselling and debtor education fees, and other miscellaneous fees. The amount that a business will have to pay for bankruptcy depends on the complexity of the case and the size of the business. For example, larger businesses with more complex operations typically have higher fees than smaller ones with simpler operations. The fees charged by bankruptcy attorneys can also vary widely depending on their experience and expertise. In some cases, a business may have no income or assets and may not be able to pay for the costs of the bankruptcy process. In this situation, the bankruptcy trustee may pay the filing fees and other costs associated with the bankruptcy. However, the trustee will only do so when they believe that the business will be able to repay the costs of the bankruptcy process through the sale of its assets. Bankruptcy involves several costs that must be paid by the filer. These costs include: Filing for bankruptcy can help individuals and businesses eliminate their debts, repay their creditors, and get a fresh financial start. However, the bankruptcy filing cost can vary depending on several factors. The filing fees for chapter 7, chapter 11, and chapter 13 bankruptcy are standardized nationally and mandated by the U.S. Bankruptcy Court. Filing fees include filing, administrative, and trustee surcharge fees. Attorney fees for bankruptcy cases can vary widely based on the location, complexity, and type of case. Factors that can affect the cost of bankruptcy include whether it is a business or personal bankruptcy, whether it is filed jointly with a spouse or individually, the type and number of assets, income level, the number of creditors, and bankruptcy history. Before filing for bankruptcy, individuals are required to complete credit counselling and debtor education courses. These courses are designed to help individuals understand their financial situation and develop better money management skills. Credit counselling courses are usually completed before filing for bankruptcy, while debtor education courses are completed after filing for bankruptcy. Nationwide, the fees for credit counselling are capped at $79, meaning that individuals will not be charged more than this amount, regardless of the amount of debt they owe. The fees for debtor education programs are typically $50 or less. While the fees for credit counselling and debtor education may seem relatively small compared to other bankruptcy costs, they can still be a significant burden for individuals who are already struggling financially. However, completing these courses is a requirement for filing for bankruptcy, and individuals who fail to complete them may have their bankruptcy case dismissed. There are some exceptions to the general rule that the individual or business filing for bankruptcy is responsible for paying the costs associated with the process. The government may pay for bankruptcy costs for disabled veterans. The specific circumstances under which these programs apply and any eligibility requirements or restrictions vary depending on the program. Individuals or businesses should consult with an attorney or a bankruptcy court clerk to learn more about these programs and how to apply for them. They can also visit the U.S. Department of Justice, which provides information on bankruptcy and related programs. Bankruptcy is not the only option for individuals or businesses struggling with debt. Other options may include debt consolidation, debt settlement, or credit counselling. Debt consolidation combines multiple debts into one loan with a lower interest rate. Debt settlement negotiates with creditors to settle debts for less than the full amount owed. Credit counselling involves working with a credit counsellor to make a budget and a debt management plan to repay the debts. Before considering bankruptcy, individuals or businesses should explore these alternatives and determine if they are viable options. Debt consolidation, debt settlement, or credit counselling may be a better option for those who have manageable debts and a steady income. However, bankruptcy may be the best option if the debts are overwhelming. Bankruptcy is a legal process that can help individuals or businesses eliminate or repay their debts and get a fresh start. However, filing for bankruptcy is not free, and the process has associated costs. When an individual files for bankruptcy, they are typically responsible for paying the costs of the bankruptcy process, while the business is responsible for paying the costs of the bankruptcy process when a business files. The costs of bankruptcy can vary depending on various factors, such as the type of bankruptcy, the complexity of the case, and the location of the court. However, some low-income individuals may be eligible for fee waivers or reductions. There are exceptions to the general rule, and some government programs may pay for bankruptcy costs for certain individuals or businesses. Before considering bankruptcy, individuals or businesses should explore alternatives such as debt consolidation, debt settlement, or credit counselling. Who Pays for Bankruptcy When an Individual Files?

Who Pays for Bankruptcy When a Business Files?

Costs Associated with Bankruptcy

Filing Fees

Attorney Fees

Credit Counseling and Debtor Education Fees

Exceptions to General Rule for Bankruptcy

Alternatives to Bankruptcy

Final Thoughts

Who Pays for Bankruptcies FAQs

The costs associated with bankruptcy include filing fees, attorney fees, credit counselling and debtor education fees, and other miscellaneous fees. The amount of these fees can vary depending on the type of bankruptcy, the complexity of the case, and the location of the court.

Debt consolidation, debt settlement, and credit counselling are some of the alternatives to bankruptcy. These options may be viable for individuals or businesses with manageable debts and a steady income.

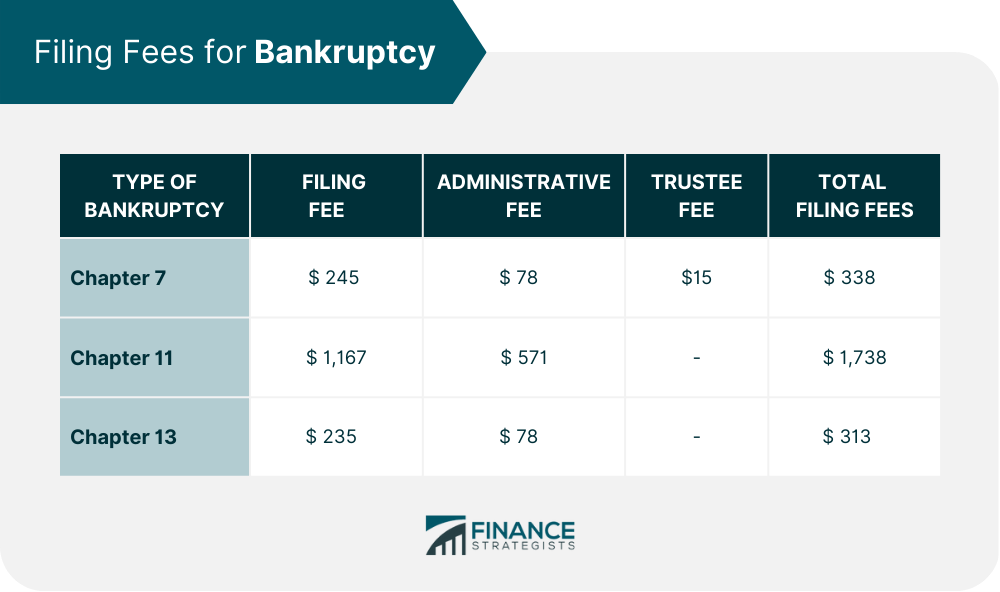

The filing fees for bankruptcy depending on the type of bankruptcy being filed. For chapter 7 bankruptcy, the filing fee is $245, while for chapter 11 bankruptcy, it is $1,167, and for chapter 13 bankruptcy, it is $235. These fees are standardized nationally and mandated by the U.S. Bankruptcy Court.

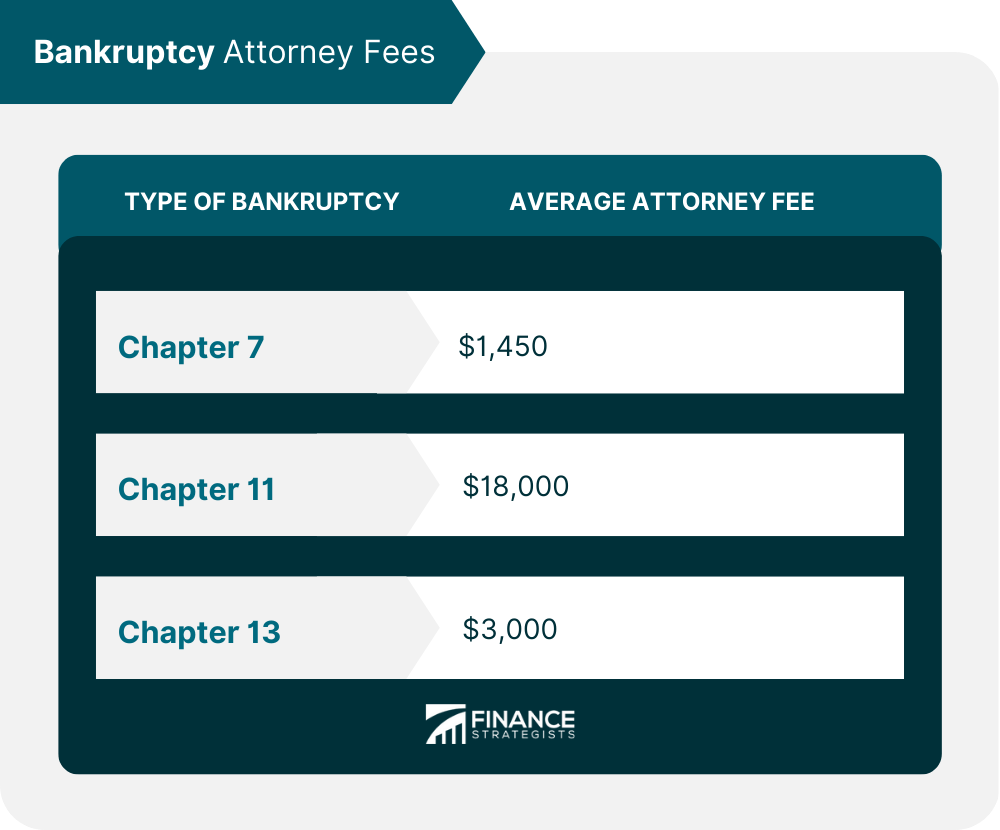

The fees charged by bankruptcy attorneys can vary widely depending on their experience and expertise, as well as the complexity of the case. On average, chapter 7 bankruptcy attorneys charge around $1,450, while chapter 11 bankruptcy attorneys may charge up to $18,000 for a small, simple case. chapter 13 bankruptcy attorneys charge around $3,000 on average.

Individuals who fail to complete credit counselling or debtor education courses may have their bankruptcy case dismissed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.