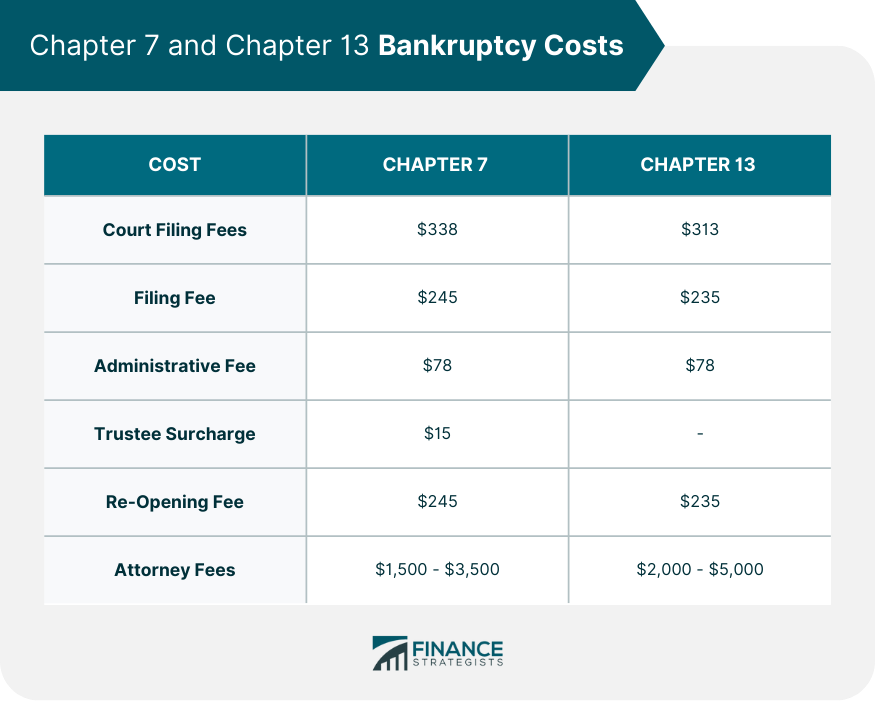

Bankruptcy refers to a legal process that individuals or businesses can undertake when they are unable to repay their debts. It is a formal declaration that an individual or organization is unable to meet its financial obligations and seeks relief from its creditors. The bankruptcy filing process involves several steps, starting with the individual or business filing a petition with the bankruptcy court. The court then assesses the financial situation and may appoint a trustee to oversee the case. Creditors are notified, and a repayment plan or liquidation of assets may be established to satisfy the debts. The cost of bankruptcy can vary depending on your circumstances. As of 2024 filing bankruptcy costs $338 for chapter 7 and $313 for chapter 13. These are only basic filing fees, however, and you could pay about $100 for mandatory debt counseling courses or other expenses, plus between $1,000 and $5,000 for a bankruptcy lawyer. In general, filing Chapter 7 costs $338, about $100 in possible additional fees, and between $1,500 and $3,500 for a lawyer. The court filing fees that amount to a total of $338 includes a filing fee of $245, an administrative fee of $78, and a trustee surcharge of $15. If a Chapter 7 case needs to be reopened, there is an additional filing fee of $245. Chapter 13 costs $310 to file, about $100 in possible additional fees, and between $2,000 and $5,000 for a lawyer. The $313 court filing fee includes a filing fee of $235 and an administrative fee of $78. In the event that a Chapter 13 case needs to be reopened, there is an additional filing fee of $235. How much a bankruptcy lawyer will cost depends on your state of residence and circumstances. It can also depend on the type of bankruptcy you file, the complexity of your case, the experience of your attorney. In general, you can expect to pay between $1,000-$3,500 for chapter 7 and as much as $5,000 for chapter 13. There are some cases that may cost more or less. For example, if you have a complex case with a lot of assets or debts, your attorney may charge more. Or, if you live in a major city, your attorney may charge more than an attorney in a rural area. Generally the amount of money saved by bankruptcy lawyers exceeds the cost of hiring one. Financial stress can be overwhelming, especially when bankruptcy seems like the only viable option. While the costs can vary significantly, here are some of the primary determinants. The type of bankruptcy you choose to file can significantly affect the overall cost. There are two common types for individuals: Chapter 7 and Chapter 13. Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the sale of the debtor's non-exempt assets by a trustee. It's typically cheaper than Chapter 13 but may require you to give up some of your assets. Chapter 13 bankruptcy, or reorganization bankruptcy, involves creating a three-to-five-year repayment plan for your debts. This form of bankruptcy is typically more expensive due to the extended legal assistance needed to draft and execute the repayment plan. However, Chapter 13 allows you to keep your property while repaying your debts. Simple cases typically incur fewer legal fees and are processed more quickly, reducing associated costs. However, if you have multiple types of debt (like credit card debt, mortgages, or student loans), significant assets, or a high income, your case may be more complex. More complicated cases often require more paperwork, more court appearances, and consequently, more attorney time, resulting in higher costs. Your geographic location can significantly influence the cost of filing bankruptcy. This can occur because attorneys' fees vary widely by region, and local court filing fees can also differ. For instance, filing bankruptcy in a major metropolitan area like New York or San Francisco may cost more than in a small town due to higher attorney rates and court costs. It's advisable to research costs in your specific area to get a better understanding of what you can expect to pay. Hiring a bankruptcy attorney isn't required, but it can be beneficial due to the complexity of bankruptcy laws. Attorney fees can vary widely based on factors such as the attorney's experience, the complexity of your case, and your location. While these fees add to your bankruptcy's overall cost, skilled legal representation can help ensure that your case proceeds smoothly, possibly saving you money in the long run. When you file for bankruptcy, you'll need to pay filing fees to the court. These fees vary based on the type of bankruptcy you're filing. In addition to these fees, there may be costs for credit counseling courses, which are required before filing for bankruptcy. Here are some of the strategies you can explore. If you're a low-income individual considering bankruptcy, certain options can help reduce costs. Fee waivers are available for Chapter 7 bankruptcy for individuals who can't afford to pay the filing fee. Additionally, low-income individuals may qualify for free legal help through various legal aid organizations. These services can significantly reduce the costs associated with bankruptcy. Pro bono legal services and legal aid organizations can provide invaluable assistance to individuals who can't afford the cost of a bankruptcy attorney. These organizations offer free or reduced-cost legal help, making the bankruptcy process more accessible. By taking advantage of these services, you can significantly reduce the overall cost of filing for bankruptcy. If you can't afford to pay attorney fees upfront, it's worth discussing payment plan options with your bankruptcy attorney. Many attorneys understand the financial strain their clients are under and may be willing to offer a flexible payment plan. This can help spread out the cost of bankruptcy over time, making it more manageable. While the upfront cost of filing bankruptcy can be daunting, it's important to evaluate the long-term financial benefits. For individuals buried under insurmountable debt, bankruptcy can offer a fresh start by eliminating or reducing their debt load. This financial relief can far outweigh the initial costs, providing a pathway to regain financial stability. The cost of filing for bankruptcy varies based on factors such as the type of bankruptcy, complexity of the case, geographic location, and attorney fees. Chapter 7 bankruptcy costs $338 in court filing fees, while Chapter 13 costs $313. Attorney fees range from $1,500 to $3,500 for Chapter 7 and $2,000 to $5,000 for Chapter 13. Strategies for managing costs include exploring options for low-income individuals, seeking pro bono legal services or legal aid organizations, and discussing payment plans with attorneys. It's crucial to evaluate the long-term financial benefits of bankruptcy, as it provides a fresh start and the chance to regain financial stability. While the initial costs may seem daunting, bankruptcy can offer significant relief from overwhelming debt. What Is Bankruptcy?

How Much Does Filing Bankruptcy Cost?

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

How Much Does a Bankruptcy Lawyer Cost?

Factors That Determine the Cost of Filing Bankruptcy

Type of Bankruptcy Being Filed

Complexity of the Case

Geographic Location

Attorney Fees

Filing Fees and Other Court Costs

Strategies for Managing the Costs of Filing Bankruptcy

Exploring Options for Low-Income Individuals

Seeking Pro Bono Legal Services or Legal Aid Organizations

Discussing Payment Plans With Bankruptcy Attorneys

Evaluating the Long-Term Financial Benefits of Bankruptcy

Conclusion

How Much Does It Cost to File Bankruptcy? FAQs

Bankruptcy is a legal proceeding in which a debtor declares their inability to pay back their creditors.

The cost to file bankruptcy depends on several factors, including the type of bankruptcy case you file and your local court’s filing fees. In most cases, it costs between $335 and $1,046 in total fees to file a Chapter 7 bankruptcy case with an attorney. Filing a Chapter 13 case also involves some upfront costs, but many people are able to make payment arrangements with their attorney or pay off the debt over time.

Yes, there may be additional expenses associated with filing for bankruptcy such as credit counseling courses, document-filing fees from the court system, and other miscellaneous costs.

Yes, help is available in the form of fee waivers for qualifying individuals. Additionally, depending on your financial situation and state of residence, you may be able to have your attorney’s fees paid by the court system or a third-party organization.

You can apply for a fee waiver from the court system when you file your bankruptcy papers. The application process typically requires you to provide proof of your income and financial resources to determine if you qualify for a fee waiver or other assistance with payment arrangements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.