Portfolio turnover is a crucial concept in the world of investment, and understanding it is essential for investors to make informed decisions. It refers to the rate at which assets in a portfolio are bought and sold over a given period of time and is a measure of the level of trading activity within the portfolio. Portfolio turnover is usually expressed as a percentage and is calculated by dividing the total value of assets bought or sold during a given period by the average value of assets held during the same period. The resulting portfolio turnover ratio represents the percentage of the portfolio that is bought or sold in a given period. A high turnover ratio indicates frequent trading, while a low ratio suggests a buy-and-hold approach. To determine portfolio turnover, the following formula is used: The components of this formula include: Total Sales or Purchases: The sum of the value of all assets bought or sold within a given period. Average Portfolio Value: The average value of the portfolio during the same period. Typically, portfolio turnover is calculated on an annual basis, but it can also be calculated for different timeframes, depending on the needs of the investor. The resulting portfolio turnover ratio represents the percentage of the portfolio that is bought or sold in a given period. A high turnover ratio indicates frequent trading, while a low ratio suggests a buy-and-hold approach. 1. High Turnover Strategies: These strategies often involve frequent trading to capitalize on short-term market movements or trends. They can potentially yield higher returns but are also associated with increased risks and costs. 2. Low Turnover Strategies: These strategies focus on long-term growth and stability. They involve fewer trades, lower costs, and reduced risk exposure, but may generate lower returns. 1. Trading Costs: High portfolio turnover typically results in higher transaction costs, such as brokerage fees and bid-ask spreads. 2. Tax Implications: Frequent trading can lead to short-term capital gains, which are generally taxed at a higher rate than long-term capital gains. Effectively managing portfolio turnover can help investors balance risk, return, and costs, while ensuring that their investment strategy aligns with their financial goals. Active managers typically have higher portfolio turnover due to frequent trading, while passive managers, who follow an index, exhibit lower turnover. Growth investors may experience higher turnover as they seek rapidly expanding companies, whereas value investors may have lower turnover as they focus on undervalued companies with long-term potential. Investors focusing on specific sectors may experience varying levels of turnover, depending on the dynamics and volatility of the chosen sector. Quantitative investors, who rely on data-driven models, may have higher turnover, while qualitative investors, who focus on fundamentals and management quality, may have lower turnover. Adopting a Long-Term Investment Horizon: Focusing on long-term growth can help minimize trading and reduce turnover. Implementing a Buy-and-Hold Strategy: Holding assets for extended periods can reduce transaction costs and tax liabilities. Utilizing Tax-Efficient Investment Vehicles: Tax-efficient funds or accounts can help mitigate the impact of turnover on taxes. Monitoring and Rebalancing Portfolio Periodically: Regularly reviewing and adjusting your portfolio can help maintain an optimal balance of risk, return, and costs. Evaluating a fund manager's performance should include analyzing their portfolio turnover ratio to understand their trading frequency and investment style. Investors can compare the portfolio turnover ratios of various funds to gain insight into their respective investment strategies and potential costs. This comparison can help investors choose the most suitable fund according to their risk tolerance and investment objectives. A fund manager's investment philosophy, as reflected in their portfolio turnover, can provide valuable information about their approach to risk management, cost control, and return generation. Portfolio turnover is a critical metric for investors to understand as it has significant implications on investment performance, costs, and strategies. High portfolio turnover can result in potential for higher returns, but also increased risks and costs, while low portfolio turnover can provide more stability and reduced risks, but may generate lower returns. Moreover, managing portfolio turnover effectively can help investors balance risk, return, and costs, while ensuring that their investment strategy aligns with their financial goals. The impact of portfolio turnover varies across different investment styles, such as active versus passive management, growth versus value investing, sector-specific investing, and quantitative versus qualitative analysis. Strategies for controlling portfolio turnover include adopting a long-term investment horizon, implementing a buy-and-hold strategy, utilizing tax-efficient investment vehicles, and monitoring and rebalancing the portfolio periodically. Ultimately, investors must be aware of their risk tolerance and investment objectives while making informed decisions based on their understanding of portfolio turnover.What Is Portfolio Turnover?

Calculating Portfolio Turnover

Timeframe Considerations

Interpretation of Portfolio Turnover Ratio

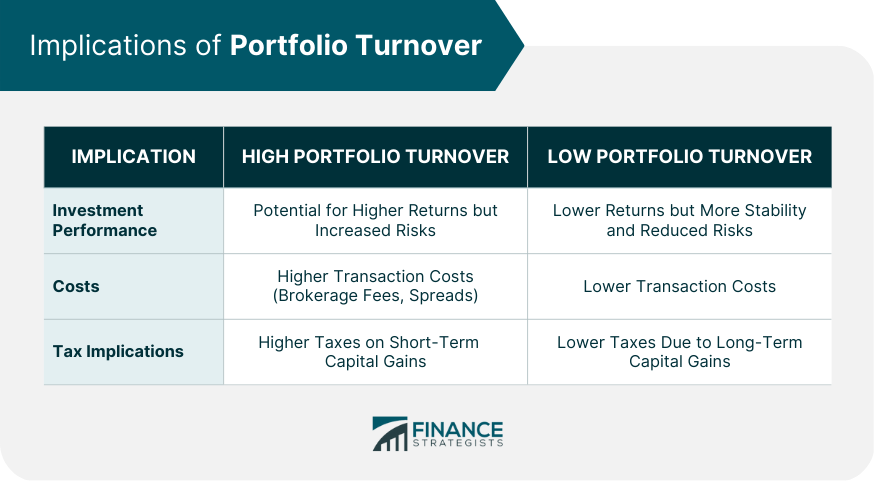

Implications of Portfolio Turnover

Impact on Investment Performance

Costs Associated With Turnover

Benefits of Managing Turnover Effectively

Portfolio Turnover in Different Investment Styles

Active vs Passive Management

Growth vs Value Investing

Sector-Specific Investing

Quantitative vs Qualitative Analysis

Strategies for Controlling Portfolio Turnover

Portfolio Turnover and Fund Manager Evaluation

Assessing Fund Manager Performance

Comparing Portfolio Turnover Across Funds

Understanding a Fund Manager's Investment Philosophy

Conclusion

Portfolio Turnover FAQs

Portfolio turnover is a measure of how frequently a fund or investment manager buys and sells assets within a portfolio. It is important because it helps investors understand the investment strategy, potential costs, and tax implications associated with a fund or portfolio.

To calculate portfolio turnover, divide the total sales or purchases of assets within a given period by the average portfolio value during the same period. This calculation results in a percentage that represents the portion of the portfolio bought or sold during the specified timeframe.

Portfolio turnover can impact investment performance as high turnover strategies may yield higher returns but are associated with increased risks and costs. Low turnover strategies, on the other hand, can offer more stability and lower costs but may generate lower returns. High portfolio turnover also leads to higher transaction costs and potential tax implications due to short-term capital gains.

Some strategies to control portfolio turnover include adopting a long-term investment horizon, implementing a buy-and-hold strategy, utilizing tax-efficient investment vehicles, and periodically monitoring and rebalancing your portfolio to maintain an optimal balance of risk, return, and costs.

Portfolio turnover can be used to evaluate and compare fund managers by assessing their investment philosophy, trading frequency, and potential costs associated with their strategies. A higher portfolio turnover may indicate an active manager, while a lower turnover suggests a more passive approach. Comparing portfolio turnover across funds can help investors choose the most suitable fund based on their risk tolerance and investment objectives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.