The dollar-weighted average age is a financial metric that calculates the average age of the assets in a portfolio, weighted by their market value. It reflects the relative age of each asset in relation to its contribution to the total value of the portfolio, providing insight into the portfolio's overall risk profile and investment strategy. The dollar-weighted average age is used to assess the risk and performance of a portfolio, particularly in terms of interest rate risk and credit risk. It helps investors, portfolio managers, and analysts to evaluate the effectiveness of investment strategies, monitor asset allocation, and manage liabilities. The primary users of the dollar-weighted average age metric include portfolio managers, investment analysts, risk managers, and financial advisors. To calculate the dollar-weighted average age, the following data is required: The age of each asset in the portfolio The market value of each asset in the portfolio Determine the market value of each asset in the portfolio Calculate the product of the age and market value for each asset Sum the products calculated in step 2 Divide the sum of the products by the total market value of the portfolio A higher dollar-weighted average age indicates that older, potentially riskier assets represent a larger proportion of the portfolio's total value. Conversely, a lower dollar-weighted average age suggests that younger, possibly less risky assets make up a more significant portion of the portfolio's value. The time-weighted average age is another metric used to analyze a portfolio's risk profile, calculated by weighting the age of each asset by the time it has been held in the portfolio. While similar in concept to the dollar-weighted average age, the time-weighted average age focuses on the holding period rather than the asset's market value. Dollar-weighted average maturity is a measure that calculates the average time to maturity of the assets in a portfolio, weighted by their market value. It is commonly used in fixed income portfolios to assess interest rate risk and evaluate the portfolio's sensitivity to changes in market interest rates. Average life is a metric used in fixed income analysis to measure the weighted average time until the principal amount of a bond or other debt instrument is repaid. It is particularly useful for analyzing bonds with embedded options, such as callable or prepayable bonds. The dollar-weighted average age helps portfolio managers to evaluate the risk profile of their portfolios, particularly in terms of interest rate risk and credit risk. A portfolio with a higher dollar-weighted average age may be more exposed to changes in interest rates and credit events, such as defaults or credit rating downgrades. The dollar-weighted average age can be used to monitor asset allocation over time, ensuring that the portfolio remains aligned with the investor's risk tolerance and investment objectives. Portfolio managers can use the dollar-weighted average age to evaluate the performance of their investment strategies and identify potential areas for improvement or adjustment. The dollar-weighted average age can be used to assess the interest rate risk of fixed income securities, as a higher dollar-weighted average age may indicate greater sensitivity to changes in interest rates. This information can help investors and analysts make more informed decisions about the composition of their fixed income portfolios. The dollar-weighted average age can also be used to evaluate credit risk in a fixed income portfolio. Older assets may be more susceptible to credit events, such as defaults or rating downgrades, which could impact the overall credit risk of the portfolio. Dollar-weighted average age can be used by institutions, such as insurance companies and pension funds, to match the duration of their assets and liabilities. By closely aligning the dollar-weighted average age of their assets with the liabilities they must fulfill, these institutions can better manage their interest rate risk and ensure they have sufficient funds to meet their obligations. Institutional investors can use the dollar-weighted average age to assess the effectiveness of their funding strategies. For example, they can compare the dollar-weighted average age of their investment portfolio to the duration of their liabilities to determine if their funding strategy is effective in managing interest rate risk. The dollar-weighted average age is sensitive to changes in market prices, as fluctuations in asset values can impact the metric's calculation. This sensitivity may lead to variations in the dollar-weighted average age over time, even if the underlying assets' characteristics have not changed. The dollar-weighted average age does not account for optionality in assets, such as embedded call or put options in bonds. This limitation may result in a misleading assessment of a portfolio's risk profile, as optionality can significantly impact the risk and return characteristics of the assets. The dollar-weighted average age is an essential metric for assessing the risk profile and performance of a portfolio. It provides valuable insights into the portfolio's exposure to interest rate and credit risk, as well as its alignment with investment objectives and risk tolerance. While the dollar-weighted average age offers numerous benefits, it also has limitations, such as sensitivity to market changes and the inability to account for optionality. Investors and portfolio managers should consider these limitations when using the metric and integrate it with other tools and metrics to develop a more comprehensive understanding of their portfolios' risk and performance. The dollar-weighted average age can be combined with other metrics, such as time-weighted average age, dollar-weighted average maturity, and average life, to provide a more comprehensive analysis of a portfolio's risk profile. By integrating these metrics, investors and portfolio managers can better understand their portfolios' exposures and make more informed investment decisions.What Is Dollar-Weighted Average Age?

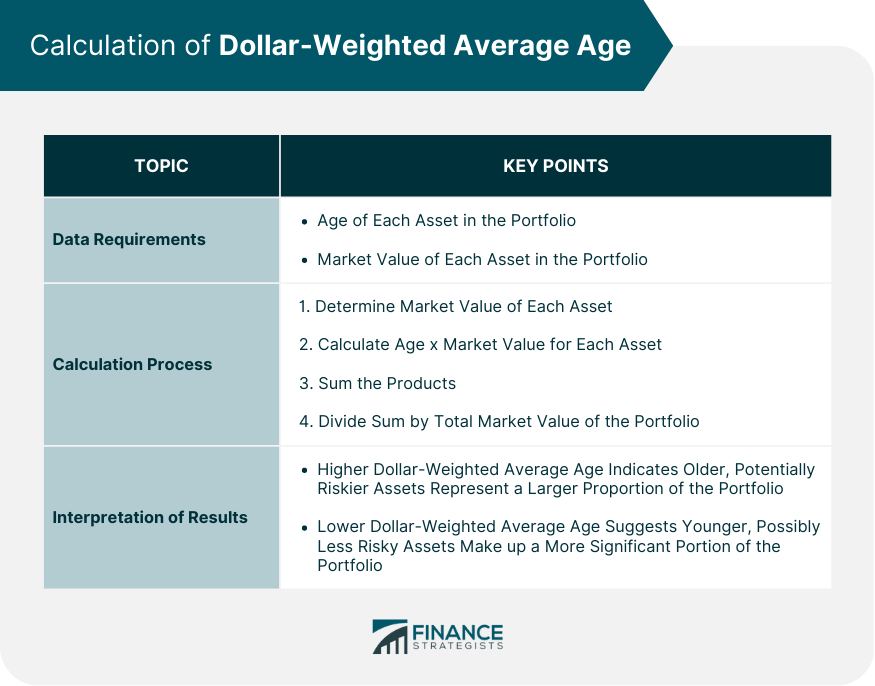

Calculation of Dollar-Weighted Average Age

Data Requirements

Step-By-Step Calculation Process

Interpretation of Results

Comparison to Other Metrics

Time-Weighted Average Age

Dollar-Weighted Average Maturity

Average Life

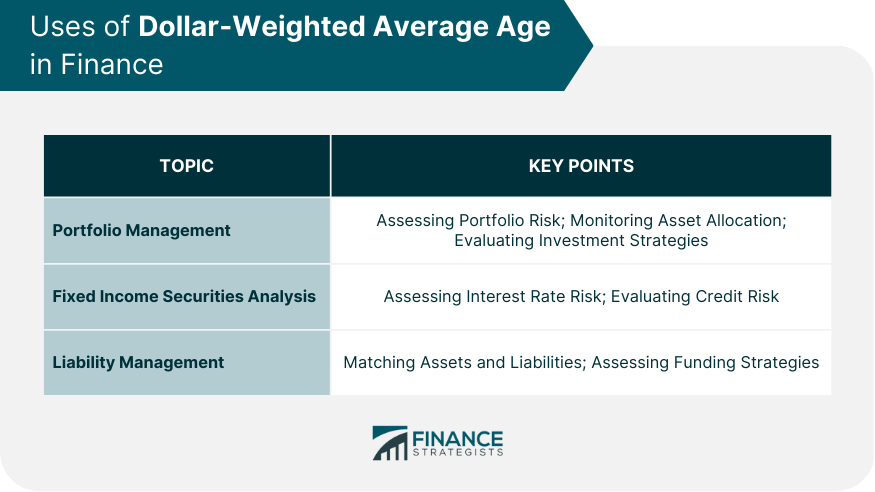

Uses of Dollar-Weighted Average Age in Finance

Portfolio Management

Assessing Portfolio Risk

Monitoring Asset Allocation

Evaluating Investment Strategies

Fixed Income Securities Analysis

Assessing Interest Rate Risk

Evaluating Credit Risk

Liability Management

Matching Assets and Liabilities

Assessing Funding Strategies

Limitations of Dollar-Weighted Average Age

Sensitivity to Market Changes

Inability to Account for Optionality

Conclusion

Importance of Dollar-Weighted Average Age in Financial Analysis

Balancing Benefits and Limitations

Integration With Other Metrics and Tools

Dollar-Weighted Average Age FAQs

Dollar-weighted average age is a measure of the age of a group of fixed-income securities weighted by the dollar amount invested in each security. It takes into account the amount of time each security has been held, as well as the relative size of each holding.

To calculate the dollar-weighted average age of a group of fixed-income securities, multiply the age of each security by the dollar amount invested in that security. Sum the results and divide by the total dollar amount invested in the group of securities.

Dollar-weighted average age is important because it provides insight into the overall maturity of a fixed-income portfolio. A higher dollar-weighted average age indicates that the portfolio has a longer average maturity, which may increase its exposure to interest rate risk.

Dollar-weighted average age is related to yield in that it can impact the sensitivity of a portfolio to changes in interest rates. Generally, a portfolio with a higher dollar-weighted average age will be more sensitive to interest rate changes, which may impact its yield.

Dollar-weighted average age can be used in portfolio management to help manage interest rate risk. By tracking the dollar-weighted average age of a fixed-income portfolio, investors can adjust their holdings to align with their investment objectives and risk tolerance. For example, if interest rates are expected to rise, an investor may choose to reduce the dollar-weighted average age of their portfolio to mitigate the impact of rising rates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.