A benchmark index is a portfolio of securities that represents a specific market or a sector of the market. It is a standard measure used to evaluate the performance of an investment portfolio relative to the overall market or a specific sector. A benchmark index can be used to compare the returns of an investment portfolio against the returns of a specific market or sector. It helps investors to determine how their investments are performing relative to the market, which can be helpful in evaluating the performance of an investment manager. The purpose of a benchmark index is to provide a standard measure for evaluating the performance of investment portfolios. By comparing the returns of an investment portfolio to the returns of a benchmark index, investors can determine whether their investments are outperforming or underperforming the market. Benchmark indices also help investors to evaluate the performance of investment managers, which can be helpful in selecting investment managers who are skilled at generating returns above the market average. A market capitalization-weighted index is a benchmark index that weights each security in the index based on its market capitalization. Market capitalization is calculated by multiplying the number of outstanding shares of a company by its current stock price. This means that companies with a higher market capitalization will have a greater weighting in the index. Market capitalization-weighted indices are widely used because they reflect the market capitalization of companies, which is an important measure of their size and influence in the market. However, they can be heavily influenced by a few large companies with high market capitalization, which may not be representative of the broader market. A price-weighted index is a benchmark index that weights each security in the index based on its stock price. This means that companies with a higher stock price will have a greater weighting in the index. Price-weighted indices are rarely used in the financial industry because they can be heavily influenced by a few companies with a high stock price. This means that the performance of these indices may not be representative of the broader market. An equal-weighted index is a benchmark index that weights each security in the index equally. This means that each security in the index has the same weighting, regardless of its market capitalization or stock price. Equal-weighted indices can provide a more diversified representation of the market because they are not heavily influenced by a few large companies or companies with a high stock price. However, they may not accurately reflect the performance of the broader market because smaller companies may have a disproportionately large impact on the index. A fundamental-weighted index is a benchmark index that weights each security in the index based on fundamental factors such as earnings, book value, and dividends. This means that companies with higher earnings, book value, or dividends will have a greater weighting in the index. Fundamental-weighted indices are designed to provide a more accurate reflection of a company's underlying value, as opposed to its market capitalization or stock price. However, they can be heavily influenced by companies with high earnings or dividends, which may not be representative of the broader market. A smart beta index is a beta for benchmark index that uses a combination of weighting factors to construct the index. These factors can include market capitalization, fundamental factors, and volatility. The goal of a smart beta index is to provide a more efficient portfolio that generates higher returns with less risk. Smart beta indices are designed to address the limitations of traditional benchmark indices by incorporating multiple factors into the weighting methodology. This can result in a more efficient portfolio that generates higher returns with less risk. However, the performance of smart beta indices can be highly dependent on the specific factors used in the weighting methodology. The first step in creating a benchmark index is to select the securities that will be included in the index. The selection criteria can vary depending on the type of index being created. For example, a market capitalization-weighted index may include all publicly traded companies within a specific market, while a smart beta index may only include companies that meet specific fundamental and volatility criteria. Once the securities have been selected, the next step is to determine the weighting methodology. The weighting methodology will determine how each security is weighted in the index. This can vary depending on the type of index being created. For example, a market capitalization-weighted index will weight each security based on its market capitalization, while a smart beta index may use a combination of market capitalization, fundamental factors, and volatility to determine the weighting of each security. The final step in creating a benchmark index is to rebalance the index. Rebalancing involves adjusting the weighting of each security in the index to ensure that the index continues to reflect the underlying market or sector. The frequency of rebalancing can vary depending on the type of index being created. For example, a market capitalization-weighted index may be rebalanced quarterly, while a smart beta index may be rebalanced annually. The S&P 500 is a market capitalization-weighted index that includes 500 of the largest publicly traded companies in the United States. It is widely used as a benchmark for the performance of the U.S. stock market. The Dow Jones Industrial Average is a price-weighted index that includes 30 of the largest publicly traded companies in the United States. It is one of the oldest and most widely recognized benchmark indices in the world. The NASDAQ Composite is a market capitalization-weighted index that includes all the companies listed on the NASDAQ stock exchange. It is widely used as a benchmark for the performance of the technology sector. The Russell 2000 is an equal-weighted index that includes 2000 small-cap companies in the United States. It is widely used as a benchmark for the performance of small-cap stocks. The MSCI World Index is a market capitalization-weighted index that includes companies from developed markets around the world. It is widely used as a benchmark for the performance of the global equity market. Benchmark indices are used to evaluate the performance of investment portfolios relative to the market or a specific sector. By comparing the returns of an investment portfolio to the returns of a benchmark index, investors can determine whether their investments are outperforming or underperforming the market. This can help investors to identify areas where they may need to make adjustments to their investment strategy. Benchmark indices are also used in the development of investment strategies. For example, an investment manager may use a market capitalization-weighted index as a benchmark for constructing a portfolio of large-cap stocks. By using the benchmark index as a reference point, the investment manager can ensure that the portfolio is well-diversified and representative of the underlying market. Benchmark indices are also used in risk management. By comparing the volatility of an investment portfolio to the volatility of a benchmark index, investors can determine whether their portfolio is more or less risky than the market. This can help investors to identify areas where they may need to adjust their portfolio to reduce risk. Benchmark indices are also used in asset allocation. By using benchmark indices as a reference point, investors can determine the optimal allocation of their portfolio across different asset classes. For example, an investor may use the MSCI World Index as a benchmark for determining the allocation of their portfolio between domestic and international equities. Benchmark indices provide a standard measure for evaluating the performance of investment portfolios. By comparing the returns of an investment portfolio to the returns of a benchmark index, investors can determine whether their investments are outperforming or underperforming the market. This can help investors to identify areas where they may need to make adjustments to their investment strategy. Benchmark indices can be used as a reference point for developing investment strategies. By using a benchmark index as a reference point, investors can ensure that their investment strategy is well-diversified and representative of the underlying market. Benchmark indices are widely used in the financial industry, which promotes transparency. By using a standard measure for evaluating the performance of investment portfolios, investors can compare the performance of different investment managers and identify those who are skilled at generating returns above the market average. Benchmark indices may not be appropriate for all investors. For example, an investor with a specific investment objective may not find a benchmark index that accurately reflects their investment goals. Benchmark indices can be heavily influenced by market conditions. For example, during a market downturn, a market capitalization-weighted index may be heavily influenced by a few large companies with high market capitalization, which may not be representative of the broader market. Benchmark indices may not reflect the individual investment objectives of an investor. For example, an investor may have specific ethical or social considerations that are not reflected in a benchmark index. In this case, the investor may need to use a customized benchmark that reflects their specific investment objectives. Benchmark indices are a standard measure used to evaluate the performance of investment portfolios. They are important for investors and investment managers because they provide a benchmark for comparison, facilitate investment strategy development, and promote transparency. There are several types of benchmark indices, including market capitalization-weighted, price-weighted, equal-weighted, fundamental-weighted, and smart beta indices. Benchmark indices are created through a process of selecting securities, determining the weighting methodology, and rebalancing the index. Benchmark indices play a crucial role in investment management by providing a standard measure for evaluating the performance of investment portfolios. However, they also have several disadvantages, including being inappropriate for all investors, being affected by market conditions, and not reflecting individual investor objectives. As such, investors and investment managers should carefully consider the advantages and disadvantages of benchmark indices before using them in their investment strategies.What Is a Benchmark Index?

Types of Benchmark Indices

Market Capitalization-Weighted Index

Price-Weighted Index

Equal-Weighted Index

Fundamental-Weighted Index

Smart Beta Index

How Benchmark Indices Are Created

Selection of Securities

Weighting Methodology

Rebalancing

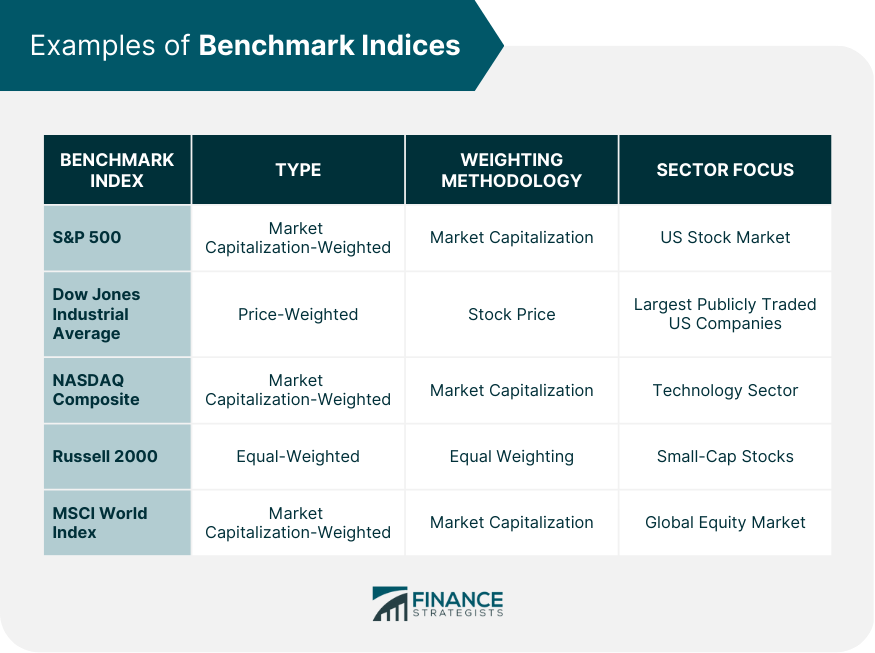

Examples of Benchmark Indices

S&P 500

Dow Jones Industrial Average

NASDAQ Composite

Russell 2000

MSCI World Index

Role of Benchmark Indices in Investment Management

Portfolio Performance Evaluation

Investment Strategy Development

Risk Management

Asset Allocation

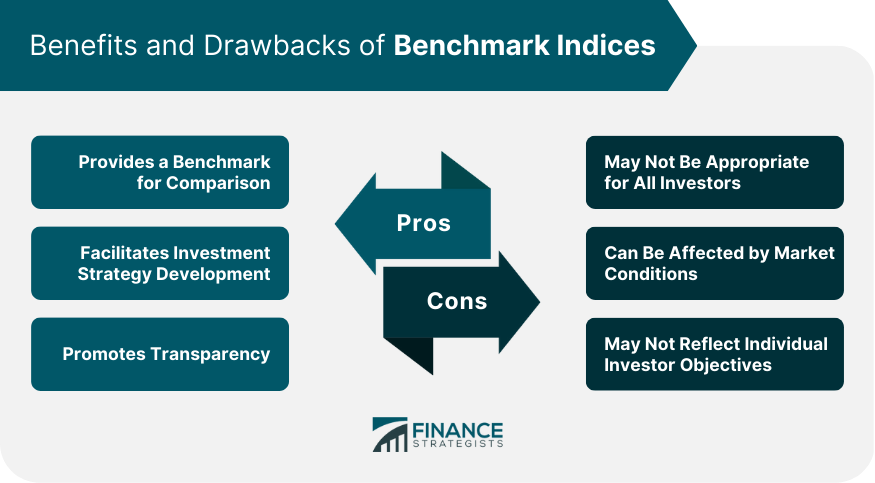

Advantages of Benchmark Indices

Provides a Benchmark for Comparison

Facilitates Investment Strategy Development

Promotes Transparency

Disadvantages of Benchmark Indices

May Not Be Appropriate for All Investors

Can Be Affected by Market Conditions

May Not Reflect Individual Investor Objectives

Conclusion

Benchmark Index FAQs

A benchmark index is a portfolio of securities that represents a specific market or a sector of the market. It is a standard measure used to evaluate the performance of an investment portfolio relative to the overall market or a specific sector.

Benchmark indices are created through a process of selecting securities, determining the weighting methodology, and rebalancing the index. The selection criteria can vary depending on the type of index being created, and the weighting methodology can be based on market capitalization, stock price, fundamental factors, or a combination of factors.

Some examples of benchmark indices include the S&P 500, the Dow Jones Industrial Average, the NASDAQ Composite, the Russell 2000, and the MSCI World Index.

Benchmark indices play a crucial role in investment management by providing a standard measure for evaluating the performance of investment portfolios. They are used for portfolio performance evaluation, investment strategy development, risk management, and asset allocation.

The advantages of benchmark indices include providing a benchmark for comparison, facilitating investment strategy development, and promoting transparency. The disadvantages of benchmark indices include being inappropriate for all investors, being affected by market conditions, and not reflecting individual investor objectives. Investors and investment managers should carefully consider the advantages and disadvantages of benchmark indices before using them in their investment strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.