Rolling returns, also known as rolling period returns, are a method used to calculate the performance of an investment over a specific time period, which is then moved or "rolled" along that time horizon. This approach allows investors to assess the historical performance of an asset by considering multiple periods and helps them to make more informed investment decisions. Rolling returns provide a comprehensive view of the return behavior of an asset, which can reveal insights about its risk and return characteristics. Before delving deeper into rolling returns, it is essential to understand some basic concepts and terms related to this topic: 1. Return: The profit or loss that an investor earns from an investment. 2. Holding Period: The length of time an investor holds an investment. 3. Time Horizon: The total time frame under consideration for the investment analysis. 4. Periodicity: The frequency of the rolling return calculations, such as daily, monthly, or annually. Calculating rolling returns involves the following steps: 1. Determine the holding period and periodicity for the analysis. 2. Collect historical price or return data for the investment. 3. Calculate the return for each holding period, using the periodicity chosen. 4. Move the time window along the time horizon, one period at a time, and repeat step 3. 5. Compile and analyze the results. To calculate rolling returns, investors need historical price or return data for the investment. This information is available through various sources, such as financial websites, data vendors, or investment research platforms. Additionally, investors can use software applications like Microsoft Excel, Google Sheets, or specialized financial analysis tools to perform the calculations and analyze the results. Rolling returns offer a detailed performance analysis by considering multiple overlapping periods instead of a single, static period. This provides a more comprehensive view of an investment's historical performance, helping investors understand its behavior in different market conditions. Traditional point-to-point return calculations can be misleading due to timing bias. Rolling returns help mitigate this bias by evaluating the investment's performance across multiple periods, reducing the impact of a single start or end date. Rolling returns can help investors identify consistent performers by revealing how an investment has performed over various periods. A consistently high rolling return indicates that an investment has generated strong returns in different market conditions, signaling its potential to continue performing well. The accuracy of rolling returns relies on the availability and reliability of historical price or return data. Inadequate or inaccurate data can lead to misleading results, making it crucial for investors to verify the data sources they use. Rolling returns can be misinterpreted if investors do not consider other important factors like risk, investment costs, and tax implications. For instance, an investment with high rolling returns may also have high volatility, implying higher risk. While rolling returns provide valuable insights, they should not be the sole basis for investment decisions. Other metrics, such as risk-adjusted returns, alpha, beta, and standard deviation, should also be considered for a comprehensive investment analysis. The main difference between rolling returns and average returns lies in their calculation and interpretation. Rolling returns calculate the returns for multiple overlapping periods, providing a comprehensive view of an investment's historical performance. On the other hand, average returns calculate the average return over a single, static period, offering a simplified but potentially misleading view of an investment's performance. Both rolling returns and average returns aim to measure the performance of an investment. They provide investors with insights into the return behavior of an asset, helping them make informed investment decisions. Investors can use rolling returns to analyze the performance of individual stocks or equity funds over different periods. This can reveal insights about the investment's risk and return characteristics and its performance consistency. For bond investments, rolling returns can help investors assess the interest rate risk and credit risk of bonds or bond funds. They can also reveal the impact of changes in interest rates on the investment's returns over different periods. In the case of mutual funds and ETFs, rolling returns can help investors evaluate the fund manager's performance consistency. They can also aid in comparing the performance of different funds, assisting in fund selection. Rolling returns can be used to analyze the performance of real estate investments, considering factors like rental income, property appreciation, and market conditions. This can help investors make informed decisions about buying, selling, or holding real estate investments. Investors can use rolling returns to make asset allocation decisions. By analyzing the rolling returns of different asset classes, investors can identify the asset classes that have performed well over different periods and allocate their investments accordingly. Rolling returns help by revealing the risk and return characteristics of different investments. By understanding these characteristics, investors can manage their portfolio risk more effectively. Investors can use rolling returns to benchmark against a relevant index or other portfolios. This can help them assess their portfolio's performance and make necessary adjustments. Although timing the market is generally not advisable, rolling returns can provide insights into an investment's performance in different market conditions. This can help investors identify potential buying or selling opportunities. Investors can use rolling returns to implement a sector rotation strategy. By analyzing the rolling returns of different sectors, investors can identify the sectors that are likely to outperform and adjust their portfolio accordingly. For value and growth investing, rolling returns can assist in identifying stocks or funds that have consistently performed well. This can guide investors in selecting value stocks or growth stocks for their portfolio. The use of rolling returns is often debated in the context of market efficiency. Some argue that past performance, as reflected in rolling returns, does not guarantee future performance due to market efficiency. Others contend that rolling returns can reveal patterns that may persist in the future. Another criticism of rolling returns involves the risk-reward trade-off. An investment with high rolling returns may also have high risk, implying that investors may need to carefully consider the risk associated with high returns before making investment decisions. Rolling returns offer investors a comprehensive and dynamic perspective on an investment's historical performance. By considering multiple overlapping periods, rolling returns provide detailed performance analysis, mitigate timing bias, and identify investment consistency. However, it is crucial to acknowledge the limitations of rolling returns, such as data availability and misinterpretation risks. It is advisable to supplement the analysis with other important metrics and factors to make well-informed investment decisions. Rolling returns find practical applications in various asset classes, including equities, bonds, mutual funds, ETFs, and real estate. They play a vital role in portfolio management decisions, such as asset allocation, risk management, and performance benchmarking. Additionally, rolling returns can inform investment strategies like market timing, sector rotation, and value or growth investing. It is essential for investors to recognize the value of rolling returns while also considering their limitations and seeking professional guidance. Rolling returns provide a valuable analytical tool, but they should not be the sole factor in decision-making. What Are Rolling Returns?

Basic Concepts and Terms

Calculation of Rolling Returns

The Step-By-Step Process

Required Data and Tools

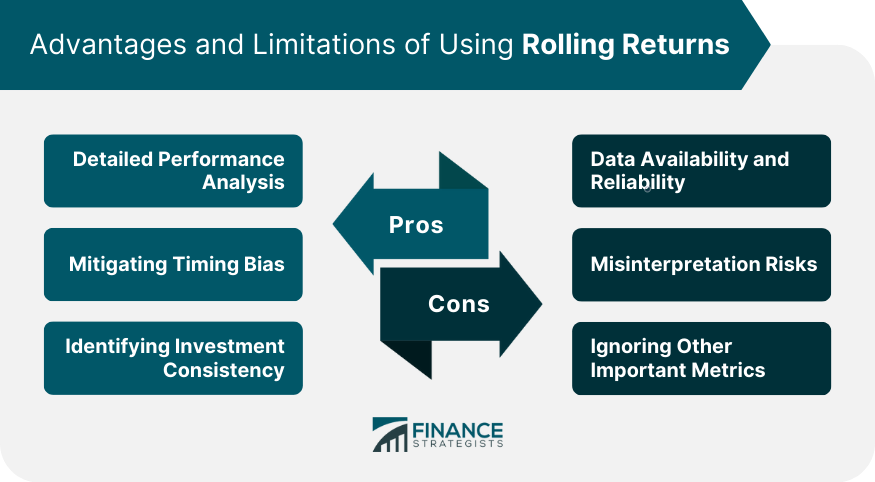

Advantages of Using Rolling Returns

Detailed Performance Analysis

Mitigating Timing Bias

Identifying Investment Consistency

Limitations of Rolling Returns

Data Availability and Reliability

Misinterpretation Risks

Ignoring Other Important Metrics

Rolling Returns vs Average Returns

Key Differences

Similarities

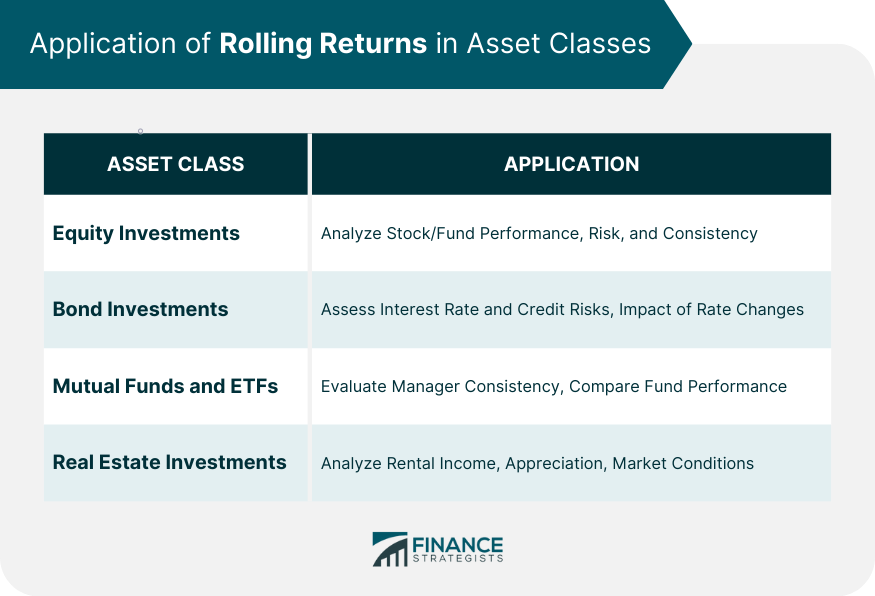

Application of Rolling Returns in Asset Classes

Equity Investments

Bond Investments

Mutual Funds and ETFs

Real Estate Investments

Rolling Returns in Portfolio Management

Asset Allocation Decisions

Risk Management

Performance Benchmarking

Using Rolling Returns for Investment Strategies

Timing the Market

Sector Rotation

Value and Growth Investing

Criticisms and Controversies Surrounding Rolling Returns

Market Efficiency Debate

The Risk-Reward Trade-off

Final Thoughts

By combining rolling returns with other metrics and considering individual financial goals and risk tolerance, investors can make well-rounded investment decisions that align with their objectives.

Rolling Returns FAQs

Rolling returns calculate the returns over multiple overlapping periods, while trailing returns calculate the returns over consecutive non-overlapping periods.

Yes, analyzing rolling returns can provide insights into an investment's performance in different market conditions, helping investors identify trends and make informed decisions.

Rolling returns are more commonly used for long-term investments, as they provide a broader perspective on an investment's performance over time.

Investors can compare the rolling returns of different funds to assess their performance consistency and choose funds with a track record of delivering favorable results.

No, rolling returns should be considered alongside other important factors, such as risk, cost, liquidity, and the investor's financial goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.