Growth vs Value Investing are two distinct investment styles in the stock market. Growth investing focuses on buying shares of companies that are expected to experience high growth rates in the future, often characterized by high revenue and earnings growth, even if the current stock price is high relative to their current earnings. Value investing involves buying stocks of companies that are undervalued by the market, as they trade at a lower price-to-earnings ratio or book value relative to their peers or the market as a whole, and have potential to provide significant returns over time when the market realizes their true value. The choice between these two styles depends on an investor's risk tolerance, investment objectives, and market outlook. Growth investing focuses on companies with higher-than-average growth potential. Growth investors target stocks with strong earnings growth, revenue expansion, and innovative products or services. These companies often reinvest profits into further expansion, leading to limited or no dividend payouts. Growth investors believe that companies with rapidly expanding earnings and revenues can generate significant capital appreciation over time. They are willing to pay a premium for these stocks based on their growth prospects, often leading to high price-to-earnings (P/E) ratios. Investing in high-growth companies can generate substantial returns if their growth projections materialize. These companies can outperform the market, providing investors with significant capital gains. Growth stocks often see significant price appreciation, as market participants become increasingly optimistic about their growth potential. This can lead to sizable capital gains for investors who hold these stocks over the long term. Growth investors can benefit from identifying and investing in innovative companies within emerging industries, positioning themselves for substantial long-term gains as these industries mature. Growth stocks tend to be more volatile than value stocks, as their valuations rely heavily on future growth expectations. Market sentiment can significantly impact growth stock prices, leading to price fluctuations. High-growth companies may have inflated valuations, which can lead to potential losses if the market reevaluates their growth prospects. Investors in growth stocks must be vigilant in monitoring their holdings to avoid potential pitfalls. Growth stocks are sensitive to changes in market sentiment. If investors become pessimistic about a company's growth prospects, the stock price may decline significantly. To succeed in growth investing, it is essential to identify industries with strong growth potential, such as technology, renewable energy, or biotechnology. Growth investors use fundamental analysis to assess a company's financial health and growth prospects. Key metrics include revenue growth, earnings growth, and profit margins. Technical analysis can help growth investors identify entry and exit points for their investments, based on historical price patterns and trends. Diversifying across different growth industries can help mitigate risk and provide exposure to various growth opportunities. Philip Fisher is considered one of the pioneers of growth investing. He wrote the influential book "Common Stocks and Uncommon Profits," which emphasizes the importance of qualitative factors in stock selection. Thomas Rowe Price Jr., founder of T. Rowe Price, is another prominent growth investor. He advocated for long-term investing in growth stocks and developed the concept of "growth at a reasonable price" (GARP). Value investing focuses on identifying undervalued stocks trading below their intrinsic value. Value investors seek companies with strong fundamentals, low price-to-earnings ratios, and high dividend yields. Value investors believe that the market sometimes misprices stocks, creating opportunities to buy undervalued companies. They emphasize the importance of a margin of safety, which is the difference between a stock's intrinsic value and its market price. By purchasing stocks with a margin of safety, value investors aim to minimize downside risk while maximizing potential returns. The margin of safety concept helps value investors minimize risk by purchasing stocks at a discount to their intrinsic value. This approach provides a cushion against potential losses if the stock price declines. Value stocks typically exhibit lower volatility than growth stocks, as their valuations are more closely tied to their underlying fundamentals rather than future growth expectations. This can result in a more stable investment experience. Many value stocks pay dividends, providing investors with a steady stream of income in addition to potential capital appreciation. Investors must be cautious of value traps, where a stock appears undervalued but has underlying issues preventing a price recovery. Thorough analysis is essential to differentiate between genuine opportunities and value traps. During periods when growth stocks outperform, value investing strategies may lag the broader market. Investors must be patient and maintain discipline during these periods. Value investing requires patience and discipline, as undervalued stocks may take time to realize their full potential. Investors must be prepared to hold their investments for an extended period to reap the benefits of value investing. Successful value investing relies on the ability to identify undervalued stocks through thorough research and analysis of a company's financial statements and industry trends. Value investors use fundamental analysis to evaluate a company's financial health and determine its intrinsic value. Key metrics include price-to-earnings ratios, price-to-book ratios, and dividend yields. Value investors often take a contrarian approach, purchasing stocks that are out of favor with the market. This strategy can uncover hidden opportunities and provide significant long-term gains. Diversifying across different industries and market sectors can help mitigate risk and increase exposure to various value opportunities. Benjamin Graham, known as the "father of value investing," developed the principles of value investing and wrote the seminal book "The Intelligent Investor." He emphasized the importance of a margin of safety and thorough analysis when selecting stocks. Warren Buffett, the chairman and CEO of Berkshire Hathaway, is one of the most successful value investors in history. A disciple of Benjamin Graham, Buffett has applied the principles of value investing to achieve remarkable long-term returns for his company and shareholders. Investors must consider their risk tolerance when choosing between growth and value investing. Growth stocks may offer higher potential returns but come with increased volatility, while value stocks may provide more stability and income through dividends. A longer time horizon may be more suitable for growth investing, as investors can ride out periods of volatility and realize the full potential of their investments. Value investing can be appropriate for shorter time horizons, as the margin of safety provides downside protection. Market conditions can impact the performance of growth and value stocks. During bull markets, growth stocks may outperform, while value stocks may provide better returns during bear markets or periods of market turbulence. Investors should consider their personal investment philosophy when choosing between growth and value investing. Some may prefer the excitement and potential rewards of investing in high-growth companies, while others may appreciate the stability and income provided by value stocks. Understanding the differences between growth and value investing is essential for investors looking to create a successful investment strategy. While both approaches have their merits, the choice between them ultimately depends on an individual's risk tolerance, time horizon, market conditions, and personal investment philosophy. By considering these factors and potentially incorporating elements of both strategies, investors can build a diversified portfolio that meets their unique financial goals and objectives.Growth vs Value Investing: Overview

Growth Investing

Overview

Key Characteristics

Philosophy

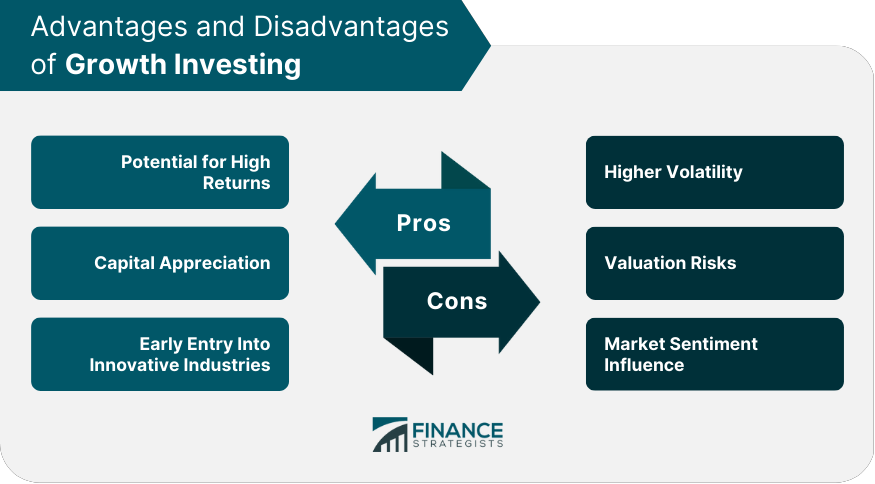

Pros of Growth Investing

Potential for High Returns

Capital Appreciation

Early Entry Into Innovative Industries

Cons of Growth Investing

Higher Volatility

Valuation Risks

Market Sentiment Influence

Growth Investing Strategies

Identifying High-Growth Industries

Fundamental Analysis

Technical Analysis

Portfolio Diversification

Famous Growth Investors

Philip Fisher

Thomas Rowe Price Jr.

Value Investing

Overview

Key Characteristics

Philosophy

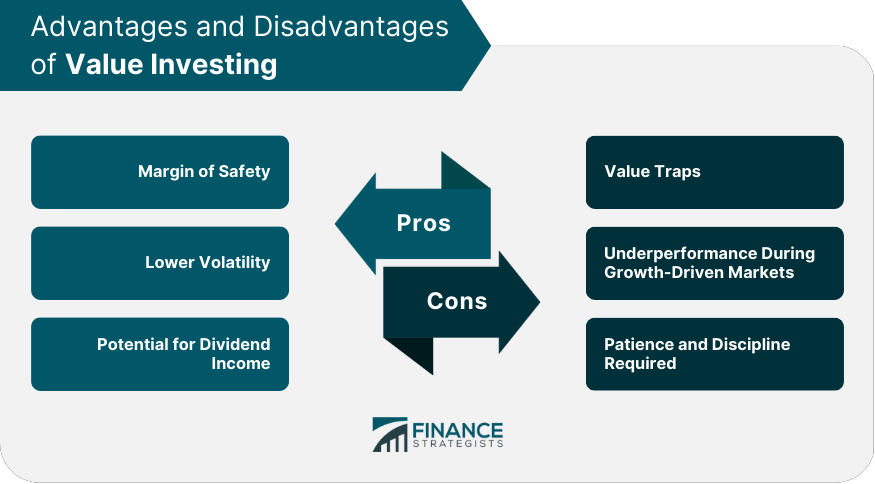

Pros of Value Investing

Margin of Safety

Lower Volatility

Potential for Dividend Income

Cons of Value Investing

Value Traps

Underperformance During Growth-Driven Markets

Patience and Discipline Required

Value Investing Strategies

Identifying Undervalued Stocks

Fundamental Analysis

Contrarian Investing

Portfolio Diversification

Famous Value Investors

Benjamin Graham

Warren Buffett

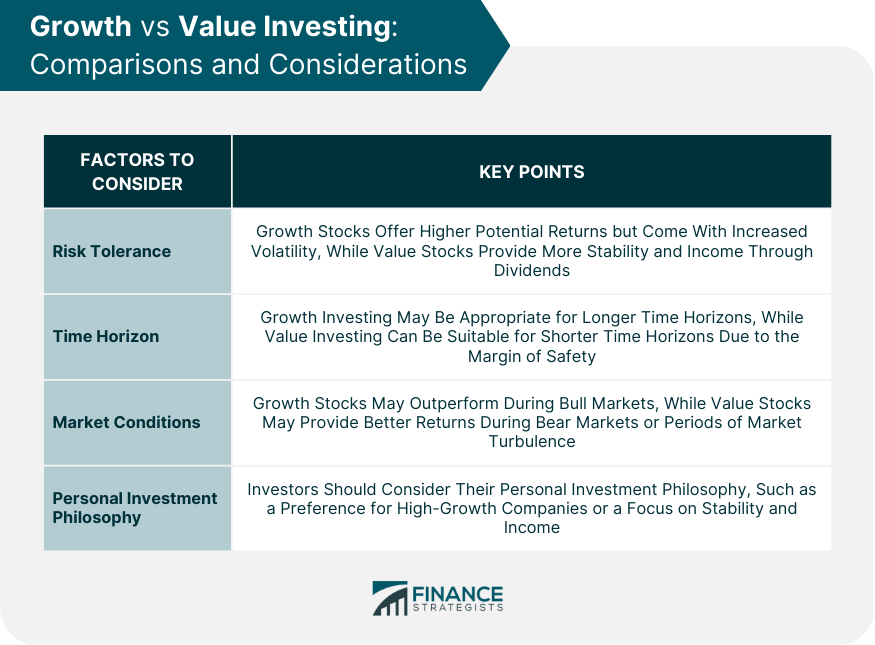

Growth vs Value Investing: Comparisons and Considerations

Risk Tolerance

Time Horizon

Market Conditions

Personal Investment Philosophy

Conclusion

Growth vs Value Investing FAQs

Growth and Value Investing are two different styles of investing in the stock market. Growth investing focuses on companies that have high potential for growth in the future, while Value investing looks for companies that are undervalued by the market and have the potential to rise in value.

It depends on your investment goals and risk tolerance. Growth investing can offer high returns but is also riskier as it requires investing in companies that are still in their growth stage. Value investing, on the other hand, is considered to be a safer option as it involves investing in established companies with a proven track record, but it may offer lower returns.

Yes, you can switch between these two investing styles. However, it is important to note that both styles have their own set of risks and rewards, so it is crucial to understand your investment goals and risk tolerance before making any investment decisions.

Choosing between Growth and Value stocks requires careful analysis of the company's financial health, market trends, and growth potential. It is recommended to consult with a financial advisor or conduct extensive research before making any investment decisions.

Growth investing is often associated with technology, healthcare, and consumer discretionary sectors, while Value investing is commonly associated with financials, energy, and utility sectors. However, the performance of these sectors can vary depending on the economic environment and market conditions. Therefore, it is important to conduct thorough research before making any investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.