Growth investing is an investment strategy that focuses on buying stocks or other securities of companies that are expected to grow at a rate faster than the overall market or their industry peers. Growth investors typically seek out companies with strong potential for revenue and earnings growth, often driven by new products or services, innovative business models, or expansion into new markets. This investment strategy generally involves investing in companies that have a higher Price-to-Earnings ratio (P/E ratio) than the market average, indicating that investors are willing to pay more for each dollar of earnings in anticipation of future growth. Growth investing is often contrasted with value investing, which focuses on buying stocks that are perceived to be undervalued by the market. To identify growth stocks, investors should look for companies exhibiting rapid revenue and earnings growth, market leadership, and strong product or service innovation. These characteristics are indicative of a company's ability to grow at an above-average rate and outperform its competitors in the long run. Several financial ratios can help investors evaluate growth stocks, including the Price-to-Earnings ratio, Price-to-Sales ratio (P/S), Earnings Per Share (EPS) growth, and Return On Equity (ROE). These ratios provide insight into a company's valuation, profitability, and growth potential, enabling investors to make informed decisions. Investors should also consider industry trends and market potential when selecting growth stocks. Companies operating in fast-growing industries with strong secular tailwinds are more likely to experience rapid growth, as they can capitalize on emerging opportunities and expand their market share. Diversifying a growth-oriented portfolio across multiple sectors can help mitigate risks and reduce the impact of sector-specific downturns. By investing in a variety of industries, investors can take advantage of growth opportunities in different areas of the market and minimize the potential for losses due to overexposure to a single sector. Growth investing typically requires a long-term investment horizon. Investors should be prepared to hold onto their investments for an extended period, allowing the companies to fully realize their growth potential. A long-term approach also helps investors to ride out short-term market fluctuations and benefit from the compounding effect of capital gains. Regularly reviewing and rebalancing a growth-oriented portfolio is essential to ensure that it remains aligned with an investor's risk tolerance and investment objectives. Rebalancing involves adjusting the portfolio's asset allocation by selling assets that have outperformed and buying underperforming assets to maintain the desired risk profile. This process can help investors lock in gains, manage risk, and stay on track to achieve their long-term goals. Dollar-cost averaging is a disciplined investment approach that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy can help growth investors reduce the impact of market volatility and lower the average cost per share over time, as they will be buying more shares when prices are low and fewer when prices are high. Growth investing is subject to market and economic risks, as growth stocks tend to be more sensitive to changes in investor sentiment and macroeconomic conditions. Factors such as interest rate changes, inflation, and geopolitical events can impact the performance of growth stocks, leading to potential losses for investors. Investing in growth stocks also involves company-specific risks, as these companies may face challenges related to competition, regulation, or execution. A company's inability to innovate, adapt to changing market conditions, or manage its growth effectively can result in underperformance or even bankruptcy, leading to losses for investors. Growth stocks can sometimes become overvalued due to high investor expectations and market enthusiasm for their growth prospects. Overvaluation can lead to sharp declines in stock prices when the company's growth fails to meet expectations or when investor sentiment shifts, posing a risk for growth investors. Investing in growth stocks can be emotionally challenging, as these stocks often experience significant price fluctuations. It's crucial for investors to maintain a disciplined, long-term approach and avoid making impulsive decisions based on short-term market movements or emotions. Growth investing aims to identify companies with the potential to deliver above-average returns. These companies typically have innovative products, services, or business models that give them a competitive edge, allowing them to expand rapidly and increase their earnings over time. This can result in significant capital appreciation for investors who identify these companies early in their growth phase. The primary goal of growth investing is to achieve capital appreciation rather than income generation. Growth stocks usually do not pay dividends or have low dividend yields, as these companies reinvest their earnings to fuel future growth. As a result, growth investors rely on increasing stock prices to generate returns, which can lead to substantial capital gains over the long term. Growth investing focuses on companies with strong future prospects, which often translates to better long-term performance. These companies are well-positioned to benefit from secular trends, technological advancements, or changing consumer preferences, providing growth investors with an opportunity to profit from their long-term success. Growth stocks tend to have a higher risk profile compared to value or income-oriented stocks. These companies are often in the early stages of their development, making them more susceptible to competitive pressures, regulatory challenges, and changing market conditions. As a result, growth investors may experience greater price volatility and face a higher risk of loss. Growth stocks are known for their increased price volatility, which can lead to significant fluctuations in an investor's portfolio value. The high growth expectations associated with these companies can result in extreme market reactions to earnings reports or other news, both positive and negative. This can be particularly challenging for investors with a low tolerance for risk. During market downturns or economic recessions, growth stocks can underperform the broader market as investors become more risk-averse. Companies with high growth expectations are often more sensitive to changes in investor sentiment and macroeconomic conditions, making them vulnerable to sharp declines in stock prices during challenging times. Growth investing can be a rewarding strategy for investors seeking long-term capital appreciation. By understanding the principles of growth investing, identifying high-potential growth stocks, and implementing effective strategies, investors can unlock long-term value and generate substantial returns. However, it's essential to be aware of the risks and challenges associated with growth investing, such as higher volatility, susceptibility to market downturns, and overvaluation concerns. By adopting a disciplined, long-term approach, and continuously learning and adapting to changing market conditions, investors can enhance their growth investing success and achieve their financial goals.What Is Growth Investing?

Identifying Growth Stocks

Key Characteristics of Growth Stocks

Analyzing Financial Ratios

Understanding Industry Trends and Market Potential

Growth Investing Strategies

Diversification Across Sectors

Employing a Long-Term Investment in Horizon

Portfolio Rebalancing

Using Dollar-Cost Averaging

Risks and Challenges of Growth Investing

Market and Economic Risks

Company-Specific Risks

Overvaluation Concerns

Emotional Investing

Advantages of Growth Investing

Higher Potential Returns

Capital Appreciation

Better Long-Term Prospects

Drawbacks of Growth Investing

Higher Risk Profile

Increased Volatility

Susceptibility to Market Downturns

The Bottom Line

Growth Investing FAQs

Growth investing is an investment strategy that focuses on companies with strong potential for future earnings and revenue growth, aiming to achieve capital appreciation. In contrast, value investing seeks to identify undervalued stocks with the expectation that they will eventually reach their intrinsic value, offering both capital appreciation and income generation through dividends.

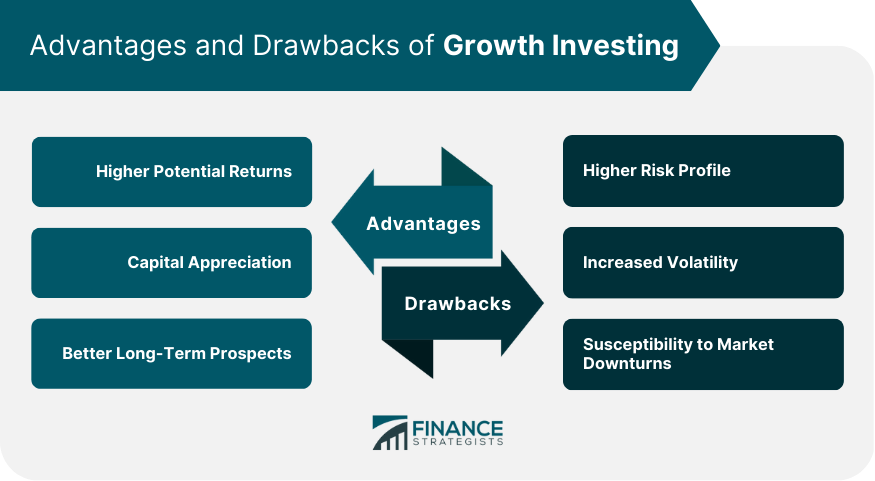

The primary advantages of growth investing include higher potential returns, capital appreciation, and better long-term prospects. Growth investors target companies with innovative products or services and strong market positions, which can result in significant capital gains over time.

Growth investing comes with several risks and challenges, including a higher risk profile, increased volatility, susceptibility to market downturns, company-specific risks, overvaluation concerns, and emotional investing. Investors need to be aware of these risks and adopt a disciplined, long-term approach to navigate these challenges effectively.

Investors can identify growth stocks by looking for companies with rapid revenue and earnings growth, market leadership, and strong product or service innovation. Analyzing financial ratios such as price-to-earnings ratio (P/E), price-to-sales ratio (P/S), earnings per share (EPS) growth, and return on equity (ROE) can also provide insight into a company's growth potential and valuation.

To enhance growth investing success, investors can diversify across sectors, employ a long-term investment horizon, regularly rebalance their portfolios, and use dollar-cost averaging. These strategies can help manage risk, reduce the impact of market volatility, and maximize long-term returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.