Quality of earnings refers to the degree to which earnings reflect a company's true financial performance, devoid of any artificial enhancements or accounting gimmicks. High-quality earnings provide an accurate and sustainable representation of a firm's economic performance, while low-quality earnings might be influenced by one-time events, accounting irregularities, or short-term tactics. In essence, when stakeholders assess the quality of earnings, they are delving into how authentic, repeatable, and representative the reported profits are of the company's true economic situation. For investors, analysts, and other stakeholders, understanding the quality of earnings is paramount. It enables them to predict future earnings and cash flows, gauge the firm's genuine financial health, and make informed decisions. The manner in which a company recognizes revenue can greatly influence its earnings quality. Some companies might recognize revenue as soon as an order is placed, while others may wait until the cash payment is received. Differences in revenue recognition policies, especially if aggressive, can lead to distortions, making earnings appear better than the actual financial reality. Just as revenue recognition is crucial, so is the treatment of expenses. Companies might choose to defer certain expenses or capitalize them instead of expensing them immediately. Such choices can artificially boost earnings in the short term. Hence, understanding a company's expense recognition policy is vital to ascertain the real sustainability and quality of its profits. Different accounting methods and assumptions can lead to varied earnings reports, even for companies with identical financial performances. Choices related to depreciation methods, inventory valuation, or pension plan assumptions, among others, can significantly impact reported earnings. Such choices don't necessarily mean manipulation, but they do underscore the importance of digging deeper into financial statements. The accruals ratio is a tool that helps in distinguishing between the cash and non-cash components of earnings. A high accrual ratio might suggest that a significant portion of the company's earnings doesn't come from cash operations, which could be a concern. On the other hand, a lower ratio indicates that more of the firm's earnings are cash-based, often seen as a sign of higher earnings quality. This ratio examines the relationship between cash flows from operations and sales. A higher ratio signals that a company can effectively convert its sales into cash, indicating strong earnings quality. Conversely, a low ratio might suggest that even though the firm reports high sales, it struggles to generate cash from these operations. Assessing cash flows from operating activities provides insights into how much cash a company generates from its core business operations. Companies with high-quality earnings will typically have robust cash flows from operations, signifying that the reported earnings aren't just numbers but are backed by genuine cash generation. Investigating cash flows from investing and financing activities offers a glimpse into a company's investment decisions and capital movements. Persistent negative cash flows from investing activities might suggest robust investment in the business, while positive cash flows from financing can indicate new borrowings or equity issuance. Earnings that exhibit consistent growth and are predictable over time are often deemed of higher quality. Such consistency suggests that the company isn't relying on one-off events or irregularities to boost its profits but is generating genuine growth from its operations. When net income and operating cash flows move in tandem, it's a positive indicator of earnings quality. It signifies that the company's reported earnings are reflective of its cash-generating abilities. A firm's net income should ideally correlate with its cash flows. If a company consistently reports high net income but has lackluster cash flows, it's a potential red flag. It suggests that while accounting profits are high, actual cash generation is not as robust. Companies that recognize revenue aggressively can inflate their earnings. Stakeholders need to be wary of firms that report sales before goods are shipped, recognize revenue from long-term projects prematurely, or use other tactics to boost reported sales artificially. Overvalued assets or understated liabilities can give an impression of a healthier balance sheet than is genuinely the case. Such discrepancies can lead to higher reported earnings but can be unsustainable in the long run. Frequent one-time gains can artificially boost earnings. While companies can have genuine one-off events, repeated instances might suggest manipulation or an attempt to smooth earnings. Clear, comprehensive, and transparent financial reporting goes a long way in improving earnings quality. It reduces the risk of misinterpretation and ensures stakeholders have a clear understanding of the company's genuine financial health. Opting for conservative accounting choices, whether related to revenue recognition, expense treatment, or other areas, ensures that the firm isn't artificially inflating its earnings. Such policies build trust and credibility with stakeholders. Robust corporate governance, including an active and independent board of directors, can act as a check against earnings manipulation. It ensures that the company's management acts in the best interests of shareholders and upholds high financial reporting standards. Quality of Earnings is the extent to which a company's earnings reflect its true financial performance, devoid of artificial enhancements or accounting tricks. High-quality earnings offer a genuine and sustainable representation of a firm's economic health, while low-quality earnings may stem from irregularities or short-term strategies. Stakeholders assess earnings quality to ascertain the authenticity, consistency, and representative nature of reported profits. It aids in predicting future earnings and cash flows, evaluating a company's financial health, and making well-informed decisions. Factors like revenue and expense recognition policies, accounting methods, and assumptions influence earnings quality. Indicators such as consistency, cash flow trends, and alignment of net income with cash flows provide insights. Red flags, including aggressive revenue recognition and one-time gains, should be scrutinized. Strategies like transparent reporting, conservative accounting, and robust corporate governance enhance earnings quality. What Is Quality of Earnings?

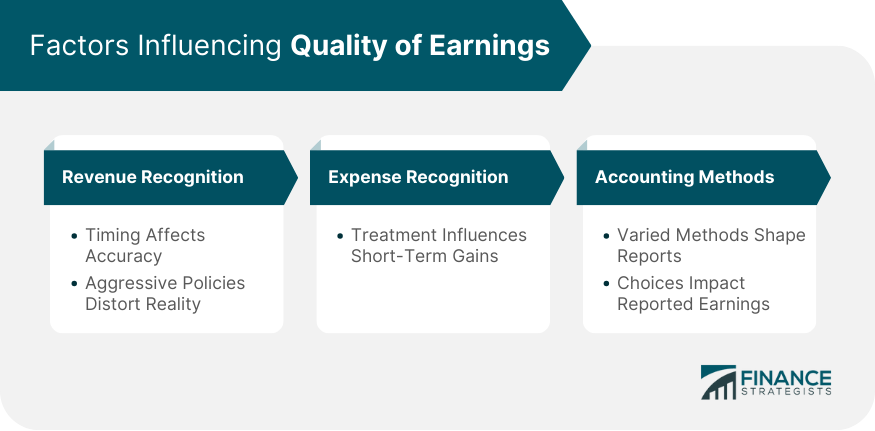

Factors Influencing Quality of Earnings

Revenue Recognition Policies

Expense Recognition Policies

Accounting Methods and Assumptions

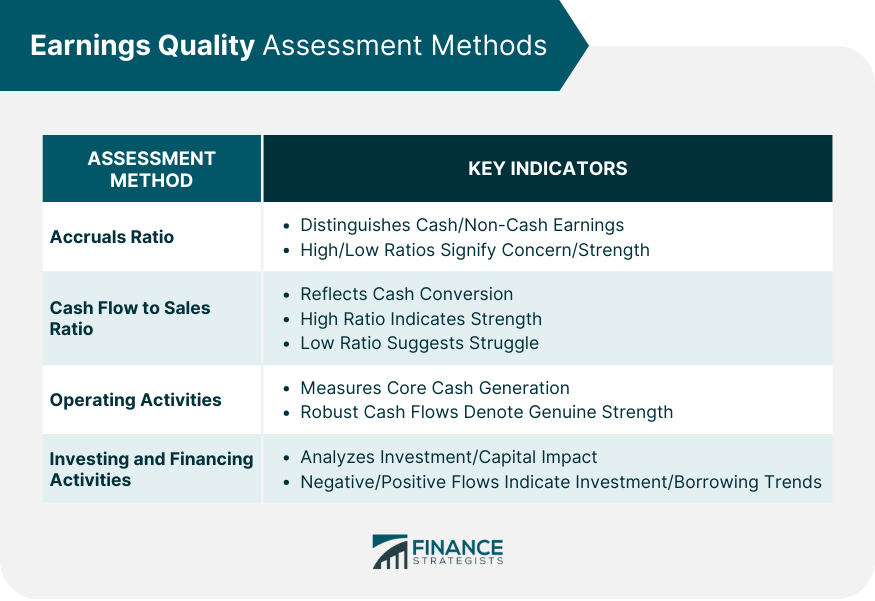

Methods to Assess Earnings Quality

Accruals Ratio

Cash Flow to Sales Ratio

Operating Activities

Investing and Financing Activities

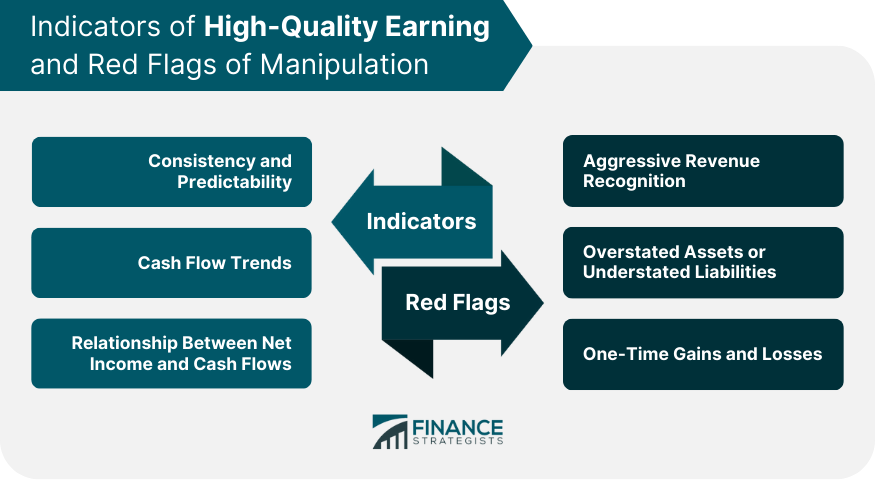

Indicators of High-Quality Earnings

Consistency and Predictability

Cash Flow Trends

Net Income and Cash Flows

Red Flags of Quality Earnings Manipulation

Aggressive Revenue Recognition

Overstated Assets or Understated Liabilities

One-Time Gains and Losses

Strategies for Improving Earnings Quality

Transparent Financial Reporting

Conservative Accounting Policies

Corporate Governance Measures

Conclusion

Quality of Earnings FAQs

Earnings quality is pivotal in investment decisions as it provides insights into a company's true financial health and its potential for future growth. High-quality earnings suggest sustainability, predictability, and genuine economic performance, making the company a potentially more attractive investment.

Revenue recognition policies can significantly impact reported earnings. Aggressive revenue recognition can inflate earnings, making a company appear more profitable than it truly is. Conversely, conservative policies might reflect a truer picture of a firm's financial health.

The correlation between net income and cash flows indicates whether the reported profits are backed by actual cash generation. Discrepancies between these two can be a warning sign of potential earnings manipulation or quality issues.

No, one-time gains or losses can arise from genuine events, such as asset sales or write-downs. However, repeated instances or patterns of such gains can indicate an attempt to smooth or manipulate earnings.

Stakeholders can delve into a company's financial statements, scrutinizing its revenue and expense recognition policies, cash flow statements, and accounting methods. Additionally, ratios like the accruals ratio or cash flow to sales ratio can provide insights into earnings quality.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.