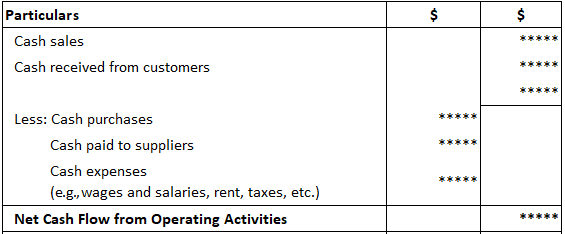

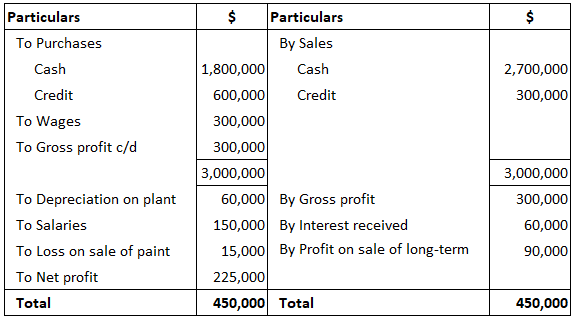

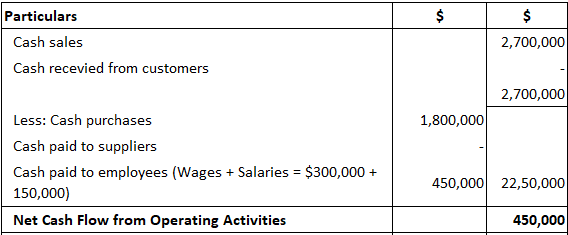

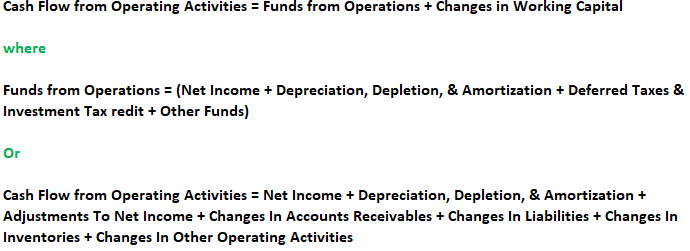

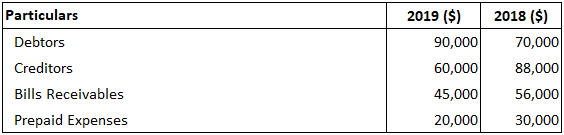

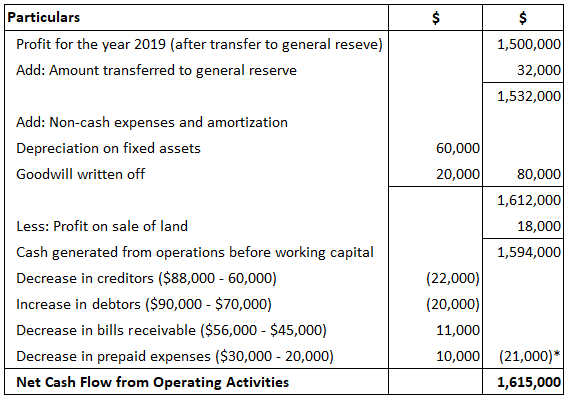

Cash flow from operating activities (CFO) shows the amount of cash generated from the regular operations of an enterprise to maintain its operational capabilities. Operating activities are the transactions that enter into the calculation of net income. Examples include cash receipts from the sale of goods and services, cash receipts from interest and dividend income, and cash payments for inventory. Operating activities is perhaps the key part of the cash flow statement because it shows whether (and to what extent) a business can generate cash from its operations. It is these operating cash flows which must, in the end, pay off all cash outflows relating to other activities (e.g., paying loan interest, dividends, and so on). Some examples of cash flows from operating activities are shown below to help illustrate the basic concept: Some transactions, such as the sale of an item of plant, may produce a loss or gain, which is included in the determination of net profit or loss. However, the cash flows relating to such transactions are cash flows from investing activities. Businesses can calculate the net cash flow from operating activities (CFO) using: An overview of these methods is given below. Under the direct method, the information contained in the company's accounting records is used to calculate the net CFO. The format shown below can be used. Calculation of Net CFO: Direct Method From the following information, calculate the net cash flow from operating activities (CFO). All sales and purchases were made on credit during the last quarter of the financial year. Therefore, no cash was paid to creditors or collected from debtors during the year. You are required to calculate CFO using the direct method. Calculation of Net CFO: Direct Method Under the indirect method, the figures required for the calculation are obtained from information in the company's profit and loss account and balance sheet. The starting point for the calculation is net profit before taxation. Given that the net profit figure might be influenced by the cash flow activities of all three categories and also non-cash activities, certain adjustments need to be considered when calculating cash flow from operating activities. The common items of adjustment are described below. Cash flow from operating activities will increase when prepaid expenses decrease. In contrast, cash flow from operating activities will decrease when there is an increase in prepaid expenses. Cash will decrease when there is a decrease in outstanding expenses. Similarly, there will be an increase in outstanding expenses. Interest paid or received will find a place in the profit and loss account and cause the movement of cash. The items need to be adjusted when calculating cash flow from operating activities because they are considered elsewhere in the cash flow statement (e.g., investing activities or financing activities). Depreciation on assets is debited to the profit and loss account. Given that it is only a book entry, depreciation does not cause any cash movement and, hence, it should be added back to net profit when calculating cash flow from operating activities. Although the profit or loss made on the sale of fixed assets is either credited (profit) or debited (loss) to the profit and loss account, these entries do not cause any cash movement. They are only book entries. Therefore, when calculating cash flow from operating activities, loss on sale of fixed assets should be added back and profit on sale of fixed assets should be deducted from net profit. A decrease in stock, debtors, or bills receivable (B/R) will increase cash flow from operating activities and increase stock. Debtors or B/R will decrease cash flow from operating activities. A decrease in creditors or bills payable will reduce cash, whereas an increase in creditors and bills payable will increase cash. Using the indirect method, calculate net cash flow from operating activities (CFO) from the following information. First, a company's profit for the year is $1,500,000 after considering the following items. 2. The company's current assets and current liabilities on 31 March 2019 are shown below. Calculation of Net CFO: Indirect Method Note: The negative balance of $21,000 should be added to find the net cash flow. Cash Flow From Operating Activities is one of the categories of cash flow. Learn more about Cash Flow from Financial Activities in this article: Cash Flow From Financial ActivitiesOperating Activities

Cash Flow From Operating Activities: Explanation

How to Calculate Net Cash Flow From Operating Activities

Direct Method

Example

Solution

Indirect Method

Formula to Calculate CFO Using Indirect Method

Example

Solution

Cash Flow From Operating Activities FAQs

Cash Flow from operating activities (CFO) shows the amount of cash generated from the regular operations of an enterprise to maintain its operational capabilities.

Businesses can calculate the net cash flow from operating activities (CFO) using: direct method and indirect method.

Under the direct method, the information contained in the company’s accounting records is used to calculate the net CFO.

Under the indirect method, the figures required for the calculation are obtained from information in the company’s profit and loss account and balance sheet. The starting point for the calculation is net profit before taxation.

Cash inflows from operating activities are generated by sales of goods or services, the collection of accounts receivable, lawsuits settled or insurance claims paid. Businesses may also generate cash inflows by obtaining refunds or license fees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.