Uptick Volume refers to the volume of shares traded while a security's price is increasing. Essentially, it's a measure of the trading volume that occurs when the price moves upwards or 'ticks up.' The purpose of analyzing Uptick Volume is to assess the strength of positive market sentiment or bullish momentum. It helps traders and investors gauge the intensity of buying interest in a particular security, providing insights into its demand and potential future price movements. Increased Uptick Volume often signifies strong buying pressure, possibly indicating a bullish trend. On the other hand, a low Uptick in Volume might suggest a lack of buyer enthusiasm. Understanding Uptick Volume can greatly impact investors and traders by aiding in timely and strategic decision-making. Uptick Volume also serves as a key technical analysis tool used alongside other volume and price indicators to predict market trends and interpret trading patterns. Uptick Volume is intrinsically linked to the Uptick Rule, a regulation imposed by the U.S. Securities and Exchange Commission (SEC). This rule stipulates that short-selling a stock is only allowed when its last price movement was upwards or 'on an uptick.' Comprehending Uptick Volume thus becomes essential in effectively employing this rule. By measuring the volume of shares traded during a price uptick, investors can gauge the bullish momentum and demand for security. High uptick volume indicates strong buying pressure, which might discourage short-selling, whereas low uptick volume could signal weak buying interest, possibly inviting short-sellers. Therefore, traders can use uptick volume data to interpret market trends better, make informed decisions on short-selling opportunities, and navigate the constraints of the Uptick Rule more efficiently. Understanding uptick volume can help investors manage risk better. For instance, a decrease in uptick volume during a price increase might indicate a weak trend, signaling investors to possibly avoid entering a long position. Investors can use uptick volume to help construct their portfolios. Stocks with high uptick volume might suggest stronger future performance, thus making them attractive for portfolio inclusion. Performance measurement often incorporates uptick volume. An asset consistently demonstrating a high uptick in volume may be deemed as outperforming its peers. Understanding uptick volume aids in spotting bullish trends in the market. When uptick volume is higher than downtick volume consistently, it signifies a bullish market sentiment. Conversely, if the downtick volume is higher, it may suggest a bearish market sentiment. In bull markets, uptick volume can verify the strength of the bullish sentiment. A high uptick in volume during price increases shows that many investors are optimistic about the asset's future performance, lending credibility to the ongoing bull run. Even in bear markets, uptick volume has its role. An increase in uptick volume amid a downtrend may signal a possible trend reversal, as it might suggest that more investors are starting to buy the asset in question. Uptick volume is often directly correlated with investor sentiment. Higher uptick volume indicates positive sentiment and vice versa. By keeping an eye on the uptick in volume, investors can gauge the market's overall mood and make informed decisions by keeping an eye on the uptick in volume. Market news can significantly impact uptick volume. Positive news can result in a surge in uptick volume as investors rush to buy, while negative news might reduce uptick volume as investors become cautious. Charting techniques often incorporate uptick volume to get a holistic view of market sentiment. For example, a sudden spike in uptick volume can be a strong buy signal in momentum trading strategies. In candlestick charts, uptick volume is often depicted as a histogram below the price chart. By comparing uptick volume bars with the corresponding price bars, traders can deduce important trading signals. Uptick volume is also used in conjunction with moving averages to identify trend reversals. For instance, a sharp rise in uptick volume accompanied by a price crossing over its moving average might indicate a bullish reversal. In day trading, an uptick volume is a critical tool for identifying intra-day momentum. Day traders often look for sudden surges in uptick volume to identify potential trading opportunities. Swing traders operate on slightly longer timeframes than day traders and use uptick volume to confirm entry and exit points. Increased uptick volume can suggest a good entry point, while a drop in uptick volume might signal an optimal exit point. Position traders, who hold assets for longer periods, utilize uptick volume to gauge the strength of a long-term trend. A consistently high uptick in volume might suggest a strong uptrend, reinforcing their decision to hold. Uptick volume analysis is particularly popular in the stock market. Analysts and traders use it as an indicator of institutional buying, which can presage major price moves. In futures trading, uptick volume is often used in conjunction with open interest. A rise in both parameters could signal strong buying pressure and a potential uptrend. Options traders use uptick volume to gauge the market sentiment for the underlying asset. A surge in call options' uptick volume, for example, could suggest bullish sentiment. As with any financial metric, uptick volume can be misinterpreted. For example, a sudden surge in uptick volume might be mistaken for a bullish signal when it could be due to short sellers covering their positions. In highly volatile markets, uptick volume might offer less reliable signals. Rapid price changes can lead to misleading uptick and downtick volumes, making it difficult to discern a clear trend. Lastly, market manipulation can artificially inflate uptick volume, giving a false impression of bullish sentiment. Investors need to be wary of such instances and corroborate the uptick in volume with other indicators. Uptick Volume, the volume of shares traded as a security's price rises, plays a crucial role in financial analysis and market trend interpretation. It is an invaluable tool in assessing buying interest and bullish momentum. Moreover, it's intrinsically tied to the Uptick Rule, helping investors navigate short-selling constraints. Practical applications of Uptick Volume extend to risk management, portfolio construction, and performance measurement. It aids in identifying market trends and serves as a key element in technical analysis and different trading strategies. Additionally, its use varies across different asset classes like stocks, futures, and options. While uptick volume offers immense utility, its limitations include potential misinterpretations, reduced reliability in volatile markets, and susceptibility to market manipulation. Understanding these facets allows investors to make informed decisions and strategically apply uptick volume in their trading endeavors. What Is an Uptick Volume?

Relation of Uptick Volume to the Uptick Rule

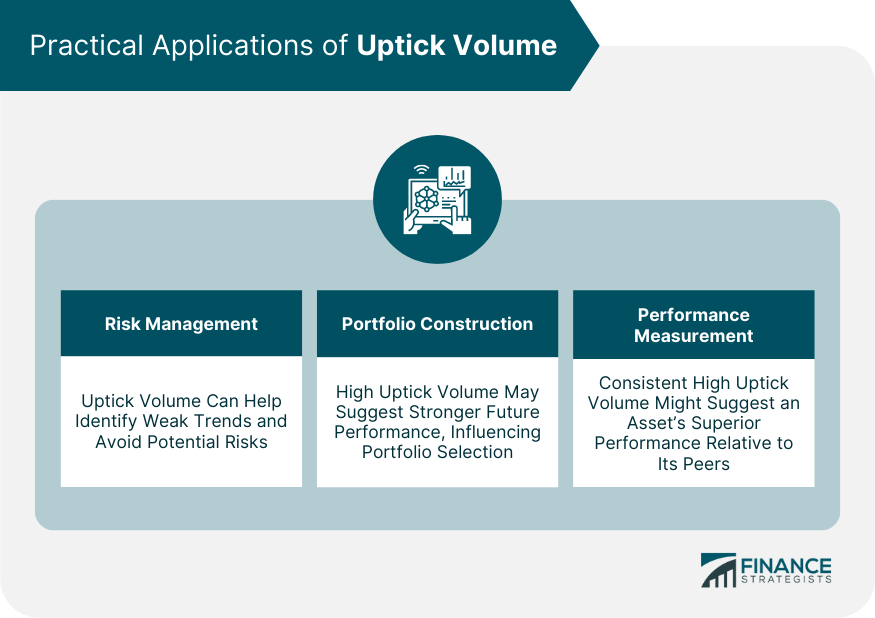

Practical Applications of Uptick Volume

Risk Management

Portfolio Construction

Performance Measurement

Uptick Volume and Market Trends

Identifying Market Trends

Bull Markets

Bear Markets

Market Sentiment

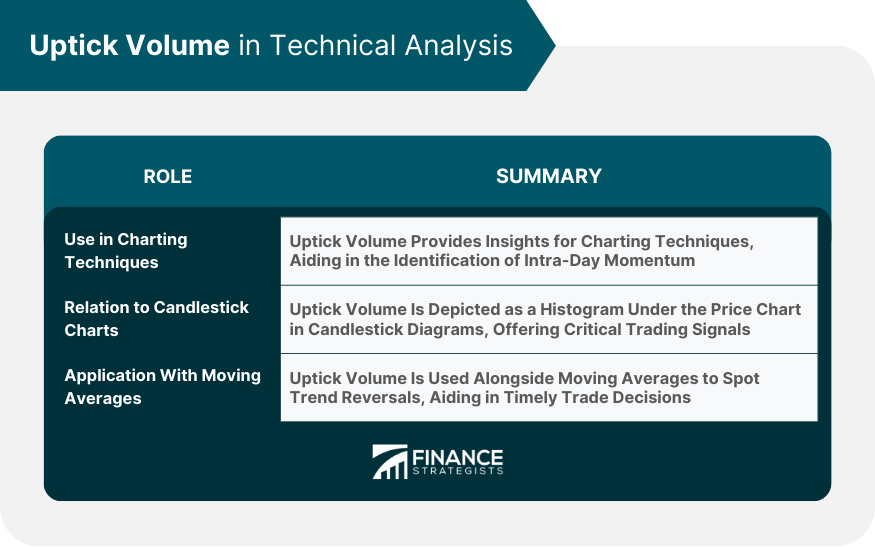

Uptick Volume in Technical Analysis

Use in Charting Techniques

Candlestick Charts

Moving Averages

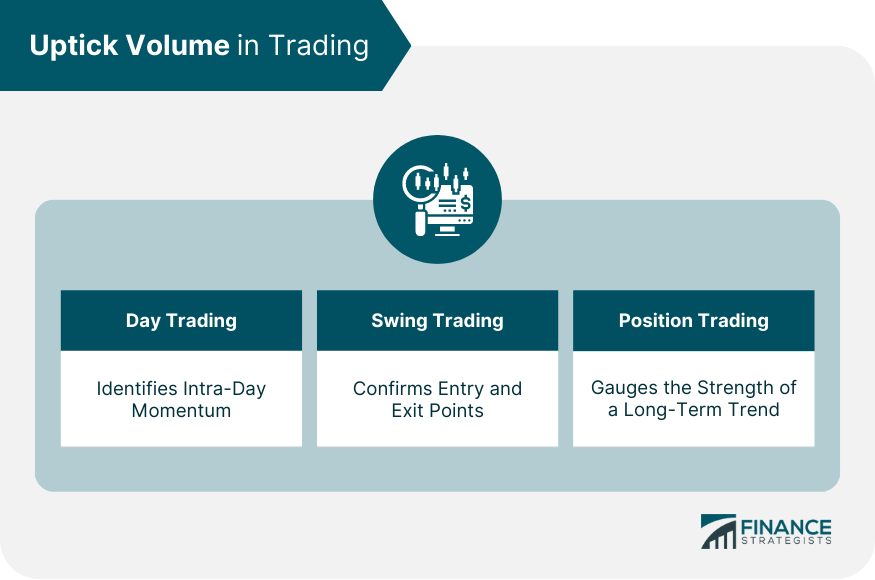

Uptick Volume in Trading

Day Trading

Swing Trading

Position Trading

Uptick Volume in Different Asset Classes

Stocks

Futures

Options

Limitations of Using Uptick Volume in Financial Analysis

Misinterpretation

Highly Volatile Markets

Market Manipulation Concerns

Final Thoughts

Uptick Volume FAQs

Uptick volume refers to the volume of shares traded during an uptick or a price increase. It is a significant tool in financial analysis, helping to measure the momentum behind an upward price trend and assess market sentiment.

Uptick volume is used in various trading strategies, including day trading, swing trading, and position trading. Traders use uptick volume to identify momentum, confirm entry and exit points, and gauge the strength of long-term trends.

The Uptick Rule, enforced by the SEC, mandates that short-selling a stock can only be carried out on an uptick. Uptick volume plays a critical role in this rule's application, especially in identifying potential short squeezes.

Uptick volume is an important indicator of market sentiment. A higher uptick volume is typically correlated with positive market sentiment, indicating strong buying pressure. Conversely, a lower uptick in volume may suggest negative sentiment.

While Uptick volume is a crucial tool, it also has limitations. It can be misinterpreted, especially during highly volatile markets, and may offer less reliable signals. Additionally, market manipulation could artificially inflate uptick volume, potentially misleading investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.