A bond is a type of investment that involves lending money to an entity, such as a government or a corporation. In return for the loan, the entity agrees to pay a specified rate of interest during the life of the bond and to repay the face value of the bond (the principal) when it matures, or comes due. Bonds are an essential component of the financial markets and are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Investors typically buy bonds to earn regular income and potentially to preserve their invested capital. Bonds have less price volatility compared to stocks and are thus a crucial element in a well-diversified portfolio, helping to mitigate risk and volatility. Treasury bonds are considered one of the safest investments because they are backed by the full faith and credit of the U.S. government. They can be purchased without a brokerage account, so you avoid paying any commission fees. You just need to create a TreasuryDirect account. You'll need to provide some basic personal information, including your Social Security number, email address, and banking information. Once you have an account, you can purchase, manage, and redeem bonds electronically. TreasuryDirect's user-friendly website makes it easy for investors to navigate the bond-buying process. The website also has a variety of resources to help you understand different bond types and decide which is right for you. To buy corporate or municipal bonds, you'll typically need to go through a brokerage firm. Look for a firm with a strong track record, transparent fees, and excellent customer service. It's also beneficial to choose a firm that provides educational resources for investors, especially if you are a novice. When you buy bonds through a firm, you may be required to pay brokerage fees. These costs can vary widely from firm to firm, so it's important to understand what you're paying before you make a purchase. Ask your broker for a full explanation of their fee structure. Your broker can guide you through the purchase process, and some firms offer online platforms where you can buy and sell bonds on your own. The secondary market is where investors buy and sell bonds after they have been issued. One benefit of the secondary market is that it provides liquidity – you can typically buy or sell bonds anytime. However, the secondary market also comes with risks. Bond prices fluctuate with changes in interest rates, so you could lose money if rates increase. The bond's price may also reflect the issuer’s creditworthiness. If their financial condition has deteriorated, the bond might be sold at a discount. Navigating the secondary market for bonds can be challenging for inexperienced investors. It's often beneficial to work with a financial advisor or broker who understands the market well. They can help you understand the nuances of bond pricing, yield, and risk. When interest rates rise, bond prices fall; when rates fall, bond prices rise. Understanding the current interest rate environment can help you anticipate potential changes in bond prices. Inflation is the rate at which the general level of prices for goods and services is rising. If inflation is high, the purchasing power of the bond's fixed interest payments can be eroded, making the bond less attractive. Bond ratings are grades given to bonds that indicate their credit quality. Independent rating services such as Moody's, Standard & Poor's, and Fitch give these ratings. High-rated bonds are deemed to be the least risky, while low-rated bonds carry more risk but offer higher potential yields. Maturity refers to the length of time until the bond issuer must repay the bond's principal amount. Bonds can have short, medium, or long maturities. Typically, longer-maturity bonds offer higher yields to compensate for the additional risk associated with the extended time frame. Interest rate risk is the risk that bond prices will decrease due to rising interest rates. As indicated above, when interest rates rise, the fixed interest payments of a bond become less attractive compared to other investments, leading to a decrease in the bond's price. It refers to the risk that the bond issuer will not be able to make the scheduled interest payments or repay the principal at maturity. Government bonds have virtually no default risk, while corporate and municipal bonds carry higher default risk. As previously mentioned, inflation risk is the risk that the bond's returns will not keep up with inflation, decreasing the purchasing power of the bond's fixed interest payments. Reinvestment risk is the risk that an investor will not be able to reinvest the bond's cash flows at a rate comparable to the bond's current yield. This is particularly relevant when interest rates are falling. Diversification involves spreading your investments among various securities to reduce risk. When it comes to bonds, this might mean buying bonds from different issuers, with different maturities, or in different sectors. A bond ladder is a portfolio of bonds with different maturity dates. As each bond matures, you reinvest the proceeds in a new bond at the longest maturity of your ladder. This strategy provides a balance of regular income, return of principal, and potential for higher returns. The barbell strategy involves buying short-term and long-term bonds, but no intermediate-term bonds. This can be a good strategy in a volatile interest rate environment, as the short-term bonds provide liquidity, while the long-term bonds offer higher yields. Bonds are investment instruments that involve lending money to governments or corporations, who then agree to pay interest and return the principal upon maturity. Bonds offer stability and are less volatile than stocks, making them valuable for diversifying portfolios and mitigating risk. When purchasing bonds, there are different avenues to explore, including TreasuryDirect for government bonds and brokerages for corporate or municipal bonds. You may also buy bonds through the secondary market, offering the advantage of liquidity. Consider factors such as the interest rate environment, inflation, bond ratings, and maturity when buying bonds. These factors influence bond prices, returns, and risks. Investors should also be aware of the drawbacks associated with bonds, including risks with interest rates, default, inflation, and reinvestment. Implementing strategies like diversification, laddering, and the barbell strategy can help manage these bond risks effectively. Lastly, seeking guidance from professionals can provide valuable insights and help you make informed decisions in the bond market.Overview of Bonds

How to Buy Bonds

Through the US Treasury

Through Brokerage Firms

Buying Bonds in the Secondary Market

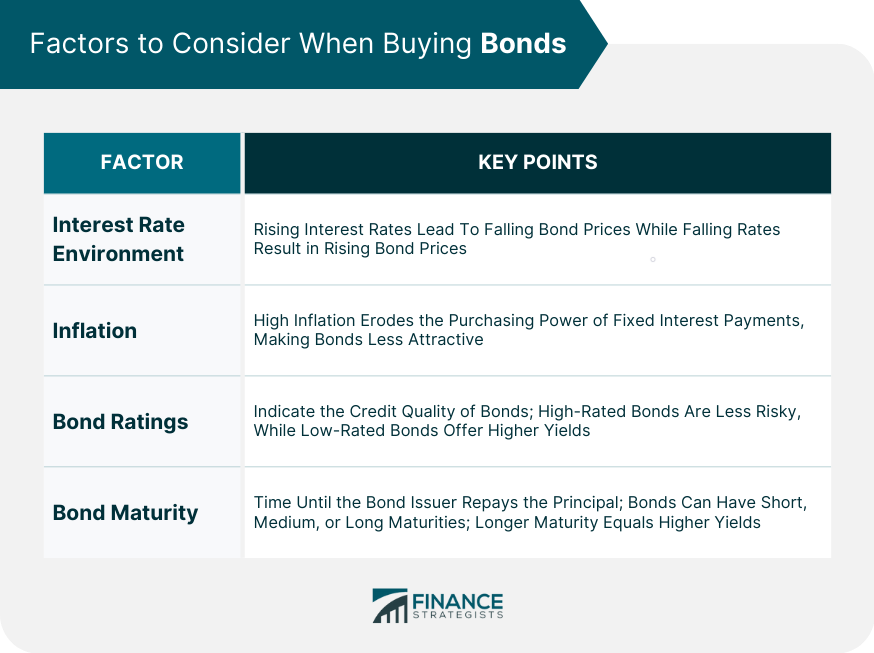

Factors to Consider When Buying Bonds

Interest Rate Environment

Inflation

Bond Ratings

Bond Maturity

Risks Associated With Buying Bonds

Interest Rate Risk

Default Risk

Inflation Risk

Reinvestment Risk

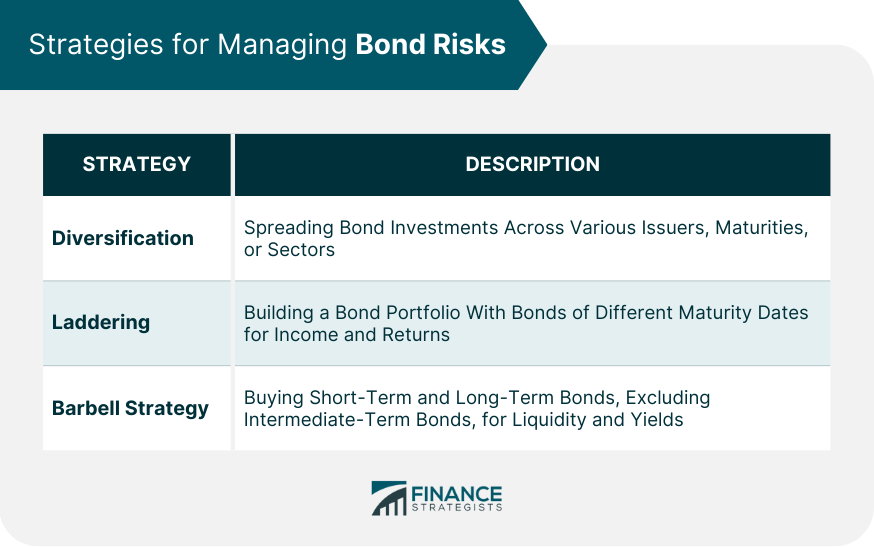

Strategies for Managing Bond Risks

Diversification

Laddering

Barbell Strategy

Final Thoughts

How to Buy Bonds FAQs

To buy bonds through the U.S. Treasury, you can create a TreasuryDirect account. Provide your personal information, including your Social Security number, email address, and banking details. Once your account is set up, you can purchase, manage, and redeem bonds electronically.

When selecting a brokerage firm, consider factors such as their track record, transparent fees, and customer service quality. It's also beneficial to choose a firm that provides educational resources, especially if you are new to bond investing.

Yes, the secondary market allows investors to buy and sell bonds after they have been issued. This market provides liquidity, meaning you can typically buy or sell bonds at any time. However, it's important to note that bond prices in the secondary market can fluctuate based on factors such as interest rates and creditworthiness.

When evaluating the interest rate environment, consider whether rates are rising or falling. Rising interest rates can cause bond prices to fall, while falling rates can lead to price increases. Understanding the current interest rate trend can help anticipate potential changes in bond prices.

Working with a financial advisor or broker can be beneficial, especially for inexperienced investors. They have expertise in navigating the bond market and can provide guidance on bond pricing, yield, and risk. Their knowledge can help you make more informed decisions and optimize your bond investment strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.