An Asset Management Company (AMC) and a Brokerage House serve different purposes in the financial landscape. An AMC manages pooled funds from multiple investors to create diversified portfolios, aiming for long-term returns. It's an attractive choice for investors looking for professional, hands-off management of their assets. On the other hand, a Brokerage House facilitates the buying and selling of financial securities such as stocks, bonds, or ETFs. It's ideal for investors who want direct control over their transactions. The choice between an AMC and a brokerage primarily depends on an individual's investment goals, desired level of involvement, and tolerance for risk. The costs also differ; AMCs charge a management fee based on asset percentage, while brokerages generally charge per trade or offer flat-fee accounts. An AMC typically works with institutional investors and high-net-worth individuals. They often manage pooled investments or mutual funds, employing a team of expert portfolio managers and analysts. AMCs work towards achieving the specific financial goals of their clients, providing not just investment management but also risk assessment and financial planning. Mutual fund companies pool resources from various investors to invest in a diversified portfolio of stocks, bonds, or other assets. These companies offer various types of funds, like equity funds, bond funds, and balanced funds, giving investors multiple options to choose from based on their risk tolerance and investment goals. Hedge funds are typically geared towards wealthy investors and require a significant minimum investment. They have a more aggressive investment strategy, utilizing advanced financial techniques like leverage, short-selling, and derivatives to maximize returns. Private equity firms invest in private companies or conduct buyouts of public companies that result in the company being delisted from public stock exchanges. The investments are generally long-term, with the goal of improving performance before selling the company for a profit. This involves managing an investment portfolio on behalf of the client. The AMC's portfolio managers consider factors such as the client's financial goals, risk tolerance, and investment time horizon to construct and manage a portfolio. AMCs also offer comprehensive financial planning services, including tax planning, estate planning, retirement planning, and risk management, to manage and increase the wealth of their clients effectively. AMCs provide investment advice based on extensive market research and analysis. They guide clients on where and when to invest, aiming to maximize returns while mitigating risks. When you invest with an AMC, your funds are managed by a team of professionals. These individuals have significant experience and expertise in financial markets and investments. This professional management can be beneficial for those who lack the time or knowledge to manage their funds independently. AMCs often manage large pools of money, allowing for diversification across a variety of asset classes, sectors, and regions. This broad diversification can reduce risk by offsetting losses in one area with gains in another. AMCs can provide access to advanced investment opportunities, such as hedge funds and private equity funds, which might be out of reach for individual investors due to high minimum investment requirements or regulatory restrictions. AMCs typically focus on long-term growth and sustainable returns. They maintain a steady course of action, even in volatile market conditions, avoiding hasty decisions based on short-term market fluctuations. AMCs often charge a fee based on a percentage of the assets under management. Over time, these fees can add up and significantly reduce your net returns. This can be especially significant if AMC's performance doesn't justify the high fees. When you invest with an AMC, you delegate investment decisions to the AMC's managers. If you prefer to be directly involved in managing your investments, this lack of control might be a disadvantage. Some AMCs require a high minimum investment, making them inaccessible to smaller investors. This is especially true for AMCs that manage hedge funds or private equity funds. Despite the professional management, there is no guarantee of high returns. AMCs can and do underperform the market or their benchmarks. As with any investment, there is always a risk of loss. Brokerages essentially serves as a platform for investors to trade financial securities. They can cater to all types of investors, from the novice to the seasoned, providing them with the tools and resources to execute their trading strategies. Brokerages come in two main forms: full-service brokers and discount brokers. Full-service brokers offer a wide array of services, including investment advice, research, and financial planning, in addition to executing trades. They provide a higher level of service and personal attention, but their fees are also typically higher. Discount brokers mainly focus on executing trades on behalf of their clients. They offer lower fees but provide limited services compared to full-service brokers. Nowadays, many discount brokers also offer research tools and educational resources to help investors make informed decisions. Brokerage houses offer various services to help investors trade and manage their investments. This is the core service of any brokerage. They provide a platform for investors to buy and sell various types of securities, including stocks, bonds, ETFs, mutual funds, and more. Many brokerages provide research reports and analysis to help clients make informed trading decisions. Full-service brokers often offer personalized investment advice as well. Some brokerages also offer portfolio management services, where they manage your investments on your behalf, typically for an additional fee. Brokerage houses provide access to a wide range of investment products, including stocks, bonds, exchange-traded funds (ETFs), mutual funds, and sometimes even futures and forex trading. This array allows investors to diversify their portfolios across different asset classes. Many brokerages offer extensive research resources to help their clients make informed investment decisions. These resources may include market news, analyst reports, and educational materials on investing and personal finance. This can be particularly valuable for novice investors looking to broaden their knowledge. With a brokerage, you have complete control over your investment decisions. You decide what to buy when to buy, and when to sell, giving you the ability to react quickly to market changes. Especially in the case of discount brokerages, the transaction fees are generally lower than those of traditional asset management services. This can make investing more accessible and cost-effective, particularly for those who trade frequently. Investing through a brokerage house means you are essentially your own portfolio manager. This requires a solid understanding of financial markets and investment strategies, as well as the time to research and monitor your investments. Given that you are responsible for your investment decisions, there is a risk of making poor choices if you lack the necessary knowledge and experience. This could potentially result in significant financial losses. While brokerages provide research resources, they usually offer limited personalized investment advice, especially discount brokerages. Unless you pay for a premium service, you are largely on your own when it comes to making investment decisions. Since brokerages are predominantly online platforms, they are susceptible to technical issues and cyber security risks. Downtime during trading hours could impact your ability to execute trades, while a data breach could put your personal information at risk. When comparing AMCs and brokerage houses, there are several key factors to consider. While both AMCs and brokerages provide investment services, the nature of these services can vary significantly. AMCs offer a more hands-off approach, managing your investments for you. Brokerages, on the other hand, primarily provide a platform for you to manage your investments, though some also offer portfolio management services. AMCs typically charge a management fee, which is a percentage of the assets under management. Brokerages generally charge per trade, although some also offer flat-fee accounts. AMCs often provide a more personalized service, with a portfolio manager assigned to each client. Brokerages, particularly discount brokers, tend to offer less personalized service, although they often provide a range of tools and resources to help clients manage their investments. Both AMCs and brokerages incorporate risk management into their services. However, with an AMC, the risk management is typically handled by the company's investment professionals, while with a brokerage, the investor is often responsible for managing risk. The choice between an AMC and a brokerage house depends significantly on your investment goals and strategies. If you have a hands-off approach to investing and prefer having professionals manage your investments, an AMC might be the right choice. On the other hand, if you prefer to be actively involved in your investment decisions, a brokerage house may be more suitable. Cost is another crucial factor. If you have a large investment amount and don't mind paying a percentage of your assets as a management fee, you might prefer an AMC. However, if you are a small investor or trade frequently, the lower cost structure of a brokerage house might be more appealing. How much control you want over your investments can also influence your choice. With an AMC, you delegate the control to the company's investment professionals. With a brokerage house, you have more direct control over your investment decisions. Choosing between an Asset Management Company (AMC) and a Brokerage House depends on factors such as investment objectives, preferred involvement level, and cost considerations. AMCs, offering professional portfolio management and advanced investment opportunities, are ideal for those seeking a hands-off approach. Brokerage houses, providing access to a variety of investment products and direct control over transactions, cater to more hands-on investors. The associated costs also differ, with AMCs charging asset-based fees and brokerages typically billing per trade or providing flat-fee accounts. Regardless of market conditions, the choice between an AMC and a brokerage house should align with your individual investment strategy, financial goals, and risk tolerance. Remember, both options carry their own set of advantages and disadvantages, and neither guarantees success. Therefore, thorough research and careful assessment of your unique circumstances are crucial before making a decision.Asset Management Company (AMC) vs Brokerage House Overview

Nature of Asset Management Company (AMC)

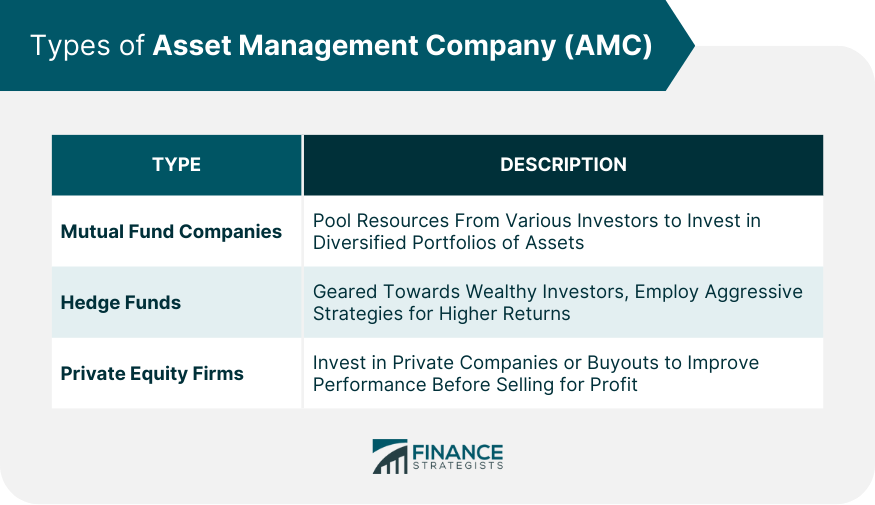

Types of Asset Management Company (AMC)

Mutual Fund Companies

Hedge Funds

Private Equity Firms

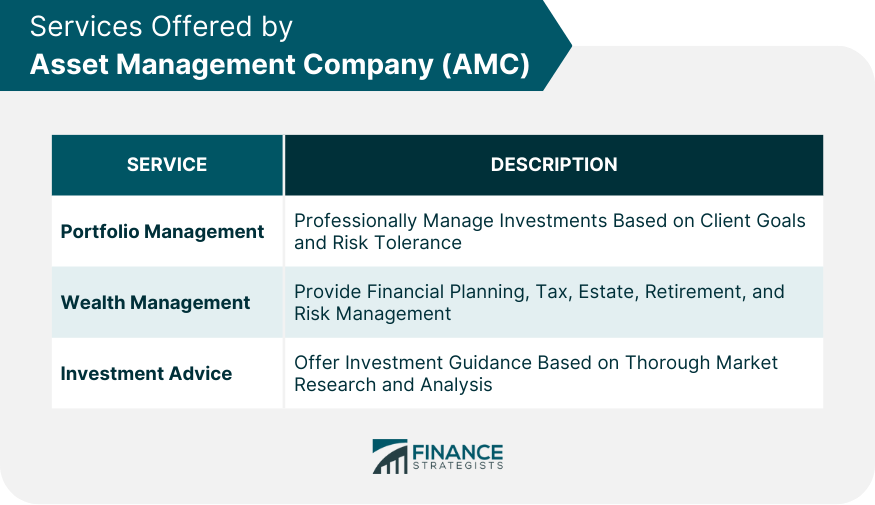

Services Offered by Asset Management Company (AMC)

Portfolio Management

Wealth Management

Investment Advice

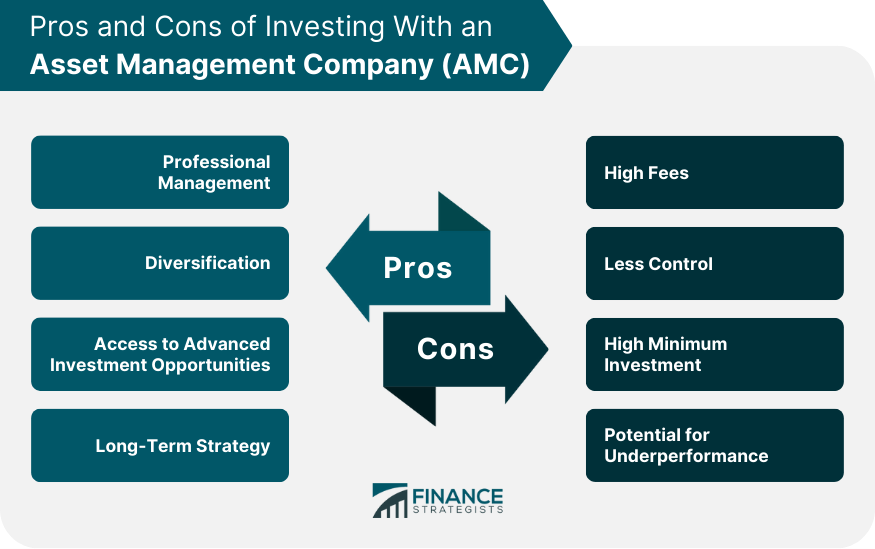

Pros of Investing With an Asset Management Company (AMC)

Professional Management

Diversification

Access to Advanced Investment Opportunities

Long-Term Strategy

Cons of Investing With an Asset Management Company (AMC)

High Fees

Less Control

High Minimum Investment

Potential for Underperformance

Nature of Brokerage Houses

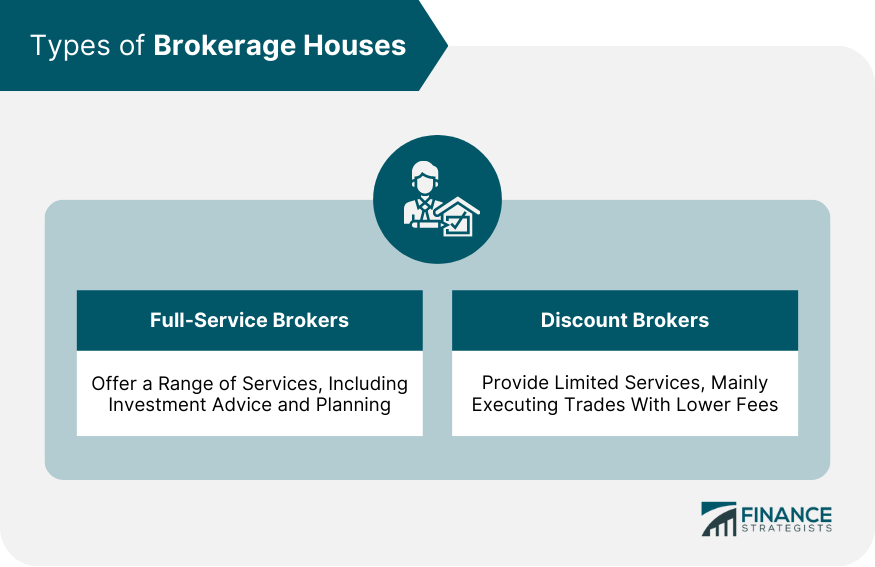

Types of Brokerage Houses

Full-Service Brokers

Discount Brokers

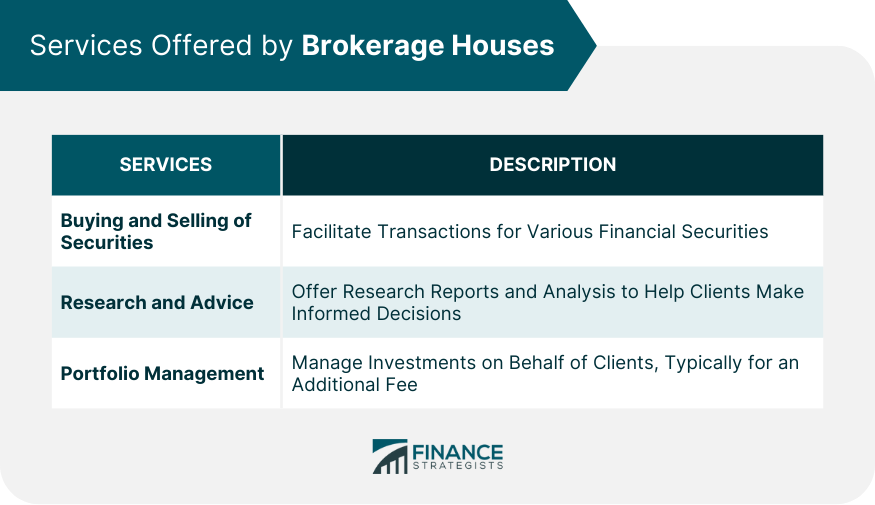

Services Offered by Brokerage Houses

Buying and Selling of Securities

Research and Advice

Portfolio Management

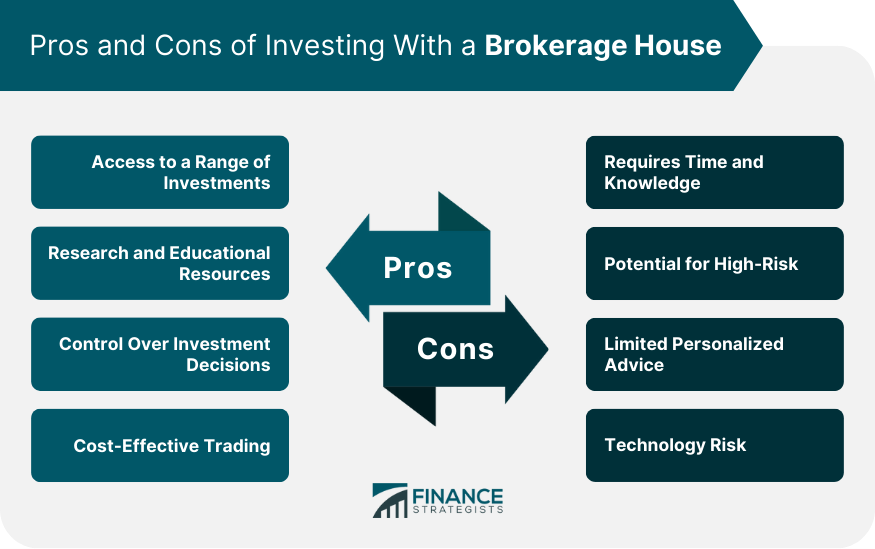

Pros of Investing With a Brokerage House

Access to a Range of Investments

Research and Educational Resources

Control Over Investment Decisions

Cost-Effective Trading

Cons of Investing With a Brokerage House

Requires Time and Knowledge

Potential for High-Risk

Limited Personalized Advice

Technology Risk

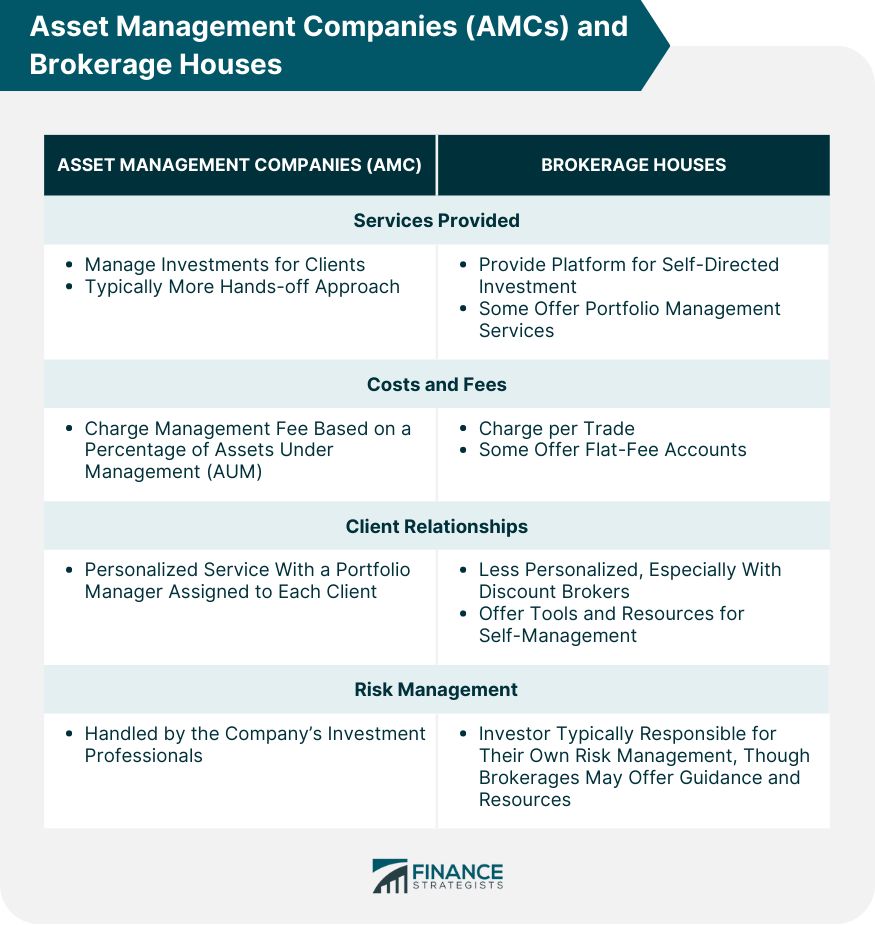

Comparing Asset Management Companies (AMCs) and Brokerage Houses

Services Provided

Costs and Fees

Client Relationships

Risk Management

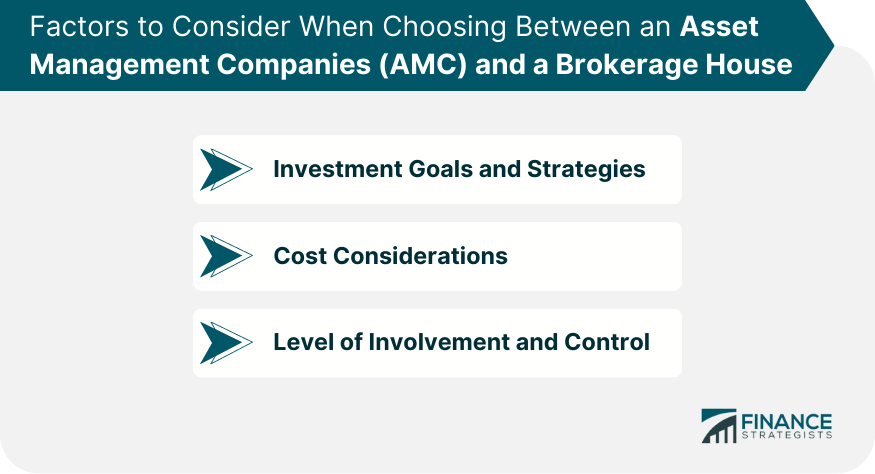

Factors to Consider When Choosing Between an AMC and a Brokerage House

Investment Goals and Strategies

Cost Considerations

Level of Involvement and Control

Conclusion

Asset Management Company (AMC) vs Brokerage House FAQs

The primary difference lies in the nature of services. AMCs provide professional portfolio management and often handle diverse, pooled investments, focusing on long-term growth. In contrast, Brokerage Houses offer platforms for individual investors to execute trades, providing more control over immediate buy/sell decisions.

AMCs generally charge a management fee based on a percentage of the assets under management. Brokerage Houses, on the other hand, typically charge per trade or offer a flat fee for unlimited trades.

It depends on the investor's time, knowledge, and comfort with managing their investments. AMCs, with their professional management, might be a better fit for those who prefer a hands-off approach. Conversely, Brokerage Houses can be suitable for those willing to learn and make their own investment decisions, especially with numerous educational resources available.

Investors who want more control over their investments and those who prefer to be actively involved in buying and selling securities often use Brokerage Houses. Frequent traders might also prefer brokerages due to lower transactional costs.

Yes, many investors utilize both for different purposes. For instance, you might use an AMC for long-term wealth building and a Brokerage House for executing short-term trades and taking advantage of immediate market opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.