Funds are a type of investment vehicle that allows individuals to pool their money together to invest in a diversified portfolio of assets, such as stocks, bonds, or real estate. This pooling of funds helps to spread out the risk of investing and can provide access to a wider range of investment opportunities than an individual investor may be able to achieve on their own. There are various types of funds available, each with their own unique investment strategies, objectives, and risks. By investing in different fund types, investors can better manage risk and potentially increase returns. Mutual funds are a popular investment option, offering investors access to professionally managed, diversified portfolios. A mutual fund is a type of investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities. They are managed by professional portfolio managers who make investment decisions on behalf of the fund's investors. Mutual funds offer several benefits, including professional management, diversification, and liquidity. However, they can also come with high fees and expenses, which may erode returns over time. There are various types of mutual funds, including equity, fixed-income, money market, balanced, index, and specialty or sector funds. Each type has a different investment objective and risk-return profile, catering to diverse investor needs. ETFs are a popular alternative to mutual funds, offering similar diversification benefits with some unique advantages and disadvantages. An exchange-traded fund is a type of investment fund that holds a diversified portfolio of assets, like stocks or bonds, and trades on a stock exchange. ETFs can be bought and sold throughout the trading day, just like individual stocks. ETFs often have lower costs and greater tax efficiency than mutual funds, as well as increased trading flexibility. However, they are still subject to market risk and may not be suitable for all investors. There are various types of ETFs, including equity, fixed-income, commodity, currency, inverse, and leveraged ETFs. Each type provides different exposure to various asset classes and investment strategies. Hedge funds are sophisticated investment vehicles that cater to high-net-worth individuals and institutional investors. A hedge fund is a private investment fund that uses various investment strategies to generate returns for its investors. These funds often employ complex trading strategies, including the use of derivatives and leverage, to achieve their objectives. Hedge funds have the potential to deliver high returns and employ advanced risk management techniques. However, they are subject to limited regulation, high fees, and substantial minimum investments, making them less accessible to the average investor. Hedge funds employ a wide range of strategies, including long/short equity, market neutral, event-driven, global macro, and relative value. Each strategy has its own unique risk-return profile and investment approach. Private equity funds are a type of investment vehicle that focuses on private, non-publicly traded companies. A private equity fund is a pooled investment vehicle that invests in private companies, often with the goal of creating value through active management and operational improvements. These funds typically have a long-term investment horizon. Private equity funds can offer high potential returns and active management but come with drawbacks such as illiquidity, high costs, and a long-term investment horizon. These factors can make them less suitable for some investors. There are several private equity strategies, including leveraged buyouts, growth capital, distressed debt, real estate, and venture capital. Each strategy focuses on a different aspect of the private market, offering various risk-return profiles. REITs provide investors with exposure to the real estate market through a diversified, professionally managed portfolio. A real estate investment trust is a company that owns, operates, or finances income-producing real estate properties. REITs allow investors to access the real estate market without directly owning property. REITs offer income generation, diversification, and liquidity benefits. However, they are still subject to market risk and can be impacted by economic factors, such as interest rates and property market fluctuations. There are three main types of REITs: equity, mortgage, and hybrid REITs. Each type invests in different aspects of the real estate market, offering varying levels of risk and potential returns. Selecting the appropriate fund type for your investment portfolio depends on several factors, such as risk tolerance, investment objectives, and time horizon. Understanding your risk tolerance is crucial for determining which fund types are suitable for your portfolio. Investors with a lower risk tolerance may prefer more conservative investments, like fixed-income or money market funds, while those with a higher risk tolerance may opt for more aggressive investments, like equity funds or hedge funds. Your investment objectives will also play a role in choosing the right fund type. For instance, if your goal is to generate income, you may lean towards dividend-paying equity funds or REITs. If your objective is capital appreciation, growth-oriented funds might be more suitable. Lastly, consider your investment time horizon and liquidity needs. If you require easy access to your funds, mutual funds or ETFs might be a better fit. On the other hand, if you have a long-term investment horizon and can tolerate illiquidity, private equity funds or venture capital funds may be worth considering.Overview of Fund Types

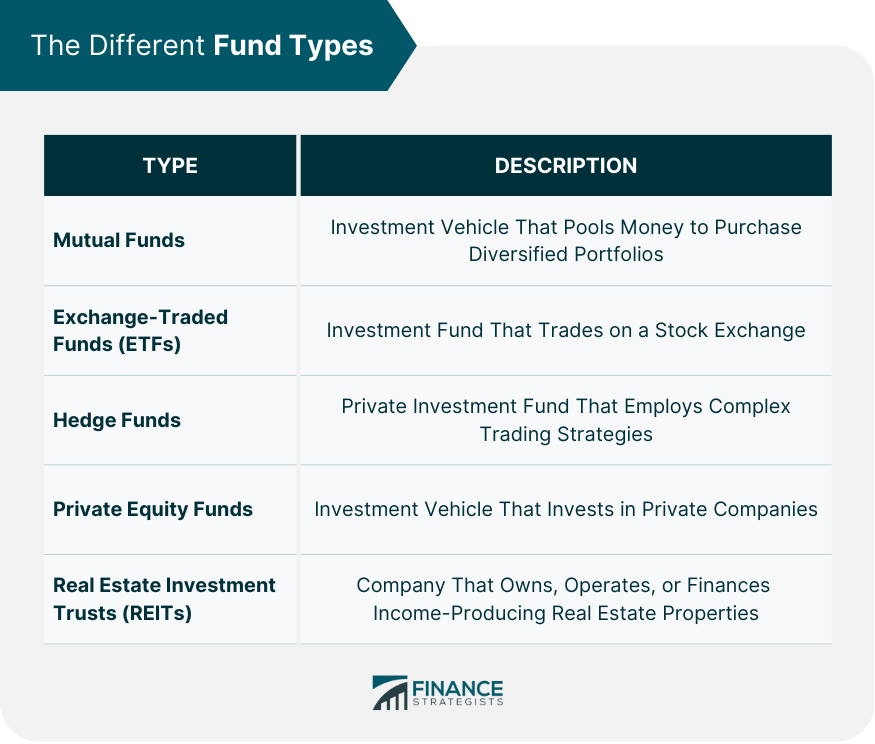

In this overview, we will discuss several common fund types, including mutual funds, exchange-traded funds (ETFs), hedge funds, private equity funds, real estate investments trusts (REITs).Mutual Funds

Exchange-Traded Funds (ETFs)

Hedge Funds

Private Equity Funds

Real Estate Investment Trusts (REITs)

Final Thoughts

Fund Types FAQs

Funds are a type of investment vehicle that allows individuals to pool their money together to invest in a diversified portfolio of assets, such as stocks, bonds, or real estate. This pooling of funds helps to spread out the risk of investing and can provide access to a wider range of investment opportunities than an individual investor may be able to achieve on their own. There are various types of funds available, each with their own unique investment strategies, objectives, and risks.

There are many types of funds, including mutual funds, exchange-traded funds (ETFs), hedge funds, private equity funds, real estate investments trusts (REITs).

There are various types of funds available, each with their own unique investment strategies, objectives, and risks. By investing in different fund types, investors can better manage risk and potentially increase returns.

Investing in different fund types involves various risks, including market risk, manager risk, concentration risk, liquidity risk, tracking error risk, and counterparty risk. These risks stem from fluctuations in financial markets, portfolio management decisions, focused investment strategies, difficulties in selling less liquid assets, discrepancies between fund performance and benchmark indexes, and potential defaults by counterparties in derivative transactions or securities lending.

To choose the right fund for you, consider your investment goals, risk tolerance, time horizon, and investment style. You can also consult with a financial advisor or conduct research on the different Fund options available.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.