A zero-coupon inflation swap is a type of financial derivative instrument used to hedge or speculate on the impact of inflation. In this swap agreement, one party agrees to pay a fixed rate to another party while the other party pays an inflation-adjusted rate in return. Unlike traditional interest rate swaps, zero-coupon inflation swaps do not involve periodic interest payments; instead, the cash flows are exchanged at the end of the contract in a single payment. Zero-coupon inflation swaps play a crucial role in financial markets by enabling market participants to manage their inflation exposure. They provide a means for investors to protect their investments from the eroding effects of inflation and for issuers to manage the inflation risk inherent in their liabilities. Additionally, zero-coupon inflation swaps facilitate price discovery and contribute to the overall efficiency of the market by allowing participants to express their views on future inflation trends. In a zero-coupon inflation swap, the fixed leg represents the cash flow that is determined at the inception of the contract. The fixed rate is agreed upon by both parties and remains constant throughout the life of the swap. The notional amount on which the fixed payment is based is also agreed upon at the start of the contract. The inflation-adjusted leg represents the cash flow that varies with the inflation rate during the term of the swap. The payment is based on the difference between the reference inflation index at the start of the contract and the index value at the end of the contract. The notional amount on which the inflation-adjusted payment is based is typically the same as the notional amount for the fixed leg. At the end of the swap contract, the two parties exchange the cash flows determined by the fixed and inflation-adjusted legs. The party paying the fixed rate will pay the fixed cash flow, while the party paying the inflation-adjusted rate will pay the inflation-adjusted cash flow. The net payment will be the difference between the two cash flows. The settlement process for zero-coupon inflation swaps typically involves a net payment from one party to the other. The payment is made at the end of the contract, and the direction of the payment depends on the difference between the fixed and inflation-adjusted cash flows. If the inflation-adjusted cash flow is greater than the fixed cash flow, the party paying the fixed rate will make a payment to the party paying the inflation-adjusted rate, and vice versa. Inflation expectations are a critical determinant of the pricing of zero-coupon inflation swaps. Market participants form their expectations based on various factors, such as macroeconomic data, central bank policies, and geopolitical events. The higher the expected future inflation rate, the higher the fixed rate that will be demanded by the party paying the inflation-adjusted rate. Interest rates also play a significant role in the pricing of zero-coupon inflation swaps. Changes in interest rates can affect the present value of the cash flows exchanged in the swap. A rise in interest rates can lead to a decrease in the value of the fixed leg and an increase in the value of the inflation-adjusted leg, and vice versa. The credit risk associated with the counterparty to the swap can also influence the pricing of zero-coupon inflation swaps. If a counterparty is perceived to have a higher credit risk, the other party may demand a higher fixed rate to compensate for the additional risk. Discount factors are used to determine the present value of future cash flows in a zero-coupon inflation swap. The discount factors are derived from the yield curve, which represents the market's expectations for future interest rates. The present value of each cash flow is calculated by multiplying the cash flow by the appropriate discount factor. Inflation forward rates are used to estimate the future inflation rate implied by the market. They can be derived from the difference between nominal and inflation-linked government bond yields or from the prices of inflation derivatives such as zero-coupon inflation swaps. Inflation forward rates are used to calculate the inflation-adjusted cash flows in a zero-coupon inflation swap. The net present value (NPV) of a zero-coupon inflation swap is calculated as the difference between the present value of the fixed and inflation-adjusted cash flows. A positive NPV indicates that the swap has a positive value for the party receiving the fixed rate, while a negative NPV indicates a positive value for the party receiving the inflation-adjusted rate. One of the primary uses of zero-coupon inflation swaps is to hedge inflation risk. Investors holding assets with fixed cash flows, such as bonds, can use zero-coupon inflation swaps to protect themselves against the adverse effects of rising inflation on the real value of their investments. Similarly, issuers of fixed-rate debt can use zero-coupon inflation swaps to hedge their exposure to inflation risk in their liabilities. Market participants can also use zero-coupon inflation swaps to speculate on future inflation trends. Bullish investors use zero-coupon inflation swaps, paying fixed rates, for higher-than-expected inflation, while bearish investors pay inflation-adjusted rates for lower-than-expected inflation. Corporations and financial institutions with inflation-linked liabilities can use zero-coupon inflation swaps to manage their exposure to inflation risk. By entering into a zero-coupon inflation swap as the party paying the fixed rate, these entities can lock in a fixed cash flow to offset their inflation-adjusted cash outflows. Zero-coupon inflation swaps can be used as a tool for portfolio diversification. By including inflation-linked investments in their portfolios, investors can benefit from the low correlation between inflation and traditional asset classes such as stocks and bonds, thereby reducing the overall risk of their investment portfolios. Central banks and governments are key players in the zero-coupon inflation swap market. They use these instruments to manage their inflation exposure and to implement monetary policy. By engaging in zero-coupon inflation swaps, central banks can gain insights into market expectations for future inflation, which can help inform their policy decisions. Financial institutions and banks are also active participants in the zero-coupon inflation swap market. They use these instruments for various purposes, such as hedging inflation risk, speculating on future inflation trends, and managing their balance sheets. Additionally, banks often act as intermediaries between other market participants, facilitating the execution and settlement of zero-coupon inflation swap transactions. Asset managers and institutional investors, such as pension funds, insurance companies, and mutual funds, use zero-coupon inflation swaps to manage their portfolios' exposure to inflation risk. By incorporating inflation-linked investments into their portfolios, these investors can achieve greater diversification and protect their investments from the eroding effects of inflation. Corporations can use zero-coupon inflation swaps to manage their inflation risk exposure, particularly if they have inflation-linked liabilities or if their revenues are sensitive to changes in inflation. By entering into zero-coupon inflation swaps, corporations can lock in a fixed cash flow to offset their inflation-adjusted cash outflows. Retail investors, with limited access to zero-coupon inflation swaps, can gain exposure through investment funds or structured products incorporating these swaps as part of their strategy. Counterparty credit risk is the risk that one party to the zero-coupon inflation swap will default on its obligations. This risk can be mitigated through the use of collateral agreements or by engaging in transactions with well-capitalized counterparties. However, counterparty credit risk remains an inherent risk in the zero-coupon inflation swap market. Market risk arises from fluctuations in market variables, such as interest rates and inflation rates, that can impact the value of a zero-coupon inflation swap. Market participants can manage this risk through diversification and by closely monitoring market conditions. Liquidity risk refers to the risk that a market participant may be unable to exit a zero-coupon inflation swap position at a favorable price due to a lack of market depth or trading activity. This risk can be mitigated by engaging in transactions with highly liquid instruments or by using electronic trading platforms that provide greater transparency and access to liquidity. Operational risk arises from the potential for errors, system failures, or other disruptions in the execution and settlement of zero-coupon inflation swap transactions. Market participants can mitigate this risk by implementing robust operational controls and by using standardized documentation and processes. Legal and regulatory risks stem from potential changes in laws and regulations that could impact the zero-coupon inflation swap market. Market participants should stay abreast of relevant regulatory developments and ensure compliance with all applicable laws and regulations. Zero-coupon inflation swaps are primarily traded in the over-the-counter (OTC) market, where transactions are negotiated directly between counterparties rather than through a centralized exchange. This allows for greater flexibility in the terms of the swap, but also introduces counterparty credit risk and operational risks. In recent years, electronic trading platforms have emerged as an important venue for trading zero-coupon inflation swaps. These platforms offer increased transparency, efficiency, and access to liquidity, as well as helping to mitigate operational risks by automating trade execution and settlement processes. Standardization of zero-coupon inflation swap contracts and the use of central clearing parties (CCPs) have become increasingly important in reducing counterparty credit risk and enhancing the overall stability of the market. CCPs act as intermediaries between counterparties, ensuring the performance of the contract and reducing the risk of default. Inflation-linked bonds are debt securities whose principal and/or coupon payments are adjusted for inflation. While both inflation-linked bonds and zero-coupon inflation swaps provide inflation protection, the former involves holding an actual bond, while the latter is a derivative contract with no principal investment. Year-on-year inflation swaps are similar to zero-coupon inflation swaps, but they involve periodic payments based on the change in inflation over a one-year period. This structure results in more frequent cash flow exchanges, making them more suitable for investors who require periodic cash flows. Inflation caps and floors are options-like instruments that provide protection against inflation above or below a specified level. These instruments can be used in conjunction with zero-coupon inflation swaps to create customized inflation protection strategies. Inflation options are derivatives that give the holder the right, but not the obligation, to enter into an inflation swap at a specified future date and at a predetermined fixed rate. Inflation options can be used for hedging or speculating on future inflation trends. The Basel III framework establishes capital requirements for banks to ensure their financial stability and to mitigate systemic risks in the financial system. Under Basel III, banks are required to hold capital against their exposure to counterparty credit risk in zero-coupon inflation swaps. The Dodd-Frank Act introduced significant reforms to the derivatives market in the United States, including new rules for trading, clearing, and reporting of over-the-counter derivatives such as zero-coupon inflation swaps. These regulations aim to enhance transparency, reduce counterparty credit risk, and promote market stability. EMIR is a set of regulations governing the European derivatives market, including zero-coupon inflation swaps. The regulations require the use of central clearing, standardized documentation, and trade reporting, among other provisions, to enhance transparency and reduce systemic risk. In addition to the above-mentioned regulations, market participants should be aware of other relevant rules and guidelines, such as those issued by the International Swaps and Derivatives Association (ISDA) and the Financial Stability Board (FSB). These organizations provide best practices and standards for the derivatives market, including zero-coupon inflation swaps. zero-coupon inflation swaps are valuable financial instruments used for hedging or speculating on the impact of inflation. They involve an agreement between two parties, with one paying a fixed rate and the other paying an inflation-adjusted rate. The structure of these swaps includes a fixed leg and an inflation-adjusted leg, with cash flows exchanged at the end of the contract. Pricing and valuation of zero-coupon inflation swaps depend on factors such as inflation expectations, interest rates, and counterparty credit risk. These swaps find applications in hedging inflation risk, speculating on future inflation, managing liability exposures, and portfolio diversification. Market participants in zero-coupon inflation swaps include central banks, financial institutions, asset managers, corporations, and retail investors. However, trading in these swaps carries risks such as counterparty credit risk, market risk, liquidity risk, operational risk, and legal and regulatory risks. Understanding the features, uses, risks, and regulations of zero-coupon inflation swaps is essential for market participants seeking to manage their inflation exposure effectively.What Is Zero-Coupon Inflation Swap?

How Zero-Coupon Inflation Swaps Work

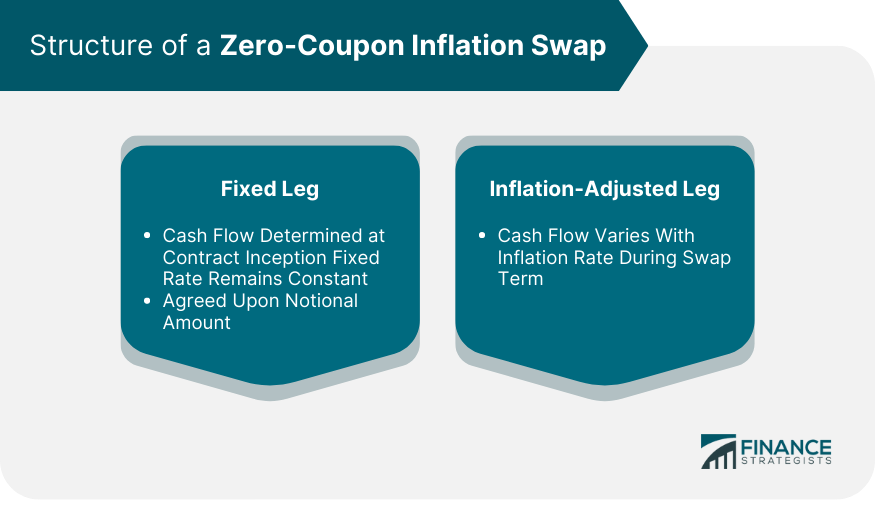

Structure of a Zero-Coupon Inflation Swap

Fixed Leg

Inflation-Adjusted Leg

Cash Flow Exchange

Settlement Process

Pricing and Valuation of Zero-Coupon Inflation Swap

Key Factors Influencing Pricing

Inflation Expectations

Interest Rates

Counterparty Credit Risk

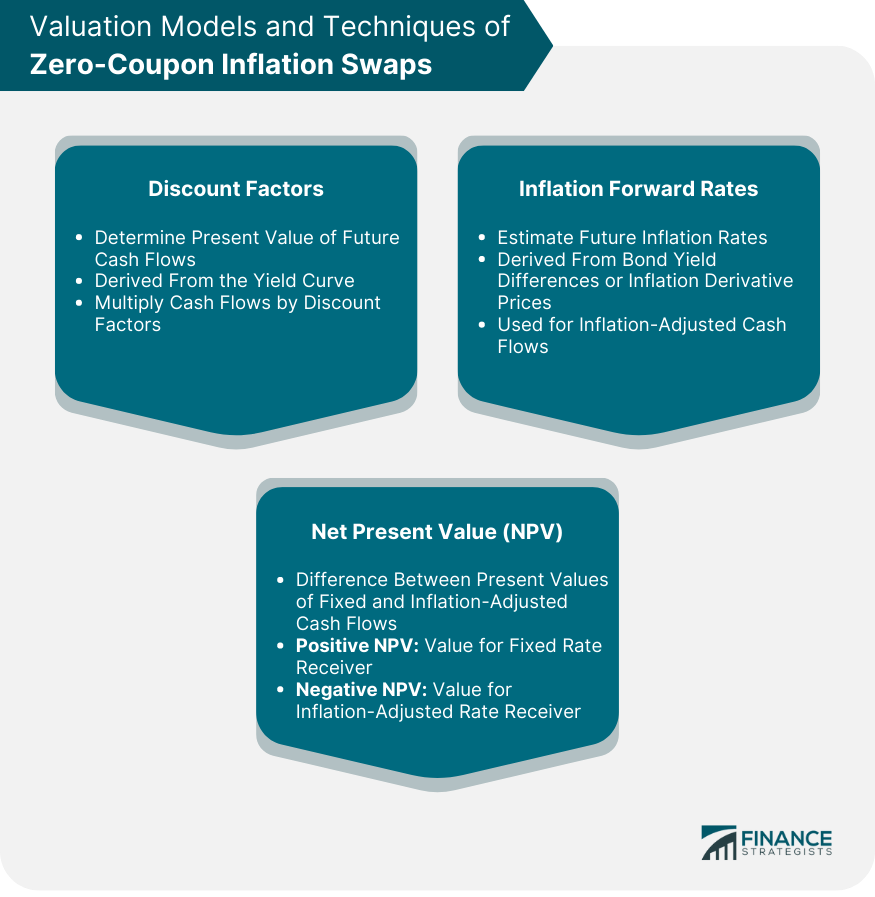

Valuation Models and Techniques of Zero-Coupon Inflation Swaps

Discount Factors

Inflation Forward Rates

Net Present Value Calculations

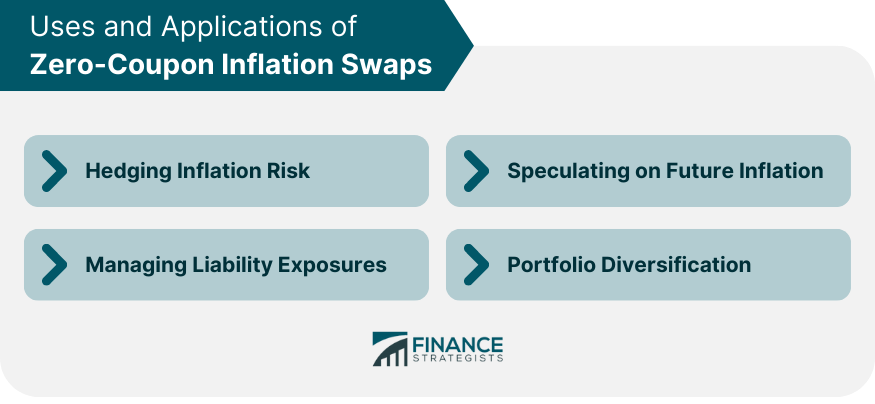

Uses and Applications of Zero-Coupon Inflation Swaps

Hedging Inflation Risk

Speculating on Future Inflation

Managing Liability Exposures

Portfolio Diversification

Market Participants in Zero-Coupon Inflation Swaps

Central Banks and Governments

Financial Institutions and Banks

Asset Managers and Institutional Investors

Corporations

Retail Investors

Risks Associated With Zero-Coupon Inflation Swaps

Counterparty Credit Risk

Market Risk

Liquidity Risk

Operational Risk

Legal and Regulatory Risks

Trading Zero-Coupon Inflation Swaps

Over-the-Counter (OTC) Market

Electronic Trading Platforms

Standardization and Clearing

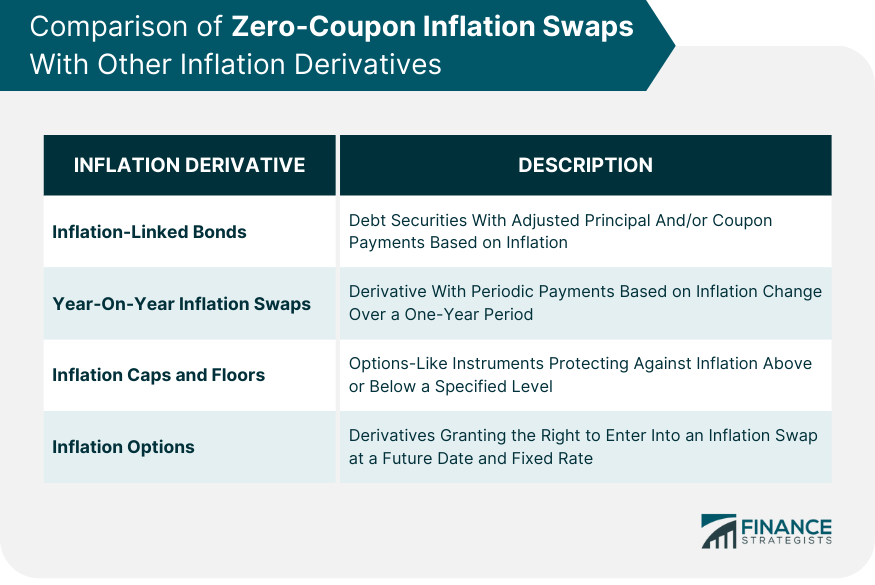

Comparing Zero-Coupon Inflation Swaps to Other Inflation Derivatives

Inflation-Linked Bonds

Year-On-Year Inflation Swaps

Inflation Caps and Floors

Inflation Options

Regulatory Landscape for Zero-Coupon Inflation Swaps

Basel III Capital Requirements

Dodd-Frank Wall Street Reform and Consumer Protection Act

European Market Infrastructure Regulation (EMIR)

Other Relevant Regulations and Guidelines

Final Thoughts

Zero-Coupon Inflation Swap FAQs

A zero-coupon inflation swap is a financial derivative used to hedge or speculate on the impact of inflation by exchanging a fixed cash flow for an inflation-adjusted cash flow at the end of the contract.

In a zero-coupon inflation swap, one party agrees to pay a fixed rate to another party while the other party pays an inflation-adjusted rate in return. The cash flows are exchanged at the end of the contract in a single payment.

The pricing and valuation of zero-coupon inflation swaps are influenced by factors such as inflation expectations, interest rates, and counterparty credit risk.

zero-coupon inflation swaps are used for hedging inflation risk, speculating on future inflation, managing liability exposures, and achieving portfolio diversification.

zero-coupon inflation swaps differ from other inflation derivatives like inflation-linked bonds and year-on-year inflation swaps in their structure and cash flow exchange, as they involve a single payment at the end of the contract.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.