The Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly referred to as the Dodd-Frank Act, is a landmark U.S. legislation passed in response to the financial crisis of 2007-2008. Enacted in 2010, it brought significant changes to federal financial regulatory policies and agencies, aiming to decrease various risks in the U.S. financial system. Named after Senator Christopher Dodd and Representative Barney Frank, its chief legislative sponsors, the law spans numerous areas of financial regulation. The Dodd-Frank Act introduced a myriad of new government agencies and made amendments to existing chapters of the U.S. Code, fundamentally changing the way financial institutions operate and the way they're overseen by the regulators. The primary objective of the Dodd-Frank Act was to prevent a recurrence of the events that caused the 2008 financial crisis. It sought to reduce systemic risks through increased transparency, consolidation of oversight, and prevention of fraudulent activities. The Dodd-Frank Act set rules, created agencies, and aimed to prevent financial collapse and deceptive practices, safeguarding consumers. This title created the Financial Stability Oversight Council (FSOC) responsible for identifying threats to the financial stability of the United States, promoting market discipline, and responding to emerging risks in the financial system. Its role is to identify and monitor companies—other than banks—that could pose broad-based threats to the financial system. In order to avoid future taxpayer-funded bailouts, this title provides a process for the FDIC to liquidate failing financial institutions outside of the usual bankruptcy process. It aims to ensure that payout to creditors and shareholders is in accordance with liquidation under the Bankruptcy Code and that customers of these institutions are protected. Title III eliminated the Office of Thrift Supervision and transitioned its powers and responsibilities to the Comptroller of the Currency and the Federal Deposit Insurance Corporation (FDIC). It is intended to streamline oversight and reduce the potential for conflicting regulatory directives. This title introduced greater oversight of hedge funds and private equity funds by requiring advisers to register with the SEC. It increased transparency by mandating these advisers to maintain records and provide data about the funds they oversee. The Federal Insurance Office (FIO) was established under this title. While not a regulatory agency, the FIO monitors the insurance industry and identifies gaps in regulation that could contribute to a systemic crisis. This title, often referred to as the Volcker Rule, primarily restricts banks from making certain kinds of speculative investments if they are not on behalf of their customers. It aims to separate the investment risks from federal depository institutions. Aiming to reduce risks in the derivatives market, this title mandates that most derivatives be cleared and exchanged and sets forth a specific regulatory framework for such transactions. This title seeks to mitigate systemic risks associated with payment, clearing, and settlement activities. It gives the FSOC the responsibility to designate firms as systemically significant and subjects them to heightened oversight. Title IX strengthens the ability of the Securities and Exchange Commission (SEC) to protect investors. It enhances its enforcement powers, allows for larger monetary penalties, and enables whistleblowers to receive a larger share of monetary sanctions. Perhaps one of the most debated titles, this established the Consumer Financial Protection Bureau (CFPB) as an independent entity within the Federal Reserve. It aims to prevent predatory mortgage lending, make it easier for consumers to understand the terms of a mortgage before agreeing, and prohibit deceptive lending practices. This title provides for a one-time audit of emergency loans and credit facilities extended by the Federal Reserve during the financial crisis. It aims to increase transparency and accountability of the Federal Reserve. Aimed at expanding access to mainstream financial institutions for underserved consumers, this title establishes programs to assist low and moderate-income individuals in securing affordable financial services. The financial turmoil that unfolded in 2007-2008 necessitated a legislative response to fortify the foundation of the American economy and financial systems. The Dodd-Frank Act aimed to do just that. It sought to diminish the chances of future financial crises by focusing on systemic risks. Through the establishment of the Financial Stability Oversight Council (FSOC), the act aimed to monitor and mitigate threats to the economy posed by financial institutions deemed "too big to fail". As a result, large banks now undergo stringent stress tests to ensure they can withstand economic shocks. Moreover, the act ushered in the Volcker Rule, which primarily restricts banks from indulging in proprietary trading not done on behalf of customers, effectively creating a divide between a bank's investment activities and its depository functions. This pivotal rule sought to prevent banks from making high-risk investments with depositors’ funds, thus minimizing the risk of catastrophic bank failures. In a bid to shield consumers from deceitful financial practices, the Dodd-Frank Act instituted the Consumer Financial Protection Bureau (CFPB). This independent entity aimed to be the watchdog of consumers, ensuring that they aren't subject to unscrupulous actions by lenders, especially in the areas of mortgages, credit cards, and student loans. Thanks to the CFPB, there have been stricter regulations on lending practices, and consumers now have a centralized agency to address their grievances against unfair practices. Additionally, the Dodd-Frank Act made it mandatory for financial institutions to be more transparent in their operations and dealings with consumers. This meant clearer documentation, disclosure of fees, and helping consumers better understand the terms and conditions of their financial contracts. Post the 2008 financial crisis, it became abundantly clear that opacity in financial institutions' operations was a major contributor to the meltdown. To address this, the Dodd-Frank Act incorporated provisions to enhance transparency, especially in derivative markets. Derivatives, complex financial instruments that derive their value from underlying assets, were largely blamed for amplifying the effects of the crisis. With the act in place, most derivatives must now be cleared and traded openly, shedding light on a previously darkened area of finance. Moreover, the act compelled large banks to develop "living wills" – plans detailing how they would safely be dissolved without triggering a financial crisis. This provides a clearer understanding of their operations and reduces the uncertainties surrounding their potential failures. While the intentions behind the Dodd-Frank Act were largely commendable, its implementation brought forth a new set of challenges. One of the most vocal criticisms was the substantial regulatory burden it placed on financial institutions, especially smaller ones. With over 400 new rules and mandates, banks found themselves navigating a complex web of regulations, necessitating increased compliance teams and associated costs. This regulatory complexity not only meant higher operational costs but also acted as a deterrent for new entrants into the banking sector, potentially stifling competition and innovation. While large banks could, to an extent, absorb the added costs of compliance, smaller institutions, such as community banks and credit unions, felt the weight more acutely. These entities argued that they played no role in the financial crisis and yet found themselves bound by the same strict regulations as their larger counterparts. For some of these smaller banks, the costs associated with adhering to Dodd-Frank regulations were prohibitive, leading to reduced profitability, limiting their capacity to lend, and in some cases, pushing them towards mergers or shutdowns. Like all comprehensive legislation, the Dodd-Frank Act had its share of unintended consequences. For instance, while the Volcker Rule aimed to minimize risk-taking by banks, some argue it has limited banks' ability to play their traditional role in market-making, potentially reducing liquidity in the markets. Another unintended consequence was the potential reinforcement of the "too big to fail" notion. Monitoring critical institutions for systemic risks could imply an ongoing government bailout commitment. The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010 in response to the 2008 financial crisis, stands as a monumental legislative effort to fortify the U.S. financial system. It addressed systemic risks, improved transparency, and bolstered consumer protection. Through the establishment of the Financial Stability Oversight Council (FSOC), it aimed to prevent catastrophic failures by closely monitoring institutions deemed "too big to fail." The act's creation of the Consumer Financial Protection Bureau (CFPB) enhanced oversight on lenders and empowered consumers. Furthermore, it increased transparency, as exemplified by the regulation of derivatives trading and the requirement for "living wills." However, alongside its positive impact, the act faced criticisms. Smaller financial institutions struggled with compliance costs, and unintended consequences such as limited market liquidity and reinforced perceptions of government bailout commitments emerged. The Dodd-Frank Act remains a complex and pivotal chapter in modern financial regulation, shaping the industry while prompting ongoing discussions about its effectiveness and balance.What Is the Dodd-Frank Wall Street Reform and Consumer Protection Act?

Purpose of the Dodd-Frank Wall Street Reform and Consumer Protection Act

Key Provisions of the Dodd-Frank Act

Title I: Financial Stability

Title II: Orderly Liquidation Authority

Title III: Transfer of Powers to the Comptroller and FDIC

Title IV: Regulation of Advisers to Hedge Funds and Others

Title V: Insurance

Title VI: Improvements to Regulation of Bank and Savings

Title VII: Wall Street Transparency and Accountability

Title VIII: Payment, Clearing, and Settlement Supervision

Title IX: Investor Protections and Improvements to the Regulation of Securities

Title X: Bureau of Consumer Financial Protection

Title XI: Federal Reserve System Provisions

Title XII: Improving Access to Mainstream Financial Institutions

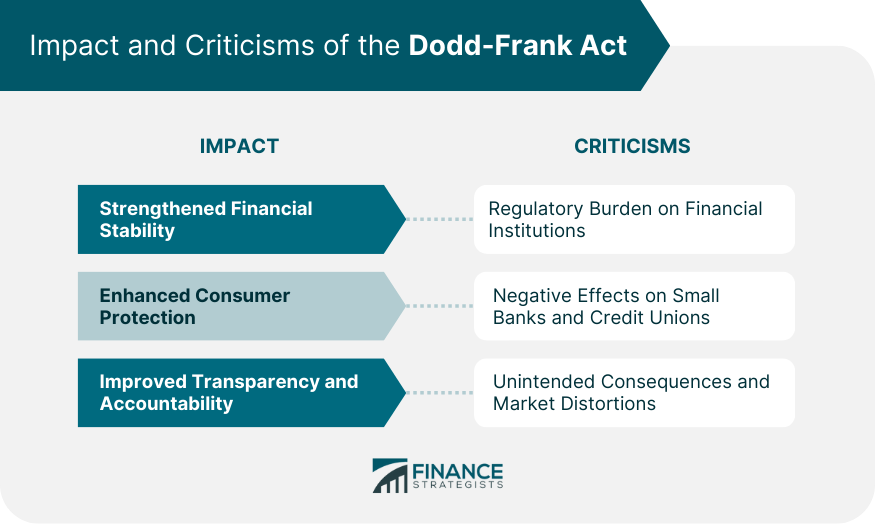

Impact of the Dodd-Frank Act

Strengthened Financial Stability

Enhanced Consumer Protection

Improved Transparency and Accountability

Criticisms of the Dodd-Frank Act

Regulatory Burden on Financial Institutions

Negative Effects on Small Banks and Credit Unions

Unintended Consequences and Market Distortions

Conclusion

Dodd-Frank Wall Street Reform and Consumer Protection Act FAQs

The Dodd-Frank Act was a response to the 2007-2008 financial crisis, aiming to prevent similar future crises by increasing regulations on financial institutions and protecting consumers against fraudulent practices.

The act established the Consumer Financial Protection Bureau (CFPB), an independent agency tasked with ensuring that consumers are treated fairly by banks, lenders, and other financial institutions. The CFPB oversees and enforces consumer financial laws, provides consumer education, and investigates complaints about financial products and services. This means more transparency, better accountability, and stricter regulations against deceptive practices.

One criticism of the Dodd-Frank Act is that its regulations can disproportionately affect smaller banks and credit unions. While the act targets larger financial institutions to prevent system-wide collapses, smaller institutions might find it challenging to meet some of the regulatory requirements due to fewer resources. This could lead to increased consolidation in the banking industry, with smaller banks either merging or being acquired by larger ones.

The Dodd-Frank Act introduced several provisions to reduce risks in the mortgage market. Lenders are now required to verify a borrower's ability to repay a loan, reducing the number of high-risk mortgages. This has made the lending process more rigorous, ensuring that borrowers don't receive loans they can't afford. While it has led to a more stable housing market, some critics argue it has also made it harder for certain groups, especially first-time homebuyers, to secure mortgages.

Yes, like any piece of legislation, the Dodd-Frank Act can be modified or repealed by Congress. In fact, there have been various amendments and proposed changes since its inception. The Economic Growth, Regulatory Relief, and Consumer Protection Act, signed into law in 2018, for example, rolled back some of the Dodd-Frank provisions, particularly for smaller banks. Future modifications will depend on the economic climate, political will, and the perceived effectiveness of the act's provisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.