Inflation-linked bonds are unique financial instruments designed to provide protection against inflation. Inflation is the rate at which the general level of prices for goods and services is rising. It erodes the purchasing power of money over time, which can negatively impact fixed-income investments. By understanding inflation, investors can make more informed decisions about their portfolios. Inflation-linked bonds are debt securities whose principal and interest payments are adjusted for inflation. This means that the bond's value increases with inflation, providing a hedge against the eroding effects of rising prices. Issued by governments and corporations, these bonds can be an attractive option for investors seeking protection from inflation risk. The primary purpose of inflation-linked bonds is to help investors preserve their purchasing power in the face of inflation. They serve as an essential tool for diversification in investment portfolios, as they tend to exhibit low correlation with other asset classes. Additionally, they play a vital role in the financial market by allowing governments and corporations to borrow money at lower interest rates during inflationary periods. To understand how inflation-linked bonds function, it is essential to examine their structure, principal and coupon adjustments, and the inflation indices used for calculation. Inflation-linked bonds are issued by governments or corporations, with their structure typically consisting of a principal amount and periodic coupon payments. The principal and coupon payments are adjusted for inflation, ensuring that the bond's value remains consistent with changing price levels. This unique feature sets inflation-linked bonds apart from traditional fixed-income securities. The principal and coupon payments of inflation-linked bonds are adjusted based on an inflation index, such as the Consumer Price Index (CPI). When the index rises, the bond's principal and coupon payments increase, maintaining their real value. Conversely, if the index falls, the adjustments may result in lower payments, potentially exposing investors to deflation risk. The inflation index used for calculating adjustments to inflation-linked bonds can vary depending on the issuer and the specific bond. Common indices include the CPI, the Retail Price Index (RPI), or the GDP deflator. These indices measure the change in prices of a basket of goods and services over time, providing a reliable benchmark for inflation adjustments. There are several types of inflation-linked bonds, including Treasury Inflation-Protected Securities (TIPS), global inflation-linked bonds, corporate inflation-linked bonds, and municipal inflation-linked bonds. TIPS are issued by the U.S. Department of the Treasury and are the most well-known type of inflation-linked bonds. They provide investors with protection against inflation as measured by the CPI. TIPS are considered to be low-risk investments, as they are backed by the full faith and credit of the U.S. government. Global inflation-linked bonds are issued by various governments around the world, offering investors the opportunity to diversify their portfolios geographically. These bonds are similar to TIPS, but they may be linked to different inflation indices, depending on the issuing country. Some well-known global inflation-linked bonds include UK Index-Linked Gilts and French OATi bonds. Corporate inflation-linked bonds are issued by private companies and can offer higher yields than government-issued bonds due to the increased risk associated with corporate issuers. These bonds provide investors with exposure to both inflation protection and credit risk, making them suitable for investors seeking higher returns with an inflation hedge. Municipal inflation-linked bonds are issued by local governments or municipalities and are designed to fund public projects. These bonds offer tax advantages, as the interest income is usually exempt from federal income taxes and, in some cases, state and local taxes. Like other inflation-linked bonds, they provide protection against inflation while contributing to portfolio diversification. Inflation-linked bonds offer several benefits to investors, including protection against inflation risk, diversification in investment portfolios, real return preservation, and lower volatility. The primary benefit of inflation-linked bonds is their ability to shield investors from the eroding effects of inflation on their portfolios. By adjusting principal and coupon payments to account for changes in inflation, these bonds help preserve the purchasing power of the invested capital. Inflation-linked bonds tend to have low correlation with other asset classes, such as stocks and traditional bonds, making them an effective diversification tool. By including inflation-linked bonds in their portfolios, investors can reduce overall portfolio risk and improve potential returns. Unlike nominal bonds, which provide fixed interest payments that may not keep up with inflation, inflation-linked bonds offer returns that are adjusted for inflation. This ensures that the real return on investment, or the return after accounting for inflation, is preserved over the life of the bond. Compared to other fixed-income securities, inflation-linked bonds generally exhibit lower price volatility due to their inflation-adjusted cash flows. This characteristic can make them an attractive option for investors seeking more stable investment options. Despite their benefits, inflation-linked bonds carry some risks, such as interest rate risk, liquidity risk, deflation risk, and tax considerations. Like all fixed-income securities, inflation-linked bonds are subject to interest rate risk. When interest rates rise, bond prices generally fall, resulting in potential capital losses for investors who sell their bonds before maturity. Some inflation-linked bonds may be less liquid than their nominal counterparts, making it more challenging to buy or sell them in the secondary market. This can result in wider bid-ask spreads and increased price volatility. In a deflationary environment, where the general level of prices is falling, inflation-linked bonds may underperform nominal bonds. This is because the principal and coupon payments of inflation-linked bonds may be adjusted downward, leading to lower cash flows for investors. The tax treatment of inflation-linked bonds can be complex. In the U.S., for example, investors are taxed on both the coupon payments and the inflation adjustments to the principal. Even though the inflation adjustments are not received until the bond matures or is sold. This can result in a higher tax burden compared to nominal bonds. Investors seeking inflation protection may also consider alternatives such as traditional bonds, inflation-protected annuities, real estate investment trusts (REITs), and stocks and commodities. Although traditional bonds do not offer direct inflation protection, they can still provide a reliable income stream and potential capital gains. Investors may choose to invest in a mix of nominal and inflation-linked bonds to balance their portfolios. Inflation-protected annuities provide a guaranteed income stream that increases with inflation, offering a similar inflation hedge to inflation-linked bonds. These annuities can be an attractive option for retirees seeking to maintain their purchasing power throughout their retirement years. REITs are companies that invest in income-producing real estate properties, such as apartments, offices, and shopping centers. They offer investors the potential for both income and capital appreciation, and since real estate often serves as a hedge against inflation, REITs can be a suitable alternative to inflation-linked bonds. Stocks and commodities, such as gold and oil, can also provide some degree of inflation protection. Companies can often pass on higher costs to consumers during inflationary periods, which can lead to higher earnings and stock prices. Meanwhile, commodities like gold have historically been seen as a store of value, making them an attractive investment option during times of inflation. Inflation-linked bonds can play a crucial role in an investor's long-term investment strategy, providing protection against inflation and contributing to portfolio diversification. However, it is essential to evaluate their suitability for each investor's individual needs and risk tolerance. Before investing in inflation-linked bonds, investors should carefully consider their financial goals, risk tolerance, and investment horizon. These factors will help determine the appropriate allocation of inflation-linked bonds within a diversified portfolio. Inflation-linked bonds can serve as a valuable tool in long-term investing strategies, particularly for investors seeking to maintain their purchasing power and protect their wealth from the effects of inflation. By including inflation-linked bonds in a well-diversified portfolio, investors can achieve a more balanced risk-return profile. The market for inflation-linked bonds may continue to evolve as governments and corporations around the world recognize their value as a financing tool during inflationary periods. Investors should stay informed about market developments and trends to capitalize on new opportunities and manage potential risks associated with this unique asset class.Definition of Inflation-Linked Bonds

How Inflation-Linked Bonds Work

Bond Structure and Issuance

Principal and Coupon Adjustments

Inflation Index and Calculation Methods

Types of Inflation-Linked Bonds

Treasury Inflation-Protected Securities (TIPS)

Global Inflation-Linked Bonds

Corporate Inflation-Linked Bonds

Municipal Inflation-Linked Bonds

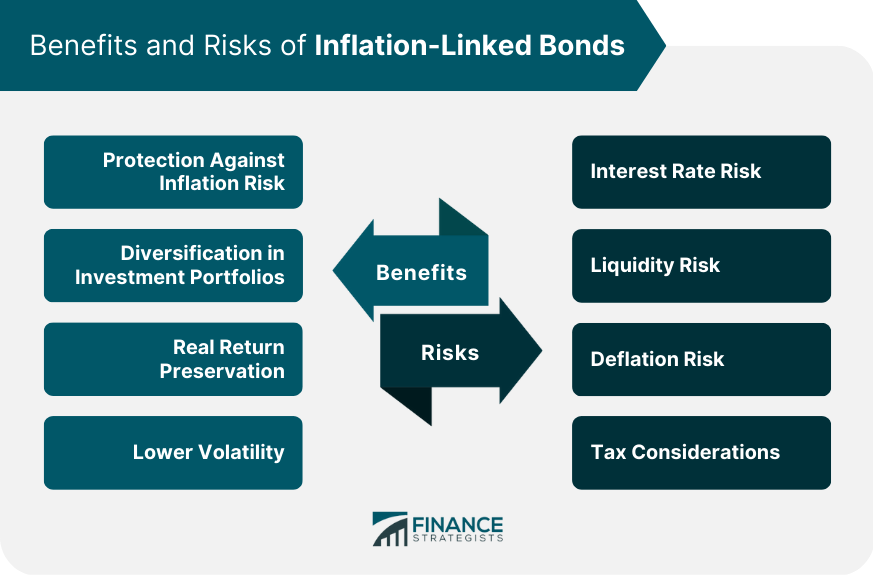

Benefits of Inflation-Linked Bonds

Protection Against Inflation Risk

Diversification in Investment Portfolios

Real Return Preservation

Lower Volatility

Risks Associated with Inflation-Linked Bonds

Interest Rate Risk

Liquidity Risk

Deflation Risk

Tax Considerations

Alternatives to Inflation-Linked Bonds

Traditional Bonds

Inflation-Protected Annuities

Real Estate Investment Trusts (REITs)

Stocks and Commodities

Final Thoughts

Inflation-Linked Bonds FAQs

Inflation-linked bonds are bonds whose interest payments and principal value are adjusted for inflation.

Inflation-linked bonds work by adjusting the value of the bond's interest payments and principal value in response to changes in inflation.

Inflation-linked bonds provide protection against inflation, diversification in investment portfolios, preservation of real return, and lower volatility.

The risks associated with investing in inflation-linked bonds include interest rate risk, liquidity risk, deflation risk, and tax considerations.

Investors can buy inflation-linked bonds directly from the government or through a broker. Inflation-linked bond funds or ETFs are also available for investment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.