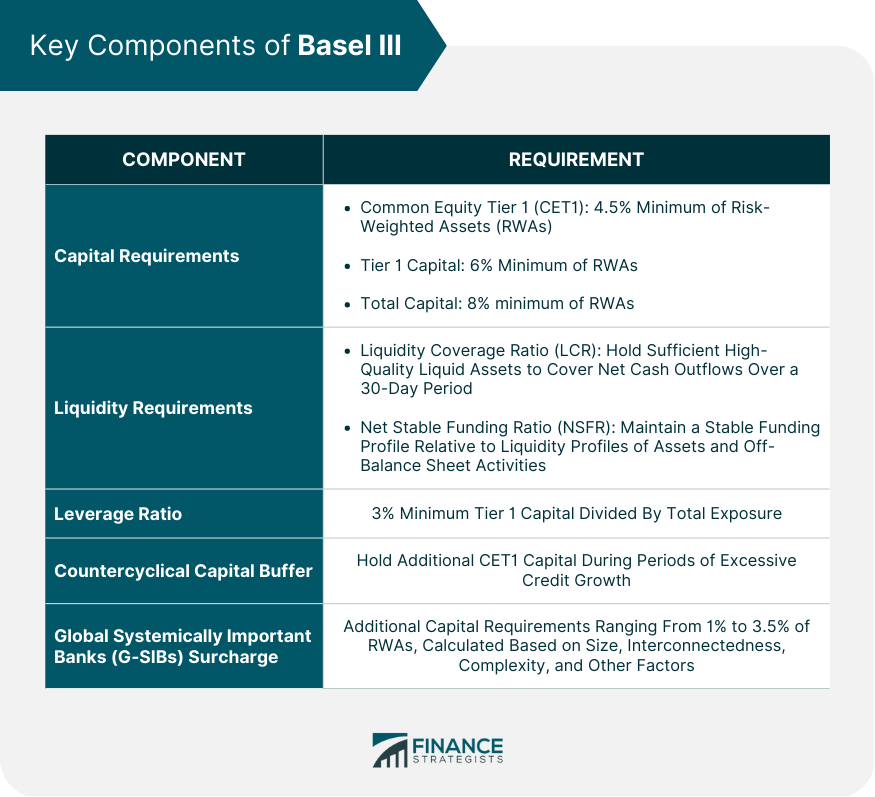

Basel III is a comprehensive set of banking regulations introduced by the Basel Committee on Banking Supervision (BCBS) in response to the 2007-2009 global financial crisis. The primary goal of Basel III is to improve the resilience of the global banking system by strengthening capital, liquidity, and leverage requirements for banks, as well as introducing new risk management and transparency measures. Basel III was developed as a successor to the Basel I and Basel II frameworks, which were established in 1988 and 2004, respectively. The BCBS introduced Basel III in 2010, with gradual implementation starting in 2013 and continuing through 2022. CET1 capital is the highest quality capital and consists primarily of common shares and retained earnings. Basel III increased the minimum CET1 capital requirement from 4% to 4.5% of risk-weighted assets (RWAs). Tier 1 capital includes CET1 and additional Tier 1 capital instruments, which are subordinated debt instruments that can absorb losses. The minimum Tier 1 capital requirement was raised from 4% to 6% of RWAs. Total capital includes Tier 1 and Tier 2 capital. Tier 2 capital consists of subordinated debt instruments that can absorb losses in the event of a bank's insolvency. The minimum total capital requirement remains at 8% of RWAs. The LCR requires banks to hold sufficient high-quality liquid assets (HQLA) to cover their total net cash outflows over a 30-day stressed period. This requirement ensures that banks can meet their short-term liquidity needs in times of crisis. The NSFR aims to promote long-term funding stability by requiring banks to maintain a stable funding profile relative to the liquidity profiles of their assets and off-balance sheet activities. This ratio is designed to reduce banks' reliance on short-term wholesale funding and encourage more stable funding sources. The leverage ratio serves as a backstop to the risk-based capital requirements, providing an additional safeguard against excessive leverage. Basel III introduced a minimum leverage ratio of 3% for all banks, calculated as Tier 1 capital divided by the bank's total exposure. The countercyclical capital buffer is a macroprudential tool designed to mitigate the buildup of systemic risks during periods of excessive credit growth. Banks are required to hold additional CET1 capital during periods of excessive credit growth to absorb potential losses when the credit cycle turns. G-SIBs are subject to additional capital requirements to reflect their systemic importance and potential impact on financial stability. The G-SIB surcharge is calculated based on a bank's size, interconnectedness, complexity, and other factors, with the additional capital requirements ranging from 1% to 3.5% of RWAs. Basel III implementation started in 2013 and has been carried out in multiple phases, with most components fully implemented in 2022. This gradual approach allows banks sufficient time to adapt to the new requirements and minimize any potential disruptions to the financial system. Some challenges and criticisms of Basel III implementation include concerns about the complexity of the regulations, the potential for reduced lending to small and medium-sized enterprises, and the uneven implementation across different jurisdictions. These challenges highlight the need for ongoing dialogue and coordination among regulators, banks, and other stakeholders. Different countries and regions have adopted Basel III standards with some variations, reflecting their unique financial systems and regulatory environments. This flexibility allows for the implementation of Basel III in a manner that is most appropriate for each jurisdiction, while maintaining a consistent global framework. Basel III has led to significant improvements in banks' capital adequacy, with many institutions raising capital to meet the new requirements. This increased capital base enhances the resilience of banks and reduces the likelihood of bank failures. The implementation of Basel III has encouraged banks to adopt more robust risk management practices, including improvements in credit, market, and operational risk management. This has contributed to a more stable and secure banking sector. Basel III has influenced banks' lending behavior, with some institutions reducing lending to riskier borrowers or sectors to maintain compliance with the new regulations. This has led to concerns about the potential impact on credit availability, particularly for small and medium-sized enterprises. The increased capital and liquidity requirements under Basel III have placed pressure on banks' profitability, leading some institutions to reevaluate their business models and focus on core activities. Additionally, the new regulations have influenced competition within the banking sector, with some smaller banks facing challenges in adapting to the new requirements. While it is difficult to fully assess the long-term impact of Basel III, the framework has contributed to a reduction in systemic risks and an overall improvement in financial stability. The increased capital and liquidity requirements have enhanced banks' resilience to shocks and reduced the likelihood of future financial crises. By promoting stronger capital and liquidity positions, improved risk management practices, and greater transparency, Basel III has contributed to a safer and more stable financial system. This has fostered increased confidence in the banking sector and supported economic growth. Despite the progress made under Basel III, some limitations and areas for improvement remain, such as addressing the issue of "too big to fail" institutions, further enhancing the measurement of systemic risk, and ensuring consistent implementation across jurisdictions. Basel III has played a crucial role in strengthening the global banking system through enhanced capital, liquidity, and leverage requirements, as well as the introduction of new risk management and transparency measures. These reforms have reduced systemic risks and contributed to a more resilient financial system. The key components of Basel III, including capital, liquidity, and leverage ratios, countercyclical capital buffer, and G-SIB surcharge, have been gradually implemented since 2013. Despite some challenges and criticisms, the overall progress has been positive, with banks adapting to the new requirements and regulators adjusting the framework as needed. The implementation of Basel III has led to significant improvements in banks' capital adequacy, risk management practices, and overall financial stability. Financial institutions and policymakers must remain vigilant and adaptive to ensure that the global financial system remains resilient in the face of new challenges and risks. Basel III has played a critical role in shaping a more resilient global financial system by addressing key weaknesses exposed during the 2007-2009 financial crisis. Consult a banking expert for further information on Basel III.What Is Basel III?

Key Components of Basel III

Capital Requirements

Common Equity Tier 1 (CET1) Capital

Tier 1 Capital

Total Capital

Liquidity Requirements

Liquidity Coverage Ratio (LCR)

Net Stable Funding Ratio (NSFR)

Leverage Ratio

Countercyclical Capital Buffer

Global Systemically Important Banks (G-SIBs) Surcharge

Implementation of Basel III

Timeline and Phases

Challenges and Criticisms

Regional and National Adaptations

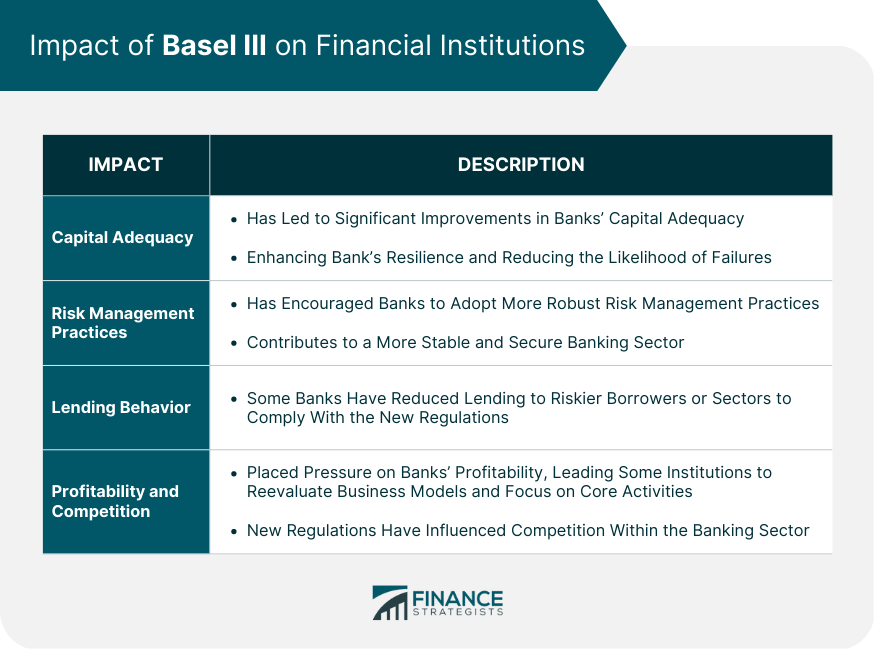

Impact of Basel III on Financial Institutions

Capital Adequacy

Risk Management Practices

Lending Behavior

Profitability and Competition

Basel III and Financial Stability

Effectiveness in Reducing Systemic Risks

Contribution to a Safer Financial System

Limitations and Areas for Improvement

Final Thoughts

Basel III FAQs

Basel III is a set of global regulatory standards developed by the Basel Committee on Banking Supervision, which is made up of central banks and regulatory authorities from around the world. The standards aim to strengthen the regulation, supervision, and risk management of the banking sector in order to promote financial stability.

Some of the key features of Basel III include higher capital requirements for banks, stricter liquidity standards, and new rules for measuring and managing risk. Banks are also required to conduct stress tests to assess their ability to withstand adverse economic conditions, and to establish a plan for resolving themselves in the event of a financial crisis.

Basel III was introduced in response to the global financial crisis of 2008, which exposed weaknesses in the regulatory framework for banks and highlighted the need for stronger risk management and supervision. The aim of Basel III is to make the banking sector more resilient to shocks and to reduce the risk of future financial crises.

Basel III has a significant impact on banks, particularly in terms of capital and liquidity requirements. Banks are required to hold more capital and high-quality liquid assets in order to strengthen their resilience to financial shocks. This can have implications for their profitability, as they may need to raise additional capital or adjust their business models in order to comply with the new standards.

Basel III has been implemented in many countries around the world, although the specific timelines and requirements vary depending on the jurisdiction. Some countries have already fully implemented the standards, while others are still in the process of doing so. The Basel Committee continues to monitor the implementation of Basel III and may make further adjustments or revisions as needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.