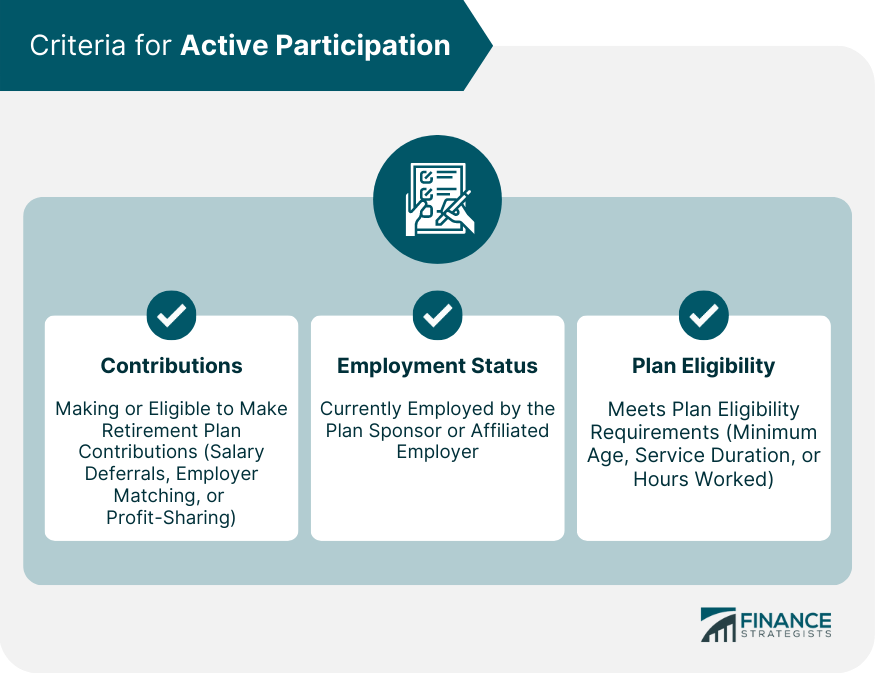

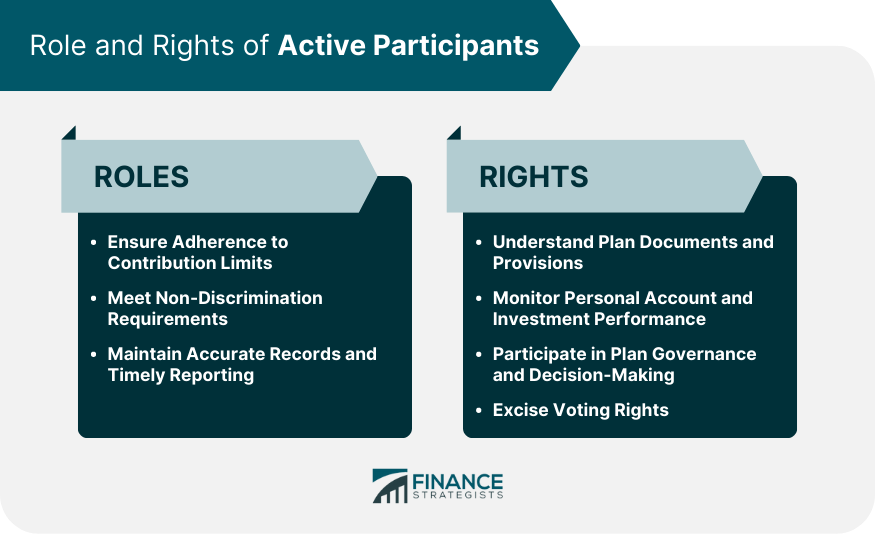

An active participant in the context of retirement plan compliance refers to an individual who is currently eligible to make contributions or receive employer contributions to their retirement account. These participants play a crucial role in ensuring ongoing compliance with their retirement plans. Active participation is essential for maintaining retirement plan compliance because it involves a range of responsibilities that, if executed diligently, can help ensure the plan adheres to applicable regulations and guidelines. To be considered an active participant in a retirement plan, an individual must meet certain criteria: 1. Contributions: The participant is making, or is eligible to make, contributions to the retirement plan, either through salary deferrals, employer matching, or profit-sharing contributions. 2. Employment status: The participant is currently employed by the plan sponsor or an affiliated employer. 3. Plan eligibility: The participant meets the plan's eligibility requirements, such as minimum age, service duration, or hours worked. Active participants are distinct from inactive participants, who may have ceased making contributions, terminated employment, or become ineligible due to changes in plan provisions. Understanding the difference is crucial for accurate reporting and maintaining plan compliance. Active participants must monitor their contributions to ensure they do not exceed the annual limits established by the Internal Revenue Service (IRS). Excess contributions can result in tax penalties and compliance issues for the retirement plan. Retirement plans must meet certain nondiscrimination requirements to maintain tax-qualified status. Active participants play a role in this process by ensuring fair distribution of benefits between Highly Compensated Employees (HCEs) and Non-Highly Compensated Employees (NHCEs). Active participants are responsible for providing accurate and timely information to their plan sponsor, such as changes in personal information or beneficiary designations. This ensures that plan records are up-to-date and facilitates compliance with reporting requirements. Active participants should familiarize themselves with their retirement plan documents and provisions to understand their rights, benefits, and responsibilities. This helps ensure that they are well-informed and can advocate for their interests. Active participants should regularly review their account statements and investment performance to ensure their retirement savings are on track. They should also make adjustments to their investment allocations as needed based on their risk tolerance and financial goals. Active participants have the right to participate in plan governance and decision-making processes. They can express their views on plan administration and investment options, and they can exercise their voting rights during annual meetings or other plan events. Active participants may have the right to vote on certain matters related to their retirement plans, such as plan amendments, trustee elections, or other significant decisions. Exercising these rights helps ensure that the plan is managed in the best interests of all participants. Retirement plans must undergo annual compliance testing to ensure adherence to IRS regulations. Key tests include the Actual Deferral Percentage (ADP) test, Actual Contribution Percentage (ACP) test, and Top-Heavy test. Active participant data is crucial for these tests. If compliance issues are identified, plan sponsors can use various correction programs to rectify the problems, such as the Voluntary Correction Program (VCP), Self-Correction Program (SCP), and Audit CAP (Correction of Audit Findings). Active participants may be involved in the correction process by working with plan sponsors to address any discrepancies and ensure accurate records. Plan sponsors have a responsibility to educate employees about their retirement plan, including the importance of active participation and the impact on plan compliance. Effective education can help participants make informed decisions and contribute to overall plan success. Plan sponsors can employ various communication methods to educate and engage active participants: 1. Periodic Newsletters: Regularly distributed newsletters can provide updates on plan provisions, investment options, and other relevant information. 2. Educational Workshops and Webinars: Interactive workshops and webinars can help educate participants about retirement planning, investment strategies, and plan compliance. 3. Online Resources: Plan sponsors can provide access to online resources, such as retirement planning tools, investment information, and plan documents. By promoting active participation, plan sponsors can help ensure that employees are engaged in their retirement planning and preparation for their financial future. This, in turn, contributes to the long-term success of the retirement plan and helps maintain compliance with applicable regulations. Active participation plays a vital role in retirement plan compliance. By understanding their rights and responsibilities, actively participating in plan governance, and working with plan sponsors to maintain accurate records, active participants can help ensure that their retirement plan remains compliant and operates in the best interests of all participants. A compliant retirement plan benefits both employees and employers. Employees benefit from tax-advantaged savings and investment growth, while employers can attract and retain a talented workforce and receive tax deductions for their contributions. By fostering a culture of active participation, employers and employees can work together to achieve long-term retirement success and maintain plan compliance.Definition of Active Participant

Importance of Active Participation

Identifying an Active Participant

Criteria for Active Participation

Differentiating Between Active and Inactive Participants

Role of Active Participants

Ensuring Adherence to Contribution Limits

Meeting Non-Discrimination Requirements

Maintaining Accurate Records and Timely Reporting

Active Participant Rights and Responsibilities

Understanding Plan Documents and Provisions

Monitoring Personal Account and Investment Performance

Participating in Plan Governance and Decision-Making

Exercising Voting Rights

Retirement Plan Compliance Testing

Annual Testing Requirements

Correcting Compliance Issues

Importance of Education and Communication

Plan Sponsor's Role in Educating Employees

Effective Communication Methods

Encouraging Active Participation for Long-Term Retirement Success

Conclusion

Active Participant FAQs

Active participation is essential for maintaining retirement plan compliance because it involves a range of responsibilities, such as monitoring contributions, meeting non-discrimination requirements, and maintaining accurate records. Active participants play a crucial role in ensuring their retirement plans adhere to applicable regulations and guidelines.

Active participation helps ensure a fair distribution of benefits between Highly Compensated Employees (HCEs) and Non-Highly Compensated Employees (NHCEs). By actively participating in the plan and staying informed about non-discrimination rules, participants can help maintain the tax-qualified status of the retirement plan.

Active participants have several responsibilities in retirement plan compliance, including adhering to contribution limits, providing accurate and timely information to plan sponsors, understanding plan documents and provisions, monitoring personal account and investment performance, and participating in plan governance and decision-making.

Active participation encourages employees to be engaged in their retirement planning and make informed decisions about their savings and investments. By staying informed and actively involved in their retirement plan, participants can better prepare for their financial future and contribute to the overall success of the plan.

Plan sponsors can promote active participation through various communication methods, such as periodic newsletters, educational workshops and webinars, and online resources. By providing education and ongoing support, plan sponsors can help ensure that employees are actively engaged in their retirement planning and contribute to maintaining plan compliance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.