The effective tax rate represents the average tax rate that an individual or a corporation pays on their taxable income. It is calculated by dividing the total tax paid by the taxable income. The effective tax rate provides a more accurate representation of an individual's or corporation's tax burden than the marginal tax rate, which only considers the highest tax bracket applicable to their income. Understanding the effective tax rate is crucial for individuals and businesses alike. It provides a clear picture of the overall tax burden and helps make informed financial decisions. By being aware of their effective tax rate, taxpayers can optimize their financial strategies, maximize deductions and credits, and minimize tax liabilities. Comparing effective tax rates across different jurisdictions can help businesses make better decisions regarding expansion and relocation. The United States employs a progressive tax system for individual income taxes, which means that as an individual's income increases, so does their tax rate. This system ensures that higher-income people contribute more of their tax earnings. The progressive tax system consists of several tax brackets with corresponding tax rates adjusted annually for inflation. The marginal tax rate is the tax rate applicable to the last dollar an individual or corporation earns. It is the highest tax rate applied to a taxpayer's income. On the other hand, the effective tax rate is the average rate at which an individual's or corporation's taxable income is taxed. The effective tax rate considers all tax brackets and rates applicable to a taxpayer's income, providing a more comprehensive view of the overall tax burden. Sales taxes are indirect taxes levied on the sale of goods and services. In the United States, sales taxes are primarily imposed at the state and local levels. State sales tax rates vary, with some states having no sales tax and others having rates as high as 7.25%. Local sales tax rates may also be imposed in addition to state rates, leading to a combined sales tax rate that can be as high as 9.50%. Sales taxes can impact the effective tax rate of an individual. Consumers pay sales taxes indirectly when purchasing goods and services, increasing their overall tax burden. The impact of sales taxes on an individual's effective tax rate may vary depending on their consumption habits and the tax rates in their state and local jurisdictions. High sales tax rates may discourage spending and negatively affect local economies, especially if consumers can shop in neighboring jurisdictions with lower tax rates. Property taxes on land value and improvements, such as buildings and structures, are assessed. These taxes are imposed by local governments, such as counties, cities, and school districts, and are used to fund public services, including education, infrastructure, and public safety. Property tax rates vary by jurisdiction and are typically expressed as a percentage of the assessed property value. Personal property taxes are levied on the value of tangible personal property, such as automobiles, boats, and recreational vehicles. Like real estate property taxes, personal property taxes are assessed by local governments and contribute to an individual's effective tax rate. The impact of personal property taxes on an individual's effective tax rate depends on the value of the taxable property and the tax rates in their jurisdiction. The federal corporate tax rate in the United States is a flat rate applied to a corporation's taxable income. As of 2023, the federal corporate tax rate was 21%. The Tax Cuts and Jobs Act of 2017 significantly reduced the federal corporate tax rate from 35% to 21%. This reduction aimed to make the United States more attractive for businesses and stimulate economic growth. In addition to federal corporate taxes, corporations may also be subject to state and local corporate income taxes. State corporate tax rates vary significantly, with some states imposing no corporate income tax and others having rates as high as 11.5%. Local corporate tax rates may also apply in some jurisdictions, further impacting a corporation's effective tax rate. The combined federal, state, and local corporate tax rates determine the overall tax burden for corporations operating in the United States. The Social Security tax is a federal payroll tax levied on employers and employees to fund the Social Security program, providing retirement, disability, and survivor benefits. As of 2024, the Social Security tax rate remains at 12.4%, with employers and employees each contributing 6.2%. The tax applies to wages and salaries up to a certain limit, known as the Social Security wage base, which is adjusted annually for inflation. The Medicare tax is another federal payroll tax that funds the Medicare program, which provides health insurance for individuals aged 65 and older and certain younger individuals with disabilities. The Medicare tax rate is 2.9%, with employers and employees each contributing 1.45%. Unlike the Social Security tax, there is no wage base limit for the Medicare tax, which applies to all wages and salaries. Additionally, high-income earners are subject to an additional Medicare tax of 0.9% on wages exceeding a certain threshold. The single filing status is applicable to individuals who are unmarried, divorced, or legally separated as of the end of the tax year. Single filers have their own tax brackets and rates, which are generally less favorable than married filers. Consequently, single filers may have a higher effective tax rate than married individuals filing jointly with similar income levels. Married couples can file their federal income tax return jointly, combining their incomes and deductions. Married filing jointly typically results in a lower effective tax rate for both spouses, as the tax brackets and rates for joint filers are more favorable than those for single filers or married individuals filing separately. Married couples may also choose to file their federal income tax returns separately. This filing status may be beneficial in certain situations, such as when one spouse has significant deductions or tax credits that would be limited or phased out on a joint return. However, married filing separately generally results in higher effective tax rates for both spouses than jointly married filing, as the tax brackets and rates are less favorable. The head of household filing status is available to unmarried individuals who provide more than half the cost of maintaining a household for a qualifying person, such as a dependent child or relative. This filing status provides more favorable tax brackets and rates than the single filing status, resulting in a lower effective tax rate for eligible taxpayers. As mentioned earlier, the United States employs a progressive tax system for individual income taxes. The tax brackets and rates applicable to taxpayers' income significantly determine their effective tax rate. Higher-income earners are subject to higher tax rates, resulting in a higher effective tax rate than lower-income earners. Tax deductions and credits can significantly impact an individual's effective tax rate. Deductions reduce taxable income, while tax credits directly reduce the tax liability. The greater the number of deductions and credits a taxpayer can claim, the lower their effective tax rate will be. Deductions and credits can vary based on factors such as income level, filing status, and eligibility for specific tax benefits. The standard deduction is a fixed amount that taxpayers can subtract from their taxable income, effectively reducing their tax liability. The standard deduction amount varies based on filing status and is adjusted annually for inflation. Taxpayers can choose between taking the standard deduction or itemizing deductions, depending on which option provides the greatest tax benefit. For many taxpayers, especially those with lower incomes or fewer deductible expenses, the standard deduction helps lower their effective tax rate. Some taxpayers may benefit more from itemizing deductions, which involves listing and claiming specific deductible expenses on their tax returns. Common itemized deductions include mortgage interest, charitable contributions, and medical expenses. The total amount of itemized deductions a taxpayer can claim may be limited based on their adjusted gross income (AGI) and specific deduction limitations. Taxpayers who can claim a significant amount in itemized deductions may experience a lower effective tax rate compared to those who take the standard deduction. The Earned Income Tax Credit (EITC) is a refundable tax credit designed to provide financial assistance to low- and moderate-income working individuals and families. The amount of the credit depends on the taxpayer's income, filing status, and number of qualifying children. The EITC can significantly lower a taxpayer's effective tax rate by directly reducing tax liability and potentially resulting in a tax refund. The Child Tax Credit is a partially refundable tax credit that provides financial assistance to families with qualifying children. The amount of the credit depends on the taxpayer's income and the number of qualifying children. By reducing tax liability and potentially resulting in a tax refund, the Child Tax Credit can lower a taxpayer's effective tax rate. Education tax credits, such as the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), help offset higher education costs for taxpayers, their spouses, or their dependents. These credits directly reduce tax liability and can lower the taxpayer's effective tax rate. The eligibility and amount of these credits depend on factors such as income, filing status, and qualified education expenses. To calculate the effective tax rate, divide the total tax paid by the taxable income. This calculation provides a percentage representing the average tax rate paid on the taxable income. The effective tax rate considers all applicable tax rates and brackets, more accurately representing the overall tax burden. For example, suppose a single filer has a taxable income of $50,000 and pays a total tax of $6,500. Their effective tax rate would be 13% ($6,500 ÷ $50,000). Consider a married couple filing jointly with a combined taxable income of $100,000 and a total tax payment of $11,500. Their effective tax rate would be 11.5% ($11,500 ÷ $100,000). Lastly, let's take a head of household-filer with a taxable income of $75,000 and a total tax payment of $9,000. Their effective tax rate would be 12% ($9,000 ÷ $75,000). Comparing effective tax rates across different scenarios can help taxpayers understand the impact of various factors, such as income level, filing status, deductions, and credits, on their overall tax burden. By analyzing different scenarios, taxpayers can identify opportunities to optimize their financial strategies and minimize their effective tax rate. Comparing effective tax rates can also provide insights into the fairness and progressivity of the tax system and highlight potential tax policy issues. Income shifting is a tax planning strategy that involves moving income between different tax years or between taxpayers with different tax rates. Examples of income shifting include deferring bonuses, accelerating deductions, or shifting income between family members in lower tax brackets. By strategically timing income and deductions, taxpayers can minimize their effective tax rate and reduce their overall tax liability. Maximizing deductions and credits is another essential tax planning strategy for reducing the effective tax rate. By identifying and taking advantage of all available deductions and credits, taxpayers can lower their taxable income and reduce their tax liability. This may involve tracking and documenting deductible expenses, utilizing tax-advantaged accounts, or claiming credits for eligible education or childcare expenses. Tax-deferred accounts, such as traditional IRAs and 401(k) plans, allow taxpayers to contribute pre-tax dollars, lowering their taxable income and reducing their effective tax rate. Investment earnings in these accounts grow tax-deferred until withdrawn, usually during retirement when the taxpayer may be in a lower tax bracket. Utilizing tax-deferred accounts can be an effective strategy for long-term tax planning and retirement savings. Tax-exempt investments, such as municipal bonds, generate interest income that is exempt from federal income tax and, in some cases, state and local taxes. By incorporating tax-exempt investments into their portfolios, taxpayers can generate tax-free income and potentially reduce their effective tax rate. When planning for retirement, taxpayers must consider the tax implications of different retirement accounts, such as traditional IRAs and Roth IRAs. Contributions to traditional IRAs are tax-deductible, which can lower the taxpayer's taxable income and effective tax rate. However, withdrawals in retirement are taxed as ordinary income. Conversely, Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. Choosing the right type of retirement account can help taxpayers minimize their effective tax rate during their working years and retirement. Contributing to a 401(k) plan is another effective strategy for reducing the effective tax rate. Contributions to a traditional 401(k) plan are made with pre-tax dollars, which can lower the taxpayer's taxable income and effective tax rate. Additionally, investment earnings in a 401(k) grow tax-deferred until withdrawn in retirement. Donor-advised funds (DAFs) are charitable giving vehicles that allow taxpayers to make tax-deductible contributions and recommend grants to qualified charities over time. By contributing to a DAF, taxpayers can maximize their itemized deductions for charitable contributions and reduce their effective tax rate. Charitable remainder trusts (CRTs) are another tax-efficient charitable giving strategy. CRTs allow taxpayers to contribute assets, such as stocks or real estate, to a trust paying them an income stream for a specified period of life. The remaining assets are distributed to a designated charity upon the trust's termination. CRTs provide several tax benefits, including an immediate income tax deduction, avoidance of capital gains tax, and potential estate tax savings, all of which can help reduce the taxpayer's effective tax rate. Qualified charitable distributions (QCDs) are another tax-efficient charitable giving strategy, particularly for taxpayers at least 70.5 years old and with individual retirement accounts (IRAs). QCDs allow taxpayers to directly transfer up to $100,000 per year from their IRA to a qualified charity without incurring income tax on the distribution. While QCDs do not provide an income tax deduction, they do satisfy required minimum distribution (RMD) requirements and exclude the distributed amount from the taxpayer's taxable income, thus reducing their effective tax rate. Understanding the effective tax rate is essential for individuals and corporations to make informed financial decisions and optimize their tax strategies. The effective tax rate considers various types of taxes, such as income tax, sales tax, property tax, and corporate tax, as well as factors like filing status, income level, deductions, and credits. By analyzing the effective tax rate and comparing different scenarios, taxpayers can identify opportunities to minimize their tax burden and make better financial decisions. Implementing tax-efficient strategies, such as tax planning, tax-efficient investments, retirement planning, and charitable giving, can further help reduce the effective tax rate and maximize after-tax income.What Is the Effective Tax Rate?

Types of Taxes and Their Impact on Effective Tax Rates

Income Tax

Progressive Tax System

Marginal Tax Rate vs Effective Tax Rate

Sales Tax

State and Local Sales Tax Rates

Impact on Consumers

Property Tax

Real Estate Property Tax

Personal Property Tax

Corporate Tax

Federal Corporate Tax Rate

State and Local Corporate Tax Rates

Payroll Taxes

Social Security Tax

Medicare Tax

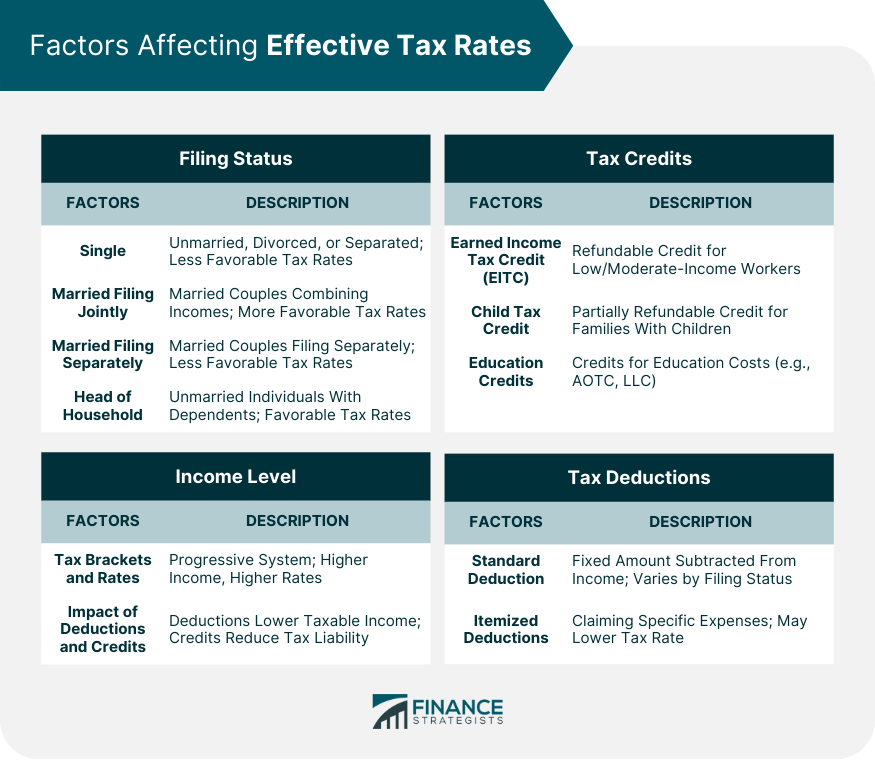

Factors Affecting Effective Tax Rates

Filing Status

Single

Married Filing Jointly

Married Filing Separately

Head of Household

Income Level

Tax Brackets and Rates

Impact of Deductions and Credits

Tax Deductions

Standard Deduction

Itemized Deductions

Tax Credits

Earned Income Tax Credit (EITC)

Child Tax Credit

Education Credits

Calculating Effective Tax Rates

Formula for Calculation

Example Calculations

Single Filer

Married Filing Jointly

Head of Household

Comparing Effective Tax Rates Across Different Scenarios

Strategies for Reducing Effective Tax Rates

Tax Planning

Income Shifting

Deduction and Credit Maximization

Tax-Efficient Investment Strategies

Tax-Deferred Accounts

Tax-Exempt Investments

Retirement Planning

Traditional IRA vs Roth IRA

401(k) Contributions

Charitable Giving Strategies

Donor-Advised Funds

Charitable Remainder Trusts

Qualified Charitable Distributions

Conclusion

Effective Tax Rate FAQs

The Effective Tax Rate is the average rate at which an individual or corporation's income is taxed. It is calculated by dividing the total tax paid by the total taxable income. The formula is: Effective Tax Rate = Total Tax Paid / Total Taxable Income.

The Effective Tax Rate represents the average tax rate applied to an individual or corporation's total taxable income. In contrast, the Marginal Tax Rate is the tax rate applied to the next dollar of income earned. The Effective Tax Rate is typically lower than the Marginal Tax Rate due to the progressive nature of most tax systems.

The Effective Tax Rate is important for financial analysis because it provides a more accurate picture of the overall tax burden on an individual or corporation. It allows analysts and investors to assess the impact of taxes on profitability and cash flow, and it helps compare the tax burdens of different entities.

Yes, deductions and credits can affect an individual's Effective Tax Rate. Deductions reduce taxable income, which can lower the Effective Tax Rate. Tax credits directly reduce the amount of tax owed, which can also result in a lower Effective Tax Rate.

To determine your own Effective Tax Rate, you need to calculate the total amount of tax you paid during the tax year and divide it by your total taxable income for the same period. The result is your Effective Tax Rate. You can find the necessary information on your tax return or consult a tax professional.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.