A 401(k) is a retirement account offered by employers to help their employees save funds for retirement. A 401(k) differs from a savings account or an Individual Retirement Account (IRA) because it provides a set of investment opportunities that employers select. These can be stock and bond mutual funds, guaranteed investment contracts (GICs), target-date funds, and your employer's stock. The 401(k) plan has an option for employers to make contributions. Some employers make matching contributions, depositing a certain amount for each dollar their employee contributes. Other employers contribute a fixed percentage of income for each eligible employee, whether or not the employee decides to contribute to the plan. With this plan, you can regularly contribute a portion of your income to buying investments within the 401(k). These investments' accumulated contributions and earnings become available for withdrawal after retirement. Once you hit a certain age, you must withdraw a minimum amount from your 401(k) plan per year. This amount is called the required minimum distribution. Depending on the type of 401(k) plan you choose, you will either be taxed before you contribute or later when you withdraw your money.

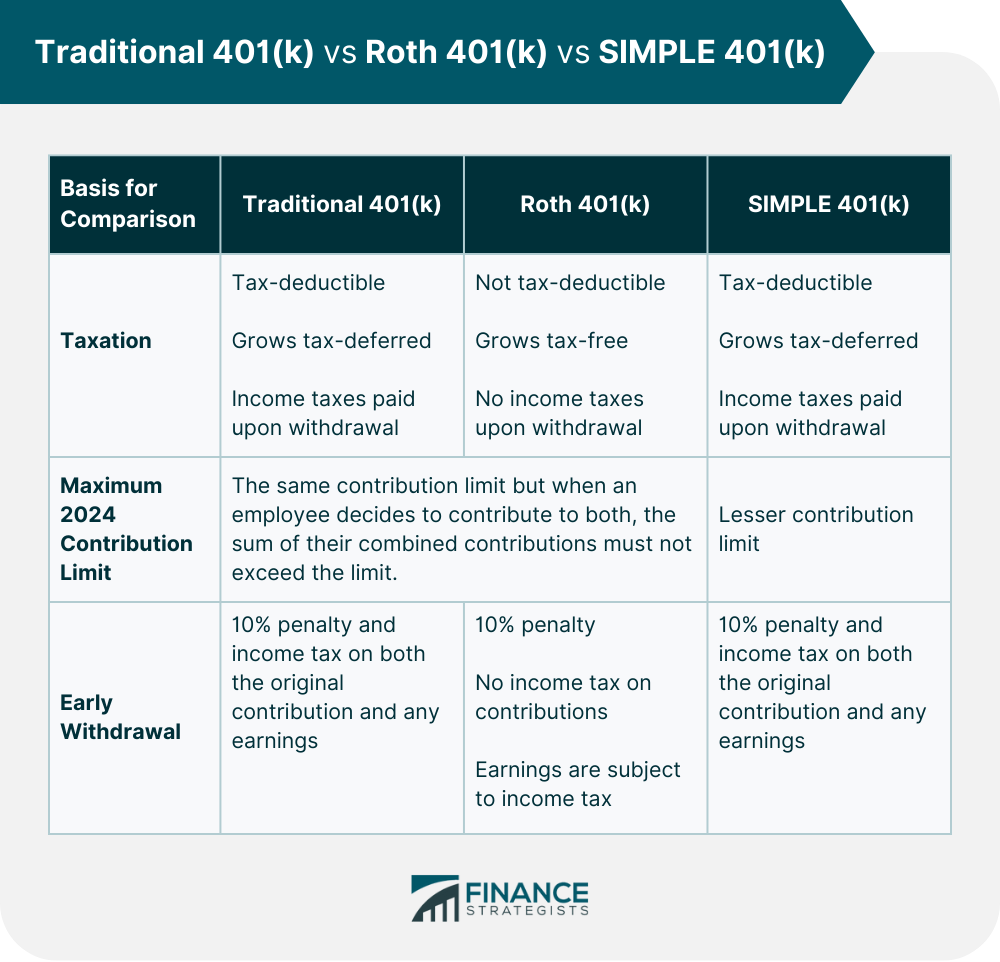

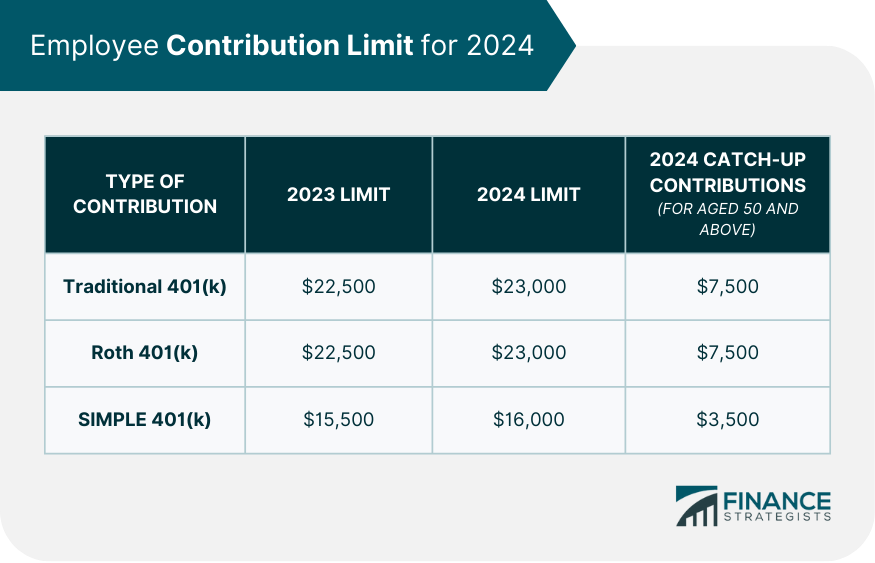

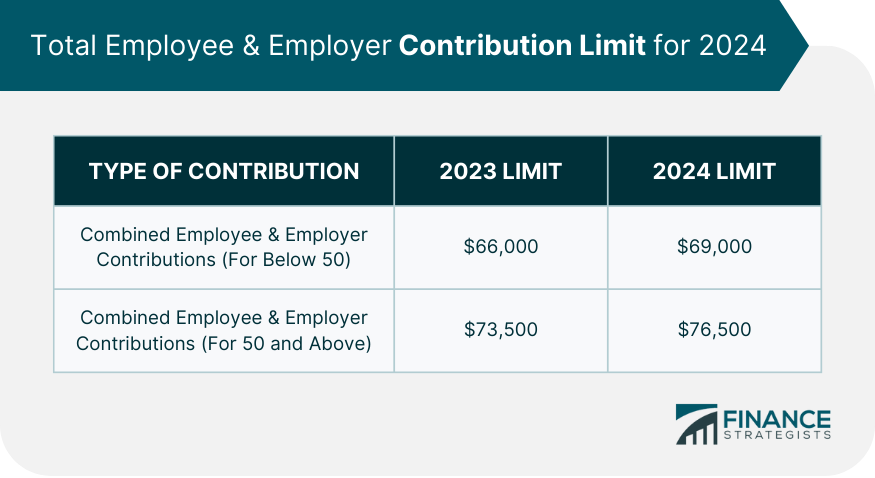

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Maximizing your 401(k) contribution is a powerhouse move for retirement savings. By investing the maximum allowed by law, you not only reduce your taxable income but also compound your wealth over time through tax-deferred growth. This strategy accelerates your journey to financial security, making the most of employer matches and investment gains. Consider adjusting your contributions today to unlock the full potential of your 401(k). It's a smart, proactive step toward ensuring a comfortable and secure retirement. Let's talk strategy. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Several types of 401(k) plans have different contribution rules and tax implications. Some of them are: With a traditional 401(k), you invest with pre-tax dollars. Before you get paid, money for your 401(k) is taken out of your paycheck. Then the remaining money in your paycheck gets taxed. With this set-up, your money in a traditional 401(k) will grow tax-deferred. Once you reach the age of 59 ½ years old, you can already start withdrawing money from your 401(k). However, you will need to pay income tax on the amount you withdraw. If you withdraw funds from your 401(k) before you reach this age, you will be subjected to a 10% penalty fee. The traditional 401(k) assumes that you currently belong to a higher tax bracket because you are being paid. It also presumes that you will be in a lower tax bracket when you retire. This arrangement can result in tax savings if you end up in a lower tax bracket when you retire. Nevertheless, people generally invest in traditional 401(k) because it lowers their current taxable income. Whether or not you contribute to a traditional 401(k) or a Roth 401(k), your company’s contributions will always go into a traditional 401(k). That is because these contributions are not taxed. Thus, you will still need to pay taxes when you take them out later. The Roth 401(k) comes with a slightly different tax treatment. With Roth 401(k), you invest with post-tax dollars. When you get your paycheck, the entire amount is taxed. Then your contribution is taken from your paycheck and put into your Roth 401(k). Because you have already paid taxes on your contributions, when you withdraw funds after retirement, you will not pay any income taxes on these amounts. However, you do need to pay taxes when you withdraw earnings made by your investments. Both traditional 401(k)s and Roth 401(k)s require participants to be at least 59 ½ years old before they can withdraw penalty-free. A notable difference is that Roth 401(k)s also require participants to have their accounts for at least five years before a penalty-free withdrawal can be made. This rule is enforced regardless of a participant’s current age. A Savings Incentive Match Plan for Employees or SIMPLE 401(k) is a version of the 401(k) plan made accessible for companies with 100 or fewer employees. To qualify for this type of plan, a company must file a Form 5500 annually, and their employees must have no other existing retirement plans. Under this setup, employers can make a matching contribution of up to 3% of the employee's income or a non-elective contribution of up to 2%. The same taxation and early withdrawal rules that apply to a traditional 401(k) also apply to a SIMPLE 401(k). One key difference, however, is that SIMPLE 401(k) has a lesser contribution limit. Below is a summary of the similarities and differences between the SIMPLE 401(k) and the other types of 401(k) plans that were previously mentioned. As announced by the Internal Revenue Service (IRS), contribution limits for 401(k) plans have increased in 2024. Contribution limits are typically influenced by an increase in the nation’s inflation rates. The changes are outlined in the table below. The table shows that the contribution limits for traditional 401(k), Roth 401(k), and SIMPLE 401(k) plans have increased by $500 from the previous year. The table also indicates differences between employees below 50 and those aged 50 and above. Those in the latter group are allowed to make additional catch-up contributions regardless of which type of 401(k) plan they have. Thus, they may contribute up to $30,500 for traditional 401(k) and Roth 401(k) plans. On the other hand, for SIMPLE 401(k) plans, they can contribute up to $19,500. It is also important to note that participants are allowed to have both a traditional 401(k) and a Roth 401(k). However, the sum of their contributions to both accounts must not exceed the limit of $23,000. Employers’ 401(k) contributions do not count toward employees’ contribution limits. Instead, employers’ contributions are capped by the total contribution limit. This is the sum of their contributions and that of their employees. There have also been changes in the total annual 401(k) contribution limit since 2022. The following are the changes: The information presented above only covers the traditional 401(k) and Roth 401(k) plans. For SIMPLE 401(k) plans, the total annual contribution limit varies per company. This is because employers can either make a matching contribution of up to 3% of the income of the employees or make a non-elective contribution of up to 2% of the employee's income. Regardless of the plan type, the total annual contribution limit must not exceed 100% of employees’ annual compensation. Most employees can max out their 401(k) plans up to the annual contribution limit. However, some employers may limit employee contributions. This is especially true for highly compensated employees (HCE). Here are some guidelines to identify highly compensated employees. Companies are required to undergo annual nondiscrimination tests to ensure that the average contributions of their HCEs do not exceed the average non-HCE’s contributions by more than 2%. Aside from this, the tests also confirm that total HCE contributions do not exceed more than double the total contributions of non-HCEs. If companies fail the nondiscrimination tests, they must take immediate steps to fix the issue. Otherwise, their 401(k) plans could lose tax-qualified status. To remedy this, companies can make extra contributions for the non-HCEs or require HCEs to withdraw some of their contributions. The contribution limits for HCEs are in place to ensure that 401(k) plans benefit all employees, not just those who earn a high income. That is, high-earning employees must not benefit more than the average earners from the tax advantages of these plans. You may consider increasing your contribution to the maximum amount allowed for your respective 401(k) plan. By doing so, you can take advantage of several benefits. Increasing your contribution to your 401(k) plan has many benefits. These include: While there are many benefits to increasing your contribution to your 401(k) plan, you must be careful not to go over your limit. There are consequences to over-contributing, such as: If you are interested in boosting your contribution to your 401(k) plan, there are a few things that you may need to do. You need to check with your employer to see if they offer 401(k) matching contributions. If they do, you will want to make sure you contribute enough to take advantage of the employer match. Once you have increased your contribution, you will want to make sure you diversify your investments. This means that you should not put all of your eggs in one basket. You will want to invest in a variety of different investments, such as stocks, bonds, and mutual funds. You will also want to avoid investing in funds with high fees. This is because the fees can eat into your investment returns. Some 401(k) plans have high fees, so you will want to ensure that you are aware of the fees before investing. In addition to increasing your contribution, there are other changes that you can make to your 401(k) plan. 401(k) plans are a great way to save for retirement. Common types of 401(k) plans are traditional 401(k), Roth 401(k), and SIMPLE 401(k). Several benefits come with saving in a 401(k) plan, such as employer-matching contributions and tax breaks. However, you should be aware of the contribution limits for 401(k) plans. If you contribute more than the specified limit, you will be subject to a tax penalty. You can increase your 401(k) plan contribution by checking for employer-matching contributions and diversifying your investments. You may also want to avoid funds with high fees. Other changes that can be made to your 401(k) plan include converting your 401(k) into an IRA and borrowing from your 401(k) plan. You can also set up automatic increases in your contribution per year, which increases your savings without thinking about it.What Is a 401(k) Plan?

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Common Types of 401(k) Plans

Traditional 401(k) Plan

Roth 401(k) Plan

SIMPLE 401(k) Plan

Employee Contribution Limit for 2024

Total Annual 401(k) Contribution Limit for 2024

Contribution Limits for Highly Compensated Employees (HCE)

What Are HCEs?

How Do 401(k) Plans Work for HCEs?

Why Are There Different Limits for HCEs?

Increasing Your 401(k) Contribution

The Benefits of Increasing Your Contribution

You will also increase your employer's contribution if you increase your contributions. This way, the amount of money invested into your account is doubled for free.

The Consequences of Over-Contributing to Your 401(k) Plan

Maximizing Your 401(k) Contribution

Check for Employer-Matching Contributions

Diversify Your Investments

Avoid Funds With High Fees

Other Changes That Can Be Made to Your 401(K)

The Bottom Line

Maximum 401(k) Contribution FAQs

In 2024, both the traditional 401(k) and Roth 401(k) have a contribution limit of $23,000, while SIMPLE 401(k) has a limit of $16,000.

The catch-up contribution limit for those aged 50 and over is $8,000 in 2024 for traditional 401(k) and Roth 401(k). It is $3,500 for SIMPLE 401(k).

Yes. It is included in the contribution limit.

No, you need to monitor your 401(k) contributions. You will be subject to a tax penalty if you go over the limit.

If you put too much in your 401(k), you will be subject to a tax penalty. You will need to withdraw the excess contribution plus any earnings on the excess contribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.