Delving into the world of finance and investments, dividends stand as crucial components to understand. In the simplest terms, dividends are payments made by a corporation to its shareholders, usually in the form of cash or additional shares. These payments stem from the corporation's profits and act as a means of distributing a portion of the earnings back to the investors. Hence, dividends are a reward mechanism, essentially thanking shareholders for their trust in the company. Contrary to the belief of some, dividends are not guaranteed payments. They are distributed at the discretion of a company's board of directors, based on the company's profitability and other considerations. When the company performs well and achieves profits, shareholders often receive dividends. On the other hand, if the company fails to profit or needs to reinvest its profits, the board might decide to reduce or eliminate dividends. In retirement planning, evaluating dividend-paying stocks is a critical step. While dividends provide a potential income stream, not all dividend-paying stocks are equal. Investors need to examine a company's dividend yield, payout ratio, and dividend growth rate. The dividend yield tells you how much income you'll receive for every dollar invested. The payout ratio provides insights into a company's ability to maintain its dividend payments, while the dividend growth rate indicates how fast the company's dividends have grown over time. However, yield shouldn't be the sole determinant; it's essential to examine the company's financial health and growth prospects. A high yield might be a result of a declining stock price, which could indicate trouble. Thus, dividend investors must consider these parameters and the overall company’s performance to make informed decisions. The role of diversification and asset allocation in a retirement plan cannot be overstated. It reduces risk by spreading investments across different asset classes and sectors. Dividend-paying stocks should be one part of a diversified portfolio, not the entire portfolio. Investors must also consider bonds, real estate, and possibly international investments to create a balanced, risk-appropriate portfolio. Dividend investors, in particular, should avoid overconcentration in sectors known for high dividends, like utilities or consumer staples. Different sectors perform differently under varying economic conditions, and an overemphasis on high-dividend sectors may leave investors exposed to sector-specific risks. A well-diversified portfolio, on the other hand, can provide a degree of protection against such pitfalls. Dividend reinvestment plans (DRIPs), offer a strategy for growing investments over time. DRIPs automatically reinvest dividends into additional shares of the company, thereby increasing the investor's holdings. This strategy harnesses the power of compounding, which can lead to significant growth over the long term. DRIPs are particularly advantageous for retirement planning as they enable continuous investment growth without any additional capital input. Moreover, many DRIPs allow purchasing shares at a discount or without brokerage fees, further maximizing returns. However, investors should remember that reinvested dividends are still subject to taxation, and the increased share count from DRIPs can complicate tax calculations. In the quest to maximize dividend income for retirement, selecting high-quality dividend stocks is vital. High-quality stocks usually belong to companies with strong financials, a history of stable earnings, and a consistent record of paying dividends. Such companies often have a competitive advantage in their industry, which enables them to generate consistent profits and, consequently, consistent dividends. Investors should also seek companies that regularly increase their dividends. These 'dividend growers' not only provide an increasing income stream but are often associated with strong financial health. By carefully selecting such stocks, investors can ensure a reliable and growing source of retirement income. The strategy of reinvesting dividends can significantly boost retirement income. By opting for automatic dividend reinvestment, investors can acquire more shares of a company, which can lead to higher dividend payments in the future. This approach exploits the power of compounding, enabling the value of investments to grow exponentially over time. While reinvesting dividends can lead to substantial growth, investors should also consider their income needs. For retirees needing immediate income, reinvesting may not be the best strategy. However, for those in the accumulation phase of their retirement planning, reinvesting dividends can help maximize future income. Another tactic to maximize dividend income involves selecting stocks with consistent dividend growth. Companies with a track record of steadily increasing dividends are often financially strong and committed to returning profits to shareholders. A pattern of regular dividend growth can also be a positive indicator of a company's future performance. However, consistent dividend growth should not be considered in isolation. Investors should also analyze other aspects of a company's performance, including earnings growth, debt levels, and cash flow stability. A comprehensive evaluation can help ensure the chosen stocks are likely to continue their dividend growth and contribute significantly to retirement income. When structuring a retirement income strategy, timing dividend payments with retirement expenses can be helpful. By investing in companies that distribute dividends quarterly, semi-annually, or annually, retirees can align their income with their spending needs. This strategy provides a regular and predictable income stream, which can make budgeting easier for retirees. However, this strategy's success depends on the reliability of the dividends. If a company cuts its dividend, it could disrupt the retiree's income stream. Therefore, it's crucial to select dividend-paying stocks with a history of reliable dividend payments, while also maintaining a diversified portfolio to mitigate the risk of any single dividend cut. While dividends can provide a steady income stream for retirement, it's vital to consider their sustainability. Companies might face financial difficulties, forcing them to reduce or eliminate their dividends. As a result, retirees relying on dividends for income might face financial challenges. Investors can gauge dividend sustainability by analyzing a company's payout ratio—the percentage of earnings paid out as dividends. A high payout ratio could suggest that the company is returning more to shareholders than it can afford, which might endanger future dividends. Therefore, it's crucial to assess the company's financial health and the sustainability of its dividends. Inflation represents another significant risk for dividend-focused investors. As the cost of living rises, the purchasing power of a given income stream declines. For retirees, this could mean that their dividend income becomes inadequate to cover their expenses over time. To mitigate this risk, retirees can invest in companies that regularly increase their dividends. Such 'dividend growers' can help offset the impact of inflation and provide a growing income stream. Inflation-protected securities, like Treasury Inflation-Protected Securities (TIPS), can also be a part of the investment mix to hedge against inflation risk. Closely linked to inflation is the issue of purchasing power. As prices rise, a dollar can buy less, impacting the real value of retirees' dividend income. Retirees must consider this risk in their planning and strive to grow their income to keep pace with rising costs. Investing in companies with a history of dividend growth can help to maintain purchasing power. These companies, by increasing their dividends, can help ensure that the income generated keeps up with or even outpaces inflation, thereby preserving the value of the retirement income. A key part of a dividend investment strategy is regular monitoring of the company's financial performance. By keeping an eye on a company's earnings, cash flow, and balance sheet, investors can anticipate potential problems that might impact the company's ability to pay dividends. Analyzing earnings reports, attending shareholder meetings, and following news about the company and its industry can provide valuable insights. If the financial performance starts to decline, it might be time to reconsider the investment. Just as important as monitoring individual companies is staying informed about broader market conditions. Economic factors, interest rate trends, and market cycles can all impact the performance of dividend-paying stocks. For instance, during a market downturn, companies may cut back on their dividends to conserve cash. Conversely, in a robust economy, companies may increase their dividends. By staying abreast of market conditions, investors can make timely adjustments to their dividend strategies. Investors must be ready to adjust their dividend allocations as needed. Changes in a company's financial health, shifts in market conditions, or changes in personal financial circumstances can all warrant adjustments. For example, if a company shows signs of prolonged financial distress, it might be wise to reduce the allocation to that stock. Similarly, if a better opportunity arises in another dividend-paying stock, investors may want to shift some of their investments. Rebalancing is an essential tool for managing risk and maintaining the desired level of diversification in a portfolio. Over time, some investments may grow faster than others, resulting in a portfolio that's disproportionately weighted toward certain stocks or sectors. Regular rebalancing helps keep the portfolio aligned with the investor's risk tolerance and investment goals. Rebalancing may involve selling shares in over-weighted investments and using the proceeds to buy more shares in under-weighted investments. Dividends can be a significant component of retirement income. To incorporate them into retirement planning, investors must understand and evaluate dividend-paying stocks carefully, considering factors such as dividend yield, growth, and sustainability. Additionally, maintaining a diversified portfolio and considering strategies such as DRIPs can contribute to a robust retirement income strategy. Maximizing dividend income involves selecting high-quality dividend stocks, reinvesting dividends, and targeting stocks with consistent dividend growth. Additionally, timing dividend payments to coincide with retirement expenses can provide a regular and predictable income stream. All these strategies require diligent monitoring and timely adjustments to respond to changing market conditions and personal circumstances.Overview of Dividends

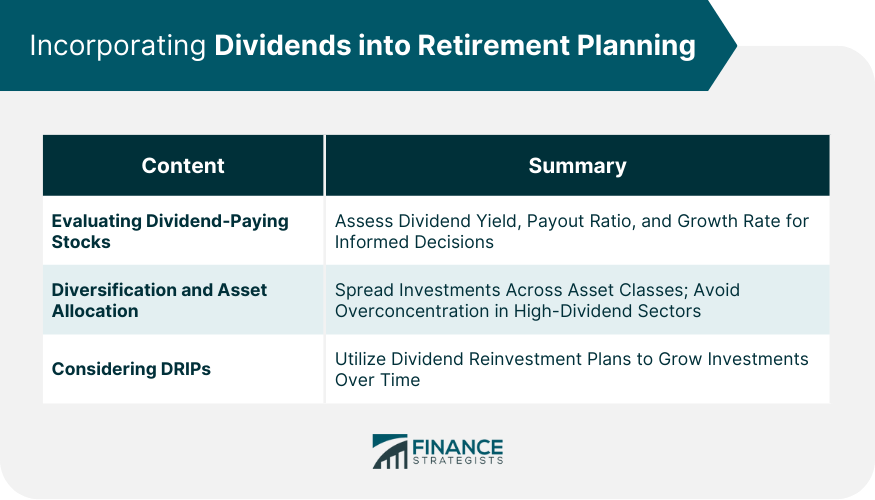

Incorporating Dividends Into Retirement Planning

Evaluating Dividend-Paying Stocks

Diversification and Asset Allocation

Considering Dividend Reinvestment Plans (DRIPs)

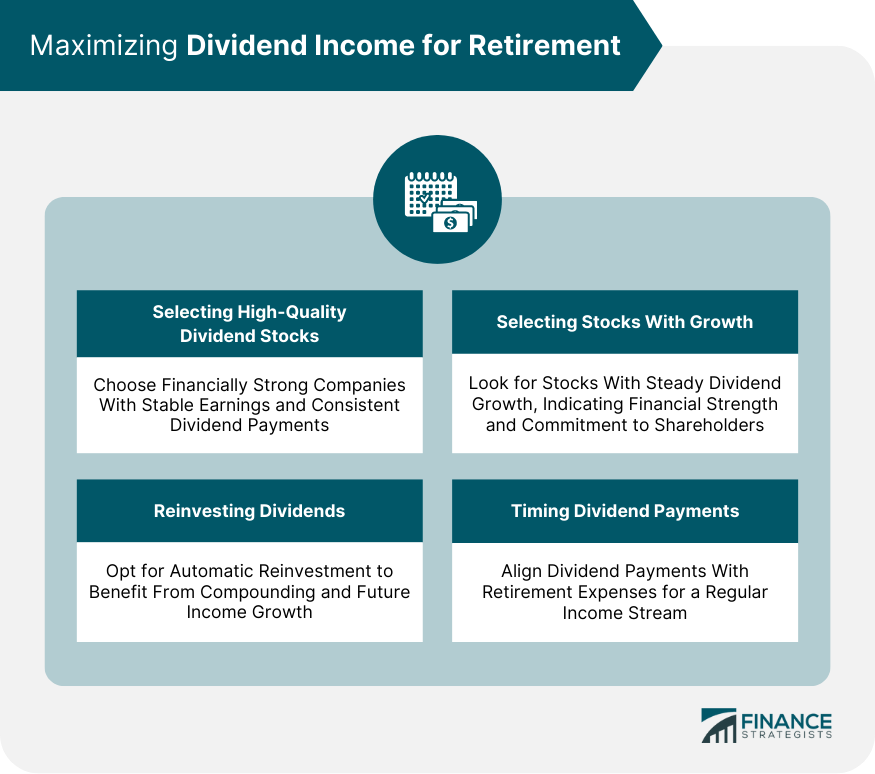

Maximizing Dividend Income for Retirement

Selecting High-Quality Dividend Stocks

Reinvesting Dividends

Selecting Dividend Stocks With Consistent Dividend Growth

Timing Dividend Payments With Retirement Expenses

Risks and Considerations

Dividend Sustainability

Inflation

Purchasing Power

Monitoring and Adjusting Dividend Strategies

Monitoring the Company's Financial Performance

Staying Informed About Market Conditions

Adjusting Dividend Allocations as Needed

Rebalancing the Portfolio

Conclusion

How to Use Dividends for Retirement Income? FAQs

Dividends are payments that companies distribute to their shareholders from their profits. To use dividends for retirement income, you can invest in dividend-paying stocks or funds. These investments provide regular cash payments, which can be a reliable source of income during retirement.

Using dividends for retirement income offers several advantages. First, dividends can provide a consistent stream of income, helping to supplement other sources like Social Security or pensions. Second, dividend payments tend to increase over time, offering potential inflation protection. Lastly, dividend stocks can appreciate in value, providing capital appreciation in addition to income.

Dividend income can be maximized by selecting high-quality dividend stocks, reinvesting dividends, selecting dividend stocks with consistent growth, and timing dividend payments with retirement expenses.

Key risks and considerations include the sustainability of dividends, inflation, and the purchasing power of the dividend income. To mitigate these risks, it's crucial to evaluate the financial health of the company paying the dividends, consider the impact of inflation, and strive to grow income to keep pace with rising costs.

Investors should regularly monitor the company's financial performance, stay informed about market conditions, adjust dividend allocations as needed, and rebalance their portfolios periodically to manage risk and maintain the desired level of diversification.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.