Retirement income refers to the total funds a person has to live on when they cease full-time work. This income typically comes from various sources, including Social Security benefits, pensions, personal savings, and investments such as 401(k)s and IRAs. The purpose of managing retirement income is to ensure financial security and a comfortable lifestyle during the post-employment phase of life. Accurate understanding and calculation of retirement income have a profound impact on individuals, enabling them to plan effectively, meet financial goals, and reduce stress about their future. In the context of an aging population and shifting pension schemes, understanding retirement income becomes even more essential, impacting financial decisions from early career years through to retirement.

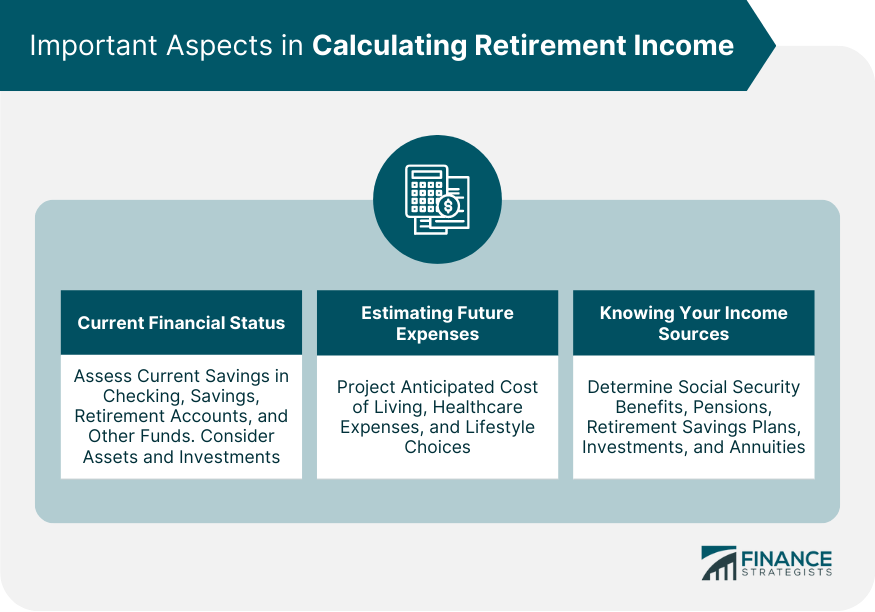

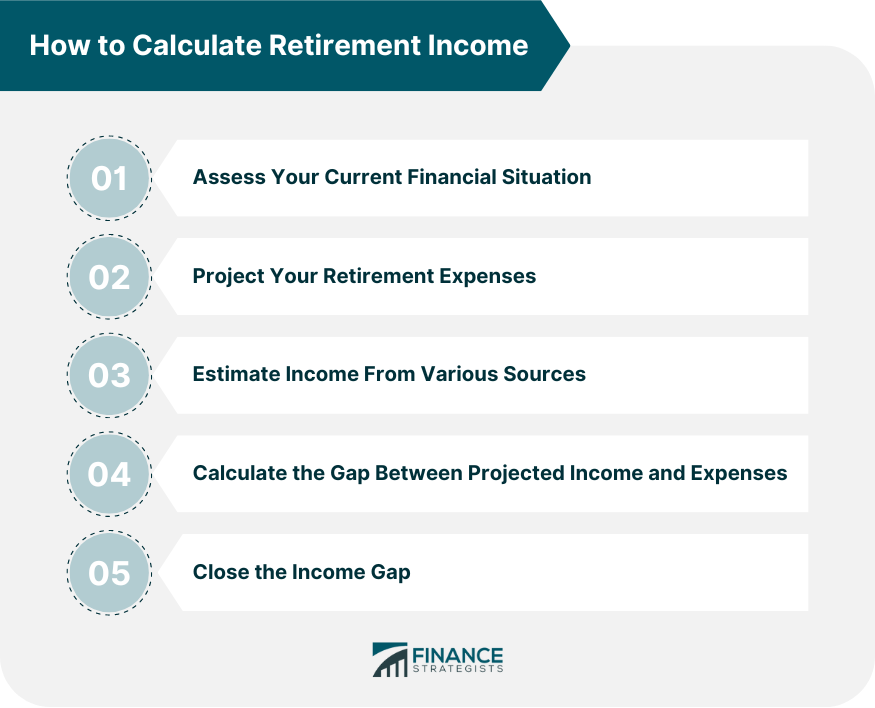

Calculating retirement income requires a comprehensive understanding of your current financial status, an estimate of your future expenses, and a clear picture of your potential income sources. Knowing your current financial status begins with an inventory of your savings. This includes money set aside in checking and savings accounts, retirement savings accounts, and any other funds intended for use during retirement. Next, consider your assets and investments. This could include the value of your home if you plan to downsize, as well as any investment portfolios, rental properties, or businesses. To calculate your retirement income, you need to project your future expenses. The first consideration is your anticipated cost of living, which can include housing, utilities, food, transportation, and entertainment. Healthcare expenses often increase as we age, so it’s essential to factor them into your future budget. Consider both your current health and your family health history when estimating these costs. Your lifestyle choices will significantly impact your retirement expenses. Will you travel extensively? Do you plan to relocate to a more expensive location? Are there hobbies you wish to pursue that might require substantial funding? Your Social Security benefits will form a significant part of your retirement income. The amount you receive depends on your work history and the age at which you start claiming benefits. Pensions can provide a steady income stream during retirement, although they are less common now. Also, consider how much you will withdraw each year from your retirement savings accounts. Investments can provide both income and growth potential. Annuities are insurance products that can provide a guaranteed income stream for a certain period of life, depending on the contract. Begin by taking stock of all your financial resources. This includes your current savings and investments, your projected Social Security benefits, and any pensions or other income sources you expect to have. Next, consider what your expenses will look like in retirement. Remember to factor in inflation and potential increases in healthcare costs. Consider your lifestyle goals and how they will affect your expenses. Calculate how much income you expect to receive from each of your identified sources. This can involve some guesswork, particularly when it comes to investments, but make your estimates as accurate as possible. Once you've estimated your retirement income and expenses, compare the two figures. If your projected income is less than your projected expenses, you will have a gap to fill. This gap represents the additional savings you need to accumulate before retirement. If there is a gap, consider strategies to close it. This could involve saving more, investing more aggressively, working longer, reducing your retirement expenses, or a combination of these strategies. Retirement income calculators can be a useful tool for estimating your retirement income. They can handle complex calculations and consider factors like inflation and taxes. 1. Personalization: Retirement income calculators allow you to input personal financial information, providing customized estimates based on individual financial situations. 2. Planning: They can be an excellent tool for retirement planning, helping you understand how much money you may need to retire comfortably. 3. Scenario Analysis: Many calculators allow you to change variables such as retirement age, investment returns, and annual savings, enabling you to explore different scenarios and strategies. 4. Understanding of Gap: They can help identify any gaps between your retirement income goal and your projected income, facilitating adjustments to savings or investment strategies. 5. Simplicity: Most calculators are user-friendly, making it easy for individuals to get a quick estimate of their retirement income without the need for complex calculations. 1. Accuracy: Calculators rely on assumptions (about inflation rates, life expectancy, rates of return, etc.), which can vary greatly. This can impact the accuracy of the projected retirement income. 2. Incomplete Picture: Many calculators focus mainly on financial assets and may not consider other income sources in retirement, such as social security, pensions, or part-time work. 3. Lack of Personal Advice: While calculators provide a good starting point, they can't replace personalized advice from a financial advisor who understands your complete financial situation and goals. 4. Underestimating Costs: Some calculators might not fully account for costs in retirement, such as healthcare expenses, which can be significant and increase over time. 5. Ignoring Market Risks: The calculators may not adequately account for potential investment risks and market fluctuations over the investment horizon. 1. Understand the Inputs: Ensure that you understand all the inputs required by the calculator. These may include current savings, annual contributions, retirement age, expected retirement expenses, and more. The more accurate your inputs, the more useful your results will be. 2. Consider Multiple Scenarios: Don't just run the calculator once. Try different scenarios such as changes in income, earlier or later retirement ages, different savings rates, or varying rates of return. This will give you a range of potential outcomes and can help you prepare for various situations. 4. Consider All Income Sources: Many retirement calculators focus primarily on investment income. Ensure you are also considering other income sources in retirement, such as social security, pensions, part-time work, or any rental income. 5. Seek Professional Advice: While retirement income calculators can provide valuable insights, they aren't a substitute for professional advice. Consider discussing your results with a financial advisor who can help you create a more comprehensive retirement plan. Planning for retirement income is a crucial step in securing a comfortable lifestyle in your golden years. Understanding your current financial status, estimating future expenses, and identifying potential income sources lay the foundation for successful retirement planning. Retirement income calculators can offer invaluable insights, although they come with limitations such as potential inaccuracies and not accounting for all income sources. Therefore, these tools should be complemented with professional advice. Additionally, considering multiple scenarios, updating calculations regularly, and taking into account all possible income sources can enhance the effectiveness of these calculators. Remember, a well-planned retirement income strategy can provide peace of mind and financial stability, enabling you to enjoy your retirement to the fullest.Retirement Income Overview

Basics of Calculating Retirement Income

Understanding Your Current Financial Status

Current Savings

Assets and Investments

Estimating Future Expenses

Cost of Living

Healthcare Expenses

Lifestyle Choices

Knowing Your Income Sources

Social Security Benefits

Pensions and Retirement Savings Plans

Investments and Annuities

How to Calculate Retirement Income

Assessing Your Current Financial Situation

Projecting Your Retirement Expenses

Estimating Income From Various Sources

Calculating the Gap Between Projected Income and Expenses

Strategies to Close the Income Gap

Utilizing Retirement Income Calculators

Advantages of Retirement Income Calculators

Limitations of Retirement Income Calculators

Tips on How to Use Income Calculators Effectively

3. Update Regularly: Your financial situation and goals can change over time. Make it a habit to revisit your calculations at least annually or whenever significant changes occur in your income, savings, or retirement goals.

Conclusion

How to Calculate Retirement Income FAQs

Learning how to calculate retirement income allows you to plan for the future effectively, ensuring that you have sufficient funds to maintain your desired lifestyle once you stop working. It helps identify any potential shortfall between your expected income and expenses, giving you time to adjust your savings or investment strategies.

To calculate retirement income from different sources, you need to estimate the amount you'll receive from each one. For example, you can use your Social Security statement to estimate your benefits, review your pension or 401(k) plan documents to predict your income from these sources, and calculate potential income from investments based on conservative growth rates.

If you're self-employed, you'll need to consider sources such as SEP IRAs, solo 401(k)s, or SIMPLE IRAs that you've set up for your retirement. Additionally, investments, rental income, or continued part-time work in your business might contribute to your retirement income. You may also be eligible for Social Security benefits based on your tax filings.

The retirement income gap is the difference between your estimated income in retirement and your projected expenses. You can calculate this by subtracting your projected retirement expenses from your estimated income. If you identify a gap, strategies to reduce it may include increasing your savings, adjusting your investment strategy, working longer, or planning to reduce expenses in retirement.

There are various tools available that can help you calculate retirement income. These include online retirement income calculators that take into account your savings, expected Social Security benefits, and potential income from investments. These calculators also consider factors like estimated retirement expenses, inflation, and taxes. However, they should be used as a guide rather than a definitive solution, as they're based on assumptions that might not reflect your exact situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.