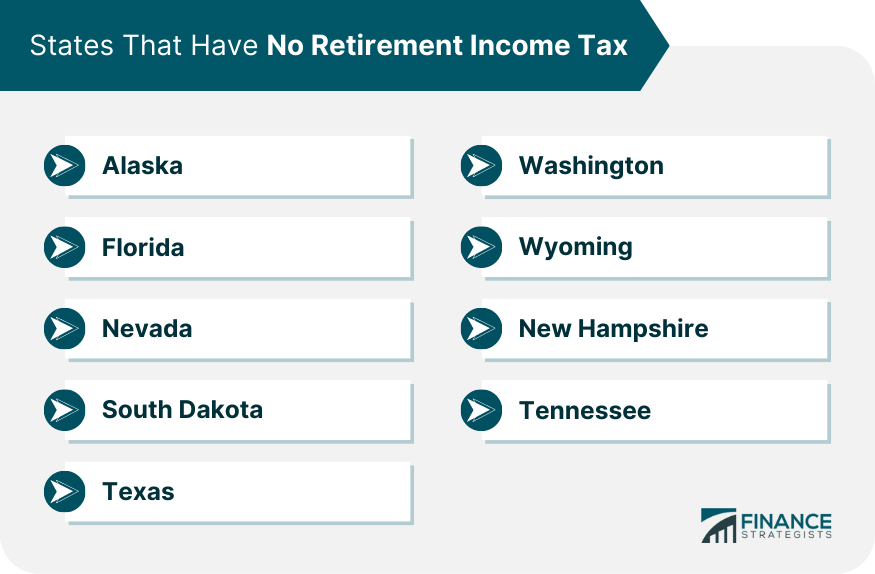

The taxation of retirement income varies considerably across states in the U.S. The types of retirement income typically subject to state taxes include Social Security benefits, pensions, and distributions from 401(k) plans and Individual Retirement Accounts (IRAs). However, some states fully exempt certain types of retirement income, while others may tax them partially or fully. As of 2024, eleven states tax Social Security benefits to varying degrees. Furthermore, nine states, including Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire, and Tennessee, have no income tax at all. Therefore, retirement income is not taxed. The exact rules and rates depend on each state's tax laws and fiscal policies and may change over time. Therefore, understanding state-specific rules is crucial for retirement planning. While Social Security benefits are exempt from federal tax up to a certain level, eleven states, as of 2024, tax them to varying degrees. These are Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia. Taxation of pensions depends on the state. Some states, like Alabama and Illinois, exempt all pension income, while others tax pension income fully or partially. 401(k) and IRA distributions are usually fully taxable at your income rate, but some states offer exemptions or exclusions, particularly for retirees over a certain age. Federal law establishes the overall framework for taxation, but states have considerable discretion in determining their tax policies within this framework. This leads to a wide variation in tax burdens across states. The economic condition of a state can influence its tax policies. States with strong economies and stable revenue sources may be able to offer generous tax breaks to retirees, while those struggling financially might levy higher taxes. An individual’s tax liability can also depend on their residency status and income level. For example, states may have different tax rules for part-year residents or non-residents. Additionally, retirees with higher incomes might pay more taxes due to progressive tax structures. Many states offer specific exemptions and credits for retirees. These could include exemptions for Social Security income, military pensions, public pensions, and more. Such provisions could significantly reduce the tax burden for retirees. When planning for retirement, one must consider not just the sunnier climate or lower cost of living but also the tax implications. A state with a lower cost of living but high taxes might end up costing more in the long run. Strategies for minimizing retirement income tax include choosing to live in a tax-friendly state, leveraging state-specific tax breaks, and optimizing the types of income you receive in retirement. Given the complexity of state tax laws, it might be beneficial to seek advice from a tax professional. They can provide personalized advice based on your specific circumstances. Several states have recently made changes to their tax policies affecting retirees. For example, Illinois is considering changing its constitution to allow for the taxation of retirement income, while Colorado recently lowered the age at which retirees can claim an exemption for retirement income. The financial strain of the COVID-19 pandemic may prompt more states to reconsider their tax policies. While it's hard to predict what changes might occur, retirees should keep abreast of potential changes and consider how they might affect their retirement finances. Understanding the taxation of retirement income across various states is essential for effective retirement planning. States employ diverse methods to tax income sources like Social Security benefits, pensions, and distributions from 401(k) plans and IRAs. Nine states, as of 2024, levy no income tax, while eleven states tax Social Security benefits. Residency status, income level, and state-specific exemptions all influence tax liability. Recognizing these nuances can aid in strategizing to minimize tax burdens, emphasizing the necessity of professional advice for personalized planning. Furthermore, state tax laws are subject to change, influenced by fiscal policy, economic conditions, and external pressures, such as the financial aftermath of the COVID-19 pandemic. Keeping abreast of these changes and their potential impact on retirement finances is crucial for maintaining a secure financial future in retirement.How Do States Tax Retirement Income?

Understanding Taxation of Specific Types of Retirement Income

Taxation of Social Security Benefits

Taxation of Pension Benefits

Taxation of 401(k) and IRA Distributions

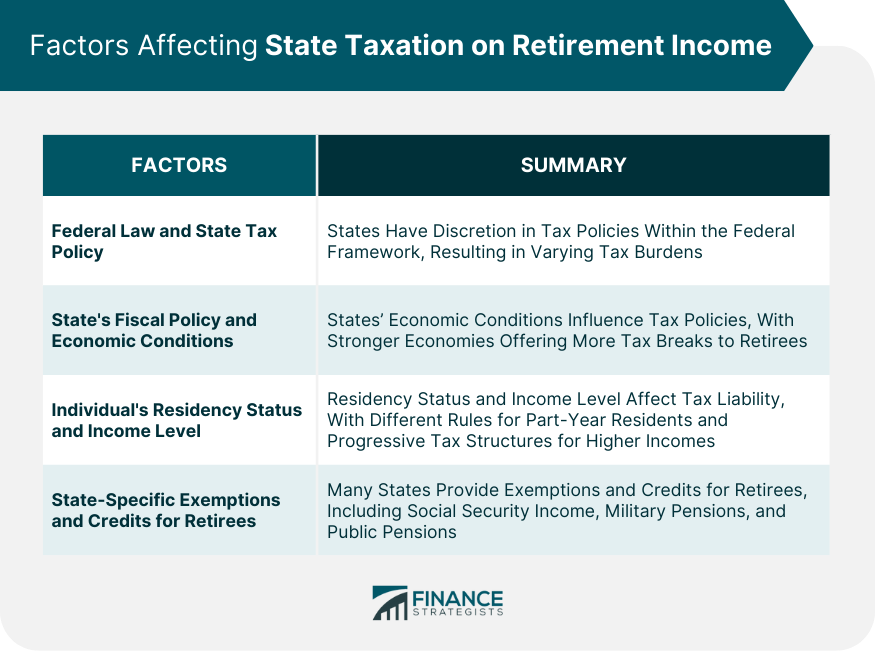

Factors Affecting State Taxation on Retirement Income

Federal Law and State Tax Policy

State's Fiscal Policy and Economic Conditions

Individual’s Residency Status and Income Level

State-Specific Exemptions and Credits for Retirees

Planning for Retirement Income Tax

Importance of Considering State Taxes

Strategies for Minimizing Retirement Income Tax

Seeking Professional Advice

Recent Trends and Changes in State Taxation of Retirement Income

Recent Policy Changes and Their Impact on Retirees

Potential Future Changes and Their Implications

Conclusion

How Do States Tax Retirement Income? FAQs

Social Security benefits are taxed depending on the state. As of 2023, thirteen states tax Social Security benefits to some extent: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont, and West Virginia.

The taxation of pension and 401(k) income varies by state. Some states fully exempt these types of income from taxes, others tax them partially, and a few tax them fully. For example, Alabama and Illinois fully exempt all pension income, while states like California tax these income sources fully.

Residency status can affect how retirement income is taxed in a state. For instance, some states may have different tax rules for part-year residents or non-residents. Additionally, states may have progressive tax structures, meaning that retirees with higher income might pay more taxes.

Yes, there are states that do not levy any income tax, hence retirement income is not taxed. These states include Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, Tennessee, New Hampshire as of 2023.

Recent trends and future changes in state tax policy depend on a variety of factors, including the state's fiscal situation, policy decisions, and external factors like the impact of the COVID-19 pandemic. It's important for retirees to keep abreast of potential changes in their state's tax policies to manage their retirement finances effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.