Baby Boomers are the generation born between 1946 and 1964, during the post-World War II baby boom. This generation has been a major force in shaping the cultural, economic, and social landscape of the United States and other countries. Baby Boomers are known for their work ethic, ambition, and desire for personal growth. They have witnessed significant historical events, such as the Civil Rights Movement, the Vietnam War, and the rise of the internet. They value hard work, independence, and loyalty to institutions and are often seen as the "sandwich generation," taking care of both their aging parents and their adult children. As Baby Boomers reach retirement age, many face unique challenges in planning for a secure and comfortable retirement. Retirement planning is crucial to ensure that they can maintain their desired lifestyle, afford healthcare costs, and manage the financial risks associated with living longer. There are over 69 million Baby Boomers in the United States, making up about 20% of the total population. Their sheer numbers have had a significant impact on various industries, including housing, healthcare, and social services. As Baby Boomers retire, there is a growing demand for services and resources tailored to their needs. Baby Boomers were born between 1946 and 1964, with the oldest members of the generation turning 80 in 2024 and the youngest turning 60. As they reach retirement age, the impact of this generation on the economy and social systems will continue to be felt. Baby Boomers are dispersed throughout the United States, with significant concentrations in states such as California, Texas, and Florida. As they retire, many choose to relocate to areas with warmer climates, affordable housing, and access to healthcare services, which can impact local economies and real estate markets. Baby Boomers are living longer than previous generations, with an average life expectancy of 84 years for men and 86 years for women. This increased longevity creates financial challenges, as retirees need to ensure they have enough savings and income to last throughout their retirement years. Many Baby Boomers have not saved enough for retirement, with nearly half having less than $100,000 in retirement savings. This lack of savings can create financial strain and force retirees to rely heavily on Social Security benefits or continue working past retirement age. Healthcare costs continue to rise, posing a significant challenge for Baby Boomers in retirement. A 65-year-old couple retiring in 2022 would need an estimated $315,000 to cover healthcare expenses throughout retirement. This figure does not include long-term care costs, which can be substantial. Over the past few decades, there has been a shift from defined benefit pension plans, which provide a guaranteed income for life, to defined contribution plans, such as 401(k)s, which place the investment risk on the individual. This shift has increased the responsibility of Baby Boomers to manage their retirement savings and investment strategies. The future of Social Security benefits is uncertain, with the program facing potential funding shortfalls. While benefits are unlikely to disappear entirely, Baby Boomers must be prepared for potential changes to the system, such as reduced benefits or delayed retirement age. Baby Boomers should start by evaluating their current financial situation, including savings, investments, debt, and anticipated expenses in retirement. They should also consider factors such as life expectancy, inflation, and potential healthcare costs. By assessing their retirement readiness, Baby Boomers can identify areas where they need to adjust their savings and investment strategies to meet their retirement goals. To ensure a stable retirement income, Baby Boomers should diversify their income sources. This can include a combination of Social Security benefits, pensions, investment income, part-time employment, and annuities. By relying on multiple income streams, retirees can mitigate the risks associated with relying solely on one source of income. Baby Boomers should be strategic about when and how they claim Social Security benefits. By delaying claiming benefits until full retirement age or beyond, they can increase their monthly benefit amount. Additionally, they should consider strategies such as coordinating spousal benefits or using a restricted application to maximize their benefits. Navigating healthcare options in retirement is crucial for Baby Boomers. They should familiarize themselves with Medicare coverage, including Parts A, B, C, and D, and consider supplemental insurance options, such as Medigap policies. Baby Boomers should also review their healthcare needs regularly and adjust their coverage as necessary. As Baby Boomers age, they may require long-term care services, such as assisted living or nursing home care. Planning for long-term care expenses is essential, as these costs can quickly deplete retirement savings. Baby Boomers should explore options such as long-term care insurance, reverse mortgages, or savings specifically earmarked for long-term care costs. As Baby Boomers approach retirement, they should reassess their asset allocation to ensure it aligns with their risk tolerance and retirement goals. This may involve shifting to a more conservative investment mix, focused on preserving capital and generating income while still maintaining some exposure to growth assets. When constructing a retirement portfolio, Baby Boomers should consider factors such as income needs, tax implications, and investment time horizon. They should also periodically review and rebalance their portfolio to ensure it remains aligned with their objectives. To supplement their retirement income, Baby Boomers should consider incorporating income-generating investments into their portfolio. This can include dividend-paying stocks, bonds, real estate investment trusts (REITs), and annuities. Minimizing taxes is an essential part of retirement planning. Baby Boomers should explore tax-efficient investment strategies, such as utilizing tax-advantaged accounts like IRAs and 401(k)s, strategically withdrawing from taxable and tax-deferred accounts, and considering municipal bonds for tax-free income. As Baby Boomers plan for retirement, they should also address estate planning and wealth transfer strategies. This can involve updating wills, establishing trusts, and ensuring beneficiary designations are up-to-date. By addressing these issues, Baby Boomers can help preserve their wealth for future generations and minimize potential estate taxes. Many Baby Boomers prefer to remain in their homes during retirement. To do so, they may need to make modifications to their homes to accommodate their changing needs, such as installing grab bars, widening doorways, or adding ramps. Aging in place can be a cost-effective and comfortable option for retirees who want to maintain their independence and community connections. Downsizing to a smaller home or condo can help Baby Boomers reduce housing expenses and maintenance responsibilities. This can also free up equity to bolster their retirement savings or fund other retirement expenses. Active adult communities cater specifically to individuals aged 55 and older, offering a range of housing options, amenities, and social activities. These communities often feature recreational facilities, clubs, and organized events that promote social interaction and physical activity, making them an attractive option for Baby Boomers seeking an active and engaged lifestyle in retirement. Assisted living facilities provide a higher level of care and support for retirees who need assistance with daily activities, such as bathing, dressing, or meal preparation. These facilities offer a combination of housing, personalized care, and social activities in a supportive environment, allowing Baby Boomers to maintain their independence while receiving the necessary care and assistance. CCRCs provide a comprehensive range of care options, from independent living to skilled nursing care, all within the same community. This allows Baby Boomers to transition between different levels of care as their needs change without having to relocate. CCRCs often require an upfront entrance fee and monthly fees, which can be substantial but provide long-term security and peace of mind. Maintaining social connections and support networks is crucial for the well-being of Baby Boomer retirees. Staying socially engaged can help prevent loneliness, improve mental and emotional health, and contribute to a higher quality of life. Retirees should prioritize nurturing existing relationships and forming new connections through clubs, organizations, or volunteer opportunities. Volunteering and community involvement offer Baby Boomers a chance to give back, stay connected, and find purpose in retirement. By engaging in meaningful volunteer work, retirees can stay active, develop new skills, and create social connections with like-minded individuals. Pursuing lifelong learning and skill development can enrich the lives of Baby Boomer retirees, keeping their minds sharp and promoting personal growth. Many educational institutions and community organizations offer classes and workshops specifically designed for older adults, covering topics such as art, technology, and personal finance. Prioritizing health and wellness is essential for Baby Boomers in retirement. This includes regular exercise, a balanced diet, and regular check-ups with healthcare providers. Many communities and senior centers offer fitness classes and wellness programs tailored to the needs of older adults. Travel and leisure activities can provide Baby Boomers with new experiences, opportunities to learn, and a sense of adventure during retirement. Retirees can explore a variety of travel options, including group tours, cruises, or solo adventures, depending on their interests, budget, and mobility. Baby Boomers, born between 1946 and 1964, have had a significant impact on society and face unique challenges in retirement. With over 69 million in the US alone, their demographic influence is substantial. However, longer life expectancy, insufficient savings, rising healthcare costs, the shift from defined benefit to defined contribution plans, and Social Security uncertainty pose challenges to their retirement security. To overcome these challenges, Baby Boomers should assess their retirement readiness, diversify income sources, maximize Social Security benefits, plan for healthcare and Medicare options, and consider long-term care planning. If you are a Baby Boomer seeking guidance on retirement planning, it is highly recommended to consult with a professional financial planner or retirement expert to help you develop a personalized plan tailored to your unique needs and goals.What Is a Baby Boomer?

Demographics of Baby Boomers

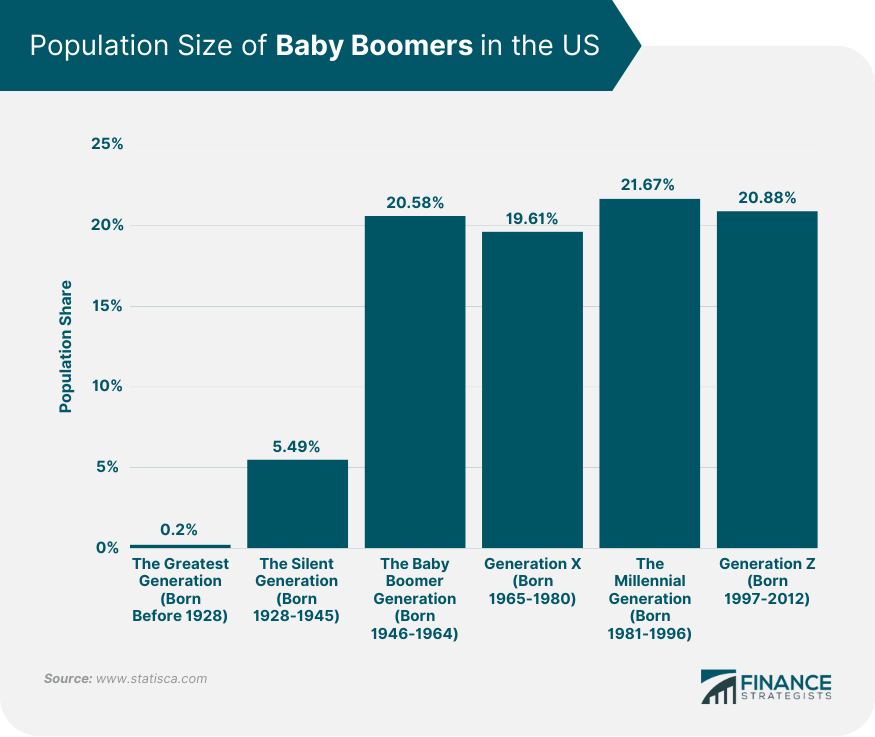

Population Size and Impact

Birth Years and Age Range

Geographic Distribution

Baby Boomer Retirement Challenges

Longer Life Expectancy

Insufficient Savings

Rising Healthcare Costs

Shift From Defined Benefit to Defined Contribution Plans

Social Security Uncertainty

Retirement Planning Strategies for Baby Boomers

Assessing Retirement Readiness

Diversifying Income Sources

Maximizing Social Security Benefits

Healthcare Planning and Medicare Options

Long-Term Care Planning

Investment Strategies for Baby Boomers

Asset Allocation and Risk Management

Retirement Portfolio Considerations

Income-Generating Investments

Tax-Efficient Investing

Estate Planning and Wealth Transfer

Housing Options for Baby Boomers in Retirement

Aging in Place

Downsizing

Active Adult Communities

Assisted Living Facilities

Continuing Care Retirement Communities (CCRCs)

Social and Lifestyle Considerations for Baby Boomer Retirees

Social Engagement and Support Networks

Volunteer Opportunities and Community Involvement

Lifelong Learning and Skill Development

Health and Wellness

Travel and Leisure

Final Thoughts

Baby Boomer FAQs

The Baby Boomer generation consists of individuals born between 1946 and 1964.

Baby Boomers face challenges such as longer life expectancies, insufficient savings, rising healthcare costs, the shift from defined benefit to defined contribution plans, and Social Security uncertainty.

Baby Boomers can maximize their Social Security benefits by strategically delaying their claiming age, coordinating spousal benefits, and utilizing restricted applications when appropriate.

Popular housing options for Baby Boomers in retirement include aging in place, downsizing, active adult communities, assisted living facilities, and Continuing Care Retirement Communities (CCRCs).

Social engagement is important for Baby Boomer retirees because it helps prevent loneliness, improves mental and emotional health, and contributes to a higher quality of life.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.