The 5-Year Rule is a crucial concept in retirement planning, specifically concerning Individual Retirement Accounts (IRAs) and Roth IRAs. It determines the eligibility of tax-free withdrawals from these accounts and helps investors avoid potential penalties. Understanding the 5-Year Rule can significantly impact your retirement planning, as it influences your investment strategies and tax implications. This comprehensive article will discuss the 5-Year Rule in the context of IRAs and Roth IRAs, as well as its importance in retirement planning. A Traditional IRA is a tax-deferred retirement account that allows individuals to contribute pre-tax dollars. The contributions are tax-deductible, and the investments grow tax-deferred until withdrawn in retirement. Withdrawals are generally taxed as ordinary income, and required minimum distributions (RMDs) must begin at age 73. A Roth IRA is a retirement account that allows individuals to contribute after-tax dollars. The contributions are not tax-deductible, but the investments grow tax-free, and qualified withdrawals are tax-free in retirement. Unlike Traditional IRAs, Roth IRAs do not have RMDs, allowing for more flexible retirement planning. The main differences between Traditional and Roth IRAs lie in their tax treatment and distribution rules. While Traditional IRA contributions are tax-deductible and grow tax-deferred, Roth IRA contributions are not tax-deductible but grow tax-free. Additionally, Traditional IRAs have RMDs, whereas Roth IRAs do not. The 5-Year Rule for Roth IRA contributions states that an investor must have held their Roth IRA for at least five years before making qualified withdrawals. Qualified withdrawals are tax-free and penalty-free if the account holder is at least 59 1/2 years old, has become disabled, or uses the withdrawal for a first-time home purchase (up to a $10,000 lifetime limit). The five-year period begins on January 1 of the tax year in which the first contribution was made. For example, if you made your first Roth IRA contribution in April 2022 for the tax year 2021, the 5-Year Rule would be satisfied on January 1, 2026. If a Roth IRA holder withdraws earnings before satisfying the 5-Year Rule and meeting one of the qualifying criteria, the withdrawal is subject to income taxes and a 10% early withdrawal penalty. However, Roth IRA holders can always withdraw their contributions tax-free and penalty-free, regardless of the 5-Year Rule or their age. When an investor converts a Traditional IRA or another pre-tax retirement account to a Roth IRA, the 5-Year Rule also applies. The converted funds must remain in the Roth IRA for at least five years before being withdrawn tax-free and penalty-free. This five-year period begins on January 1 of the year the conversion took place. If an investor withdraws the converted funds before the five-year period has elapsed, they may be subject to a 10% early withdrawal penalty. However, the penalty only applies to the taxable portion of the conversion, and the withdrawal is still tax-free since taxes were paid at the time of conversion. When a beneficiary inherits a Roth IRA, the 5-Year Rule also comes into play. If the original account owner held the Roth IRA for at least five years before their death, the beneficiary can withdraw earnings tax-free. However, if the original account owner did not satisfy the 5-Year Rule before their death, the beneficiary must wait until the five-year period is completed to withdraw earnings tax-free. Beneficiaries of Roth IRAs must follow specific distribution rules. Non-spouse beneficiaries must either withdraw the entire account balance within ten years of the original owner's death or take required minimum distributions (RMDs) over their life expectancy, depending on the account owner's death date. Spousal beneficiaries can choose to treat the inherited Roth IRA as their own or follow similar distribution rules as non-spouse beneficiaries. If the 5-Year Rule is not met before the beneficiary withdraws earnings, the earnings may be subject to income taxes. However, there will be no penalties for early withdrawal in this case. In the context of Traditional IRAs, the 5-Year Rule applies to early withdrawals made using the Substantially Equal Periodic Payments (SEPP) exception. SEPP allows account holders to withdraw funds from their Traditional IRA before age 59 1/2 without incurring the 10% early withdrawal penalty. To qualify for the SEPP exception, the account holder must commit to taking substantially equal periodic payments from their IRA for the longer of five years or until they reach age 59 1/2. The five-year period begins with the first SEPP withdrawal. While the SEPP withdrawals avoid the 10% early withdrawal penalty, they are still subject to income taxes. Additionally, if the account holder modifies or stops the SEPP withdrawals before the end of the five-year period or before they reach age 59 1/2, the 10% early withdrawal penalty will apply retroactively to all SEPP withdrawals taken. Understanding the 5-Year Rule can help investors time their Roth IRA contributions and conversions strategically. For example, an investor may choose to open and fund a Roth IRA early, even with a small contribution, to start the five-year clock. Similarly, investors planning to convert their Traditional IRA to a Roth IRA should consider the timing of the conversion to satisfy the 5-Year Rule before their anticipated retirement or withdrawal needs. When planning for retirement, investors should consider their financial needs and goals in conjunction with the 5-Year Rule. This includes evaluating their expected retirement expenses, potential tax implications, and the benefits of tax-free withdrawals from Roth IRAs. By understanding how the 5-Year Rule impacts their retirement planning, investors can make more informed decisions about their investment strategies. Given the complexities of the 5-Year Rule and its implications on retirement planning and tax liabilities, it is crucial to consult with a financial advisor. A financial advisor can help investors navigate the intricacies of the 5-Year Rule, develop a tailored retirement plan, and ensure that their investment strategies align with their financial goals and objectives. Understanding the 5-Year Rule is essential for successful retirement planning, as it directly impacts the tax treatment and withdrawal eligibility of IRAs and Roth IRAs. By grasping the nuances of the 5-Year Rule, investors can make more informed decisions about their contributions, conversions, and withdrawals, ultimately optimizing their retirement planning strategies. Given the complexities of the 5-Year Rule and its implications on tax liabilities and investment strategies, it is highly recommended that investors seek professional guidance from a financial advisor. A knowledgeable financial advisor can help navigate the intricacies of the 5-Year Rule, develop a tailored retirement plan, and ensure that investment strategies align with the investor's financial goals and objectives. By incorporating the 5-Year Rule into their retirement planning and working with a financial advisor, investors can maximize their tax benefits, avoid potential penalties, and achieve their long-term financial goals.What Is the 5-Year Rule?

Overview of Individual Retirement Accounts (IRAs)

Traditional IRA

Roth IRA

Differences Between Traditional and Roth IRAs

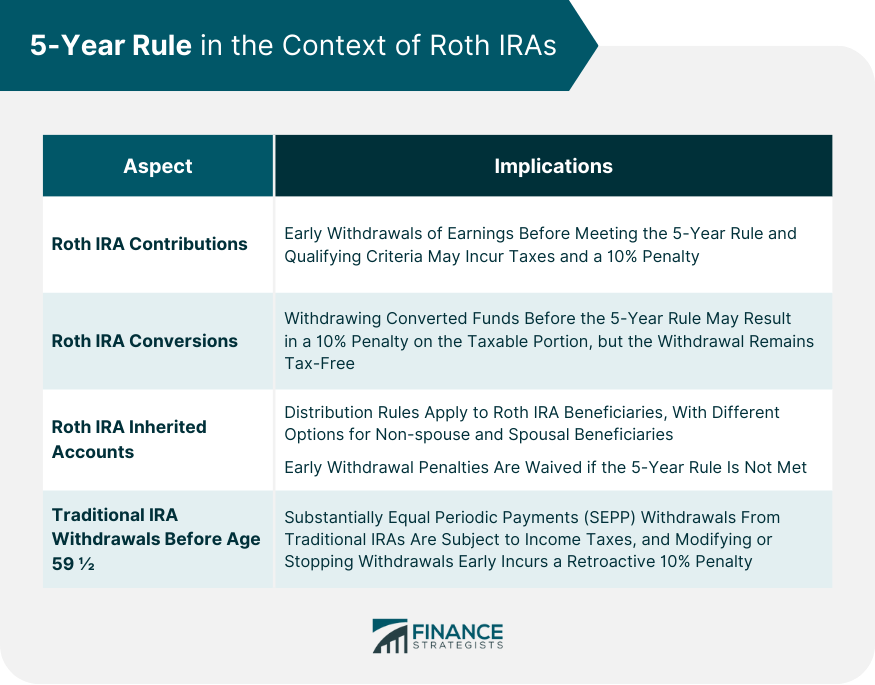

The 5-Year Rule in the Context of Roth IRAs

Roth IRA Contributions

The 5-Year Rule for Qualified Withdrawals

Exceptions and Penalties

Roth IRA Conversions

The 5-Year Rule for Converted Funds

Tax Implications and Penalties

Roth IRA Inherited Accounts

The 5-Year Rule for Beneficiaries

Distribution Requirements and Tax Implications

The 5-Year Rule in the Context of Traditional IRAs

Traditional IRA Withdrawals Before Age 59 1/2

The 5-Year Rule for Substantially Equal Periodic Payments (SEPP)

Tax Implications and Penalties

Planning Strategies and Considerations

Timing of Roth IRA Contributions and Conversions

Assessing Financial Needs and Goals

Consultation With a Financial Advisor

Conclusion

5-Year Rule FAQs

The 5-Year Rule is a requirement for tax-free withdrawals from a Roth IRA converted from a traditional IRA. The rule mandates that the account must be open for at least five years before any tax-free withdrawals can be made.

Inherited Roth IRAs are subject to the 5-Year Rule if the original account owner had not met the requirement. The rule applies to the inherited account's age, meaning the five-year countdown begins from the year the original owner first opened their Roth IRA.

No, the 5-Year Rule only applies to tax-free withdrawals of converted funds from Roth IRAs. It does not apply to contributions, which can be withdrawn tax-free at any time, or earnings, which have separate requirements.

If you withdraw converted funds from your Roth IRA before the end of the 5-year period, you may be subject to taxes and penalties. However, exceptions apply, such as qualified distributions for certain expenses or due to disability or death.

No, the 5-Year Rule cannot be reset for an individual Roth IRA account. However, if a new contribution is made to a different Roth IRA account, the clock for that account's 5-Year Rule will start at the time of the contribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.