In the financial world, the term "flip" typically refers to a quick change in investment position or direction. Investors "flip" when they quickly buy and sell assets in the hope of making a quick profit from short-term price swings or changes in market sentiment. The specific meaning of "flip" can vary depending on the context and the type of investment, but it always involves a rapid change in position. Flipping is a strategy that can be applied across multiple investment areas, including technical trading, real estate investment, initial public offerings (IPOs), and professional fund management. Each area presents unique opportunities and challenges for flipping, requiring tailored strategies and risk management measures. In technical trading, flipping refers to the act of quickly changing one's trading position in response to perceived changes in market trends. Traders who flip may go from being long (buying with the expectation of a price increase) to short (selling with the expectation of a price decrease), or vice versa, based on their interpretation of price action or other technical indicators. Technical traders use a variety of strategies when flipping. For example, they may employ swing trading, where they attempt to capture gains in a stock or other financial instrument within an overnight hold to several weeks. They could also use day trading techniques, where positions are entered and exited within the same trading day. The potential returns from flipping in technical trading can be substantial, particularly in volatile markets where price swings are large and frequent. However, the risks are also significant. Rapid changes in market conditions can lead to substantial losses, and the short-term nature of flipping means there is little room for error. Traders need to have a solid understanding of technical analysis and a well-thought-out trading plan to manage these risks effectively. In the realm of real estate, flipping involves buying properties and then selling them quickly for a profit. This usually involves some level of renovation or improvement to increase the property's value before selling, although it can also simply involve taking advantage of rapidly rising property prices. A typical real estate flip involves several key steps. Firstly, the investor must find a suitable property that can be bought at a price that allows for potential profit. This may involve extensive market research and property inspections. Once a property has been purchased, the investor will then typically carry out renovations or improvements to increase its value. Finally, the property is sold, hopefully at a substantial profit. Flipping real estate can yield high returns if property prices are rising and the investor is able to add value through renovations. However, it also involves significant risks. Property prices can fall, renovations can end up costing more than expected, and properties can take longer to sell than planned. These factors can all eat into potential profits or even result in a loss. IPO flipping involves buying shares in a company when it first goes public and then selling them quickly for a profit. This strategy is based on the tendency for IPOs to experience a "first-day pop" in price as market demand outstrips the initial supply of shares. Investors looking to flip IPOs will typically apply for shares as part of the IPO process. If they are allocated shares, they will then aim to sell them on the first day of trading or shortly thereafter to take advantage of any initial price pop. However, not all IPOs experience such a pop, and some can even fall in price on the first day of trading. While the potential returns from a successful IPO flip can be significant, the risks are also high. If the IPO does not perform as expected, the flipper could end up selling shares at a loss. In addition, access to IPO shares is often limited, and many retail investors may be unable to participate in this type of flipping. In professional fund management, flipping refers to the practice of rapidly switching between different asset classes based on changing market conditions or investment outlooks. This could involve flipping between stocks, bonds, cash, commodities, or other asset classes. The strategy behind asset class flipping is based on the idea that different asset classes perform better in different market conditions. For example, stocks might perform well during periods of economic growth, while bonds might perform better during periods of economic uncertainty or downturn. By flipping between asset classes, fund managers aim to capture the best returns from each market condition. Asset class flipping can enhance returns and manage risk by taking advantage of changing market conditions. However, it also involves risks. Timing the market is notoriously difficult, and incorrect calls can lead to missed opportunities or losses. In addition, frequent trading can result in higher transaction costs, which can eat into returns. Successful flipping hinges on several factors. Key among them is the understanding of market trends and the ability to accurately predict short-term price movements. Additionally, access to relevant and timely information, sufficient capital to absorb potential losses, and a well-defined risk management strategy are also important. Market conditions significantly influence flipping strategies. For example, volatile markets with large price swings can provide opportunities for technical traders, while a booming real estate market can favor property flippers. Conversely, unfavorable market conditions, such as a recession or a bear market, can pose substantial risks to flipping strategies. Long-term flipping strategies, though less prevalent, involve retaining an asset for an extended period before selling it for a profit. This approach is typically associated with real estate investments, where an investor may purchase a property, make substantial improvements over time, and then sell it years later when the property value has significantly increased. A noteworthy aspect of long-term flipping is that it often necessitates a more substantial initial investment. This is due to the extended holding period, which may require ongoing expenses such as maintenance costs, property taxes, or mortgage payments. Moreover, long-term flipping involves a higher level of risk, especially due to market volatility over time. However, these risks can be mitigated through careful planning, research, and diversification. Despite the increased risk and larger initial investment, long-term flipping can lead to higher returns. This is because asset values, particularly real estate, generally appreciate over time. Additionally, long-term flipping allows for more substantial improvements or renovations that can significantly increase the value of an asset. On the opposite end of the spectrum, short-term flipping is a strategy where an asset is purchased and sold within a relatively short period, often within a year. This strategy is more prevalent due to its lower risk profile and quicker turnover, making it a popular choice among new investors or those with limited capital. Short-term flipping typically involves a smaller initial investment. The costs associated with the holding period, such as maintenance or mortgage payments, are also reduced due to the shorter timeframe. Regarding risk, short-term flipping is generally perceived as less risky because the asset is not subject to long-term market volatility. While the returns from short-term flipping are generally smaller than those from long-term flipping, they can still be substantial if executed correctly. The key lies in identifying undervalued assets, improving them quickly and efficiently, and selling them at a higher price. This strategy requires a keen understanding of the market and the ability to make quick, informed decisions. Flipping, particularly when done on a large scale, can contribute to market volatility and instability. This is because it can lead to significant price swings and market unpredictability, impacting other investors and the market as a whole. Depending on the jurisdiction and the specific type of investment, flipping can sometimes fall afoul of legal and regulatory requirements. For instance, flipping IPO shares is discouraged or even prohibited by some brokerages and regulators due to the potential for market manipulation. There's an ongoing debate about the ethical implications of flipping. While some argue that it's a legitimate investment strategy, others contend that it can lead to market instability, harm long-term investors, and contribute to economic inequality. Flipping is an investment strategy that offers potential rewards but also carries significant risks. Whether you're considering technical trading, real estate flipping, IPO flipping, or professional fund management, it's crucial to approach these strategies with a well-thought-out plan and an understanding of the associated risks. Flipping can be enticing for generating short-term profits, but it's important to consider the long-term implications and ethical considerations. It can contribute to market instability and may not be suitable for all investors. Take the initiative to reach out to a trusted wealth management advisor who can guide you through the intricacies of flipping and other strategies. With their expertise and support, you enhance your chances of success while minimizing potential pitfalls.What Is Flip?

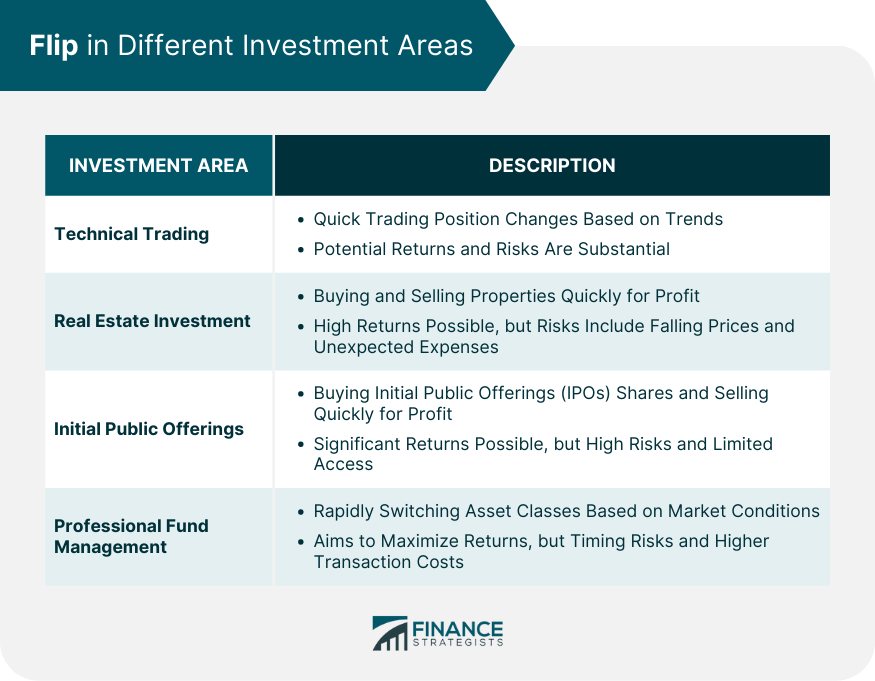

Concept of Flip in Different Investment Areas

Flipping in Technical Trading

Strategies Used by Traders

Risks and Potential Returns

Flipping in Real Estate Investment

Steps in a Typical Real Estate Flip

Risks and Potential Returns

Flipping in Initial Public Offerings (IPOs)

How IPO Flipping Works

Risks and Potential Returns

Flipping in Professional Fund Management

Strategy of Asset Class Flipping

Risks and Potential Returns

Detailed Analysis of Flipping Strategies

Factors Influencing Successful Flipping

Impact of Market Conditions on Flipping

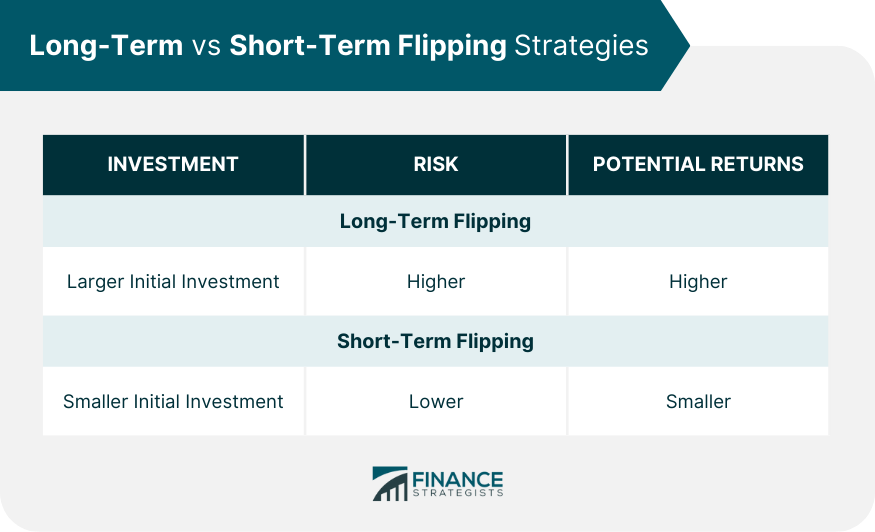

Long-Term vs Short-Term Flipping Strategies

Long-Term Flipping Strategies

Investment and Risk in Long-Term Flipping

Potential Returns From Long-Term Flipping

Short-Term Flipping Strategies

Investment and Risk in Short-Term Flipping

Potential Returns from Short-Term Flipping

Ethical Considerations in Flipping Investments

Impact of Flipping on Market Stability

Legal and Regulatory Aspects of Flipping

Ethical Debate Around Flipping Practices

Final Thoughts

Flip FAQs

In finance, 'flip' refers to quickly buying and selling assets to profit from short-term price movements.

Flipping is commonly applied in technical trading, real estate investment, initial public offerings (IPOs), and professional fund management.

The risks of flipping include substantial financial losses due to rapid changes in market conditions and potential legal or regulatory issues.

Successful flipping depends on understanding market trends, having access to timely information, sufficient capital, and a solid risk management strategy.

Ethical considerations around flipping include its impact on market stability, its compliance with legal and regulatory requirements, and the broader debate about its effects on long-term investors and economic inequality.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.