Vandalism and malicious mischief insurance is a type of insurance coverage designed to protect business owners from financial losses resulting from intentional property damage or destruction. These policies typically cover a variety of acts, including graffiti, broken windows, arson, and other forms of property damage caused by vandals or individuals with malicious intent. This insurance is essential for businesses because the costs of repairing or replacing damaged property can be significant. Additionally, it provides protection against loss of income due to business interruption, liability claims, and other potential expenses related to vandalism and malicious acts. Businesses need vandalism and malicious mischief insurance to ensure their financial stability and continued operation in the face of unforeseen property damage. Acts of vandalism can happen at any time and may not be preventable, making this type of coverage an essential safety net for businesses. In the absence of adequate insurance coverage, businesses may be left with substantial out-of-pocket expenses that can strain finances and disrupt operations. Moreover, this insurance can also serve as a deterrent to would-be vandals, as they may be more likely to target uninsured properties. Thus, having vandalism and malicious mischief insurance not only provides financial protection but can also help maintain the reputation and appearance of the business. Property damage coverage in vandalism and malicious mischief insurance policies typically covers the costs of repairing or replacing damaged property. This includes buildings, equipment, inventory, and other business assets that may be targeted by vandals or malicious actors. The coverage is often subject to a deductible, which means that the policyholder is responsible for a portion of the repair or replacement costs. In addition to covering direct property damage, these policies may also cover expenses related to cleaning up graffiti, removing debris, or taking other actions necessary to restore the property to its pre-vandalism condition. This comprehensive coverage ensures that businesses can quickly recover from acts of vandalism and minimize any disruptions to their operations. Business interruption coverage is another essential component of vandalism and malicious mischief insurance policies. This coverage provides financial assistance to businesses that suffer a loss of income due to a covered event, such as vandalism or a malicious act that results in property damage. This coverage can help businesses pay for ongoing expenses like payroll, rent, and utilities while they work to repair or replace the damaged property. This type of coverage is especially important for businesses that rely heavily on their physical location to generate revenue, such as retail stores or restaurants. Without business interruption coverage, these businesses may struggle to stay afloat during the repair or replacement process, potentially leading to long-term financial consequences. Liability coverage in vandalism and malicious mischief insurance policies protects businesses from claims brought by third parties who suffer injuries or property damage as a result of the covered event. For example, if a customer slips and falls on debris caused by vandalism, the business could be held liable for their medical expenses and other damages. Liability coverage can help businesses cover the costs of legal defense, settlements, and judgments related to these claims. Having liability coverage in place is crucial for businesses, as the costs associated with defending against liability claims can be substantial. This coverage provides an essential layer of protection for businesses, ensuring that they can continue to operate and grow, even in the face of potentially costly claims. Vandalism and malicious mischief insurance policies typically exclude coverage for acts of terrorism. This means that businesses will not be reimbursed for damages or losses resulting from terrorist acts, such as bombings, shootings, or other acts of violence intended to cause fear and harm to the public. The exclusion of terrorism from coverage is due to the potential for significant financial losses and the difficulty in accurately predicting the likelihood of terrorist events. Businesses concerned about the risk of terrorism may need to obtain separate terrorism insurance, which is specifically designed to cover damages and losses resulting from acts of terrorism. This additional coverage can provide businesses with the necessary protection to ensure their financial stability in the event of a terrorist attack. Another common exclusion in vandalism and malicious mischief insurance policies is coverage for acts of war. Damages and losses resulting from war, insurrection, rebellion, or other large-scale military actions are not covered by these policies. Similar to acts of terrorism, the exclusion of war-related events is due to the potential for extensive financial losses and the unpredictability of these events. For businesses operating in areas prone to conflict or political instability, specialized war risk insurance may be necessary to provide adequate coverage. This type of insurance can protect businesses from the financial consequences of war-related events, ensuring their continued operation and growth. Vandalism and malicious mischief insurance policies also exclude coverage for intentional acts of the insured. This means that if a business owner or employee intentionally damages or destroys the property, the insurance policy will not provide coverage for the resulting losses. The rationale behind this exclusion is to prevent fraudulent claims and discourage policyholders from intentionally causing damage to their property to collect insurance payouts. To ensure that vandalism and malicious mischief insurance policies provide adequate coverage, it is essential for businesses to carefully review their policies and understand the specific exclusions that apply. This can help businesses identify any gaps in coverage and seek additional insurance policies to provide comprehensive protection. One of the primary types of property covered by vandalism and malicious mischief insurance policies is buildings. This includes commercial structures such as offices, retail stores, warehouses, and other facilities that may be targeted by vandals or malicious actors. Coverage for buildings typically includes the costs of repairing or replacing damaged structures, as well as expenses related to cleaning and debris removal. Having adequate coverage for buildings is crucial for businesses, as the cost of repairing or replacing a damaged structure can be significant. Additionally, damage to a building can disrupt operations and result in lost income, making building coverage a vital component of any vandalism and malicious mischief insurance policy. Vandalism and malicious mischief insurance policies also often cover vehicles owned or leased by the business. This can include cars, trucks, vans, and other vehicles used for business purposes that may be targeted by vandals or malicious actors. Coverage for vehicles typically includes the costs of repairing or replacing damaged vehicles, as well as any expenses related to towing, storage, or other necessary services. For businesses that rely on their vehicles for daily operations, having adequate coverage is essential. Without proper insurance, businesses may be left with significant out-of-pocket expenses that can strain finances and disrupt operations. Another important type of property covered by vandalism and malicious mischief insurance policies is equipment and inventory. This can include machinery, tools, computers, and other valuable assets that may be damaged or destroyed by vandals or malicious actors. Coverage for equipment and inventory typically includes the costs of repairing or replacing damaged items, as well as any expenses related to cleanup and restoration. Having adequate coverage for equipment and inventory is crucial for businesses, as these assets often represent a significant investment. Without proper insurance, businesses may be unable to quickly replace damaged items, leading to operational disruptions and potential financial losses. The location of a business's property can significantly impact the premiums for vandalism and malicious mischief insurance. Properties located in areas with higher crime rates or a history of vandalism may face higher premiums due to the increased risk of vandalism or malicious acts. Conversely, properties in safer areas with lower crime rates may enjoy lower premiums. Businesses should be aware of the potential impact of their location on their insurance premiums and take steps to mitigate the risks associated with their property's location. This may include implementing security measures or seeking coverage from insurers that specialize in high-risk areas. The type of business being insured can also influence the premiums for vandalism and malicious mischief insurance. Some businesses, such as retail stores, restaurants, or entertainment venues, may be more vulnerable to vandalism or malicious acts due to their high visibility and public access. As a result, these businesses may face higher premiums for vandalism and malicious mischief insurance. On the other hand, businesses with a lower risk profile, such as office-based companies or those with limited public access, may enjoy lower premiums. Understanding the risk profile of a business can help owners make informed decisions about the level of coverage they need and the potential costs associated with their insurance policies. The security measures a business has in place can also affect vandalism and malicious mischief insurance premiums. Businesses with robust security measures, such as surveillance cameras, alarm systems, and secure access controls, may be viewed as less likely targets for vandals or malicious actors, leading to lower premiums. Conversely, businesses with inadequate security measures or a history of security breaches may face higher premiums due to the increased risk of vandalism or malicious acts. Investing in appropriate security measures can not only help protect a business's assets but also potentially lower insurance premiums. One of the primary benefits of vandalism and malicious mischief insurance is the peace of mind it provides to business owners. Knowing that their business is protected against the financial consequences of vandalism or malicious acts allows business owners to focus on growing their operations without constantly worrying about potential losses. This peace of mind is invaluable, as it allows businesses to take calculated risks and make informed decisions without being unduly influenced by the fear of vandalism or malicious acts. Vandalism and malicious mischief insurance also provides essential protection for a business's assets, including buildings, vehicles, equipment, and inventory. By covering the costs of repairing or replacing damaged property, this type of insurance ensures that businesses can quickly recover from acts of vandalism and minimize any disruptions to their operations. This protection is crucial for businesses, as the costs associated with repairing or replacing damaged property can be significant and may strain finances if not adequately insured. Finally, vandalism and malicious mischief insurance provides financial security for businesses in the face of unforeseen property damage. By covering the costs of repairs, replacements, business interruption, and liability claims, this type of insurance helps businesses maintain their financial stability, even in the face of potentially costly acts of vandalism or malicious acts. This financial security is essential for the long-term success and growth of a business, as it ensures that businesses can weather the challenges posed by vandalism or malicious acts and continue to thrive. One potential drawback of vandalism and malicious mischief insurance is the high premiums associated with this type of coverage. As mentioned earlier, factors such as the location of the property, type of business, and security measures in place can all influence the cost of premiums. For some businesses, these premiums may be prohibitive, making it difficult to obtain the necessary coverage. Businesses should carefully consider the cost of premiums when evaluating vandalism and malicious mischief insurance and weigh these costs against the potential benefits of having coverage. In some cases, businesses may need to explore alternative insurance options or take additional steps to mitigate their risks to secure more affordable coverage. Another drawback of vandalism and malicious mischief insurance is that it typically does not cover damages caused by acts of nature, such as floods, earthquakes, or hurricanes. These events can also cause significant property damage and financial losses for businesses, but they are generally not covered under standard vandalism and malicious mischief policies. Businesses located in areas prone to natural disasters should consider obtaining separate coverage for these risks, such as flood insurance or earthquake insurance. This additional coverage can help ensure that businesses are adequately protected from a wide range of potential damages and losses. Vandalism and malicious mischief insurance policies often have strict claim requirements that businesses must meet in order to receive coverage for damages or losses. These requirements may include reporting the vandalism or malicious act to the police, providing evidence of the damage, or cooperating with investigations conducted by the insurance company. Failing to meet these requirements can result in a denial of the insurance claim, leaving the business responsible for covering the costs of the damages or losses. Businesses should familiarize themselves with the specific claim requirements outlined in their insurance policies and ensure that they are prepared to meet these requirements in the event of a vandalism or malicious mischief incident. Vandalism and malicious mischief insurance is an essential type of coverage for businesses, providing protection against the financial consequences of intentional property damage or destruction. This coverage offers peace of mind, protection for business assets, and financial security for businesses, helping them navigate the challenges posed by acts of vandalism or malicious acts. These insurance policies typically cover property damage, business interruption, and liability claims related to vandalism or malicious acts. However, businesses should be aware of the common exclusions in these policies, such as acts of terrorism, acts of war, and intentional acts of the insured. Understanding the specific coverage and exclusions can help businesses identify gaps in their insurance protection and seek additional coverage as needed. While vandalism and malicious mischief insurance offers many benefits, businesses should also consider the potential drawbacks, such as high premiums, limited coverage for acts of nature, and strict claim requirements. By carefully weighing the benefits and drawbacks, businesses can make informed decisions about whether vandalism and malicious mischief insurance is right for their needs and take steps to mitigate their risks and secure adequate coverage.What Is Vandalism and Malicious Mischief Insurance?

Importance of Vandalism and Malicious Mischief Insurance

Coverage Offered by Vandalism and Malicious Mischief Insurance

Property Damage Coverage

Business Interruption Coverage

Liability Coverage

Exclusions in Vandalism and Malicious Mischief Insurance

Acts of Terrorism

Acts of War

Intentional Acts of the Insured

Types of Property Covered by Vandalism and Malicious Mischief Insurance

Buildings

Vehicles

Equipment and Inventory

Factors that Affect Vandalism and Malicious Mischief Insurance Premiums

Location of the Property

Type of Business

Security Measures in Place

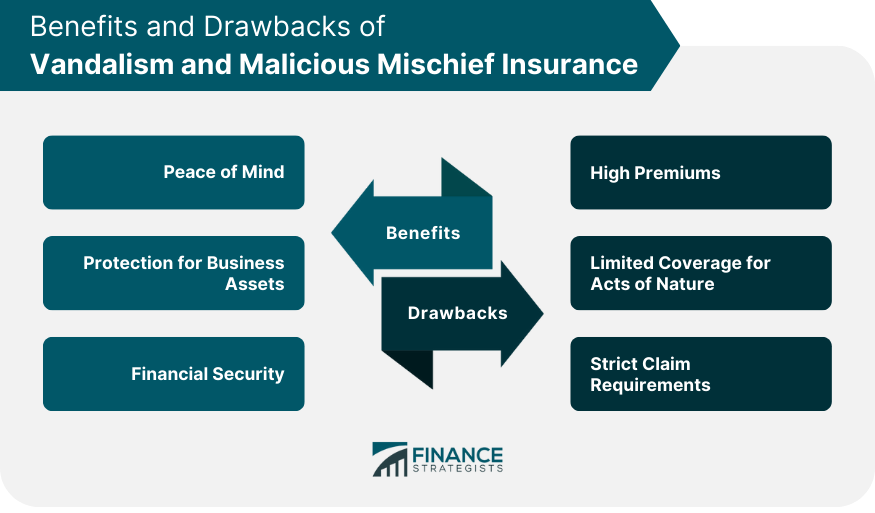

Benefits of Vandalism and Malicious Mischief Insurance

Peace of Mind

Protection for Business Assets

Financial Security

Drawbacks of Vandalism and Malicious Mischief Insurance

High Premiums

Limited Coverage for Acts of Nature

Strict Claim Requirements

Final Thoughts

Vandalism and Malicious Mischief Insurance FAQs

Vandalism and Malicious Mischief Insurance is a type of policy that provides coverage for damage caused by acts of vandalism or malicious mischief.

This insurance covers property damage, business interruption, and liability arising from acts of vandalism or malicious mischief.

No, this insurance is not required by law. However, it is highly recommended for business owners to protect their assets from unforeseen events.

The coverage amount for this insurance depends on the value of your business assets and the level of risk associated with your location and industry.

Acts of terrorism, war, and intentional acts of the insured are typically excluded from coverage. Acts of nature, such as floods or earthquakes, may also be excluded unless specifically covered in the policy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.