A wrap-around insurance program, also known as a "wrap-up," is an insurance policy used in the construction industry to protect the owner, contractors, and subcontractors under a single coverage plan for job-related accidents, injuries, or damage. The policy "wraps" around all the project participants, encompassing several smaller policies into a comprehensive coverage plan. Wrap-up insurance typically includes general liability, excess liability, workers’ compensation, employers' liability, and builders' risk coverage. Wrap-around insurance programs are essential in large-scale construction projects. They are designed to coordinate coverage, minimize gaps, and reduce the potential for litigation among project participants over who is responsible for which accident, injury, or damage. They also offer a streamlined insurance process, more control over safety and loss control measures, and potential cost savings. Project Owner: As the sponsor, the project owner secures the wrap-around insurance policy. They are a principal party and are covered under the policy. General Contractor: The general contractor is another primary party covered under the policy. They may also secure the policy in some instances. Subcontractors: Subcontractors involved in the project are enrolled in the program and are covered under the policy. Insurance Company: The insurance company underwrites the policy, providing the required coverage for all enrolled parties. Risk Management Consultant: Occasionally, a risk management consultant is involved, helping to navigate the risk landscape of the project and advise on appropriate coverage. Wrap-around insurance serves as a risk transfer tool, where risks from the project owner and the contractors are transferred to the insurance carrier. It aims to consolidate and centralize risk management for a construction project. By doing so, it ensures that claims resulting from the project will not directly impact the individual participants' loss histories. The first step in setting up a wrap-around insurance program is to thoroughly assess the project's scope. The project owner or the contractor must understand the project's complexity, risk level, and the number of parties involved. This step is crucial because it allows for the determination of whether a wrap-up policy is suitable for the project or not. Some projects might benefit more from individual policies rather than consolidated ones. Once the project owner or contractor has determined that a wrap-up policy is suitable, the next step is to select an insurance carrier. This step should involve thorough research and consideration of multiple carriers, focusing on factors such as financial stability, coverage options, customer service, and claim handling reputation. After an insurance carrier has been chosen, negotiation of the policy terms follows. The terms of the policy should be discussed in detail to ensure that it will meet the needs of all parties involved in the project. After purchasing the policy, the project owner or contractor must enroll all the contractors and subcontractors involved in the project into the program. It is crucial to ensure that all parties understand the terms and conditions of the insurance program. This process might require a series of meetings or briefings to explain the coverage details and claim procedures. Effective communication and coordination among all parties are vital throughout the process of setting up a wrap-around insurance program. This includes open and regular communication between the project owner, contractor, subcontractors, insurance carrier, and, if involved, the risk management consultant. Coordination ensures that everyone understands their roles and responsibilities and that the program is set up efficiently and effectively. Wrap-around insurance is necessary for large and complex projects involving numerous parties and subcontractors. These projects may be characterized by high risks that could result in significant claims. A wrap-around policy ensures uniform coverage, eliminates potential gaps in insurance, and reduces disputes among parties involved in the project. Wrap-around insurance programs often include several components, such as general liability coverage, workers' compensation, and excess liability. Some programs may also include builders' risk, pollution liability, professional liability, and other coverages based on the project's needs. Once the wrap-around insurance policy is purchased, it provides coverage for all parties involved in the project. If an incident occurs that results in a claim, the party suffering the loss reports it directly to the wrap-up insurance program administrator, bypassing their own insurer. The program administrator then handles the claim. Wrap-around insurance offers several benefits. It provides comprehensive and uniform coverage for all participants, simplifies the claims process, and reduces potential disputes among parties. It also offers potential cost savings, as buying one policy for a project can be more cost-effective than each participant purchasing individual policies. While there are many benefits, wrap-around insurance also comes with potential drawbacks. There may be coverage limitations that wouldn't exist with individual policies, and some contractors may face difficulties in determining costs for bids without including insurance. Additionally, the program's success heavily depends on the project owner's or general contractor's ability to manage the program effectively. OCIPs are a type of wrap-up insurance where the owner of the project sponsors the insurance program. It provides coverage for the owner, general contractor, and all enrolled subcontractors. The owner has control over the insurance coverage and has direct access to the insurance carrier. CCIPs are wrap-up insurance programs sponsored by the general contractor. They provide coverage for the contractor and all enrolled subcontractors. In a CCIP, the contractor assumes more risk but has greater control over safety and loss control measures. Apart from construction, wrap-around insurance policies can also be found in other industries, such as the energy sector (for large-scale projects like wind farms or oil rigs) or infrastructure projects like highway building. These policies are tailored to the specific risks of these industries and their projects. The construction industry is the most common sector for the application of wrap-around insurance programs. Given the complex nature of large construction projects, these programs are ideal for providing uniform coverage for all parties involved. This includes coverage for general liability, workers' compensation, and excess liability, among others. A well-structured wrap-around insurance program can help prevent disputes over liability and ensure a streamlined claims process. In the health and medical industry, wrap-around insurance programs are sometimes used in large-scale medical facility construction projects, such as hospitals or clinics. For example, a hospital system building a new facility might secure a wrap-around policy to cover itself and all the construction firms working on the project. Wrap-around insurance is not typically utilized in the auto insurance industry in the same manner as in construction or healthcare. However, similar concepts are applied when an auto dealer has an insurance policy that "wraps around" to offer coverage to customers who are test-driving vehicles. In the real estate industry, wrap-around insurance can be used in large development projects. It is particularly beneficial in mixed-use or high-rise projects involving multiple contractors and high levels of risk. These programs can provide comprehensive coverage and help mitigate disputes over liability. Wrap-around insurance programs differ from traditional insurance policies in several ways. First, they consolidate coverage for all parties involved in a project under a single policy instead of each party having individual policies. Second, they are project-specific, meaning they provide coverage for the duration of a specific project. Lastly, they may offer cost savings due to the aggregated risk. Reinsurance is a practice used by insurance companies to protect themselves from significant losses by transferring a portion of their risks to other companies. In the context of wrap-around insurance, a carrier might seek reinsurance to help mitigate the higher risks associated with these large-scale projects. In other words, reinsurance can act as a safety net for the insurer offering the wrap-around policy. Wrap-around insurance programs are designed to be comprehensive, covering most risks associated with a particular project. However, they are not meant to replace all other types of insurance. For instance, they don't replace a contractor's professional liability insurance or auto liability coverage. Therefore, it's essential for all parties to maintain their regular insurance policies unless specifically included in the wrap-around program. A wrap-around insurance program is a comprehensive policy that offers protection to all parties involved in a large-scale project, such as construction or medical facility development. The structure of this program typically includes parties like the project owner, contractors, subcontractors, and the insurance company, with the process involving risk transfer and coordinated claim handling. The application of these programs extends across various sectors like construction, healthcare, and real estate, providing unified coverage and reducing the potential for insurance disputes. With the complexity of these insurance programs, it is advisable to seek guidance from an experienced insurance broker who can help navigate the process and ensure that your interests are adequately protected.Overview of the Wrap-Around Insurance Program

Structure of the Wrap-Around Insurance Program

Parties Involved

Risk Transfer Mechanisms in Wrap-Around Insurance

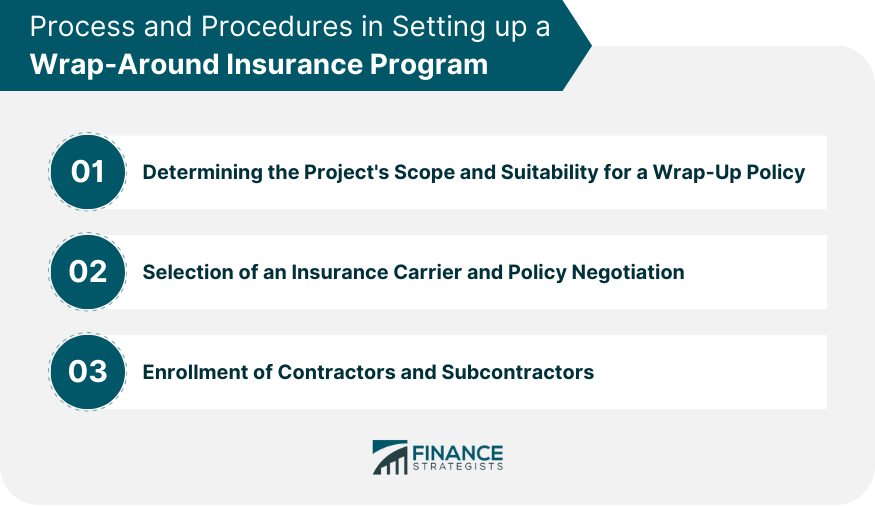

Process and Procedures in Setting up a Wrap-Around Insurance Program

Determining the Project's Scope and Suitability for a Wrap-Up Policy

Selection of an Insurance Carrier and Policy Negotiation

Enrollment of Contractors and Subcontractors

Importance of Effective Communication and Coordination

Overview of Wrap-Around Insurance

Need for Wrap-Around Insurance

Components of Wrap-Around Insurance

How Wrap-Around Insurance Works

Benefits of Wrap-Around Insurance

Potential Drawbacks and Risks Involved With Wrap-Around Insurance

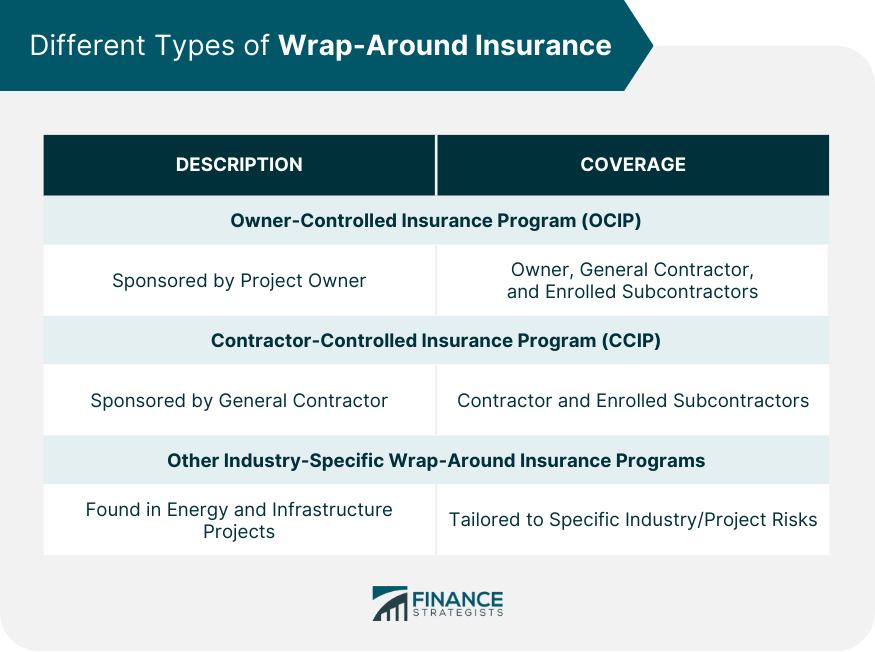

Different Types of Wrap-Around Insurance

Owner-Controlled Insurance Program (OCIP)

Contractor-Controlled Insurance Program (CCIP)

Other Industry-Specific Wrap-Around Insurance Programs

Applications of Wrap-Around Insurance Programs

Construction Industry

Health and Medical Industry

Auto Insurance Industry

Real Estate Industry

Comparisons and Interactions With Other Insurance Programs

Wrap-Around vs Traditional Insurance

Wrap-Around Insurance and Reinsurance

Interaction of Wrap-Around Insurance With Other Insurance Types

Final Thoughts

Wrap-Around Insurance Program FAQs

A wrap-around insurance program is a comprehensive policy that offers protection to all parties involved in a large-scale project, typically providing general liability, excess liability, workers’ compensation, employers' liability, and builders' risk coverage.

The parties involved in a wrap-around insurance program include the project owner, the general contractor, subcontractors, the insurance company, and, occasionally, a risk management consultant.

In the construction industry, a wrap-around insurance program provides uniform coverage for the project owner, general contractor, and all enrolled subcontractors. It simplifies the claims process and reduces disputes among parties.

The benefits include comprehensive coverage, simplified claims handling, and potential cost savings. The drawbacks may include coverage limitations and the potential for difficulties in determining bid costs without including individual insurance.

One should consider a wrap-around insurance program for large and complex projects involving numerous participants and high risks that could result in significant claims.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.