War risk insurance is a specialized type of insurance that provides coverage against risks and perils associated with war, armed conflict, terrorism, political violence, and civil unrest. It is primarily designed to protect individuals, businesses, and entities involved in international trade, shipping, or aviation from potential losses caused by war-related events. This insurance typically covers damage to insured vessels, aircraft, cargo, and property, as well as liability and loss of income resulting from war-related incidents. War risk insurance plays a crucial role in mitigating the financial impact of war and acts of hostility, offering peace of mind and financial protection in uncertain and volatile environments. With international trade at the core of modern global commerce, War Risk Insurance plays a crucial role in maintaining the stability and continuity of shipping operations. By providing financial protection to shipping companies and cargo owners, War Risk Insurance helps mitigate the risk of financial loss, ensuring that businesses can continue to operate despite geopolitical uncertainties. The concept of War Risk Insurance dates back to World War I when the British government introduced it to protect the country's shipping interests. Since then, War Risk Insurance has evolved to address the changing nature of conflicts and the increasing complexity of global trade. Today, it is a vital component of risk management strategies for businesses engaged in international commerce. There are several types of War Risk Insurance policies available, depending on the nature of the risk and the specific needs of the insured party. The three main types are Hull War Risk Insurance, Cargo War Risk Insurance, and Marine Liability War Risk Insurance. Hull War Risk Insurance provides coverage for physical damages to the ship resulting from war or war-like events, such as missile attacks, bombings, or acts of terrorism. The policy typically covers the repair or replacement costs of the vessel, ensuring that shipping companies can quickly recover from these incidents. In addition to physical damages, Hull War Risk Insurance also protects against losses resulting from piracy and terrorist attacks. With piracy incidents on the rise in certain regions, such as the Gulf of Aden and the Strait of Malacca, this coverage is essential for safeguarding shipping operations and maintaining global trade routes. Cargo War Risk Insurance offers protection for damages to goods in transit due to war-related events, such as acts of terrorism, sabotage, or piracy. This type of coverage is crucial for businesses relying on the safe delivery of their products to international markets. Various factors influence the rates of Cargo War Risk Insurance, including the nature of the cargo, the destination, and the shipping route. For instance, transporting valuable cargo through high-risk areas may result in higher premiums. Insurers also consider the shipping company's safety record and the vessel's security measures when determining the rates. Marine Liability War Risk Insurance covers legal liabilities arising from war-related events, such as damage to third-party property or personal injury claims. This type of coverage is essential for shipping companies to protect themselves from potential lawsuits and financial losses. Marine Liability War Risk Insurance can include various types of liability coverage, such as Protection and Indemnity (P&I), Collision Liability, and Removal of Wreck. Depending on the specific needs of the insured party, the policy may be customized to provide comprehensive protection. Like any insurance policy, War Risk Insurance contains exclusions that define the limits of coverage. Understanding these exclusions is critical for policyholders to ensure they have adequate protection. War Risk Insurance policies typically include standard exclusions found in most insurance policies, such as losses resulting from willful misconduct, wear and tear, and gradual deterioration. These exclusions help define the scope of coverage and clarify the circumstances under which the policy will not provide compensation. In addition to standard exclusions, War Risk Insurance policies may also contain specific exclusions related to war-related events. For example, some policies may exclude coverage for losses resulting from the use of nuclear weapons or chemical and biological warfare. It is essential for policyholders to thoroughly review their policies to understand the extent of their coverage. Exclusions play a crucial role in shaping the coverage provided by War Risk Insurance policies. By understanding the limitations of their policies, policyholders can make informed decisions about the additional coverage they may need to address any gaps in protection. Obtaining War Risk Insurance involves several steps, including identifying the need for coverage, selecting the right provider, assessing the risk factors, and customizing the policy to meet specific requirements. The first step in obtaining War Risk Insurance is to determine whether it is necessary for the business. This decision depends on several factors, such as the nature of the business, the shipping routes, and the destinations involved in the company's operations. Companies with exposure to high-risk areas or those transporting valuable cargo may have a greater need for War Risk Insurance. Once the need for War Risk Insurance is established, the next step is to choose the right insurance provider. This decision should be based on the provider's reputation, expertise in the maritime industry, and financial strength. Comparing quotes from multiple providers can help businesses find the most suitable policy at a competitive price. Insurers will assess the risk factors associated with the insured party to determine the policy's premium. This assessment may involve analyzing the shipping company's safety record, the vessel's security measures, and the nature of the cargo being transported. The destination and shipping route may also impact the premium, as higher-risk areas typically result in higher premiums. War Risk Insurance policies can be customized to meet the specific needs of the insured party. This may involve adding endorsements or riders to address any gaps in coverage, such as extending the policy to cover additional war-related events or increasing the policy limits. Policyholders should work closely with their insurance provider to design a policy that provides comprehensive protection. In the event of a covered loss, policyholders must follow the appropriate procedures to file a claim and obtain compensation. To file a claim for War Risk Insurance, policyholders should contact their insurance provider as soon as possible after the incident. The provider will typically require the insured party to submit a written notice of the claim, along with any relevant documentation, such as incident reports, photographs, and invoices. Upon receiving the claim, the insurance provider will conduct an investigation and assessment of the loss. This process may involve reviewing the documentation, consulting with experts, and conducting site visits. The insurer will then determine the extent of the coverage and the amount of compensation to be paid, based on the policy terms and the nature of the loss. Once the investigation and assessment process is complete, the insurance provider will issue a settlement offer to the policyholder. If the policyholder accepts the offer, the insurer will pay the compensation, either as a lump sum or in installments, depending on the terms of the policy. Policyholders have the right to dispute the settlement offer if they believe it is inadequate or unfair, in which case they may need to negotiate with the insurer or seek legal assistance. Governments play a significant role in shaping the War Risk Insurance landscape by implementing policies, providing support, and intervening in the market when necessary. Some governments have established War Risk Insurance programs to support the shipping industry in times of conflict or crisis. These government-backed programs may provide coverage when commercial insurers are unwilling or unable to offer adequate protection. For instance, the United States has the Federal War Risk Insurance Program, which offers coverage for U.S.-flagged vessels engaged in international trade. Government policies can have a significant impact on the War Risk Insurance market, either by encouraging or discouraging the use of such coverage. For example, regulations requiring ships to maintain a certain level of War Risk Insurance may increase demand for these policies, while sanctions or embargoes may limit the availability of coverage in certain regions. War Risk Insurance operates within the broader framework of international maritime law and is subject to oversight by various regulatory bodies. International maritime law, such as the United Nations Convention on the Law of the Sea (UNCLOS), provides a legal framework for the conduct of shipping operations and the resolution of disputes arising from war-related events. War Risk Insurance policies must adhere to these legal principles, which may influence the terms and conditions of coverage. Several regulatory bodies oversee the War Risk Insurance industry, including the International Maritime Organization (IMO), the International Group of P&I Clubs, and national insurance regulators. These organizations work to ensure that War Risk Insurance policies comply with legal and regulatory requirements, promote market stability, and protect the interests of policyholders. Insurers offering War Risk Insurance must comply with various legal and regulatory requirements, such as maintaining adequate capital reserves and adhering to international sanctions. Non-compliance may result in penalties, such as fines or the revocation of the insurer's license. The War Risk Insurance industry faces several challenges and opportunities as it adapts to the evolving geopolitical landscape and the advancements in technology. With the ongoing changes in global politics and the emergence of new conflict zones, the War Risk Insurance industry must continuously reassess and adapt to the shifting risk landscape. This requires insurers to develop innovative solutions to address emerging threats and maintain the stability of the market. Advancements in technology, such as satellite tracking, data analytics, and artificial intelligence, offer new opportunities for the War Risk Insurance industry. These technologies can improve risk assessment, claims processing, and loss prevention, ultimately enhancing the overall efficiency and effectiveness of War Risk Insurance. As the shipping industry moves towards more sustainable and responsible practices, War Risk Insurance has a role to play in promoting such initiatives. For example, insurers may offer incentives for companies that adopt eco-friendly technologies or comply with international environmental regulations, thereby encouraging responsible shipping practices. War Risk Insurance is a specialized type of insurance that provides coverage against risks and perils associated with war-related events, protecting individuals, businesses, and entities involved in international trade. It plays a crucial role in maintaining the stability and continuity of shipping operations, mitigating financial losses, and ensuring business resilience in the face of geopolitical uncertainties. There are different types of War Risk Insurance policies, including Hull, Cargo, and Marine Liability, each providing specific coverage for physical damages, goods in transit, and legal liabilities. Policyholders must understand the exclusions and claims process, file claims promptly, and undergo investigation and assessment for compensation. Governments and regulatory bodies influence the War Risk Insurance landscape, implementing policies and programs to support the industry. The industry faces challenges and opportunities, adapting to geopolitical changes and technological advancements, which can enhance risk assessment and promote sustainable shipping practices. War Risk Insurance remains essential for businesses engaged in international trade, offering financial protection and stability in uncertain environments.Definition of War Risk Insurance

Importance of War Risk Insurance in Global Commerce

Brief History of War Risk Insurance

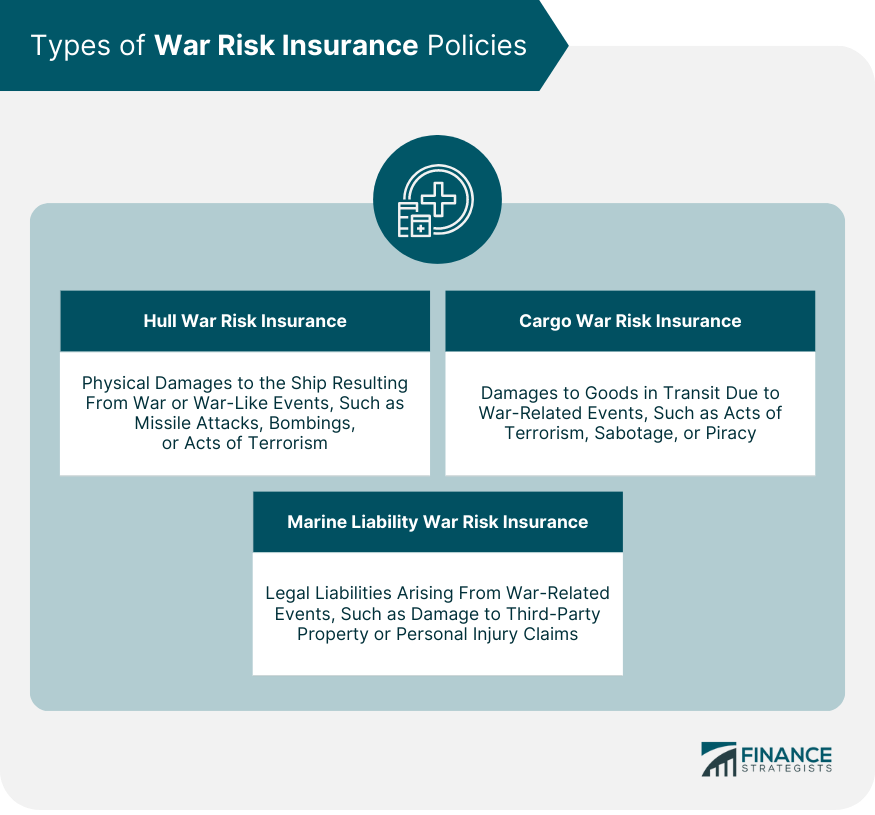

Types of War Risk Insurance Policies

Hull War Risk Insurance

Coverage for Physical Damages to the Ship

Protection Against Piracy and Terrorist Attacks

Cargo War Risk Insurance

Coverage for Damages to Goods in Transit

Factors Affecting Cargo Insurance Rates

Marine Liability War Risk Insurance

Protection Against Third-Party Claims

Types of Liability Coverage

War Risk Insurance Exclusions

Standard Exclusions in Policies

War Risk Insurance Specific Exclusions

Understanding the Role of Exclusions in Coverage

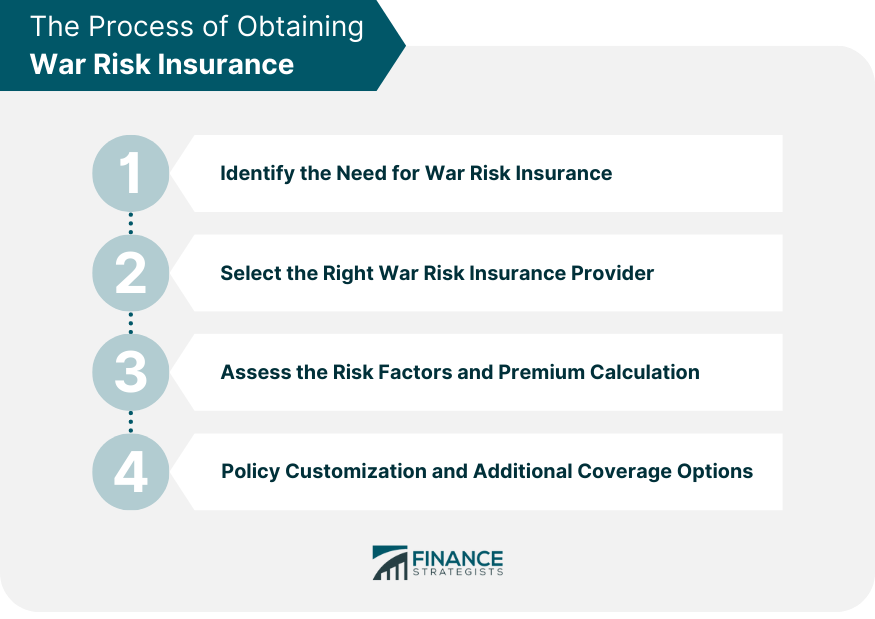

Process of Obtaining War Risk Insurance

Identifying the Need for War Risk Insurance

Selecting the Right War Risk Insurance Provider

Assessing the Risk Factors and Premium Calculation

Policy Customization and Additional Coverage Options

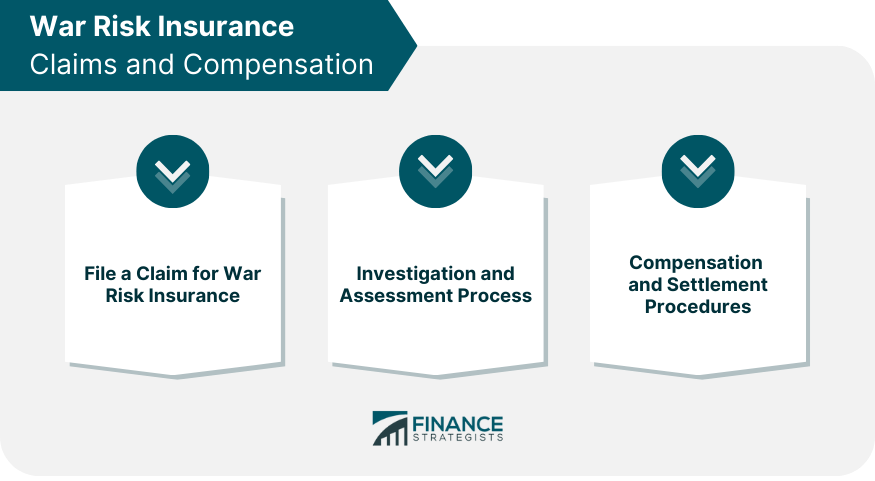

War Risk Insurance Claims and Compensation

Filing a Claim for War Risk Insurance

Investigation and Assessment Process

Compensation and Settlement Procedures

Role of Governments in War Risk Insurance

Government-Backed War Risk Insurance Programs

Impact of Government Policies on War Risk Insurance

Legal and Regulatory Aspects of War Risk Insurance

International Maritime Law and War Risk Insurance

Regulatory Bodies Overseeing War Risk Insurance

Compliance and Enforcement Measures

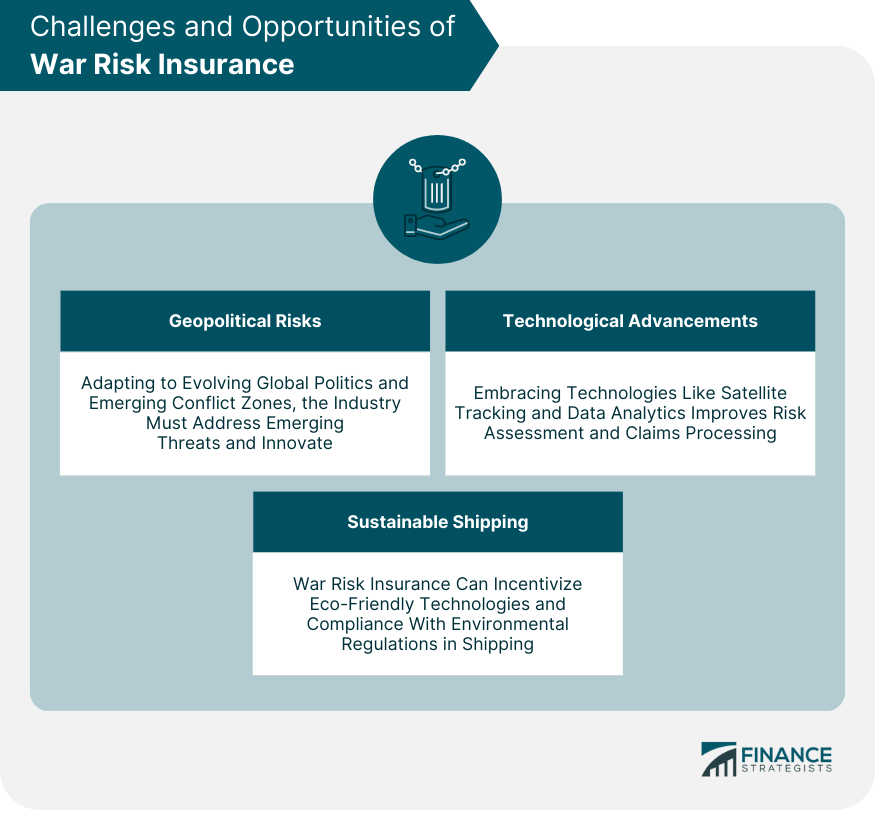

Challenges and Opportunities of War Risk Insurance

Evolving Geopolitical Risks and Their Impact on War Risk Insurance

Technological Advancements and War Risk Insurance

Role of War Risk Insurance in Sustainable and Responsible Shipping Practices

Conclusion

War Risk Insurance FAQs

War Risk Insurance provides specialized coverage for financial losses due to war-related events like terrorism and piracy. It safeguards ships, cargo, and related liabilities, offering stability and confidence for businesses engaged in international trade amid geopolitical uncertainties.

War Risk Insurance includes Hull War Risk Insurance for ship damages, Cargo War Risk Insurance for goods in transit, and Marine Liability War Risk Insurance for legal liabilities. Hull coverage protects against war-related physical damages to ships, while Cargo coverage covers damages to goods during transit due to war events. Marine Liability coverage addresses legal liabilities arising from war-related incidents, such as third-party property damage or personal injury claims.

Obtaining War Risk Insurance involves identifying coverage needs, and selecting a reputable provider with maritime expertise and financial stability. Insurers assess risk factors, such as safety records, vessel security, and cargo type, to determine the policy premium.

To file a War Risk Insurance claim, contact the insurer promptly and submit a written notice along with relevant documentation. The insurer will investigate the loss and provide a settlement offer after completing the assessment. If accepted, compensation is paid according to the policy terms, either as a lump sum or in installments.

The War Risk Insurance industry faces challenges and opportunities amid geopolitical changes and technological advancements. Technology like satellite tracking and AI provides opportunities for improved risk assessment and claims processing, enhancing overall efficiency. The industry must adapt to shifting risks, developing innovative solutions to maintain market stability and address emerging threats.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.