Cashing out an annuity refers to the process of withdrawing the entirety of your funds from an annuity contract before the contract's term has ended. In contrast to regular annuity payments that offer a stream of income over a set period, cashing out involves taking a lump sum, effectively terminating the contract. People may choose to cash out an annuity for a variety of reasons. These could range from a sudden need for a large sum of money, such as unforeseen medical expenses or a significant investment opportunity, to dissatisfaction with the annuity contract's terms or performance. However, it's important to note that this decision should be considered carefully due to potential tax implications and surrender charges. An annuity is a financial product offered by insurance companies that provide a steady income stream in return for a series of payments or a single lump sum. There are primarily two types of annuities - deferred and immediate. Deferred annuities accumulate income over time for a future payout, whereas immediate annuities start payouts almost immediately after the initial investment. Annuities offer several advantages, including providing a regular income stream, tax-deferred growth, and in some cases, a death benefit for beneficiaries. They can be a valuable tool for retirement planning, providing certainty and security of income. However, annuities also have their drawbacks. They can often be complex and difficult to understand, with numerous fees and potential penalties for early withdrawal. The return on annuities can also be lower than other investment options. Annuity payouts work based on the type of annuity you have chosen. With an immediate annuity, payouts begin soon after the annuity purchase. With a deferred annuity, payouts start at a future date specified in the contract. The amount of each payment depends on various factors, including the size of your initial investment, the terms of your specific annuity contract, your age and gender (which affects life expectancy), and the prevailing interest rates when you purchased the annuity. Annuity holders have several options for receiving their annuity payments. These include: Life Annuity: The annuity pays an income for as long as the annuitant lives. Joint Life Annuity: The annuity pays an income for as long as the annuitant or their spouse lives. Fixed-Term Annuity: The annuity pays an income for a fixed period. Life Annuity with Period Certain: The annuity pays an income for as long as the annuitant lives, with a guaranteed minimum period. One must be aware of any potential fees and penalties when cashing out an annuity. Most annuities have surrender charges, which are fees for withdrawing funds before a certain period, usually within the first 5 to 7 years of the contract. The exact surrender charges can vary widely, often starting at 7% to 10% in the first year and decreasing yearly. Moreover, if you cash out before reaching 59½ years old, you might also be subjected to a 10% penalty on the earnings portion of your withdrawal by the Internal Revenue Service (IRS). When cashing out an annuity, it's crucial to consider the potential tax implications. Annuities are tax-deferred, which means you only pay taxes on the interest, dividends, or capital gains once you withdraw the funds. However, when you do cash out, any earnings will be taxed as ordinary income, which can be a higher rate than the capital gains tax rate you might pay on other investments. If you cash out your annuity early, you could end up in a higher tax bracket for that year, causing you to owe even more in taxes. Your unique financial needs and circumstances will significantly influence whether cashing out an annuity is right. It's essential to consider your financial goals, ability to meet your current and future expenses, and overall financial health. If your annuity is a significant part of your retirement plan, cashing out could leave you without a reliable income stream later in life. On the other hand, if you need money now and have other retirement savings, cashing out might make sense. The process of cashing out an annuity involves several steps: The insurance company plays a vital role during the cash-out process. They provide the necessary paperwork, explain the process and any associated penalties or fees, and ultimately process the withdrawal. They also report the distribution to the IRS. Most insurance companies require some time to process an annuity cash-out, often up to several weeks. Additionally, some annuities restrict the amount that can be cashed out in a single year. Annuitization refers to converting your annuity investment into a series of periodic payments, which can last for a certain number of years or your lifetime. This process provides a steady income stream, making it a popular choice for retirement planning. When comparing cashing out an annuity to annuitizing it, one must consider their financial needs, tax implications, and the potential for future income. Cashing out provides a lump sum upfront, which may lead to high surrender charges and tax obligations. Annuitization can provide a steady income with less immediate tax impact, but it involves giving up access to the lump sum. A systematic withdrawal schedule is another option for receiving annuity funds. It involves taking out a certain amount periodically until the funds run out. It provides more flexibility than annuitization, as you can alter the withdrawal amount as needed, and it can extend the life of the annuity. When you cash out an annuity, you may receive a larger sum upfront, which could lead to surrender charges and large tax bills. Meanwhile, a systematic withdrawal schedule provides smaller, regular payments and might help manage tax implications better. Cashing out an annuity can significantly impact your long-term financial plans, particularly if you rely on it for retirement income. You could face high surrender charges and tax liabilities that diminish the overall amount you receive. Furthermore, you lose the income stream the annuity could provide by cashing out. One of the main risks of cashing out an annuity is jeopardizing your retirement security. Annuities are often used as part of a long-term strategy to ensure a steady income stream during retirement. If you cash out, you may need to find alternative ways to replace this income, which can be challenging and potentially risky, depending on market conditions. An alternative to cashing out an annuity is selling your annuity payments to a third party, often a financial institution, in exchange for a lump sum. However, this transaction is subject to various federal and state laws and usually involves a court approval process. You often receive significantly less than the total of your remaining payments. Another option is a 1035 exchange, which involves transferring funds from your current annuity to a new one without incurring taxes. This can be beneficial if you are unhappy with your current annuity but want to avoid cash out and facing potential tax implications. Annuities are subject to both federal and state laws, which aim to protect the investor and ensure fair practices by the insurance company. At the federal level, cashing out an annuity before the age of 59½ will generally result in a 10% early withdrawal penalty on the gains portion of the annuity. Many states also have laws regarding annuity cashouts, including regulations around surrender charges and the selling of annuity payments to third parties. Some states also require insurance companies to inform contract holders about the potential implications and consequences of cashing out an annuity. Regulatory bodies such as the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) also oversee annuities. FINRA regulates brokerage firms and their registered representatives, and it has rules and guidelines in place concerning the sale of annuities. The SEC oversees variable annuities, which are considered securities. Insurance companies must provide potential buyers with a prospectus explaining the annuity's investment objectives, risks, charges, and expenses. Cashing out an annuity involves withdrawing the entirety of the funds from an annuity contract before its term ends. This decision should be carefully considered, taking into account factors such as potential fees, tax implications, and personal financial needs. Annuities offer a steady income stream and tax-deferred growth, but they can be complex and come with surrender charges and lower returns compared to other investments. The process of cashing out involves reviewing the annuity contract, consulting a financial advisor, contacting the insurance company, and filling out the necessary paperwork. It's important to understand alternatives to cashing out, such as selling annuity payments or considering a 1035 exchange or annuity rollover. Legal and regulatory aspects, including federal and state laws and oversight by regulatory bodies like FINRA and the SEC, add further considerations to the cashing out process. By carefully evaluating these factors, individuals can make informed decisions regarding their annuity contracts and their long-term financial plans.Overview of Cashing Out Annuities

What Are Annuities?

Understanding Annuity Payouts

How Annuity Payouts Work

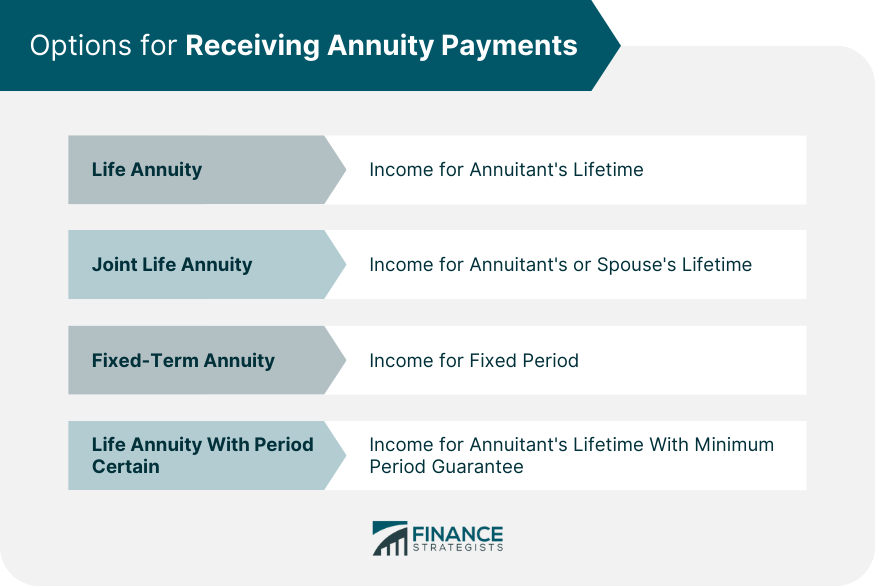

Options for Receiving Annuity Payments

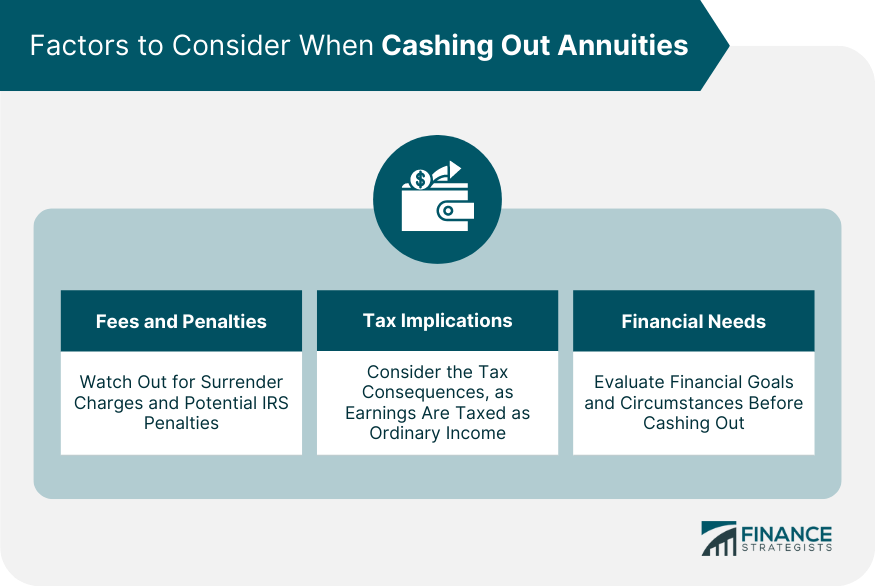

Factors to Consider Before Cashing Out Annuities

Potential Fees and Penalties

Potential Tax Implications

Financial Needs and Circumstances

Process of Cashing Out Annuities

Steps Involved in Cashing Out an Annuity

1. Review Annuity Contract: Your contract will have details about the surrender period and any associated fees for early withdrawal.

2. Consult a Financial Advisor: Given the potential financial implications, consulting a financial advisor can be beneficial.

3. Contact Insurance Company: To start the process, you must contact the insurance company issuing the annuity.

4. Fill Out Required Paperwork: The insurance company will require specific forms to be filled out to process the cash-out.

Role of the Insurance Company During the Cash-Out Process

Potential Waiting Period and Other Limitations

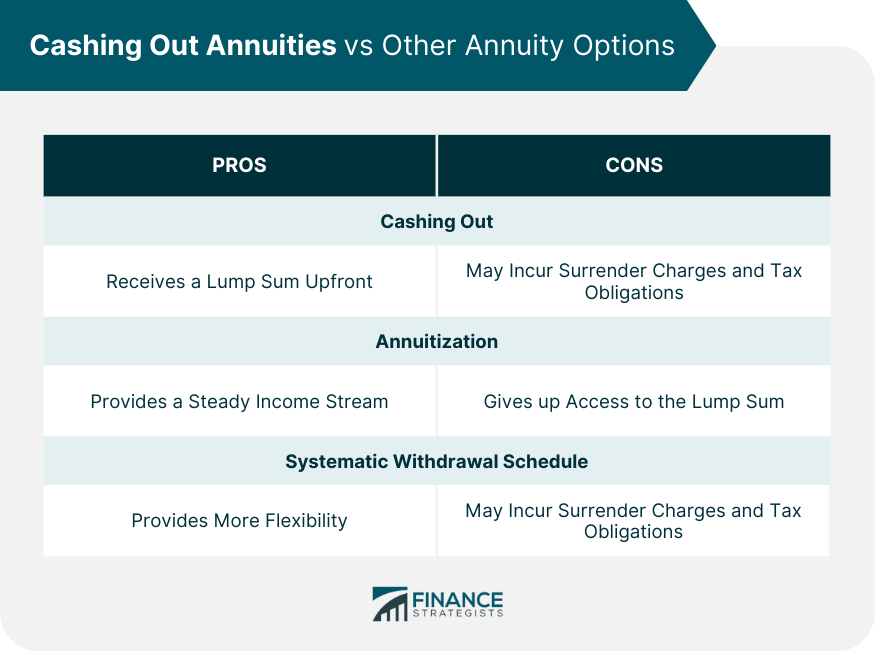

Cashing Out Annuities vs Other Annuity Options

Comparing Cashing Out to Annuitization

Comparing Cashing Out to a Systematic Withdrawal Schedule

Impact of Cashing Out Annuities on Retirement Planning

Long-Term Financial Plans

Retirement Security

Alternatives to Cashing Out Annuities

Selling Annuity Payments to a Third Party

Considering a 1035 Exchange or Annuity Rollover

Legal and Regulatory Aspects of Cashing Out Annuities

Federal and State Laws

Financial Industry Regulatory Authority (FINRA) and Other Regulatory Bodies

Conclusion

Cashing Out Annuities FAQs

While you have the option to cash out your annuity, it's important to consider the terms of your specific contract. Most annuities have a surrender period during which you may incur surrender charges for early withdrawals. It's advisable to review your contract and consult with a financial advisor to understand any potential fees or penalties associated with cashing out.

Yes, cashing out an annuity can have tax implications. Annuities are tax-deferred, meaning you only pay taxes on the earnings when you withdraw funds. When you cash out, the earnings portion of the withdrawal will be taxed as ordinary income. It's recommended to consult with a tax professional to understand the specific tax consequences based on your individual circumstances.

Yes, you have the option to sell your annuity payments to a third party in exchange for a lump sum. This is known as a structured settlement or annuity buyout. However, it's important to note that selling annuity payments often result in receiving a discounted amount compared to the total value of the remaining payments. The process typically involves court approval and is subject to federal and state laws.

A 1035 exchange allows you to transfer funds from your current annuity to a new one without incurring immediate taxes. This can be a beneficial option if you are dissatisfied with your current annuity and want to switch to a different one. It's important to follow the specific rules and guidelines outlined by the Internal Revenue Service (IRS) to ensure a smooth and tax-efficient exchange.

When considering cashing out your annuity, alternatives like annuitization or a systematic withdrawal schedule should be explored, as they offer advantages such as a steady income stream and flexibility. Consulting a financial advisor can help determine the most suitable option based on your financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.