Converting an annuity to a Roth IRA involves transferring funds from an annuity, which provides an income stream, to a retirement account with tax advantages for withdrawals. This process has significant tax implications. To convert, cash in the annuity, pay taxes on earnings and transfer the remaining funds to a Roth IRA. Any annuity earnings are subject to ordinary income tax, with potential early withdrawal penalties if under 59½ years old. In a Roth IRA, the money grows tax-free, and withdrawals, including earnings, are tax-free in retirement. This differs from annuities, where payments include taxable ordinary income and non-taxable principal. Converting to a Roth IRA can offer long-term tax advantages, particularly for those expecting a higher retirement tax bracket. Surrender charges can be a significant consideration when converting an annuity. You pay These fees if you withdraw funds from your annuity before a certain period has passed. Penalties may also apply if the annuitant is under the age of 59½. The process of conversion requires a careful assessment of tax consequences. Annuity distributions are generally taxed as ordinary income, and the entire amount of the annuity’s accumulated income is taxable when you make a conversion. You might also face conversion taxes, depending on your income tax bracket. One key consideration is your current tax rate versus what you anticipate it will be in the future. If you expect to be in a higher tax bracket in the future, it might make sense to pay taxes now by converting to a Roth IRA. Your personal financial goals and retirement plans should also be crucial in your decision. Understanding your long-term financial objectives and retirement plans can help inform whether converting an annuity to a Roth IRA aligns with these goals. It is crucial to review your annuity contract before making any decisions. The contract contains essential information about the terms and conditions of your annuity, including any penalties for early withdrawal, surrender charges, and the period of the surrender charge. Understanding these terms will help you assess the financial implications of converting your annuity. After understanding the contract, calculate your annuity's surrender value, which is the amount you will receive if you decide to exit the contract. Also, consider any surrender charges, which are fees for withdrawing funds before a certain period. This will show you how much money you can move into a Roth IRA. Converting an annuity to a Roth IRA can have significant tax consequences. This includes immediate taxation on any gains in the annuity and potential conversion taxes. It is advisable to consult with a tax professional who can help you understand the tax implications and strategize the most efficient way to manage these costs. You can initiate the conversion process once you've done your due diligence. This process typically starts by contacting your annuity provider and informing them of your wish to convert your annuity to a Roth IRA. They will guide you through their specific process. The final step in the conversion process involves completing and submitting various forms required by your annuity provider and the financial institution where your Roth IRA is held. This may include forms to liquidate the annuity, forms to open a Roth IRA (if you still need to get one), and forms to move the funds. One of the primary advantages of a Roth IRA is that it allows for tax-free withdrawals in retirement. This can result in significant tax savings, especially if you expect to be in a higher tax bracket during retirement. Unlike annuities and traditional IRAs, Roth IRAs don't have RMDs during the original owner's lifetime. This provides flexibility, allowing you to leave your money to grow tax-free for as long as you wish. All growth within a Roth IRA is tax-free. This includes dividends, interest, and capital gains, which can accumulate substantially over time. Roth IRAs can be a beneficial tool for estate planning. Heirs can inherit the Roth IRA and take distributions tax-free, a significant advantage over inherited annuities or traditional IRAs. Converting an annuity to a Roth IRA can create an immediate tax burden because the gains from the annuity are taxable upon conversion. This can be a significant cost and potentially push you into a higher tax bracket for the year of the conversion. One of the main benefits of an annuity is the steady, guaranteed stream of income it provides. By converting to a Roth IRA, you may lose this guaranteed income, which could be a significant drawback for those seeking income stability in retirement. Converting an annuity to a Roth IRA is a big decision that can impact your current and future financial needs. It's important to consider whether this move aligns with your short- and long-term financial goals. Converting an annuity to a Roth IRA offers potential benefits such as tax-free withdrawals in retirement, no required minimum distributions, tax-free growth, and estate planning advantages. However, there are also drawbacks to consider, including immediate tax consequences and the potential loss of guaranteed income. Before making a decision, it's crucial to review the annuity contract, assess surrender value and charges, determine tax consequences, initiate the conversion process, and complete the required paperwork. Factors to consider include surrender charges and penalties, tax consequences and potential conversion taxes, current and future tax rates, and personal financial goals. Consulting with a financial advisor and tax professional can help ensure the conversion aligns with your financial objectives and retirement plans.Overview of Converting an Annuity to a Roth IRA

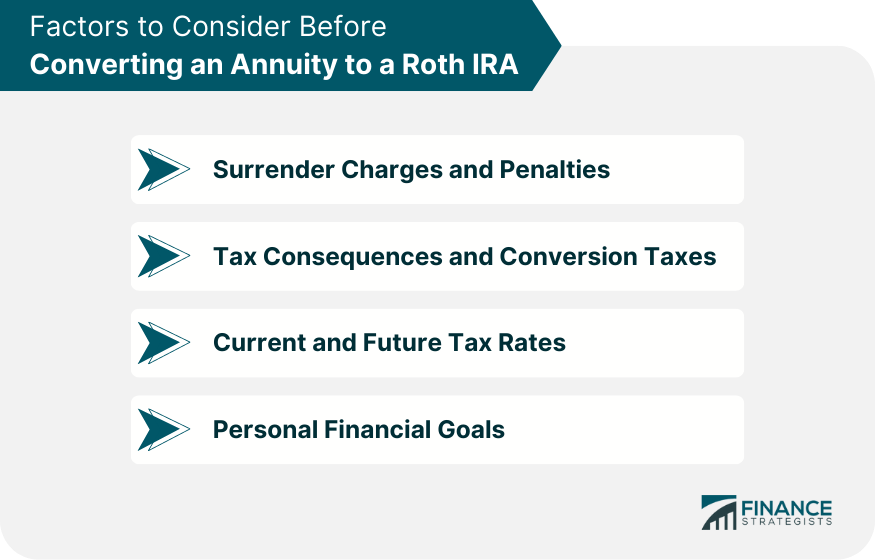

Factors to Consider Before Converting an Annuity to a Roth IRA

Surrender Charges and Penalties

Tax Consequences and Potential Conversion Taxes

Current and Future Tax Rates

Personal Financial Goals and Retirement Planning

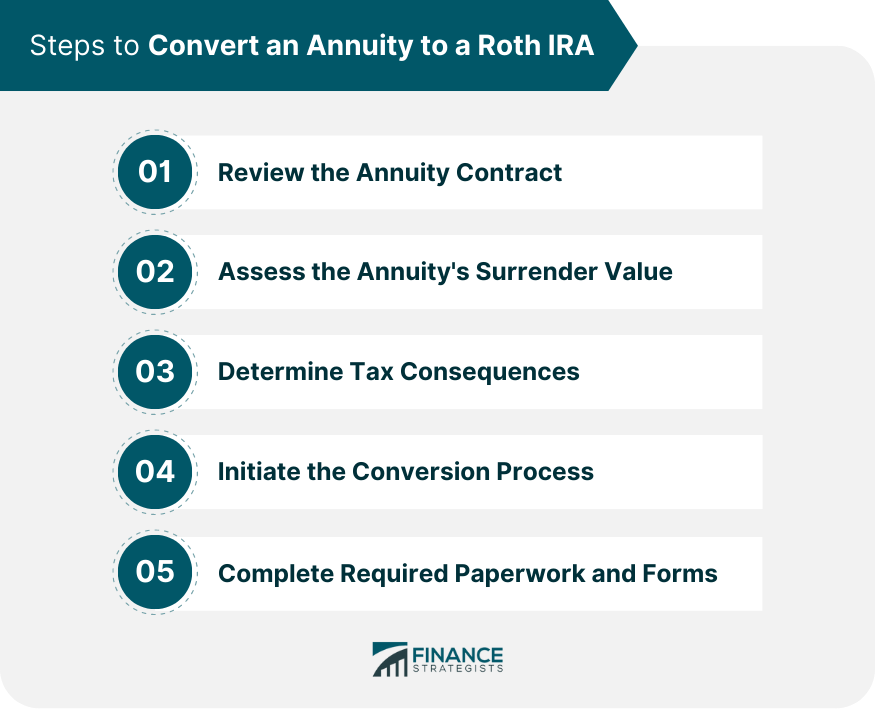

Steps to Convert an Annuity to a Roth IRA

Reviewing the Annuity Contract

Assessing the Annuity's Surrender Value and Surrender Charges

Determining Tax Consequences and Potential Conversion Taxes

Initiating the Conversion Process

Completing Required Paperwork and Forms

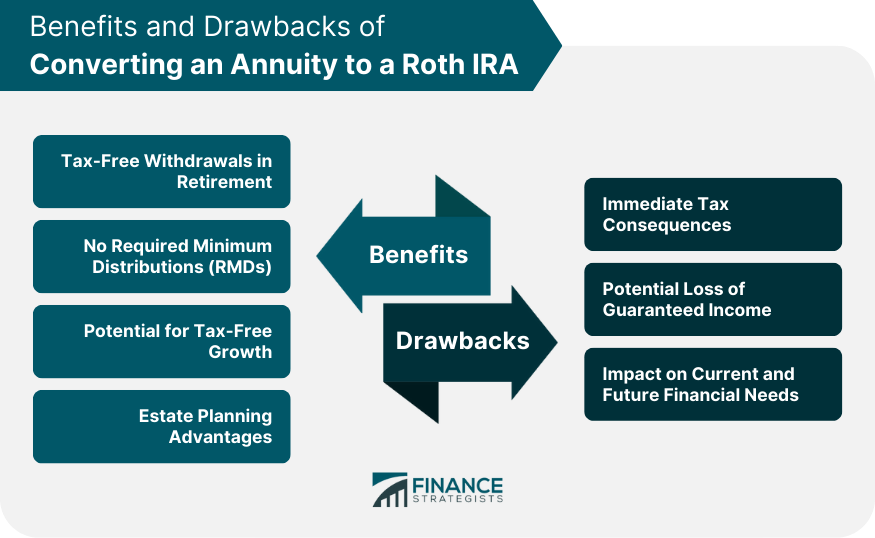

Potential Benefits of Converting an Annuity to a Roth IRA

Tax-Free Withdrawals in Retirement

No Required Minimum Distributions (RMDs)

Potential for Tax-Free Growth

Estate Planning Advantages

Potential Drawbacks of Converting an Annuity to a Roth IRA

Immediate Tax Consequences

Potential Loss of Guaranteed Income

Impact on Current and Future Financial Needs

Conclusion

Can You Convert an Annuity to a Roth IRA? FAQs

Yes, it's possible to convert any type of annuity—whether fixed, variable, or indexed—to a Roth IRA. However, remember that the conversion process and implications might vary depending on the specific annuity type. Always review your annuity contract and consult with a financial advisor for a comprehensive understanding of potential consequences.

Yes, penalties can arise when converting an annuity to a Roth IRA. For instance, surrender charges might apply if you withdraw funds from your annuity before the surrender period ends. Additionally, a 10% early withdrawal penalty could apply if you're under the age of 59½. Always verify the terms of your annuity contract and consult with a tax professional to understand the potential penalties.

The advantages of converting an annuity to a Roth IRA can vary widely depending on individual circumstances. While potential benefits such as tax-free withdrawals in retirement exist, it's important to balance these against potential drawbacks like immediate tax implications. Consider factors such as your current and future tax situation, retirement goals, and the potential tax burden of conversion.

The timeline for converting an annuity to a Roth IRA can depend on several factors. These factors include how quickly you complete and submit the required paperwork and the processing times of your annuity and Roth IRA providers. This process could take anywhere from a few weeks to several months.

Yes, a partial conversion of your annuity to a Roth IRA is possible. This strategy could be advantageous if you wish to spread out the tax liability over multiple years. However, understanding the tax implications of this strategy is crucial. As always, consulting with a financial advisor or tax professional is recommended.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.