Waiver of Premium for Disability (WoPfD) is an insurance policy clause that eliminates the obligation of the policyholder to pay any further premiums should they become seriously disabled and unable to work. The disabled policyholder can continue to enjoy the benefits of the policy without worrying about maintaining the premium payments during their period of disability. In the sphere of personal financial planning, the Waiver of Premium for Disability carries great importance. Disability can strike at any time, and when it does, it often brings significant financial challenges with it, primarily due to the potential loss of income. Having a waiver in place can provide an essential financial safety net. The policyholder can rest assured that their life insurance or other insurance protection will not lapse due to non-payment of premiums during their period of disability. Several features define the Waiver of Premium for Disability. First, it’s often a rider or additional provision that can be attached to a base insurance policy, such as life insurance. The waiver comes into effect when the insured is disabled as defined by the policy terms. Importantly, the policyholder must provide sufficient proof of disability. Once approved, the policy remains in force without further premium payments for the duration of the disability. The conditions under which the waiver is applicable vary across insurance companies and policies. However, typical conditions include a waiting period from the onset of disability, often six months, before the waiver takes effect. The disability must be total and not partial, meaning the insured person cannot work at all. Furthermore, the cause of the disability must not be self-inflicted or a result of the insured's involvement in criminal activities. While similar in name, the Waiver of Premium for Disability should not be confused with other insurance waivers like the Waiver of Premium for Payer. The latter is typically applicable in juvenile policies, where it waives the premium if the payer (usually a parent or guardian) passes away or becomes disabled. In contrast, the Waiver of Premium for Disability is specifically for the insured's disability. Invoking a Waiver of Premium for Disability involves a well-defined process. Once the insured becomes disabled, they or their representative must inform the insurance company about the disability and the intention to activate the waiver. This notification should happen within the policy’s specified time limit. Following the waiting period (usually six months), the policyholder must submit proof of continuing disability for the company to waive the premiums. The process of qualifying for the waiver involves the submission of medical evidence certifying the insured's disability. This evidence usually includes medical records, examination reports, and assessments by medical professionals. In some cases, the insurance company may also require the insured to undergo an independent medical examination by a physician of their choosing. Disability definitions can differ among insurance policies. Some policies define disability as the inability to perform any occupation for which the insured is reasonably suited by education, experience, or training. Others may define it as the inability to perform the duties of the insured's own occupation. It is crucial to understand the precise definition of disability in your policy since it determines the applicability of the waiver. Including a Waiver of Premium for Disability in an insurance policy does involve additional costs. The policyholder pays an extra premium for this rider, which is usually a small percentage of the base policy premium. Despite the additional cost, many policyholders consider this rider a worthwhile investment, given the financial protection it offers during periods of disability. The economic benefits of the waiver are significant. In the event of a disability, the policyholder can save on the otherwise hefty premium payments while their policy continues to provide coverage. Over a long-term disability, the amount saved can be substantial. Additionally, for life insurance policies with cash value, the cash value will continue to grow even though no premiums are being paid. The waiver does not negatively impact the policy value or its benefits. Once the waiver is in effect, the policy continues as if the premiums are being paid regularly. Therefore, any benefits, including the death benefit in life insurance policies or the cash value in whole life or universal life insurance policies, remain intact. The Waiver of Premium for Disability is commonly available with various types of insurance policies. It is most frequently associated with life insurance, including both term life and permanent life insurance policies such as whole life or universal life insurance. Additionally, some disability income policies and long-term care insurance policies may also offer this waiver. Many well-known insurance providers offer policies with the option of adding a Waiver of Premium for Disability. Some of these companies include MetLife, Prudential, Mutual of Omaha, and New York Life. It's essential, however, to read the policy documents thoroughly or consult with an insurance advisor to fully understand the specifics of the waiver as offered by each provider. In the realm of personal financial planning, the Waiver of Premium for Disability plays a crucial role in planning for unforeseen circumstances, particularly those leading to a loss of income. The waiver serves as a safeguard, ensuring that the insured's coverage does not lapse when they most need it due to disability-induced financial constraints. The Waiver of Premium for Disability should be integrated into comprehensive financial plans as an essential risk management strategy. Along with savings, investments, and retirement planning, insurance—complete with the appropriate riders like the waiver—forms the backbone of solid financial planning. One hypothetical example could be an individual in their prime working years who suffers an unexpected debilitating accident, leading to a long-term disability. If they had a life insurance policy without the waiver, they might face policy lapse due to the inability to pay premiums, leading to a loss of benefits. However, if the waiver were in place, it would ensure the continuation of the policy, securing their family's financial future. One common criticism of the Waiver of Premiums for Disability is that it increases the cost of insurance due to additional premiums for the waiver. Additionally, critics argue that insurance companies often have strict criteria for what constitutes a disability, making it challenging for policyholders to qualify for the waiver. Policyholders often face challenges in providing sufficient proof of disability, especially for chronic or invisible illnesses. The required documentation and medical examinations can be demanding and exhaustive. Furthermore, the waiting period before the waiver applies can also pose a financial strain. One potential solution to these challenges is to understand thoroughly the terms and conditions of the waiver and the insurance company’s definition of disability. Consulting with a financial advisor or insurance professional can also be helpful. Lastly, maintaining comprehensive medical records and securing prompt medical evaluations in the event of a disability can strengthen the case for the waiver. Legal provisions related to the waiver are often encompassed within the broader regulations governing insurance contracts and disability rights. Laws such as the Americans with Disabilities Act (ADA) might indirectly influence the operations of insurance companies and the provisions of their policies, including waivers. Regulatory control and oversight of insurance companies offering the waiver are conducted by state insurance departments in the United States. These regulatory bodies ensure that the companies are abiding by the insurance laws, treating consumers fairly, and maintaining their financial solvency. The Waiver of Premium for Disability is a valuable insurance clause that maintains policy benefits without premium payments during the policyholder's serious disability, providing crucial financial support. Its key characteristics include its activation upon total disability, an initial waiting period, and the continuation of policy benefits throughout. Understanding the waiver's workings, invocation procedure, and qualifying criteria is vital for policyholders. Despite slightly increasing policy premiums, the waiver can result in significant savings during disability periods, ensuring the insurance coverage's continuity. Consulting with an insurance broker or financial advisor is recommended to determine if the waiver aligns with your personal financial planning and to assist in the policy selection process.What Is a Waiver of Premium for Disability?

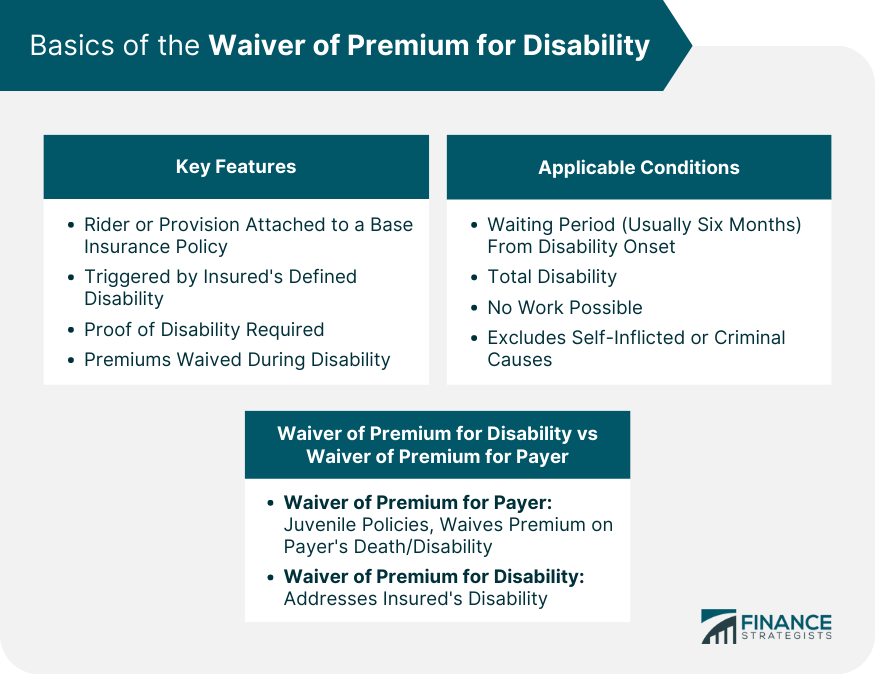

Understanding the Basics of Waivers of Premium for Disability

Key Features

Conditions Where the Waiver of Premium for Disability Is Applicable

Differences Between Waivers of Premium for Disability and Other Insurance Waivers

How the Waiver of Premium for Disability Works

Procedure for Invoking a Waiver of Premium for Disability

Process of Qualifying for the Waiver

Explanation of Disability Definition Within Insurance Policies

Financial Implications of the Waiver of Premium for Disability

Costs Associated With a Waiver of Premium for Disability

Economic Benefits of Having a Waiver of Premium for Disability

Understanding the Impact on Policy Value and Benefits

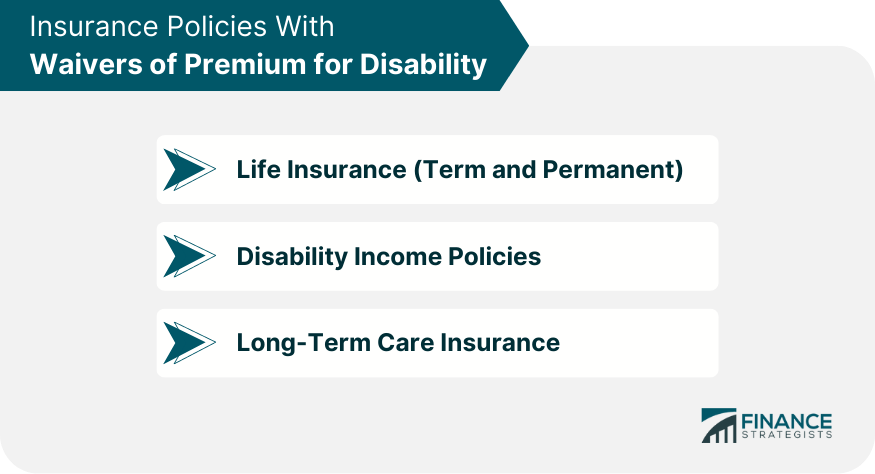

Insurance Policies With Waivers of Premium for Disability

Types of Insurance Policies

Popular Providers of Insurance Policies With This Waiver

Role of Waiver of Premium for Disability in Personal Financial Planning

Planning for Unforeseen Circumstances: Role of the Waiver

Integrating the Waiver Into Comprehensive Financial Plans

Case Studies Showing the Impact of the Waiver on Personal Finance

Criticisms and Challenges of Waivers of Premium for Disability

Common Criticisms of the Waiver of Premium for Disability

Challenges Faced by Policyholders When Attempting to Utilize the Waiver

Solutions and Recommendations for Overcoming These Challenges

Legal and Regulatory Aspects of Waivers of Premium for Disability

Legal Provisions Related to the Waiver of Premium for Disability

Regulatory Control and Oversight of Insurance Companies Offering the Waiver

Final Thoughts

Waiver of Premium for Disability FAQs

The Waiver of Premium for Disability is an insurance policy feature that suspends the requirement for premium payments if the policyholder becomes severely disabled and unable to work.

If the policyholder becomes disabled as defined by the policy, they can apply for the waiver. Once approved, they no longer have to pay premiums, but their policy continues to provide its benefits.

The waiver typically applies in cases of total disability, usually after a waiting period. It ensures the continuation of policy benefits without premium payments during the period of disability.

Although the waiver slightly increases the policy premium, it can provide substantial savings and continued coverage during periods of disability, effectively serving as a financial safety net.

The Waiver of Premium for Disability is often available as an optional rider on life insurance policies, disability income policies, and long-term care insurance policies. An insurance broker or advisor can provide detailed guidance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.