Subrogation is a fundamental concept in insurance that allows an insurance company to step into the shoes of the insured after a loss and seek recovery from a third party that caused the damage. Essentially, subrogation is the insurer's right to recoup its losses after paying a claim. The principle of subrogation serves two main purposes. Firstly, it ensures that the insured doesn't recover more than the actual amount of the loss – either from the insurer, the party at fault, or both. This prevents the insured from profiting from a covered loss and maintains the principle of indemnity, which is a cornerstone of insurance law. Secondly, subrogation allows the insurer to recover the amount of the claim paid to the insured from the party that caused the loss. This process helps to mitigate financial loss for insurance companies and can contribute to stabilizing premiums for all policyholders. One of the most critical principles of subrogation is that the insurer's right to subrogate only arises after it has indemnified the insured party. This means that the insurance company must first compensate the insured for its loss before it can seek to recover the payment from the at-fault party. In other words, the insurer cannot assert a subrogation claim against the responsible party until the insured has been fully compensated for their losses. The insurance company can't recover more than it paid out on the insurance claim. This is to prevent the insurance company from benefiting unfairly at the expense of the at-fault party. The aim of subrogation is to make the insurer whole, rather than allow it to profit from the misfortune of others. Subrogation must not impair the insured's right to recover any uninsured losses. While the insurer has a right to recoup the money it paid out for the claim, the insured still maintains the right to pursue their own recovery for any damages that weren't covered by the insurance policy. The insurer must be mindful of these rights and ensure that its subrogation efforts don't hinder the insured's attempts to recover their own uninsured losses. This duty includes providing necessary information and documentation, as well as refraining from any actions that might impair the insurer's ability to recover from the at-fault party. The insured party should not do anything that might jeopardize the insurer's ability to recover, such as signing any agreements with the at-fault party that might waive the insurer's right to subrogation. Contractual subrogation arises from an agreement between the insurer and the insured. It's common in many insurance policies, and insureds may be required to help their insurer in its subrogation efforts. Equitable subrogation is a doctrine of fairness that allows an insurer to recover from the party that caused the loss. It doesn't stem from a contractual provision, but rather from principles of equity and justice. For example, it would not be fair for the party that caused the damage to escape liability merely because the victim happened to be insured. Legal or conventional subrogation arises from the rights and liabilities of the parties as defined by law. It's not dependent on contract terms and can occur even in the absence of an insurance policy. For example, a parent company may have the legal right to subrogate against a subsidiary that caused a loss. While these forms of subrogation serve the same ultimate purpose – ensuring the party responsible for the loss bears the cost – they operate in slightly different ways. Contractual subrogation is directly dependent on policy language, while equitable and legal subrogation is rooted in principles of fairness and law. Understanding these differences can help parties manage their rights and responsibilities in the subrogation process. The subrogation process usually commences when an insurance claim is paid. The insurance company, after disbursing funds to cover the insured's loss, investigates the incident to identify if a third party can be held liable for the damages. The insurer will conduct a thorough investigation to identify a third party that may be responsible for the loss. This process requires careful analysis of the facts surrounding the loss, often involving the consultation of experts, such as accident reconstruction professionals or engineers. Once a responsible party has been identified, the insurer seeks to recover its payout. This typically involves entering into negotiations with the third party or their insurer to arrive at a fair settlement. If negotiations fail to result in a satisfactory outcome, the insurer may proceed with a lawsuit against the third party. If the recovery is successful, the insurer will first reimburse itself for the claim payment it had made to the insured. If there is any excess recovery after the insurer is reimbursed, it may be returned to the insured, subject to the policy's terms and conditions. The insured plays a significant role in the subrogation process. They are required to cooperate fully with the insurer's recovery efforts, which may include providing information, and evidence, or even participating in legal proceedings. Their cooperation is often crucial for the success of the subrogation claim. On the other hand, the insurer must diligently pursue recovery from the responsible party while respecting the insured's rights. They need to ensure that their actions do not infringe on the insured's right to seek recovery for any uninsured losses or impair the insured's potential claims. Subrogation can indeed be a complex process, presenting numerous challenges. Here are some of the hurdles and how they can be addressed: Determining fault and liability can be particularly challenging, especially in cases involving multiple parties or where the circumstances of the incident are complex. Insurance adjusters and legal professionals often need to engage in a thorough analysis of the facts, laws, and, in some cases, expert opinions to ascertain liability. Legal proceedings can be lengthy and expensive, creating a drain on resources. Insurers must efficiently manage these processes, balancing the potential for recovery against the costs of pursuing litigation. In some cases, the third-party responsible for the loss may not be in a position to pay, rendering the insurer unable to recover its losses. In such situations, the insurer must explore other potential avenues for recovery, such as seeking compensation from the third party's insurer or pursuing other parties that may share liability. In health insurance, subrogation often comes into play when an insured person is injured due to someone else's negligence. For example, if an insured person is injured in a car accident caused by another driver and the insurer pays for the medical treatment, the insurer could then subrogate against the at-fault driver or their insurer to recover those costs. In auto insurance, subrogation is a common practice when an accident is caused by a third party. Once the insurer of the not-at-fault driver pays the claim, it would then pursue the at-fault driver's insurer to recoup the claim amount. In property insurance, an insurer who pays a claim for damage caused by a third party may subrogate against that party. For instance, if a fire starts in a neighboring property due to negligence and damages the insured property, the insurer could pursue the neighbor or their insurer for recovery after paying the claim. In workers' compensation, an insurer who pays benefits to an employee injured on the job due to a third party's negligence can subrogate against that party. For example, if a delivery driver is injured by a faulty loading dock at a customer's facility, the workers' compensation insurer could seek recovery from the customer or their liability insurer. The right of subrogation is typically provided for by the language in insurance policies, but it also has a legal basis in common law principles. The idea is to prevent the insured from receiving a windfall by being paid twice for the same loss and to ensure that the party responsible for the loss ultimately bears the cost. The practice of subrogation is subject to various laws and regulations that can vary from state to state or country to country. These laws may dictate when and how an insurer can pursue subrogation, what actions the insured must take to assist the insurer, and how any recovered funds are distributed. Staying abreast of these laws and regulations is crucial for both insurers and insureds. Numerous legal disputes and court cases have revolved around subrogation issues. These cases can serve as important precedents and can shape the practice of subrogation. They often address complex questions such as the allocation of recovery between the insured and insurer, the validity of "waivers of subrogation," and the interplay of subrogation and other legal principles. Subrogation plays a significant role in claims management. By recovering funds from the party at fault, insurers can offset some of the costs of claims paid out. This can improve an insurer's loss ratio and financial performance. Effective subrogation can also serve as a deterrent against negligent behavior, as parties at fault realize they will be held financially accountable for their actions. Successful subrogation claims require strategic planning. Key strategies include thorough investigation to establish the fault of the third party, effective negotiation with the third party or their insurer, and, when necessary, aggressive legal action. Insurers should also maintain open and clear communication with the insured throughout the subrogation process. By helping insurers recoup some of their losses, subrogation can have a positive impact on insurance premiums. If insurers consistently recover a high percentage of their claims paid out through subrogation, they may be able to keep premiums lower than they otherwise would be. Subrogation is a powerful tool for risk transfer. It allows the insurer to transfer the financial risk of a claim back to the party that caused the loss. This helps to ensure that the party responsible for the loss bears the financial burden, not the insurer or the innocent insured. For businesses, effective subrogation can help to mitigate risk. By holding third parties accountable for losses they cause, businesses can incentivize safer practices among their partners and suppliers. Moreover, the funds recovered through subrogation can help to offset the financial impact of losses. In risk financing strategies, subrogation can play a key role. By recovering funds from responsible third parties, businesses can offset the costs of self-insurance or high deductibles. Successful subrogation can thus contribute to a more efficient and cost-effective risk financing strategy. Subrogation is a vital aspect of insurance that prevents double recovery, ensures the at-fault party bears the cost of a loss, and allows insurers to recoup payouts. There are several types of subrogation, each with its unique characteristics. The subrogation process involves multiple stages and requires active participation from both the insurer and the insured. Subrogation plays a significant role in various types of insurance and claims management, contributing to risk management and the future of the insurance industry. Subrogation impacts policyholder rights and responsibilities. Policyholders must cooperate with their insurers during the subrogation process and avoid any action that might harm their insurer's chance of recovery. On the other hand, policyholders can also benefit from subrogation as it can help keep insurance premiums stable. Overall, subrogation has a significant effect on the insurance industry. It helps insurers manage their financial risk, promotes accountability, and fosters a fairer insurance landscape. What Is Subrogation?

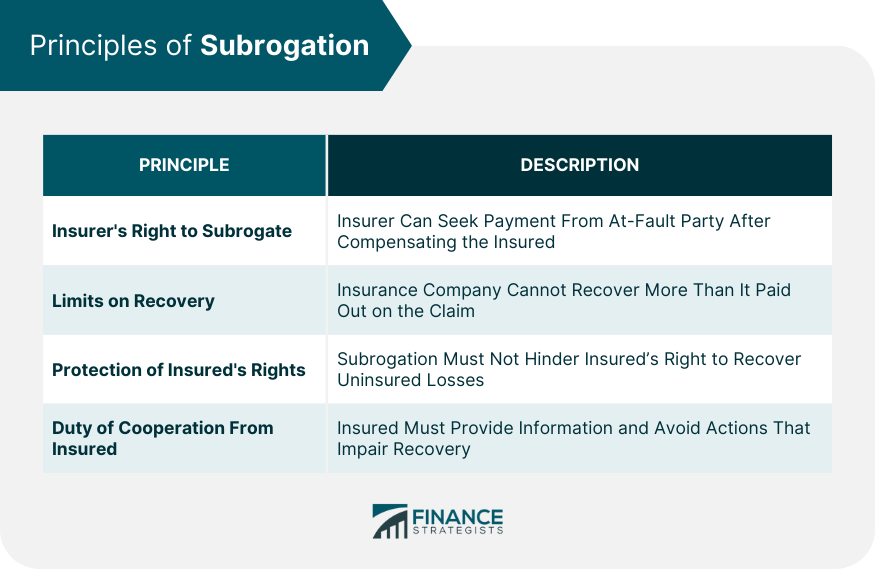

Basic Principles of Subrogation

Insurer's Right to Subrogate

Limits on Recovery in Subrogation

Protection of the Insured's Rights

Duty of Cooperation From the Insured

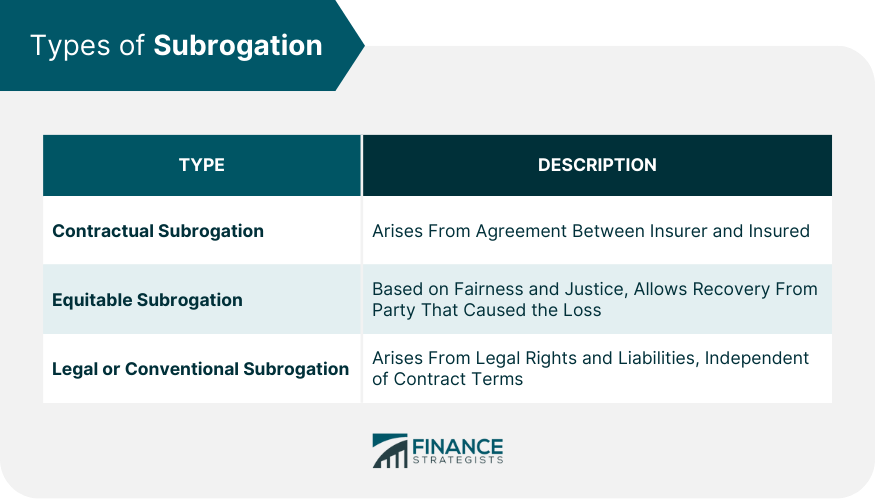

Types of Subrogation

Contractual Subrogation

Equitable Subrogation

Legal or Conventional Subrogation

Comparison of Different Types of Subrogation

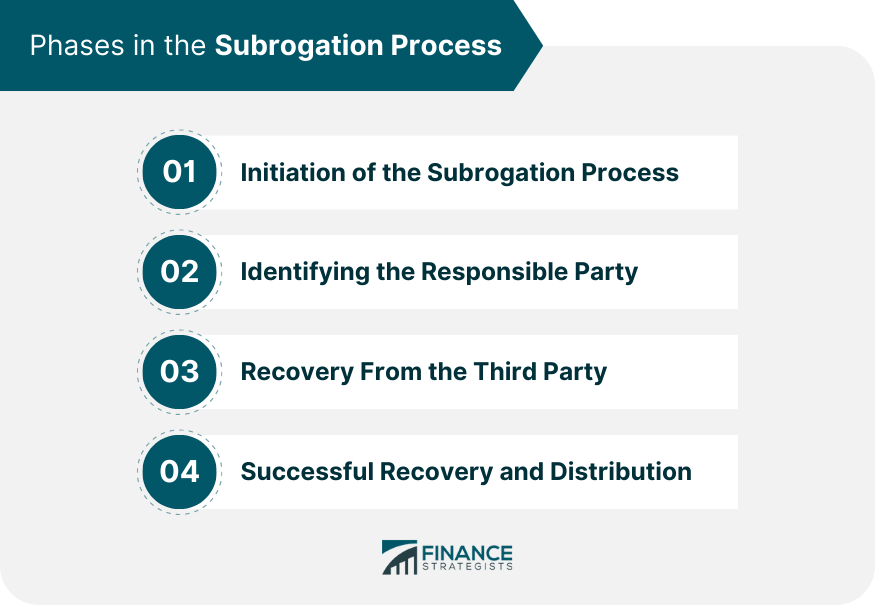

Phases in the Subrogation Process

Initiation of the Subrogation Process

Identifying the Responsible Party

Recovery From the Third Party

Successful Recovery and Distribution

Roles of the Insured and Insurer in Subrogation

Insured's Role in Subrogation

Insurer's Responsibilities in Subrogation

Overcoming Challenges in the Subrogation Process

Determining Fault and Liability

Handling Legal Proceedings

Dealing With Unrecoverable Losses

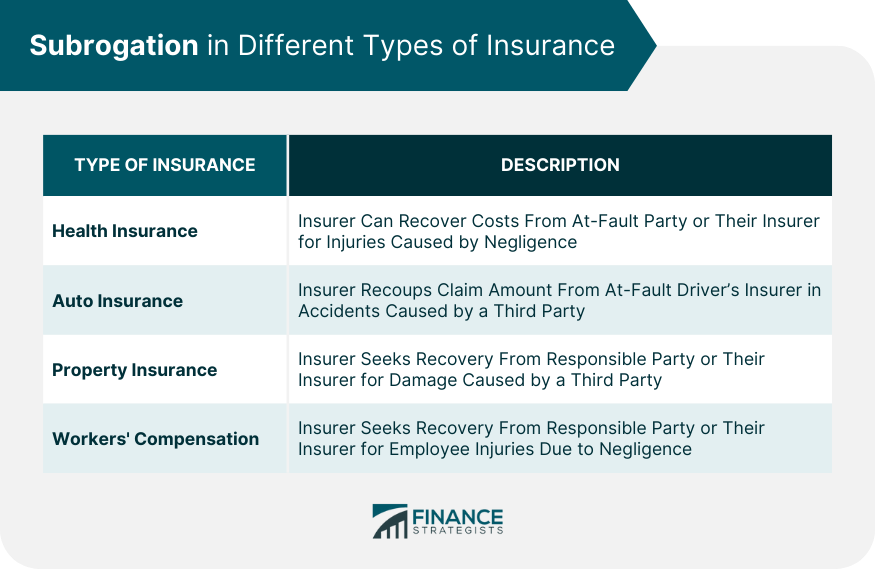

Subrogation in Different Types of Insurance

Subrogation in Health Insurance

Subrogation in Auto Insurance

Subrogation in Property Insurance

Subrogation in Workers’ Compensation

Legal Aspects of Subrogation

Legal Basis for Subrogation

Laws and Regulations Affecting Subrogation

Legal Disputes and Court Cases on Subrogation

Subrogation and Claims Management

Role of Subrogation in Claims Management

Strategies for Successful Subrogation Claims

Impact of Subrogation on Insurance Premiums

Subrogation and Risk Management

Subrogation as a Risk Transfer Tool

Role of Subrogation in Reducing Business Risk

Subrogation in Risk Financing Strategies

Final Thoughts

Subrogation FAQs

Subrogation in insurance is the right of an insurer to recover the amount it has paid to the insured for a loss from the party that caused the loss.

Subrogation is important because it prevents double recovery, ensures the responsible party bears the cost of a loss, and allows insurers to recoup their payouts, thereby helping to stabilize insurance premiums.

The subrogation process typically begins when an insurance claim is paid. The insurer then seeks recovery from the third-party responsible for the loss. This could involve negotiations or legal action, and any successful recovery is used to offset the claim payment.

The insured is expected to cooperate with their insurer during the subrogation process. This may include providing information, preserving evidence, and avoiding any actions that could harm the insurer's right to recover.

Future trends in subrogation include further automation and digitization of the subrogation process, increased investment in subrogation resources, and adapting to evolving legal and regulatory landscapes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.