Uninsurable risk refers to a situation or exposure that an insurance company will not cover due to its predictably high likelihood or magnitude of loss. It is an important part of the financial and insurance landscape because it distinguishes between manageable financial risks and those that are too great or immeasurable for insurance companies to assume. These risks, often significant, remain with the risk bearer and can lead to substantial financial loss. In finance and insurance, the concept of risk is the potential for financial loss. Risk is inherent in every economic activity, and one of the main roles of the insurance industry is to provide a mechanism to manage this risk. Insurers pool similar risks across many clients, spreading the potential for loss and making the individual impact manageable. However, not all risks are suitable for this pooling approach, leading to the concept of uninsurable risk. Uninsurable risks share common characteristics. First, they are typically unpredictable or highly uncertain in nature, meaning the likelihood of the event occurring or the potential magnitude of the loss is challenging to estimate accurately. Second, uninsurable risks often have the potential for severe loss—such severe loss that insurance companies could not cover it without significantly raising premiums. Lastly, uninsurable risks often involve correlated or systemic risks, where a single event or condition could cause widespread or simultaneous losses. The line between insurable and uninsurable risks can often blur, and it primarily depends on the insurance company's risk assessment capabilities and the regulatory environment. Insurable risks generally have the potential for loss, but that loss is both measurable and manageable. These risks often include items like property damage, personal injury, or business interruption—situations where the likelihood and cost of the event can be reasonably estimated. On the other hand, uninsurable risks are those that the insurance company deems too risky, immeasurable, or potentially catastrophic to cover. War is a classic example of an uninsurable risk. The potential damage is massive, highly uncertain, and correlates across a broad spectrum of economic activities. Other examples include certain types of nuclear accidents and acts of terrorism, especially those involving weapons of mass destruction. Natural disasters such as earthquakes and floods can also become uninsurable risks, particularly in high-risk areas. For businesses, strategic risks, including changes in consumer preferences or disruptive innovation, often fall into the category of uninsurable risks. One of the significant factors contributing to uninsurable risk is the high degree of uncertainty and unpredictability associated with certain events. Insurance operates on a model of predictability where the insurer can reasonably estimate the probability of an event occurring and the likely cost if it does. When these estimates become difficult or impossible to make with any degree of confidence, the risk becomes uninsurable. Another key contributing factor to uninsurable risk is the severity of a potential loss. Some risks might lead to such significant losses that even if they could be accurately predicted, the insurance company could not afford to cover the loss. Even if it could, the cost of premiums would be so high that no one would be willing or able to buy the insurance. Risk pooling is a fundamental principle of insurance that involves spreading risk among a large number of policyholders. However, certain risks—particularly those that are systemic or correlated—defy this principle. For example, a global pandemic affects people worldwide, meaning the risk cannot be spread or diversified away. These kinds of risks are typically deemed uninsurable due to their broad and potentially catastrophic impact. Some risks become uninsurable due to moral or legal issues. Insuring against certain kinds of risks could inadvertently encourage illegal or unethical behavior, a concept known as moral hazard. Similarly, some risks may be deemed uninsurable due to legal prohibitions or restrictions. In such cases, even if the risk could theoretically be measured and managed, the insurer may be legally unable or morally unwilling to provide coverage. Uninsurable risk significantly impacts the insurance industry. On the one hand, the existence of uninsurable risks represents a limitation on the services the industry can offer. On the other hand, it also represents a challenge and an opportunity for innovation. In recent years, the insurance industry has seen a trend of previously uninsurable risks becoming insurable due to technological advancements and innovative risk management strategies. However, this trend also introduces new complexities and uncertainties into the industry, as insurers need to navigate uncharted territories in risk assessment and pricing. The insurance industry manages uninsurable risks in several ways. One common method is exclusion, where specific risks are explicitly not covered in the policy contract. Another method is high deductibles or premiums, which transfer a larger portion of the risk to the policyholder. Furthermore, insurers invest significantly in risk assessment and predictive modeling to better understand and anticipate potential risks. In some cases, new types of insurance products or arrangements, like catastrophe bonds or reinsurance, may be developed to help manage risks that were previously considered uninsurable. Regulatory factors significantly impact the landscape of uninsurable risk. For instance, governments may mandate certain types of insurance, effectively making certain risks insurable. Conversely, regulations may also prohibit insurance for specific risks due to moral or societal concerns. Furthermore, the regulatory environment significantly influences how insurers operate, potentially impacting their risk-taking capacity and thus, their ability to insure certain types of risks. The financial implications of uninsurable risk for individuals and businesses can be substantial. Without insurance as a safety net, individuals and businesses may face significant financial loss if an uninsurable event occurs. These losses can be direct, such as the cost of rebuilding after a natural disaster, or indirect, such as the loss of income during the recovery period. Furthermore, the mere presence of uninsurable risk can have financial implications, such as increased borrowing costs or reduced investment due to perceived riskiness. Uninsurable risk also plays a significant role in decision-making for both individuals and businesses. For individuals, these risks may influence decisions about where to live or work. For businesses, they may impact decisions about where to operate, which markets to enter, or how to allocate resources. Recognizing and properly assessing these risks can lead to more informed and effective decision-making. Risk avoidance involves taking steps to entirely avoid the risk. For instance, a business might choose not to operate in a region prone to political instability, or an individual might choose not to live in a flood-prone area. While effective, this strategy may also involve forgoing potential opportunities, so it must be balanced against potential benefits. Risk reduction involves taking steps to lessen the likelihood or potential impact of the risk. For instance, a business might invest in stronger cybersecurity measures to reduce the risk of a data breach, or a homeowner in a wildfire-prone area might take steps to create a defensible space around their home. For some individuals or businesses, self-insurance or captive insurance may be a viable strategy for managing uninsurable risks. Self-insurance involves setting aside funds to cover potential losses, while captive insurance involves forming a private insurer to provide coverage. Both strategies involve significant financial commitment and risk but may provide a solution when traditional insurance coverage is not available. In some cases, government intervention may be necessary to manage uninsurable risks. This could involve forming a public insurer to provide coverage, offering subsidies or tax incentives for risk reduction measures, or implementing regulations to limit exposure to certain risks. For instance, the U.S. National Flood Insurance Program was created to provide flood insurance coverage in response to the private market's unwillingness to take on this risk. Recognizing uninsurable risk plays a crucial role in financial planning. It helps individuals and businesses understand the potential financial risks they face that cannot be transferred to an insurance company. With this understanding, they can take proactive steps to mitigate these risks and establish a financial safety net. Without a clear comprehension of uninsurable risks, a financial plan may be overly optimistic or unrealistic and could lead to significant financial hardship if an uninsurable event occurs. Uninsurable risk can also significantly impact investment decisions. Investors may require a higher return to compensate for taking on these risks, which can impact the cost of capital for businesses. Similarly, businesses may need to adjust their investment strategies based on their exposure to uninsurable risks. For instance, a company with significant exposure to climate change risks might prioritize investments in sustainable technologies or practices. Uninsurable risk refers to potential losses that insurance companies are not willing or able to cover due to their high likelihood or magnitude of loss. They are often unpredictable, and severe, and cannot be pooled or spread across a large number of policyholders. Factors contributing to uninsurable risk include the uncertainty of the event, the potential severity of loss, the inability to pool risks, and moral or legal considerations. Uninsurable risk can have significant financial implications for both individuals and businesses, influencing their decision-making and necessitating effective risk management strategies. These strategies may involve risk avoidance, risk reduction, self-insurance, captive insurance, and government intervention. Understanding and effectively managing uninsurable risk is essential for financial planning and investment decisions. Therefore, seeking the advice of professional insurance brokers or financial advisors can be invaluable. They can help navigate the complexities of risk and insurance, providing tailored strategies to manage both insurable and uninsurable risks.What Is Uninsurable Risk?

Understanding Uninsurable Risk

Characteristics of Uninsurable Risks

Differentiating Insurable Risks From Uninsurable Risks

Common Examples of Uninsurable Risks

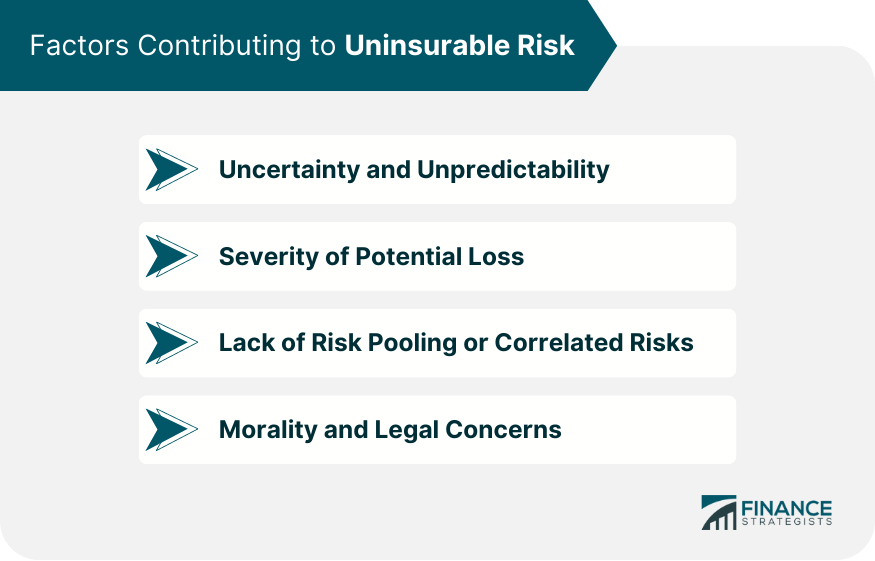

Factors Contributing to Uninsurable Risk

Uncertainty and Unpredictability

Severity of Potential Loss

Lack of Risk Pooling or Correlated Risks

Morality and Legal Concerns

Uninsurable Risk and the Insurance Market

Impact of Uninsurable Risk on the Insurance Industry

How Insurers Manage Uninsurable Risks

Regulatory Factors Affecting Uninsurable Risk

Consequences of Uninsurable Risk for Individuals and Businesses

Potential Financial Implications

Uninsurable Risk and Decision Making

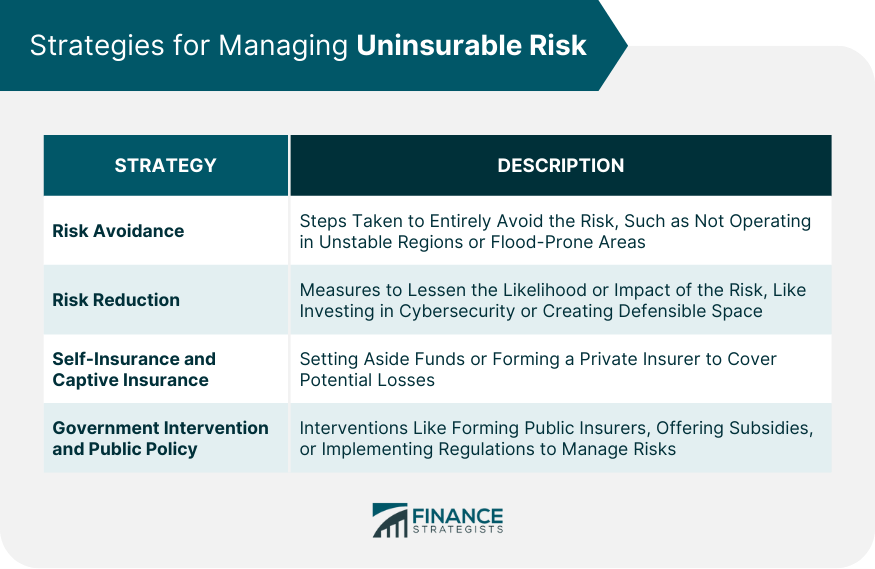

Strategies for Managing Uninsurable Risk

Risk Avoidance

Risk Reduction

Self-Insurance and Captive Insurance

Government Intervention and Public Policy

Role of Uninsurable Risk in Financial Planning

Importance of Recognizing Uninsurable Risk in Financial Planning

Effect of Uninsurable Risk on Investment Decisions

Final Thoughts

Uninsurable Risk FAQs

Uninsurable risk refers to a risk that insurance companies are not willing or able to cover due to its high likelihood or magnitude of loss.

Common examples of uninsurable risks include war, certain types of nuclear accidents, acts of terrorism, certain natural disasters, and strategic business risks like changes in consumer preferences.

Insurance companies manage uninsurable risks through methods such as policy exclusions, high deductibles or premiums, and innovative insurance products or arrangements.

Individuals and businesses can manage uninsurable risks through strategies such as risk avoidance, risk reduction, self-insurance, captive insurance, and leveraging government intervention or public policies.

Uninsurable risk plays a significant role in financial planning and investment decisions as it highlights potential financial risks that cannot be transferred to an insurance company. This understanding can guide risk management strategies and influence investment choices.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.