In insurance, Allocated Loss Adjustment Expenses, or ALAE, are expenses directly connected to the settlement of specific claims. These costs encompass legal fees, emergency services, payments to independent investigators, and other expenses directly linked to the adjustment of an insurance claim. It's important to distinguish ALAE from Unallocated Loss Adjustment Expenses (ULAE), which refer to generalized costs that cannot be directly associated with a specific claim. While ULAE might include broad costs like claims department salaries, ALAE is entirely claim-specific. ALAE holds significant importance in the insurance industry. These expenses are critical indicators of an insurance company's efficiency in managing claims and influence the pricing of insurance premiums. Properly tracked ALAE can also enhance the company's financial transparency. To fully grasp the impact of ALAE, it's crucial to dive into the inner workings of this key component within the insurance industry. Every time an insurance claim is filed, it creates a chain reaction of incurred expenses. These include legal fees if there's a dispute over the claim, costs associated with inspecting damages, and expenses for documenting and processing the claim. These costs are tracked as ALAE, with each cost item directly associated with the specific claim it relates to. Within the realm of insurance accounting, accuracy is paramount. This is especially true when it comes to the allocation of expenses. With ALAE, costs are allocated to individual claims. This enables insurance companies to precisely understand the costs associated with each claim, aiding in pricing decisions and claims management. The role of ALAE extends far beyond just being a line item in an insurer's expense account. These expenses can directly shape how insurance claims are adjusted. For instance, a high level of ALAE could indicate that a claim is complex or contentious, requiring significant resources to handle and settle. This can provide valuable insights to insurers, helping them identify areas of the claims adjustment process that need improvement or optimization. Effective ALAE management offers several distinct benefits for insurance companies. Insurance companies can significantly enhance financial transparency by accurately tracking and reporting ALAE. This involves maintaining a clear record of the costs incurred for each claim, which, in turn, provides insights into the actual cost of handling and settling insurance claims. This high level of transparency can help insurers make more informed decisions about their operational processes and pricing strategies. One of the key benefits of efficient ALAE management is the ability to price insurance premiums more accurately. When an insurer understands the real costs involved in managing claims - which includes ALAE - they can set their premiums at a level that covers not only potential payouts but also the expenses associated with the claims processing. With a clear understanding of ALAE, insurers can estimate their costs and set their premiums higher, leading to financial strain. ALAE isn't just about cost tracking; it can also serve as a valuable tool for risk management. Monitoring these expenses can help insurers identify potential inefficiencies or risks within their claims adjustment process. For instance, consistently high ALAE could indicate systemic issues in managing claims. By identifying these problem areas, insurers can refine their risk management strategies, optimize their claims-handling processes, and improve operational efficiency. Despite its many benefits, managing ALAE can present several challenges for insurers. One major area for improvement in ALAE management is the complexity of calculating these costs. Each claim is unique, and the costs associated with adjusting each claim can vary widely. Some claims may be straightforward, requiring little investigation and minimal legal intervention. Others, especially large or complex claims, might require extensive investigation, expert consultation, and lengthy legal proceedings. These factors can add to the complexity of calculating ALAE, making it a challenging task for insurers. Another challenge in ALAE management claims' inherent unpredictability and associated adjustment costs. While insurers can make educated estimates based on historical data and actuarial science, predicting future ALAE with complete certainty is virtually impossible. This unpredictability can introduce volatility into an insurer's financial planning and risk management strategies, making it harder to project future costs and revenues accurately. Although policyholders may not be directly involved in calculating ALAE, managing these expenses can significantly impact them. The way an insurer manages ALAE can have a direct influence on the premium rates policyholders must pay. If an insurer's ALAE is consistently high, it may need to raise its premiums to cover these increased costs. Conversely, an insurer that effectively manages its ALAE may offer more competitive premiums, providing a financial benefit to its policyholders. ALAE also plays a vital role in the claims settlement process. Efficient handling of these expenses can lead to more streamlined claims resolution, benefiting the policyholder. By optimizing their management of ALAE, insurers can speed up the claims settlement process, reducing the time and stress involved for policyholders. With the importance of ALAE clear, the focus shifts to how insurers can effectively manage these expenses. Investing in robust expense-tracking systems is essential to effective ALAE management. This might involve incorporating advanced technology solutions to track and analyze ALAE in real time. It also requires human expertise to ensure these systems are used effectively and their data is interpreted correctly. By investing in accurate and efficient expense tracking, insurers can gain a clearer picture of their ALAE, enabling them to make informed decisions about their operations and pricing. Given the unpredictable nature of ALAE, the ability to accurately forecast these expenses is a valuable skill for insurers. This involves analyzing historical data, understanding current trends in the insurance industry, and using actuarial science to generate reliable estimates of future ALAE. While this won't eliminate the unpredictability of these costs, it can help insurers plan for them more effectively, enhancing their financial planning and risk management strategies. Last but not least, strategic planning plays a crucial role in efficiently managing ALAE. This involves carefully selecting third-party services, such as legal counsel and independent investigators. It means training in-house claims adjusters to manage their cases efficiently, avoiding unnecessary costs. It also means continuously analyzing and refining the claims adjustment process to identify opportunities for improvement and cost savings. By strategically managing ALAE, insurers can control costs and enhance their operations' overall efficiency. Allocated Loss Adjustment Expenses (ALAE) play an important role in the complex insurance world. These expenses directly influence the efficiency of claims handling, the pricing of insurance premiums, and the overall transparency of an insurance company's operations. With the potential challenges of managing ALAE, such as complexity and unpredictability, insurers must invest in robust tracking systems, accurate forecasting, and strategic planning. By doing so, they can manage these expenses effectively, benefiting their operations and policyholders. As the insurance industry continues to evolve and face new challenges, the importance of effective ALAE management remains a constant. It is a critical factor that affects every stakeholder in the insurance landscape, making it a topic worth understanding for everyone involved.What Is Allocated Loss Adjustment Expenses (ALAE)?

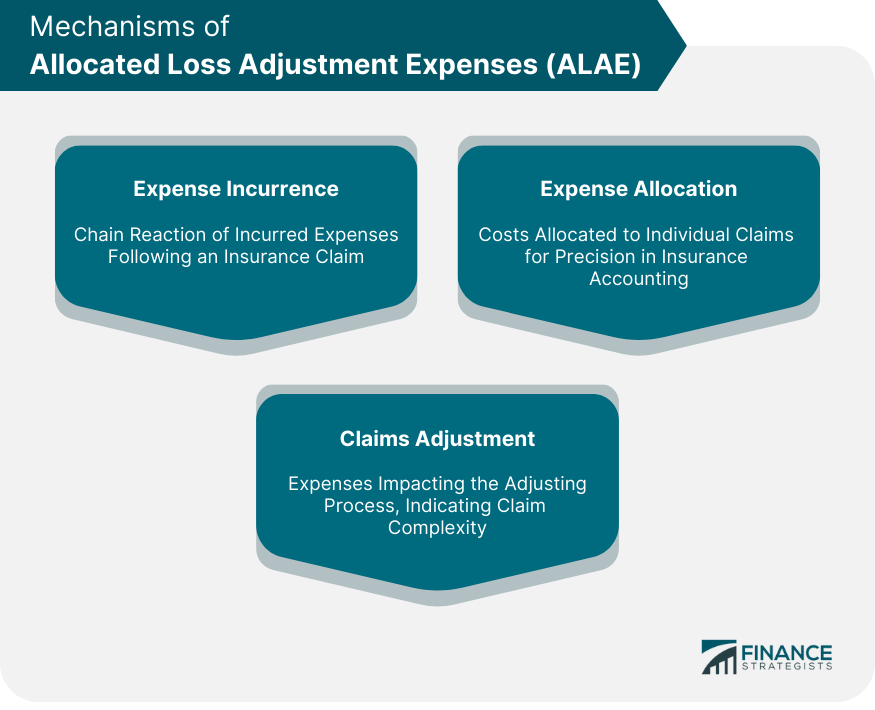

Allocated Loss Adjustment Expenses (ALAE) Mechanism

Expense Incurrence

Expense Allocation

Claims Adjustment

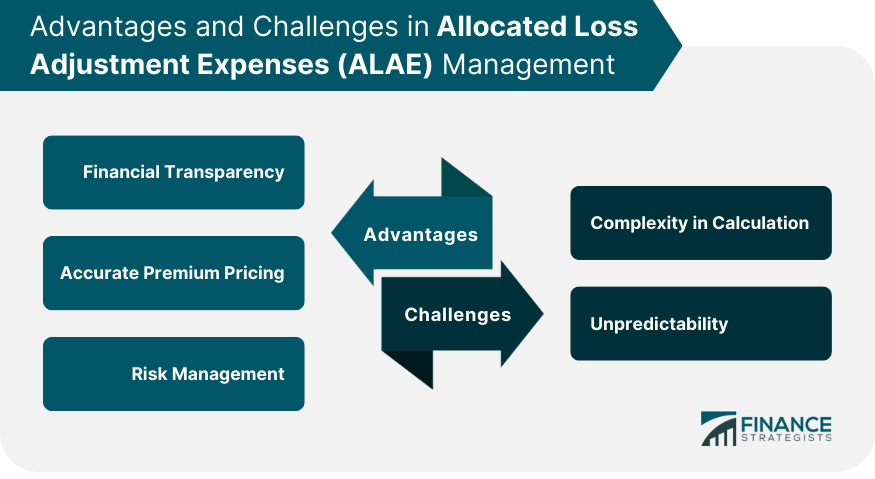

Advantages of Efficient Allocated Loss Adjustment Expenses (ALAE) Management

Financial Transparency

Accurate Premium Pricing

Risk Management

Challenges in Allocated Loss Adjustment Expenses (ALAE) Management

Complexity in Calculation

Unpredictability

Allocated Loss Adjustment Expenses (ALAE) and Its Influence on Policyholders

Effect on Premiums

Impact on Claims Settlement

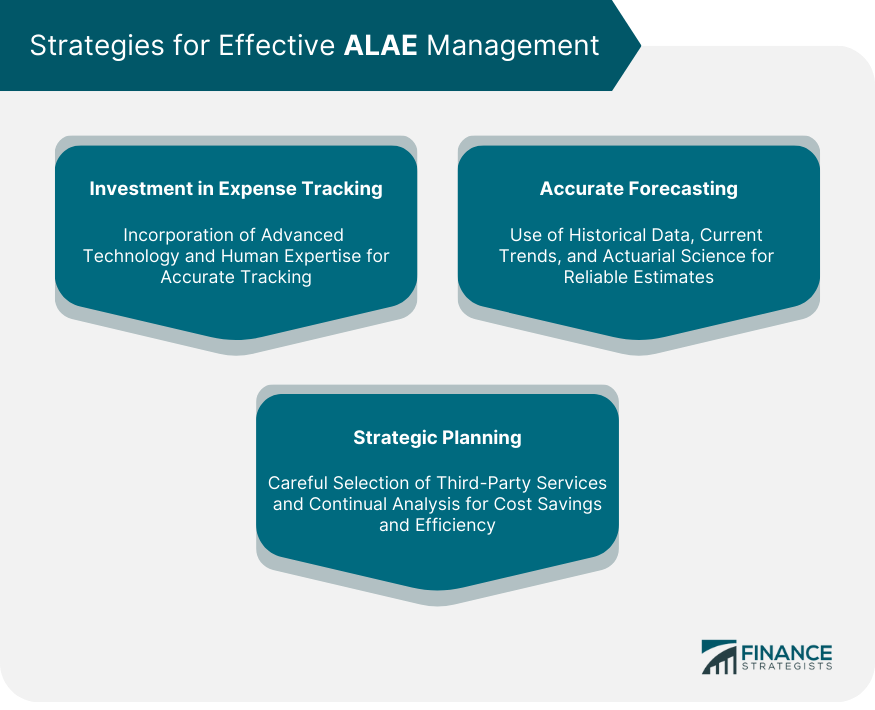

Tips for Insurers on ALAE Management

Investment in Expense Tracking

Accurate Forecasting

Strategic Planning

Conclusion

What Is Allocated Loss Adjustment Expenses (ALAE)? FAQs

ALAE are expenses directly connected to the settlement of specific claims, encompassing legal fees, investigation payments, and other claim-specific expenses.

While ULAE refers to generalized costs that cannot be directly associated with a specific claim, ALAE is entirely claim-specific.

Efficient ALAE management offers financial transparency, enables accurate premium pricing, and is a valuable risk management tool.

ALAE management can present challenges such as calculation complexity due to each claim's uniqueness and unpredictability in anticipating future costs.

ALAE management can significantly impact policyholders by affecting premium rates and the efficiency of the claims settlement process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.