A lottery annuity is a specific type of annuity that applies to individuals who win substantial amounts of money in lotteries. Rather than receiving the full jackpot immediately, winners are given the choice to receive their winnings in a structured manner over a set duration, usually between 20 to 30 years. This payment arrangement is referred to as a lottery annuity. Opting for a lottery annuity provides winners with several advantages. Firstly, it ensures a consistent and reliable stream of income over an extended period, offering financial security and stability. Moreover, this approach helps prevent reckless spending and mismanagement of funds that can occur when receiving a lump sum. By receiving regular payments, winners can better plan their financial future and effectively manage their newfound wealth. Understanding how a lottery annuity works involves understanding the process from the winning announcement through to the setup and receipt of regular payments. When a person wins the lottery, the lottery commission verifies the winning ticket and makes a public announcement. The winner is then given the option to choose how they want to receive their winnings. Lottery winners typically have two options for receiving their winnings: a lump-sum payment or an annuity. A lump-sum payment provides the winner with the entire amount of their winnings immediately, while an annuity provides the winner with a series of payments over a set period. If the lottery winner chooses the annuity option, the lottery commission will purchase an annuity from a financial institution. The terms of the annuity will dictate how and when the winner receives their payments. Once the annuity is set up, the lottery winner will start receiving regular payments according to the terms of the annuity. This could be annually, semi-annually, or at another agreed-upon interval. These payments will continue until the full amount of the winnings has been paid out. One of the primary advantages of a lottery annuity is the guarantee of income over time. Rather than receiving a massive lump sum all at once, winners can enjoy a steady and reliable income stream for many years. This provides financial security and stability, allowing individuals to plan for the long term and meet their ongoing financial needs without the risk of overspending. In the case of a lump-sum payout, the entire amount of the winnings is typically subject to immediate taxation. However, with an annuity, only the amounts received each year are subject to tax. This can potentially result in a lower overall tax burden for the winner, as the taxes are spread out over the payment period. This approach provides an opportunity for tax optimization and can help winners effectively manage their tax liabilities. Opting for a lottery annuity means depending on the fixed interest rate of the annuity for income, foregoing the chance to invest the entire winnings as a lump sum. This decision may result in missed opportunities for higher investment returns that could have been attained through alternative investment options. Additionally, the impact of inflation poses another drawback to lottery annuities. As the payments of the annuity are fixed, they do not adjust to keep up with inflation. Over time, the purchasing power of the annuity payments may decline, resulting in a decrease in their real value. This can potentially impact the winner's ability to maintain the same standard of living or meet future expenses effectively. Choosing between a lottery annuity and a lump sum payout involves considering several factors, including immediate access to funds, risk and reward considerations, and the impact on lifestyle and financial planning. A lump-sum payout provides immediate access to funds, which can be important for individuals with immediate financial needs or opportunities. Choosing a lump sum payout gives the winner the opportunity to invest the entire amount right away. Depending on the investment's performance, they could potentially earn more than what the annuity would have paid out. However, this approach also comes with higher risks. The winner could lose the invested money if the investments perform poorly. Conversely, an annuity provides a guaranteed return but offers less potential for high returns. Finally, the choice between a lottery annuity and a lump-sum payout can significantly impact the winner's lifestyle and financial planning. A lump-sum payout can provide the means for major immediate changes, such as buying a new house or starting a business. On the other hand, a lottery annuity can provide long-term financial security, ensuring a steady income stream for years to come. Lottery annuities are structured payment arrangements for lottery winners who choose to receive their winnings over a set duration instead of a lump sum. These annuities offer a guaranteed income stream over time, providing financial security and stability. Unlike lump sum payouts, annuities have tax advantages as only the annual payments are subject to taxation. However, there are drawbacks to consider, including the potential loss of investment returns due to relying on fixed annuity interest rates. Additionally, the fixed annuity payments do not adjust for inflation, which may decrease their real value over time. Comparing annuities and lump sum payouts involves considering factors such as immediate access to funds, risk and reward considerations, and the impact on lifestyle and financial planning. Lump sum payouts provide immediate funds and higher potential returns, while annuities offer long-term stability and a steady income stream.Overview of Lottery Annuities

How Does a Lottery Annuity Work?

Step 1: Initial Lottery Winning Announcement

Step 2: Choosing Between Lump-Sum or Annuity

Step 3: Setting up the Annuity

Step 4: Receiving Regular Payments Over a Set Period

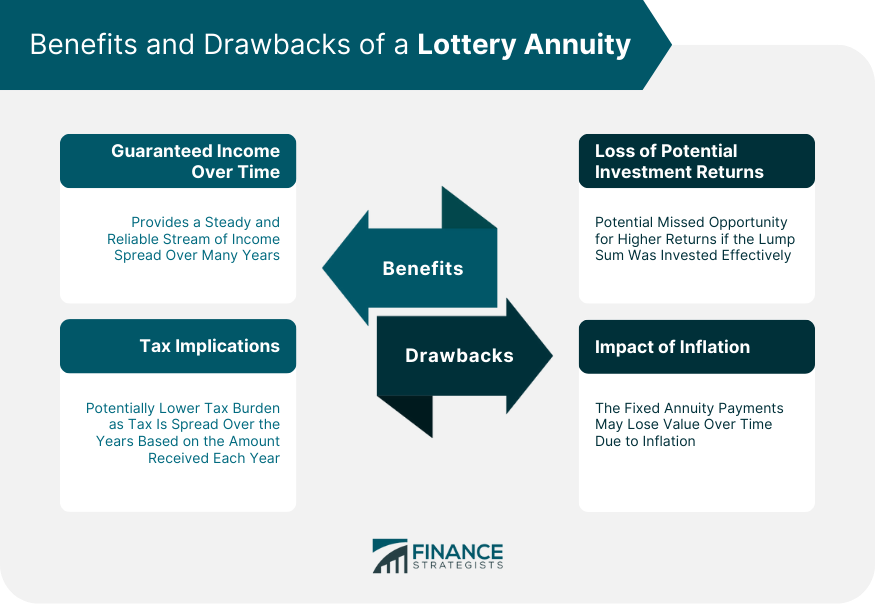

Benefits of a Lottery Annuity

Guaranteed Income Over Time

Tax Implications

Drawbacks of a Lottery Annuity

Loss of Potential Investment Returns

The Impact of Inflation

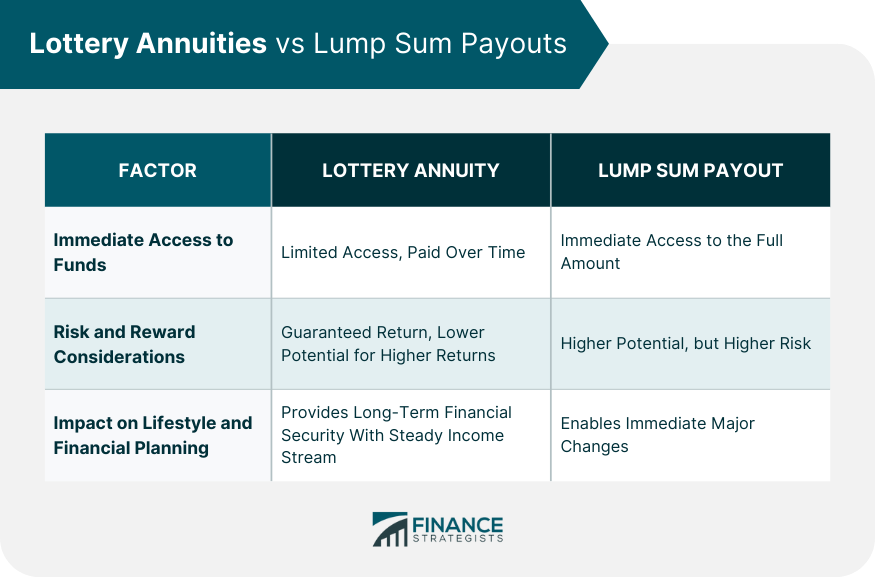

Comparing Lottery Annuities and Lump Sum Payouts

Immediate Access to Funds vs Long-Term Stability

Risk and Reward Considerations

Impact on Lifestyle and Financial Planning

Conclusion

How Does a Lottery Annuity Work? FAQs

A lottery annuity works by allowing winners to receive their jackpot in a series of payments over a specific period instead of receiving the entire amount at once.

If a lottery winner opts for an annuity, the lottery commission buys an annuity from a financial institution. The winner then receives regular payouts according to the terms of this annuity, typically annually or semi-annually, until the full amount of the winnings has been paid out.

A lottery annuity spreads the tax liability over several years. With a lump-sum payment, the entire amount is taxable in the year it is received. However, with an annuity, only the money received each year is subject to tax for that year.

If a lottery winner dies before receiving all annuity payments, the remaining payments become part of the winner's estate and are typically passed on to their heirs or designated beneficiaries. However, the specifics can depend on the lottery rules and the terms of the annuity contract.

While a lottery annuity offers a guaranteed and steady stream of income over a long period, it may result in potentially lower returns compared to investing a lump-sum payout. This is because a lump-sum payout can be invested immediately and could potentially yield higher returns, depending on the success of the investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.