The term "vanishing premium" is often used within the insurance industry, specifically when talking about whole life insurance policies. Its fundamental principle revolves around the idea that as a policy matures, the dividends it produces could reach a point where it can cover the cost of the premiums. This creates a scenario where the out-of-pocket expenses of the policyholder are potentially reduced or 'vanish,' thus earning the term "vanishing premium." The intention behind the vanishing premium is not just to introduce an intriguing concept but to create a system that offers long-term cost efficiency for policyholders. By enabling the dividends to cover premium costs, a significant financial burden could be lifted from the policyholder, making their life insurance policy more manageable over time. The backbone of the vanishing premium concept rests heavily on the accumulation of dividends. When a policyholder has a participating whole life insurance policy, they receive dividends based on the insurance company's profitability. These dividends can then be reinvested into the policy, aiding in its growth and cash value, which in turn increases the potential to offset premium costs. The phenomenon known as the 'vanishing' premium occurs when the dividends and the accumulated cash value from the policy are sufficient to cover the annual premium cost. In essence, the dividends start taking over the premium payment responsibility, potentially lessening the policyholder's direct financial obligation. Implementing a vanishing premium strategy can also have implications on a policy's value. If dividends are used to cover premium payments, the rate at which the policy's cash value grows could slow down since there are fewer funds reinvested into it. It's a trade-off that requires careful evaluation from policyholders to ensure it aligns with their long-term financial aspirations. The vanishing premium strategy can align well with those who are involved in long-term financial planning. The potential for premiums to disappear provides a level of certainty about future expenses, making it an attractive option for individuals looking towards retirement or other long-term financial goals. The vanishing premium policy could be beneficial for individuals seeking financial flexibility in their planning. The possibility of reduced premium payments could liberate financial resources, allowing policyholders to allocate them to other areas of their financial landscape. Individuals comfortable with the inherent variability of dividend performance may find a vanishing premium policy a suitable choice. As dividends fluctuate, the performance of a vanishing premium policy can also see ups and downs, thus requiring a level of comfort with such volatility. A critical first step before deciding on a vanishing premium policy is to evaluate your financial goals. Are you looking for long-term savings, or is financial flexibility more important? Answers to such questions can provide guidance in deciding if a vanishing premium policy is a good fit. The dividend history of the insurance company should be examined thoroughly. A history of robust and consistent dividend payments might indicate a higher likelihood of your premiums disappearing, which could make the policy more attractive. It is always recommended to consult with a financial advisor or insurance broker before making any decision about a vanishing premium policy. These professionals can offer personalized advice based on your unique financial circumstances and objectives. Lastly, anyone considering a vanishing premium policy should anticipate potential fluctuations in premium payments. It's essential to understand that while premiums might disappear for some time, they might reappear if dividends decrease or costs increase. A substantial advantage of the vanishing premium is the prospect of reducing out-of-pocket expenses. After an initial period of paying higher premiums, dividends may eventually reach a level that can shoulder the premium costs. This could free policyholders from making premium payments from their pockets. The vanishing premium can offer a substantial degree of financial flexibility. As dividends take on the responsibility of premium payments, policyholders may find themselves with spare funds that would otherwise have been allocated toward premiums. This surplus can be used for other financial obligations or opportunities, thereby increasing the policyholder's financial flexibility. Over an extended period, the vanishing premium concept could result in substantial savings. Policyholders could continue to enjoy the security of life insurance coverage without the constant need to make premium payments, making it an economically attractive option for many. With a vanishing premium policy, the potential for the policy to accumulate more cash value over the long term exists. Despite the fact that dividends are being used to cover premiums, the policy's cash value could continue to expand, albeit at a potentially slower pace. One significant challenge linked to the vanishing premium is its heavy reliance on the performance of dividends. Dividends are not always guaranteed as they fluctuate depending on the insurance company's profits, among other factors. In a scenario where dividends perform less than expected, the vanishing premium strategy might not pan out as planned. A vanishing premium policy does not necessarily mean that premium payments will disappear indefinitely. If dividends decrease or if the cost of insurance rises, policyholders might find themselves needing to resume premium payments. It is, therefore, crucial to understand that the 'vanishing' aspect of the premium can be temporary. The vanishing premium concept is complex, and misunderstanding or miscommunication can lead to unrealistic expectations. Some policyholders might believe their premiums will cease forever, which is not always the case. This misperception can lead to financial stress if policyholders are not adequately prepared to resume payments. Insurance brokers play a pivotal role in guiding policyholders through the complexities of vanishing premiums. They can provide precise and accurate information about how these policies function and set realistic expectations. A key responsibility for brokers is to ensure that policyholders fully comprehend the potential benefits and risks of a vanishing premium policy. This understanding includes clarifying the potential for premiums to reappear and the influence of dividends on premium payments. Once a vanishing premium policy is in place, the insurance broker's role does not end. Regular monitoring and reviewing of policies are necessary to ensure the policy continues to serve the policyholder's needs and that premium payments are vanishing as expected. Choosing a vanishing premium policy involves a comprehensive analysis of its benefits and drawbacks. This includes assessing your financial goals, considering the insurer's dividend history, and understanding your level of comfort with potential changes in premium payments. When deciding on an insurance policy, it's essential that it aligns with your personal financial goals. A vanishing premium policy could be an excellent choice if it matches your long-term financial strategy and risk tolerance. Professional advice from a financial advisor or insurance broker is crucial when considering a vanishing premium policy. They can provide insights and recommendations tailored to your individual circumstances, helping you make an informed decision. The vanishing premium strategy revolves around the accumulation of dividends, which can be reinvested to increase the policy's cash value and offset premium costs. This approach can be particularly appealing for those engaged in long-term financial planning, seeking financial flexibility, and comfortable with dividend-based decisions. Before choosing a vanishing premium policy, individuals should carefully consider their financial goals, evaluate the insurer's dividend history, and consult with a financial advisor or insurance broker. Anticipating potential fluctuations in premium payments is also essential. The advantages of the vanishing premium include a potential reduction in out-of-pocket expenses, increased financial flexibility, long-term savings, and the potential for increased cash value. However, challenges include dependence on dividend performance, the possibility of premium payments re-emerging, and the risk of miscommunication. Insurance brokers play a crucial role in providing clear guidance, ensuring comprehensive understanding, and regularly monitoring and reviewing policies. What Is the Vanishing Premium?

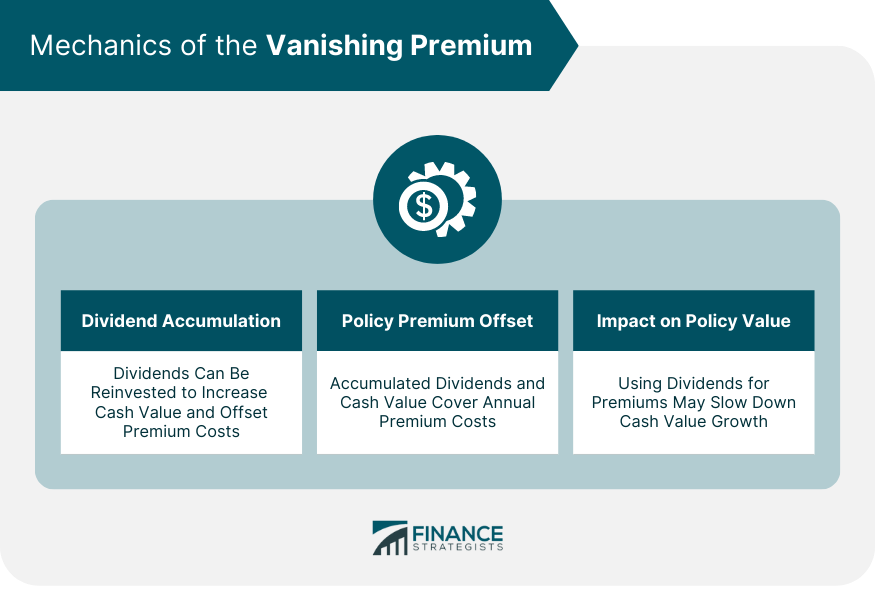

Mechanics of the Vanishing Premium

Concept of Dividend Accumulation

Policy Premium Offset

Impact on Policy Value

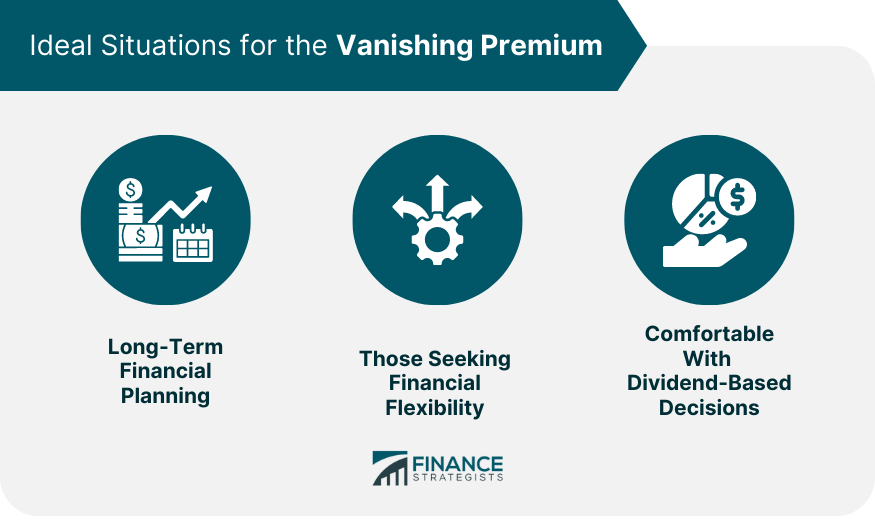

Ideal Situations for the Vanishing Premium

Long-Term Financial Planning

Those Seeking Financial Flexibility

Comfortable With Dividend-Based Decisions

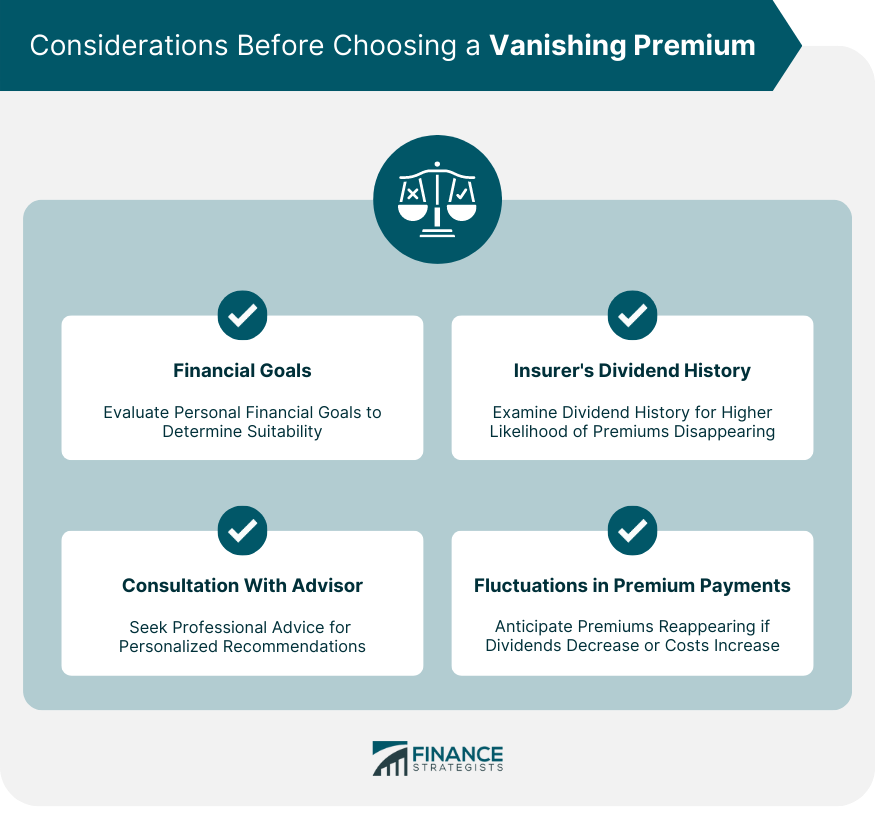

Considerations Before Choosing a Vanishing Premium

Financial Goals

Insurer's Dividend History

Consultation With a Financial Advisor or Insurance Broker

Anticipated Potential Fluctuations in Premium Payments

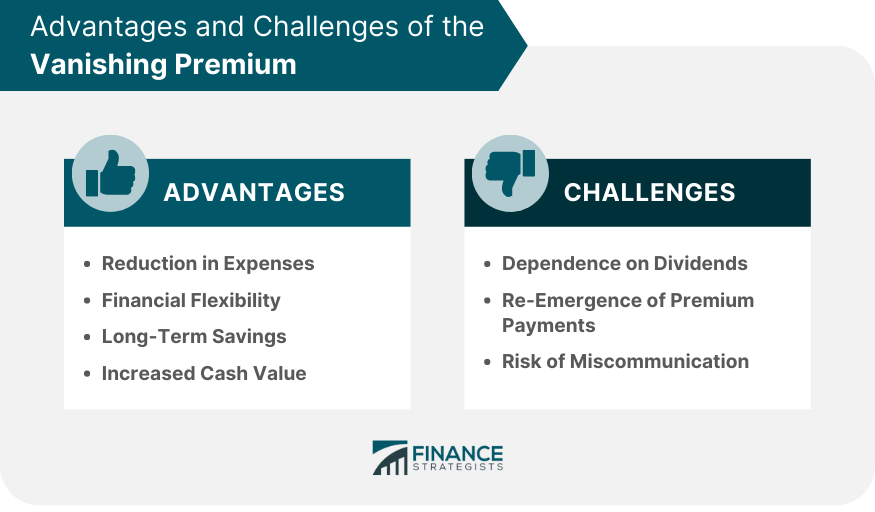

Advantages of the Vanishing Premium

Potential Reduction in Out-Of-Pocket Expenses

Financial Flexibility

Long-Term Savings

Increased Cash Value

Challenges of the Vanishing Premium

Dependence on Dividend Performance

Possibility of Premium Payments Re-Emerging

Risk of Miscommunication

Insurance Broker's Role With Vanishing Premiums

Provide Clear Guidance

Ensure Comprehensive Understanding

Regularly Monitor and Review Policies

Assess the Suitability of the Vanishing Premium

Weigh Pros and Cons

Align With Personal Financial Objectives

Importance of Professional Advice

Final Thoughts

Vanishing Premium FAQs

A vanishing premium is a concept in whole life insurance where accumulated dividends eventually cover the cost of premiums, potentially reducing out-of-pocket expenses.

Vanishing premiums can potentially reduce out-of-pocket expenses, offer financial flexibility, enable long-term savings, and increase a policy's cash value.

Challenges of vanishing premiums include dependence on dividend performance, the possibility of premium payments re-emerging, and the risk of misunderstanding the concept.

Insurance brokers provide clear guidance, ensure a comprehensive understanding of the concept, and regularly monitor and review policies.

Assessing the suitability involves weighing pros and cons, aligning the policy with personal financial objectives, and seeking professional advice from insurance brokers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.