Maximum Foreseeable Loss (MFL) is a risk assessment concept used primarily within the insurance and risk management industries. It represents the worst-case scenario for financial loss within a specific risk exposure, assuming that protective measures fail. Simply put, it's an estimate of the most significant loss that a company or individual could face. Understanding MFL is vital for businesses, insurance companies, and risk managers as it helps them prepare for and mitigate the potential financial impacts of adverse events. For instance, insurance companies use MFL assessments to determine appropriate coverage levels and premiums. At the same time, businesses use them to identify areas of significant risk exposure and develop effective risk management strategies. The concept of MFL emerged in the early days of insurance and risk management, as insurers sought ways to quantify potential losses from various risks to set premiums accurately. Over time, this concept has become a standard risk assessment tool in various industries, from manufacturing to finance, and even to information technology. MFL's relevance in financial risk management cannot be overstated. In today's interconnected world, businesses face a wide range of risks—cybersecurity threats, economic volatility, supply chain disruptions, and more. These uncertainties underscore the importance of having robust risk management strategies to safeguard a company's financial health. Understanding MFL allows businesses to assess their risk landscape, determine potential financial impacts, and make informed decisions on how to allocate resources for risk mitigation. It also enables insurance companies to price their products correctly, ensuring they remain financially stable even when claims are made. There are several components that make up MFL, and these vary depending on the specific risk being assessed. Typically, these components may include: This involves determining the financial value of the asset at risk. The asset can be anything from a physical building to an intangible asset like a brand's reputation. The valuation method may differ based on the type of asset. This part of the MFL assessment considers the specific risk exposures that the asset has. For instance, a building may be exposed to risks such as fire, flood, or earthquake. Here, worst-case scenarios are considered for each identified risk exposure. The scenario would assume that all protective measures fail, and the full impact of the risk is felt. This component involves evaluating existing protective measures, their effectiveness, and the probability of their failure. This could include physical protective measures, like fire suppression systems, or more abstract measures, like cybersecurity protocols. There are several factors that influence MFL. Understanding these factors can help a company or individual better assess their maximum potential loss and make more effective decisions about risk mitigation. The type of risk can significantly impact the MFL. Some risks, such as natural disasters or large-scale cybersecurity breaches, have the potential to result in much more significant losses than others. The effectiveness of a company's risk management strategies can also greatly affect MFL. Strong, comprehensive risk management strategies can help to minimize the potential loss from a risk event. The value of the assets at risk can also influence MFL. Higher-value assets can result in a higher MFL if they are damaged or lost. Finally, external economic factors can also affect MFL. For instance, in a volatile economy, the potential losses from risks like market downturns or investment losses can be significantly higher. Understanding the distinction between Maximum Foreseeable Loss (MFL) and Normal Loss Expectancy (NLE) is crucial in the context of risk management. These two terms, while related, refer to different concepts. MFL represents the most severe loss that might occur, assuming the worst-case scenario where all protective measures fail. On the other hand, NLE represents the loss expected to occur under normal operating conditions. It's based on historical loss data and does not consider catastrophic events. MFL is calculated by considering worst-case scenarios and factoring in the complete failure of preventative and mitigation strategies. In contrast, NLE is calculated based on average expected losses, derived from historical loss data and ordinary risk exposure. Both measures have different applications. MFL is primarily used to determine insurance needs and set premiums, while NLE is used for daily operational planning and regular risk management processes. While MFL focuses on extreme potential losses from high-severity, low-frequency events, NLE focuses on more frequent, lower-severity events that occur during normal business operations. The calculation of MFL is an integral part of risk assessment. The process involves several steps and requires a significant amount of data and statistical modeling. 1. Identify Potential Risks: The first step is identifying potential risks that could lead to a loss. 2. Evaluate the Assets: The next step is determining the value of the assets that could be impacted by these risks. 3. Consider Worst-Case Scenarios: This involves creating worst-case scenarios for each risk and estimating the potential loss. 4. Factor in Protective Measures: Assess the effectiveness of any protective measures in place and their potential failure. 5. Calculate the MFL: Finally, use the collected data to calculate the MFL. Data plays a vital role in calculating MFL. It's used to identify potential risks, value assets, create worst-case scenarios, and evaluate protective measures. Moreover, statistical models are often used to analyze this data and calculate MFL, as they can account for various factors and their interrelationships. Despite the importance of accurately calculating MFL, several common errors and misconceptions can lead to inaccurate results. One common error is underestimating the severity of the worst-case scenario. This can lead to a lower MFL calculation, which may result in inadequate insurance coverage or insufficient risk management strategies. Another error is overlooking or dismissing certain risks as insignificant. All potential risks should be considered when calculating MFL, no matter how unlikely or minor they may seem. While historical data is useful, relying solely on it can be misleading. The future may not mirror the past, especially with rapidly evolving risks like cybersecurity threats. Failing to consider how different risks are interconnected is another common mistake. Multiple risks can occur simultaneously, or one risk can lead to another, creating a cascading effect that results in a larger-than-expected loss The application of MFL in risk management comes with a multitude of benefits. These advantages underscore the significance of this metric in shaping a company's risk management and mitigation strategies. MFL provides an estimate of the potential worst-case scenario, thereby assisting companies in developing robust risk management strategies. It enables organizations to focus their attention and resources on high-risk areas, potentially minimizing the impact of adverse events. By determining MFL, businesses can make informed decisions about their insurance coverage needs. They can ensure they have sufficient coverage to protect themselves against the most significant potential losses, safeguarding their financial health. With a clear understanding of MFL, businesses can make more accurate financial forecasts and budget allocations. It also allows companies to establish adequate reserves to cater to such unforeseen events, ensuring financial stability in the long run. Companies that utilize MFL in their risk assessments can boost stakeholder confidence. It demonstrates to investors, customers, and employees that the organization is proactive in its risk management and prepared for potential worst-case scenarios. While MFL provides crucial insights for risk management and financial planning, it is not without limitations. Understanding these limitations helps put the MFL in the right perspective and fosters a more balanced approach to risk management. One of the most significant limitations of MFL is the inherent unpredictability of risks. While MFL considers worst-case scenarios, unforeseen events can still occur that exceed these scenarios. MFL calculation often involves a degree of subjectivity, particularly in estimating potential losses and the effectiveness of protective measures. This can lead to different MFL estimates for the same risk, depending on who is making the calculation. MFL calculations depend heavily on accurate and up-to-date data. If the data used is outdated or inaccurate, the MFL estimate will be misleading, potentially resulting in under-insurance or inadequate risk management strategies. MFL provides an estimate of the most severe loss from a given risk, but it does not consider how often such a loss might occur. This could lead to over-preparation for highly unlikely events while overlooking more frequent, smaller losses. Despite these limitations, MFL remains a powerful tool in risk management. When used in conjunction with other risk assessment tools and strategies, it can significantly bolster a company's resilience against potential threats. Maximum Foreseeable Loss (MFL) is a critical metric used in risk management to evaluate the worst-case financial loss scenario for a company. It involves identifying potential risks, valuing the assets that could be impacted, considering worst-case scenarios, evaluating protective measures, and ultimately, calculating the MFL. There are distinct benefits of using MFL, including improved risk management, appropriate insurance coverage, effective financial planning, and enhanced stakeholder confidence. However, it's essential to bear in mind the limitations of MFL, such as the unpredictability of risks, subjectivity, reliance on accurate data, and non-consideration of loss frequency. With the complexities involved in calculating MFL and the implications of inaccuracies, it is advisable for companies to consult with a professional insurance broker or risk management specialist. These experts can provide valuable guidance in assessing MFL accurately, ensuring adequate insurance coverage, and developing effective risk management strategies.What Is Maximum Foreseeable Loss (MFL)?

Brief History and Relevance of MFL in Financial Risk Management

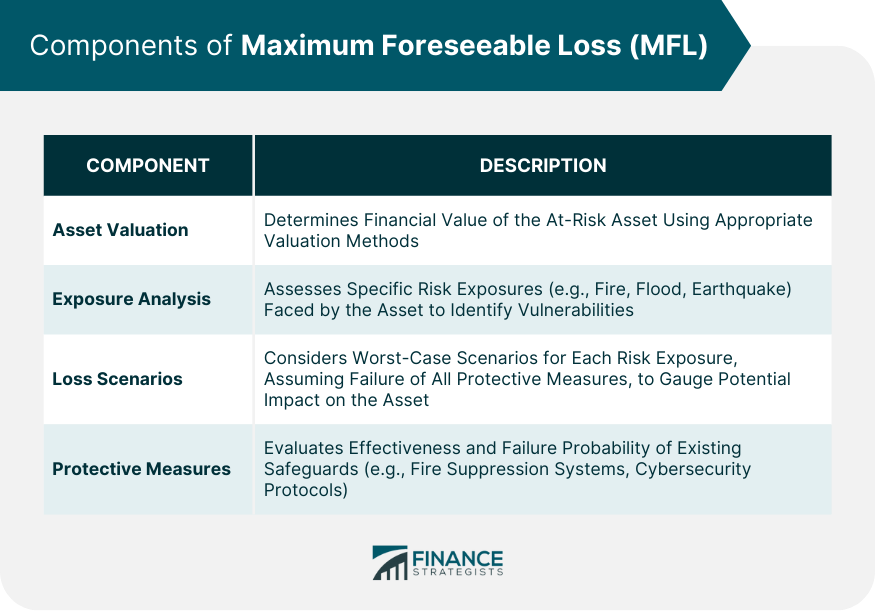

Components of MFL

Asset Valuation

Exposure Analysis

Loss Scenarios

Protective Measures

Factors That Influence MFL

Nature of the Risk

Quality of Risk Management Strategies

Value-At-Risk Assets

External Economic Factors

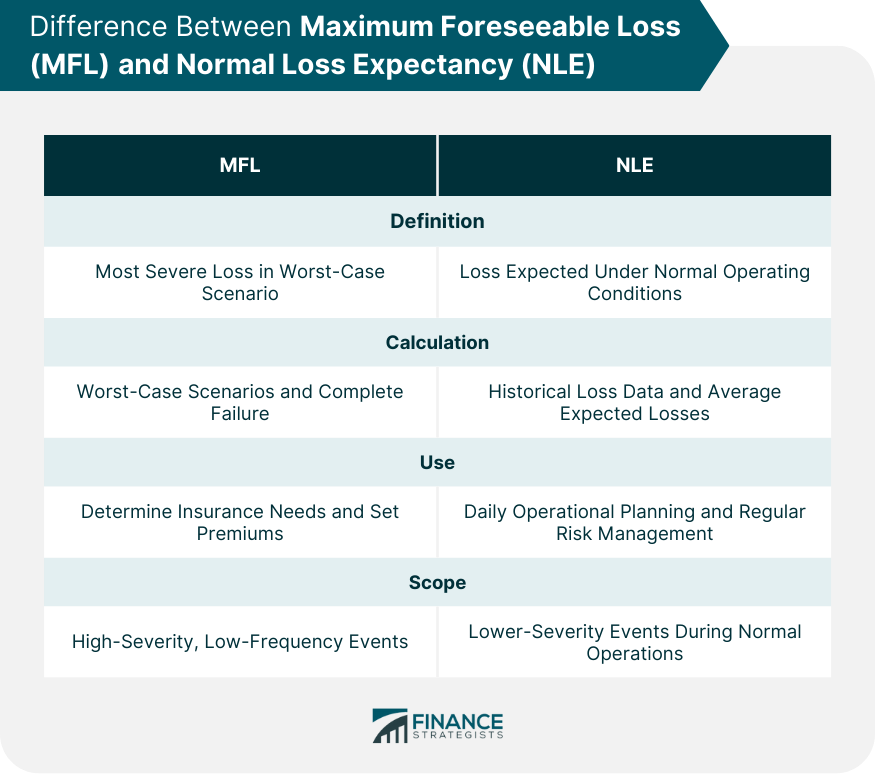

Difference Between MFL and Normal Loss Expectancy (NLE)

Definition

Calculation

Use

Scope

Calculation of MFL

Detailed Steps in Calculating MFL

Role of Data and Statistical Models in MFL Calculation

Common Errors and Misconceptions in MFL Calculation

Underestimating the Worst-Case Scenario

Overlooking Certain Risks

Over-Reliance on Historical Data

Neglecting the Interconnection of Risks

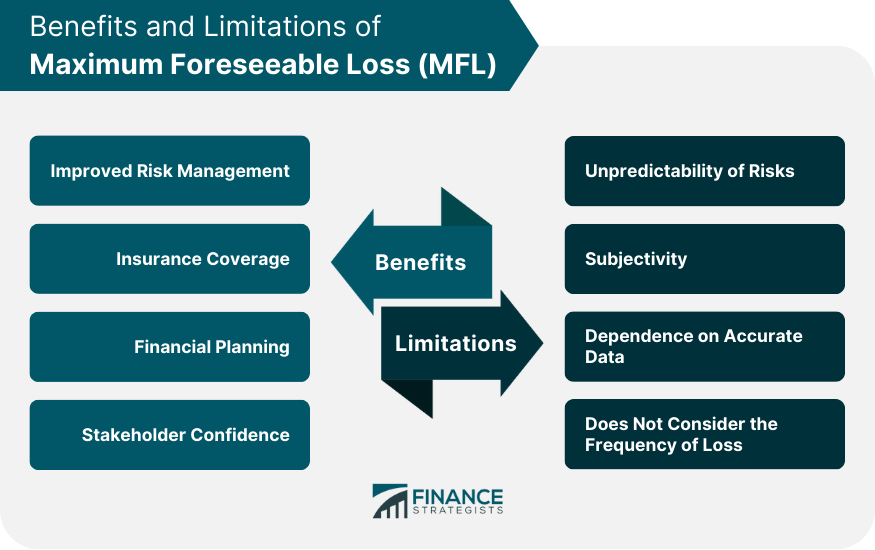

Benefits of MFL

Improved Risk Management

Insurance Coverage

Financial Planning

Stakeholder Confidence

Limitations of MFL

Unpredictability of Risks

Subjectivity

Dependence on Accurate Data

Does Not Consider the Frequency of Loss

Final Thoughts

Maximum Foreseeable Loss (MFL) FAQs

Maximum Foreseeable Loss (MFL) is a risk management concept that estimates the worst-case financial loss a company could suffer from a particular risk.

MFL is calculated by identifying potential risks, evaluating the assets at risk, considering worst-case scenarios, assessing the effectiveness of protective measures, and using this information to estimate the maximum possible loss.

MFL is crucial because it helps businesses understand their potential financial exposure in the face of certain risks. It aids in developing effective risk management strategies and ensuring adequate insurance coverage.

While MFL estimates the most severe loss assuming worst-case scenarios, NLE is an average expected loss under normal business operations, based on historical loss data.

Some limitations of MFL include the unpredictability of risks, subjectivity in calculations, dependence on accurate data, and non-consideration of the frequency of losses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.