Renters insurance is a type of insurance policy specifically designed for individuals who rent their living spaces. It provides coverage for personal property, liability, and additional living expenses in case of a covered event. Renters insurance is an affordable way for tenants to protect their belongings and personal liability. It covers losses or damages resulting from events like fire, theft, and vandalism. Many renters underestimate the value of their belongings and the potential cost of replacing them. Renters insurance provides financial protection in case of unexpected events, ensuring that tenants can replace their possessions without significant financial strain. It also offers liability coverage, which is essential in case a renter is found responsible for causing damage or injury to others. Some people believe that their landlord's insurance policy covers their personal property, but this is a misconception. A landlord's policy typically only covers the building structure and common areas. Renters insurance is necessary to protect a tenant's personal property and liability. It's also important to note that renters insurance is often more affordable than many people think, making it a wise investment for most renters. Understanding the different types of coverage available in a renters insurance policy is crucial for ensuring you have adequate protection. This coverage protects your personal belongings, such as furniture, electronics, and clothing, in case of a covered loss. Personal property coverage typically comes in two forms: actual cash value and replacement cost. Actual cash value considers depreciation, while replacement cost covers the full price of replacing the item with a new one. It's important to be aware that certain high-value items, like jewelry, art, and collectibles, may have special coverage limits. You may need to purchase additional coverage, called a "rider" or "endorsement," to ensure these items are fully protected. Review your policy and talk to your insurance agent to ensure you have adequate coverage for your valuable possessions. Liability coverage is an essential component of renters insurance. It protects you financially in case you are found responsible for causing bodily injury or property damage to others. This can include situations like a guest slipping on your wet floor or your dog biting someone. Bodily injury liability covers the medical expenses of someone injured in your rental unit, as well as legal fees if you are sued. It's essential to have adequate liability coverage to protect yourself from potential lawsuits and financial loss. Property damage liability covers the cost of repairing or replacing someone else's property that you are found responsible for damaging. This can include situations like accidentally breaking a neighbor's window or causing damage to their property while moving furniture. The cost of renters insurance can vary based on several factors, including the amount of coverage you choose, the type of coverage, and the location of your rental property. The more coverage you choose, the higher your premium will be. It's essential to strike a balance between having enough coverage to protect your belongings and liability and keeping your premiums affordable. Consider creating an inventory of your possessions to help determine the appropriate amount of coverage. The type of coverage you select also influences your premium. For example, choosing a policy with replacement cost coverage for your personal property will generally result in a higher premium than one with actual cash value coverage. Additionally, opting for higher liability limits or adding endorsements for specific high-value items can increase your premium. The location of your rental property plays a role in determining your renters insurance premium. Properties in areas with higher crime rates, greater risk of natural disasters, or a higher cost of living may have higher premiums. Conversely, properties in safer neighborhoods with lower risk factors may enjoy lower premiums. The deductible is the amount you must pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can result in lower premiums, but you should be prepared to cover that amount in case of a claim. Conversely, a lower deductible may lead to higher premiums but less financial responsibility in the event of a loss. Your claims history can impact your renters insurance premium. If you have a history of filing multiple claims, insurance companies may view you as a higher risk and charge a higher premium. Maintaining a clean claims history can help keep your premiums more affordable. Insurance companies often offer discounts for renters who invest in safety and security features. Installing smoke detectors, burglar alarms, or deadbolt locks can help lower your premium. Be sure to inform your insurance provider of any safety features in your rental unit to take advantage of potential discounts. Purchasing renters insurance requires research, assessment of your coverage needs, and understanding policy terms and conditions. Determining the right amount of coverage is crucial for adequately protecting your belongings and liability. Create an inventory of your possessions and their estimated value to help determine the appropriate amount of personal property coverage. Evaluate your potential liability risks and consider choosing higher liability limits if necessary. Before purchasing renters insurance, it's essential to compare various insurance providers. Look for a reputable company with a strong financial rating and positive customer reviews. Obtain quotes from multiple providers to ensure you find the best coverage at the most competitive price. It's important to read and understand the terms and conditions of your renters insurance policy. Familiarize yourself with the coverage limits, exclusions, and any endorsements you may need for specific high-value items. If you have any questions, consult your insurance agent for clarification. Bundling renters insurance with other insurance policies, such as auto insurance, can result in discounts and savings. Ask your insurance provider about bundling options to maximize your insurance coverage while minimizing your overall cost. Filing a renters insurance claim can be a stressful experience, but understanding the process and knowing what to expect can help. It's important to file a renters insurance claim as soon as possible after a covered loss. This ensures that you receive the financial assistance you need in a timely manner and helps prevent potential complications or delays in the claim process. Gathering documentation and evidence is crucial for supporting your claim. This may include photographs of the damage, receipts for personal property, police reports, or witness statements. Once you file a claim, your insurance company will assign an adjuster to assess the damages and determine the appropriate payout. The adjuster may request additional documentation or inspect the property in person. It's essential to cooperate fully with the adjuster and provide any requested information promptly. The claim process timeline can vary depending on the complexity of the claim, but most insurance companies aim to resolve claims within 30 to 60 days. Disputes may arise during the claim process, such as disagreements about the value of damaged items or the extent of the damage. If you believe your claim has been unfairly denied or undervalued, you can try negotiating with your insurance company or consider hiring a public adjuster to represent your interests. In some cases, legal action may be necessary to resolve disputes. Renters who share their living space with roommates may wonder whether it's better to share a renters insurance policy or purchase individual policies. In this section, we will discuss the pros and cons of each approach. Sharing a renters insurance policy with a roommate can be a cost-effective option, as it may result in lower premiums. However, this approach can also have drawbacks. Shared policies typically have a single coverage limit, which may not be sufficient to cover all roommates' belongings adequately. Additionally, sharing a policy can lead to complications in case of a claim, particularly if one roommate has a poor claims history or if the roommates' relationship becomes strained. Purchasing individual renters insurance policies for each roommate offers several advantages. Each person can tailor their coverage to their specific needs and belongings, and any claims filed will not affect the other roommates' insurance history. However, this approach may result in higher overall premiums, as each person is responsible for their policy's cost. Renters insurance is a valuable investment for anyone who rents their living space. It provides financial protection and peace of mind in case of unexpected events, ensuring that renters can replace their possessions and cover their liability without significant financial strain. Renters insurance offers essential financial protection, safeguarding you from the high costs of replacing personal property and potential liability claims. By investing in renters insurance, you gain peace of mind knowing that you are prepared for unforeseen events that could otherwise result in substantial financial hardship. It's important to regularly review and update your renters insurance policy to ensure it continues to meet your needs. As you acquire new belongings or your living situation changes, you may need to adjust your coverage accordingly. Conducting an annual policy review and updating your coverage as needed can help ensure that you remain adequately protected.What Is Renters Insurance?

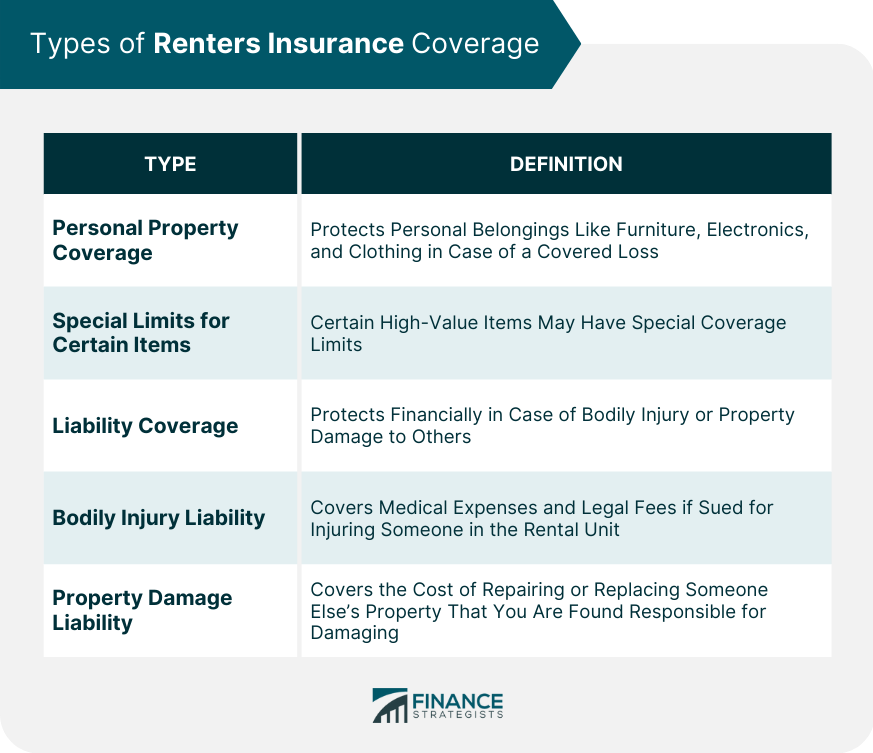

Types of Renters Insurance Coverage

Personal Property Coverage

Special Limits for Certain Items

Liability Coverage

Bodily Injury Liability

Property Damage Liability

Factors Affecting Renters Insurance Premiums

Amount of Coverage

Type of Coverage

Location of Rental Property

Deductibles

Claims History

Safety and Security Features

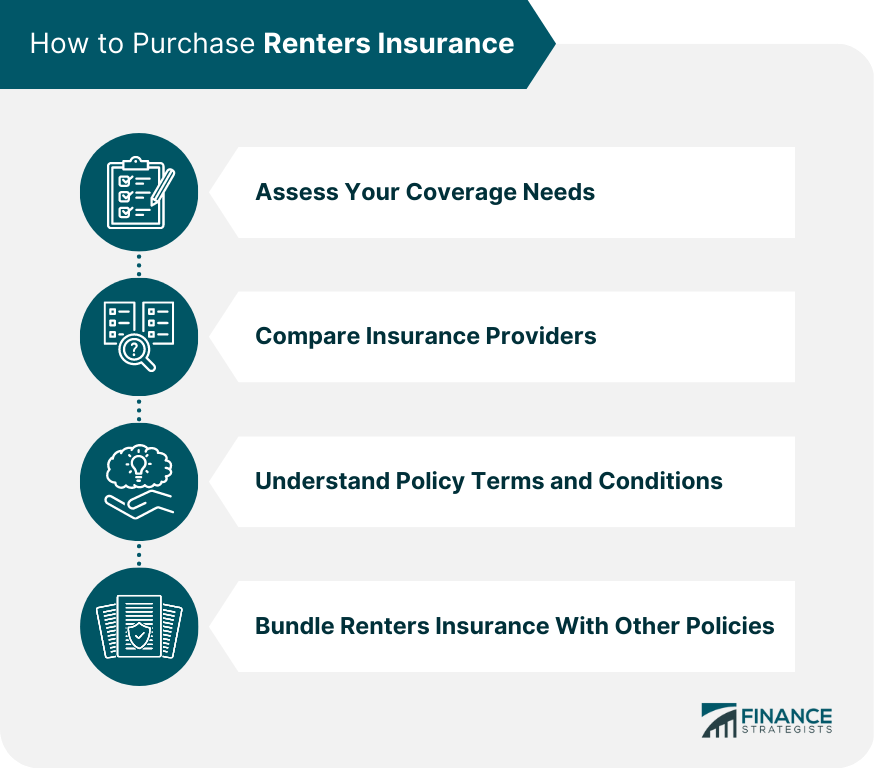

How to Purchase Renters Insurance

Assess Your Coverage Needs

Compare Insurance Providers

Understand Policy Terms and Conditions

Bundle Renters Insurance With Other Policies

Filing a Renters Insurance Claim

When to File a Claim

Documentation and Evidence

Keep a detailed record of your damaged belongings and any expenses incurred as a result of the loss.Claim Process and Timeline

Potential Claim Disputes and Resolutions

Renters Insurance and Roommates

Sharing a Renters Insurance Policy

Individual Policies for Each Roommate

Conclusion

Renters Insurance FAQs

Renters insurance is a policy that provides protection to tenants from financial losses due to theft, damage, or liability claims in their rented property.

Renters insurance typically covers personal belongings, liability, and additional living expenses in case the tenant is temporarily displaced from their rental property due to a covered event.

While your landlord's insurance covers the physical structure of the rental property, it does not protect your personal belongings or liability. Renters insurance is essential to safeguard your assets.

Renters insurance cost depends on factors like the value of your personal belongings, your location, and the level of coverage you require. On average, it costs around $15-$20 per month.

To file a renters insurance claim, contact your insurance provider immediately after the incident. Provide details of the event and evidence to support your claim. Your insurance provider will guide you through the process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.