For individuals considering a career in the insurance industry, particularly as a life insurance agent, it is natural to wonder about the potential earnings and financial prospects associated with this profession. Understanding the average salary of a life insurance agent is a crucial aspect when contemplating this career path. Before going into the specifics, to address the central question head-on: as of 2024, the national average salary for life insurance agents in the U.S. stands at approximately $57,500- $122,000. However, this can vary significantly based on multiple factors such as the agent's experience, location, and the type of insurance they sell. It's worth noting that many life insurance agents earn a large portion of their income from commissions on the policies they sell, adding to the base salary. Many life insurance agents work on a commission basis. This means they earn a certain percentage from each policy sold. For example, if an agent sells a life insurance policy with a $1,000 annual premium and the commission rate is 10%, they would earn $100 from that sale. Some insurance companies provide a base salary in addition to commissions. This structure provides a steady income and motivates agents to sell more policies to earn additional commissions. In some instances, agents receive a fixed salary without commission. This method is less common but provides financial stability and predictability. Beyond the initial sale, agents often earn renewal commissions when a policyholder renews their policy. This adds to the agent's recurring income and incentivizes them to maintain a solid relationship with their clients. Like many jobs, geographic location plays a significant role in determining an agent's income. Agents working in urban areas or regions with a higher cost of living typically earn more. More experienced agents tend to earn more. As agents gain experience, they build their client base, improve their sales skills, and understand the market better, leading to higher income. Agents with advanced training or qualifications, like Chartered Life Underwriter (CLU) certification, may earn higher commissions or have better job prospects. Agents working for larger, well-known insurance companies often earn more due to higher policy prices and the company's ability to offer competitive commission rates. The type of life insurance sold can also affect an agent's earnings. Policies like whole life or universal life insurance usually have higher premiums than term life insurance, leading to higher commissions. The size and demographic of an agent's client base significantly influence their earnings. Agents with a large, affluent client base typically earn more than those with fewer clients or clients who purchase smaller policies. Comparatively, life insurance agents fare well in the insurance industry. Health insurance agents, for example, tend to earn slightly less, with an average salary of $49,000 in the U.S. Auto insurance agents earn comparable wages, averaging around $50,000. Property and casualty insurance agents, who often manage more complex policies, earn more, with an average income of $59,000. Many insurance companies reward their top-performing agents with bonuses. These can be a significant income boost and are often tied to meeting or exceeding certain sales targets. As agents gain experience and demonstrate success in their roles, they may be promoted to managerial positions. This not only comes with an increased salary but also often includes overseeing other agents, strategic planning, and contributing to company growth. After gaining substantial industry experience, some agents choose to become independent agents or brokers. This allows them to work with multiple insurance companies, broadening their product offerings and potentially increasing their earnings. The more clients an agent has, the higher their potential income. This means that networking and relationship-building skills are essential. Agents should focus on providing excellent service to encourage referrals and retain clients. Being able to effectively network and market oneself and one's services are vital in this industry. This can involve attending industry events, using social media, or working with local businesses and community groups. Agents who continue their education and earn professional certifications often have better job prospects and earning potential. Not only can this make an agent more attractive to potential Moreover, with opportunities for performance bonuses, promotions, and the possibility of becoming an independent agent, the income potential is substantial. Like any career, maximizing earnings as a life insurance agent requires dedication, skill development, and strategic career planning. The increasing use of technology, including artificial intelligence (AI) and digital platforms, is changing the way insurance products are sold. While some may fear that this could lead to reduced demand for agents, it could also create opportunities. Agents who can effectively use these new tools may be able to reach a larger client base, improve their service, and ultimately increase their earnings. Consumer behaviors are changing, with many now expecting to be able to purchase insurance quickly and easily online. This shift could lead to greater competition in the industry, requiring agents to differentiate themselves through superior service, expertise, and personal relationships. As societies evolve, new opportunities for life insurance sales are continually arising. For instance, increasing awareness of the importance of financial planning is leading more people to consider life insurance at a younger age. Furthermore, new types of insurance products are continually being developed, providing new sales opportunities. While the average income for a life insurance agent provides a general idea of earning potential, it's clear that there are many paths to higher earnings. Whether through performance bonuses, advancing to managerial roles, or becoming an independent agent, there are plenty of opportunities to increase income. Moreover, with the ongoing evolution of the insurance industry and wider societal trends, the future could hold even more possibilities for ambitious life insurance agents. In essence, the earnings of a life insurance agent extend far beyond the average salary of $52,000-$100,000. Various factors, such as the agent's location, experience, level of education, and type of insurance sold, can significantly influence income. Furthermore, the income structure (commission-based, salary plus commission, salary only, or renewal commissions) substantially shapes the agent's earnings. Innovative strategies, such as leveraging technological advancements, adapting to evolving consumer behaviors, and seizing new market opportunities, can significantly bolster income. Ultimately, the life insurance agent's earnings are not just a number but a reflection of their professional journey, strategic adaptability, and client-centric approach. Embracing the future of the industry with a proactive and innovative mindset holds the promise of higher earnings and a rewarding career.How Much is the Average Salary of a Life Insurance Agent?

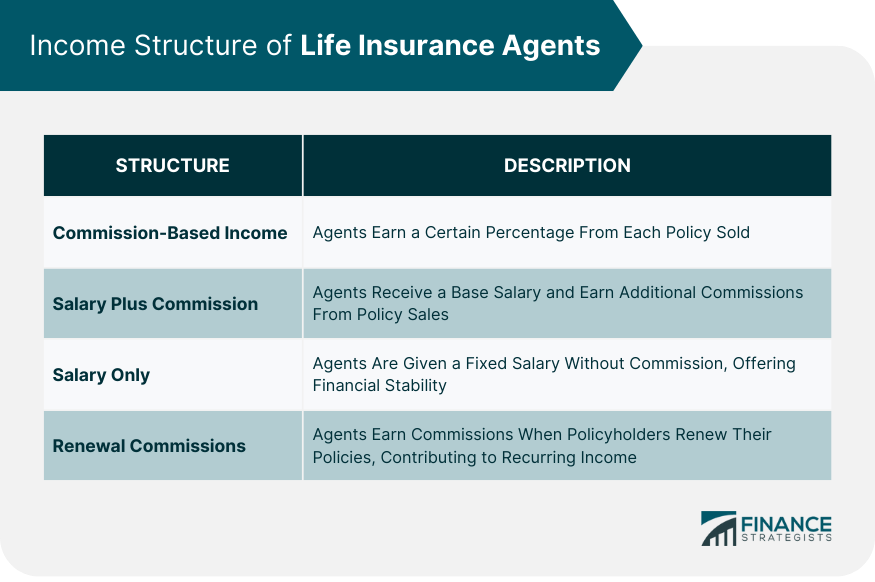

Income Structure of Life Insurance Agents

Commission-Based Income

Salary Plus Commission

Salary Only

Renewal Commissions

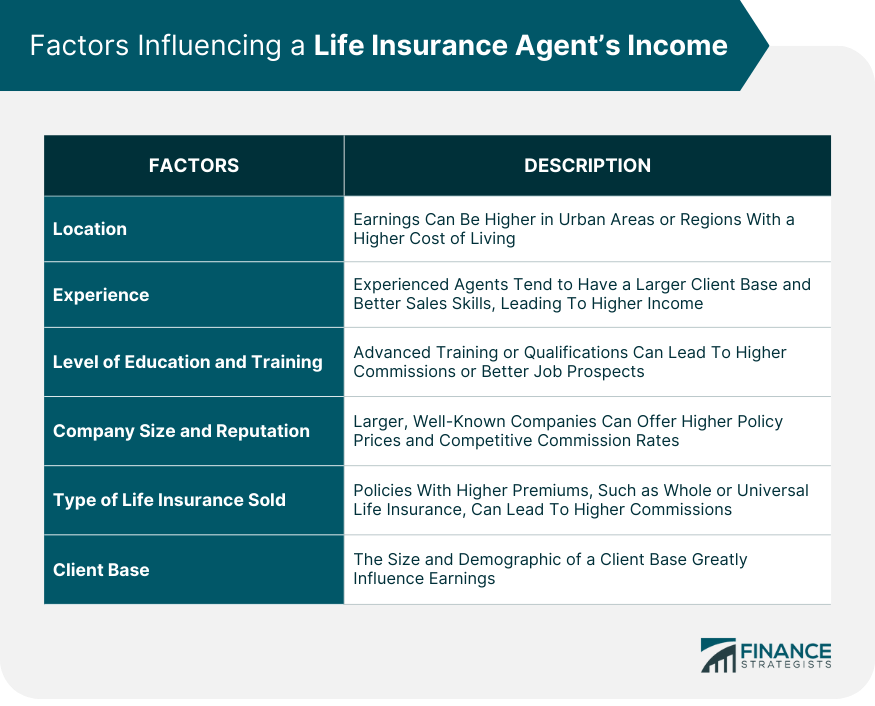

Factors Influencing a Life Insurance Agent’s Income

Location

Experience

Level of Education and Training

Company Size and Reputation

Type of Life Insurance Sold

Client Base

Comparing Life Insurance Agent Earnings With Other Insurance Agents

Performance Bonuses

Promotion to Managerial Roles

Becoming an Independent Agent or Broker

Tips for Maximizing Earnings as a Life Insurance Agent

Building a Strong Client Base

Networking and Marketing Skills

Continuing Education and Professional Certifications

Future of Life Insurance Agent Earnings

Technology Impact

Evolving Policyholder Behavior

New Market Opportunities

Conclusion

How Much Does a Life Insurance Agent Make FAQs

As of 2024, the national average salary for life insurance agents in the U.S. is approximately $57,500-$122,000. However, this figure can significantly vary based on factors like experience, location, and the type of insurance sold.

Several factors can influence a life insurance agent's income, including their geographic location, experience, level of education and training, the reputation and size of the company they work for, the type of life insurance they sell, and the size and demographic of their client base.

Many life insurance agents work on a commission basis, earning a percentage of each policy they sell. Some also receive a base salary in addition to commissions, while others may receive a salary without commission. Renewal commissions, earned when a policyholder renews their policy, can also contribute to an agent's income.

Life insurance agents can increase their income by building a strong client base, improving their networking and marketing skills, and continuing their education to earn professional certifications. Performance bonuses, promotions, and becoming an independent agent can also significantly boost their earnings.

Advancements in technology, evolving consumer behaviors, and emerging market opportunities could all influence a life insurance agent's earnings in the future. For instance, agents who effectively use digital tools could reach a larger client base and increase their earnings. Additionally, new types of insurance products and shifts in societal attitudes toward life insurance could create new sales opportunities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.