Life insurance serves as a crucial tool for safeguarding your financial well-being and providing security to your loved ones. It's natural to wonder if you can have multiple life insurance policies to ensure comprehensive coverage. In general, it is possible to have multiple life insurance policies. Individuals often choose to have more than one policy to better meet their financial goals or cover specific needs that aren't met by a single policy. However, it's crucial to ensure that the total coverage amount is reasonable given your income and overall financial situation. There are several reasons why someone might choose to have multiple life insurance policies. Some people may wish to have a separate policy for mortgage protection, while others may want to have different policies for business and personal life. Having multiple policies can also provide the flexibility to address changing insurance needs over time. Term life insurance offers coverage for a specified period, such as 10, 20, or 30 years. It's typically the most affordable type of life insurance and can be an excellent option for young families with financial constraints. Whole life insurance provides coverage for the policyholder's entire lifetime, accumulating cash value over time. This policy can serve as a financial asset that can be borrowed against if needed. Universal life insurance is a type of permanent life insurance offering flexible premium payments and death benefits. It also has a cash value component that earns interest over time. Variable life insurance is another type of permanent life insurance that includes an investment component. The policyholder can invest the policy's cash value in various investment options offered by the insurance company. Just as diversification is a key principle in investment, it can also be beneficial in life insurance. By having different policies, you can ensure that you have a broader range of coverage that can cater to your specific needs. Your insurance needs can change over time due to various factors such as family expansion, buying a house, or starting a business. Having multiple policies allows you to adjust your coverage to match your evolving needs. Different policies can be targeted toward specific financial goals or responsibilities. For instance, a term life policy could cover a mortgage, while a whole life policy ensures that your loved ones have financial support after your demise. The more policies you hold, the more challenging they can become to manage. Each policy has its terms, conditions, and premium payment schedules. Neglecting any of these could lead to lapses in coverage Each life insurance policy comes with its own set of premiums, and these costs can quickly add up when you hold multiple policies. Depending on your financial situation, the combined premiums could potentially strain your budget. There's a risk of being over-insured when holding multiple policies. Insurance companies generally limit the total amount of coverage you can have based on your income and financial needs. With multiple policies, there might be overlaps in coverage that you're paying for unnecessarily. It’s essential to regularly review all your policies to ensure they provide distinct benefits. Before deciding to hold multiple life insurance policies, it's important to assess your financial situation. The cost of premiums should be manageable and not lead to financial strain. Consider your current insurance needs and how they might change in the future. This will help you determine the types and amounts of policies that would be most beneficial. Ensure that the policies you hold complement each other and do not just provide the same benefits. Overlapping coverage might lead to unnecessary costs without providing additional benefits. Consider the affordability of maintaining multiple policies. While having multiple policies can provide broader coverage, it also means paying multiple premiums. Ensure the total cost fits comfortably within your budget. To take out a life insurance policy on someone, there needs to be an insurable interest. This means that the person purchasing the policy would suffer a financial loss or hardship if the insured person were to die. When applying for a new life insurance policy, it's essential to disclose any existing policies to the insurer. Failure to do so could be considered insurance fraud, which can have serious legal implications. Given the complexity involved in managing multiple life insurance policies, it's advisable to seek professional guidance. An insurance advisor can help determine the right combination of policies to best meet your needs. Insurance advisors can also help navigate the nuances of different policies. They can explain the terms and conditions, clarify the benefits and drawbacks of each policy, and guide you in making informed decisions. Owning multiple life insurance policies can provide coverage diversification and adaptability to changing needs. Different policy types, including term, whole, universal, and variable life insurance, can be combined to create a robust safety net. However, maintaining multiple policies requires careful consideration to manage complexities, costs, and potential over-insurance. Full disclosure is essential to avoid perceived fraud, and professional advice can help navigate these complexities. Therefore, while it is possible and potentially advantageous to have multiple life insurance policies, it requires strategic planning and diligent management to maximize the benefits while minimizing the potential downsides.Can You Have Multiple Life Insurance Policies?

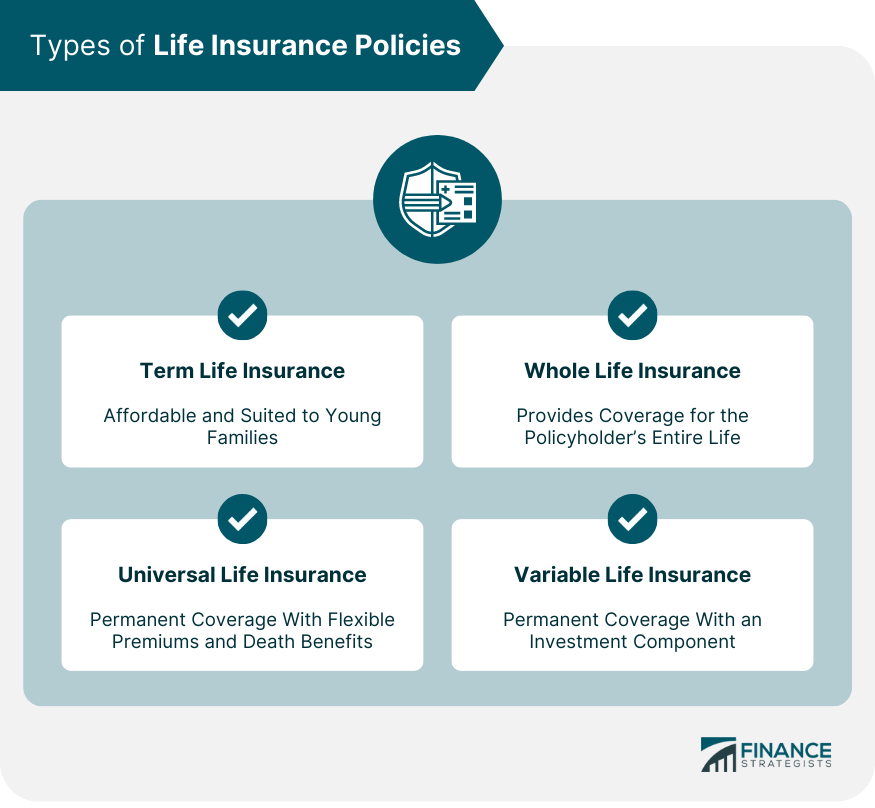

Types of Life Insurance Policies

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Variable Life Insurance

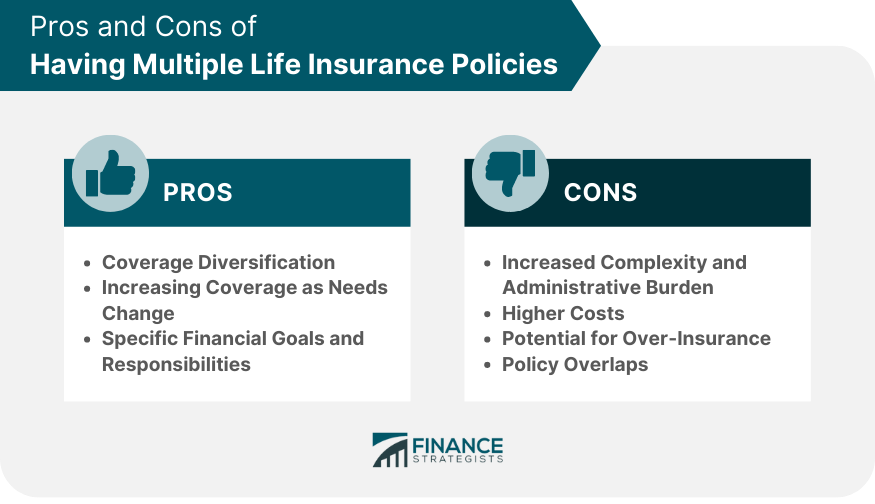

Pros of Having Multiple Life Insurance Policies

Coverage Diversification

Increasing Coverage as Needs Change

Specific Financial Goals and Responsibilities

Cons of Having Multiple Life Insurance Policies

Increased Complexity and Administrative Burden

Higher Costs

Potential for Over-Insurance

Policy Overlaps

Factors to Consider When Opting for Multiple Life Insurance Policies

Financial Situation

Current and Future Needs

Potential Overlap and Redundancy

Cost of Premiums

Legal and Ethical Implications of Multiple Life Insurance Policies

Insurable Interest

Disclosure to Insurers

Role of Insurance Advisors in Managing Multiple Policies

Need for Professional Advice

Navigating Through Different Policies

Conclusion

Can You Have Multiple Life Insurance Policies? FAQs

Yes, you can hold multiple life insurance policies at the same time. This can help diversify your coverage, address specific financial goals, and accommodate changes in your insurance needs over time.

The advantages include diversified coverage, the ability to increase coverage as needs change, and the option to target specific financial goals or responsibilities. However, it's important to manage them effectively to avoid potential downsides.

While multiple policies can offer broader coverage, they can also lead to increased complexity, higher costs, potential over-insurance, and policy overlaps. It's also important to disclose all policies when applying for new insurance to avoid a perception of fraud.

You should consider your financial situation, current and future insurance needs, the potential for policy overlap, and the cost of premiums. Seeking professional advice from an insurance advisor can also be beneficial.

Yes, you can combine different types of life insurance policies, such as term, whole, universal, and variable life insurance. This allows for a more comprehensive financial safety net that can cater to both immediate and long-term needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.